2024 Crystal Ball🔮

Goldman Sachs and experts foresee crypto market growth in 2024. Mickey Mouse enters public domain with MICKEY token. AI-enhanced MRI scans boost early Cancer detection.

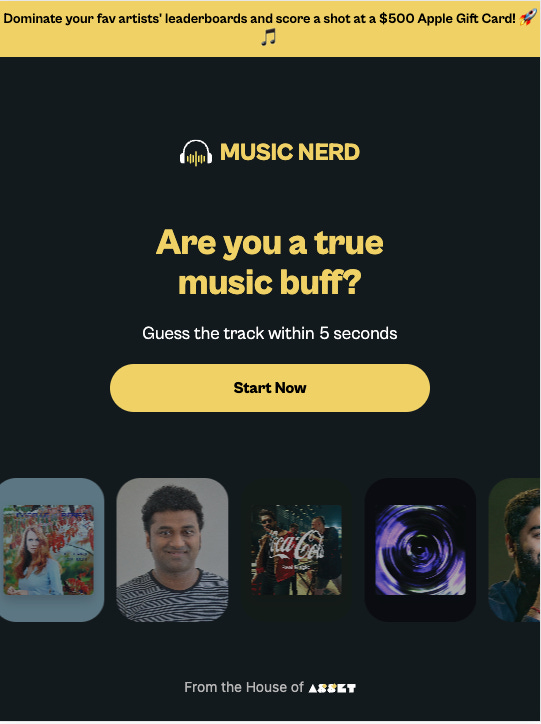

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

The 2024 predictions have started.

We are here with the second set of 2024 predictions.

After this: Happy 2024?🥳

From seeing BTC at a modest $80,000 to the sky-high dreams of $500,000 - the guessing game continues.

Goldman Sachs sees a surge

Goldman Sachs' head of digital assets, Matthew McDermott expects significant growth in the crypto market in 2024.

Institutional adoption and blockchain regulation are expected to drive digital asset maturity.

Businesses are scaling their blockchain usage to maximise commercial opportunities.

Traditional assets will likely be tokenised before more exotic ones, improving liquidity, pricing visibility, and transparency.

The approval of Bitcoin ETFs, expected by January 10, 2024, could attract investments from institutional players, such as pension funds and insurers.

Bitcoin ETFs may experience gradual growth after approval, gaining traction throughout the year.

Bitcoin and L2 year: Coinbase report

Bitcoin will continue to dominate the cryptocurrency market, especially in the first half of 2024.

Blockchain projects initiated during the bear market will yield results, with improved infrastructure, onboarding processes, and scalability.

Ethereum's position in the market will strengthen further as layer two (L2) solutions built on Ethereum continue to grow.

Layer two solutions will boost Ethereum's position.

Competing L1 blockchains must pivot toward specific sectors, such as gaming, NFTs, or institutional participation, to remain relevant.

Decentralisation Dominates: a16z report

Crypto new era: Decentralisation. Improved governance models lead to unprecedented decentralised coordination.

Enhanced User Experience: Developers work on simpler UX for crypto apps. New tools, like passkeys and embedded wallets, improve user-friendliness.

Modular Tech Stacks Rise: Open-source modular stacks foster innovation and competition.

AI and Blockchains Converge: Crypto enables global, permissionless AI markets. Lower AI costs and transparency benefit users.

Play-to-Earn Evolution: "Play and earn" replaces "play to earn," rewarding users in gaming ecosystems.

Crypto Guarantees for AI: Crypto ensures integrity in AI-driven games.

Simplified Formal Verification: Easier formal verification for software and smart contracts emerges.

NFTs as Brand Assets: Brands use NFTs for customer engagement and loyalty. NFTs become ubiquitous digital brand assets.

CoinShares says $80,000

James Butterfill, head of research at CoinShares, predicts that the potential approval of Bitcoin ETFs in the U.S. will expand the investor base and integrate cryptocurrencies with traditional financial markets.

“Thus, while the halving is a known event, other elements, particularly the potential for interest rate reductions, are likely to be significant in shaping Bitcoin’s price in the future.”

Butterfill suggests that a 20% increase in investment could drive Bitcoin prices to $80,000.

Additionally, central banks cutting interest rates may also play a role in boosting Bitcoin's value.

More adoption: Crypto.com report

Crypto Adoption Growth: In 2023, crypto adoption reached 575 million owners with a monthly growth rate of 2.8%. Expected growth in 2024 ranges between 700-900 million global crypto owners.

Bitcoin Halving: Anticipated in April 2024, Bitcoin's halving will reduce block rewards from 6.25 BTC to 3.125 BTC, historically indicating a price increase.

Ethereum's Dencun Upgrade: Focusing on rollup-centric scaling and data sharding, this upgrade aims to lower data costs for Layer-2 rollups and increase Ethereum's transaction throughput.

Account Abstraction (AA): ERC-4337 introduced AA, enhancing user-friendly Dapp interactions, with over one million wallet users by March 2023.

Bitcoin ETFs: Market expectations foresee SEC approval of spot Bitcoin ETFs in 2024, potentially attracting around $79.5 billion over three years.

Who else sees a bright 2024?

Crypto Analysts Predicts

TTD Connection 🔗

Inspired from CoinTelegraph, we asked ChatGPT if AI can help bitcoin price hit $100000 in 2024.

It says👇

AI-powered algorithms can analyse vast amounts of data and market trends to provide valuable insights into Bitcoin's price movements.

AI-driven trading bots can execute trades based on predefined rules, taking advantage of market opportunities and reducing human errors.

AI can assess the risk associated with Bitcoin investments by analysing factors such as volatility and market conditions.

AI algorithms can analyse social media and news sentiment to provide insights into public perception and market sentiment towards Bitcoin.

AI-powered portfolio management tools can optimise asset allocation and provide personalised investment recommendations to maximise returns.

Leveraging AI in these areas can potentially contribute to the growth and potential rise of Bitcoin's price to $100,000 in 2024.

Where are we at now?

Bitcoin's price has soared above $45,000 for the first time in nearly two years.

Now stands at $45,702.54.

7.33% price increase in the last 24 hours and a 7.00% price increase in the past 7 days.

This surge marks a notable new yearly high for Bitcoin, eclipsing any price point in 2023.

The market is eagerly awaiting the SEC's decision on 14 applications for a spot Bitcoin ETF, which could further impact Bitcoin's value.

The last time Bitcoin exceeded $45,000 was in April 2022, followed by a prolonged bear market.

TTD Regulations ✍🏻

What happened to regulations?

2024 is shaping up to be a critical year for the crypto industry in the US, with potential major policy developments.

The industry awaits significant events that could either enhance its growth or pose risks.

Pending Legal and Policy Developments:

Coinbase's challenge against SEC’s unclear regulations.

Supreme Court case on Federal Agencies' power definition.

Ripple's ongoing legal battle with the SEC.

Executive Agency Rules:

SEC's broadened definition of "exchange."

IRS's "broker" rule potentially impacting DeFi.

Treasury Department's regulation on cryptocurrency mixers.

US Enforcement Dominance:

The US led in penalties and legal actions against crypto companies.

Focus on countering industry malpractices post-FTX collapse.

Criticisms over the 'regulation by enforcement' approach.

Europe's MiCA Legislation: EU set to implement the Markets in Crypto-Assets regulation, targeting fraud and stablecoin control.

Country-Specific Actions in Europe:

France and Germany enhancing crypto regulations.

The UK progressing on stablecoin oversight and broader crypto rules.

Asia's Focused Regulatory Approach:

Singapore finalises stablecoin regulations, emphasising asset backing and transparency.

Hong Kong consulting on stablecoin regulations and licensing digital asset businesses.

Middle East and Africa's Emerging Crypto Hub:

UAE, particularly Dubai, strengthening its fintech sector with proactive crypto regulations.

Creation of the Virtual Asset Regulatory Authority in Dubai.

Where’s ETF? 🚨

The launch of spot Bitcoin ETFs could attract trillions of dollars to the cryptocurrency sector over time, according to VanEck adviser Gabor Gurbacs👇🏻

TTD Mickey 🐭

The first-ever Mickey Mouse cartoon, "Steamboat Willie" (1928), has entered the public domain.

To celebrate, crypto enthusiasts have minted a new meme coin named MICKEY.

About MICKEY Token

The token is inspired by the original "Steamboat Willie" character.

Runs on the Ethereum blockchain with a modest market cap of $6,500.

U.S. copyright allows character rights for 95 years, leading to this transition of Mickey Mouse to the public domain.

While the 1928 version is public, Disney intends to protect its rights in modern iterations of Mickey Mouse and other copyrighted works.

TTD AI📍

New York-based Ezra is using AI-enhanced full-body MRI scans to improve early cancer detection.

Early cancer detection significantly boosts survival rates from 20% to 80%.

Ezra's MRI Technology: The technology targets multiple body areas, aiding in comprehensive cancer screening.

Ezra provides a detailed report with a risk score, indicating the severity and need for follow-up.

AI's Role in Diagnosis

AI helps produce faster, clearer MRI scans.

Ezra's AI, trained on a vast image dataset, completes a full-body scan in about 30 minutes.

AI increasingly used for diagnosing diseases like COVID-19, Parkinson’s, and cancer.

New AI-powered tools are enhancing surgical approaches and outcomes.

TTD Surfer 🏄

Formula 1 team Sauber has signed a two-year title partnership deal with crypto casino and sports betting platform Stake.

A Shiba Inu whale has moved over 4.2 trillion SHIB tokens, worth around $44.45 million, causing chaos in the crypto community.

Bitcoin maximalist Jimmy Song has accused the Ordinals protocol of being a "pump and dump" altcoin scam.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋