$2.3 Billion Blast 💥

Blast unlocks Ether and stablecoins with mainnet launch. Memecoins marketcap $35B. Crypto projects have received over $90B in all-time funding. Microsoft launches AI-powered Copilot for Finance.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

The Ethereum Layer 2 Blast launched its mainnet.

A $2.3 Billion is unlocked in a risky crypto launch.

This isn't just any launch - Blast has already attracted over 180,000 early adopters and a whopping $2.3 billion in locked assets.

Blast promises faster and cheaper transactions compared to the Ethereum mainnet.

Users can earn up to 5% interest on their stablecoins and 4% on their ETH.

The platform boasts a secure and efficient infrastructure built on battle-tested protocols like Lido and MakerDAO.

Blast becomes the seventh-largest blockchain and the second-largest Ethereum layer 2 by total value deposited.

Early bird gets the worm (or BlastCat): Some eager users deposited even before the official launch, with memecoins like BlastCat dominating early trades.

Users only withdrew $400 million

Leaving the rest on the platform.

Before launch, users couldn't withdraw their funds.

Creating a locked pool of $2.3 billion.

Now, with withdrawals enabled, only a fraction has been taken out.

Possible reasons for the cautious withdrawals

New platform: Users might be waiting to see how Blast performs long-term.

Yield opportunity: The high yields could incentivise users to keep their funds on the platform.

What to look forward to?

Token airdrop in May: Earn points now, claim tokens later.

Developer incentives: 50% of the community airdrop is reserved for mainnet protocols, fostering a thriving ecosystem.

In the Numbers 🔢

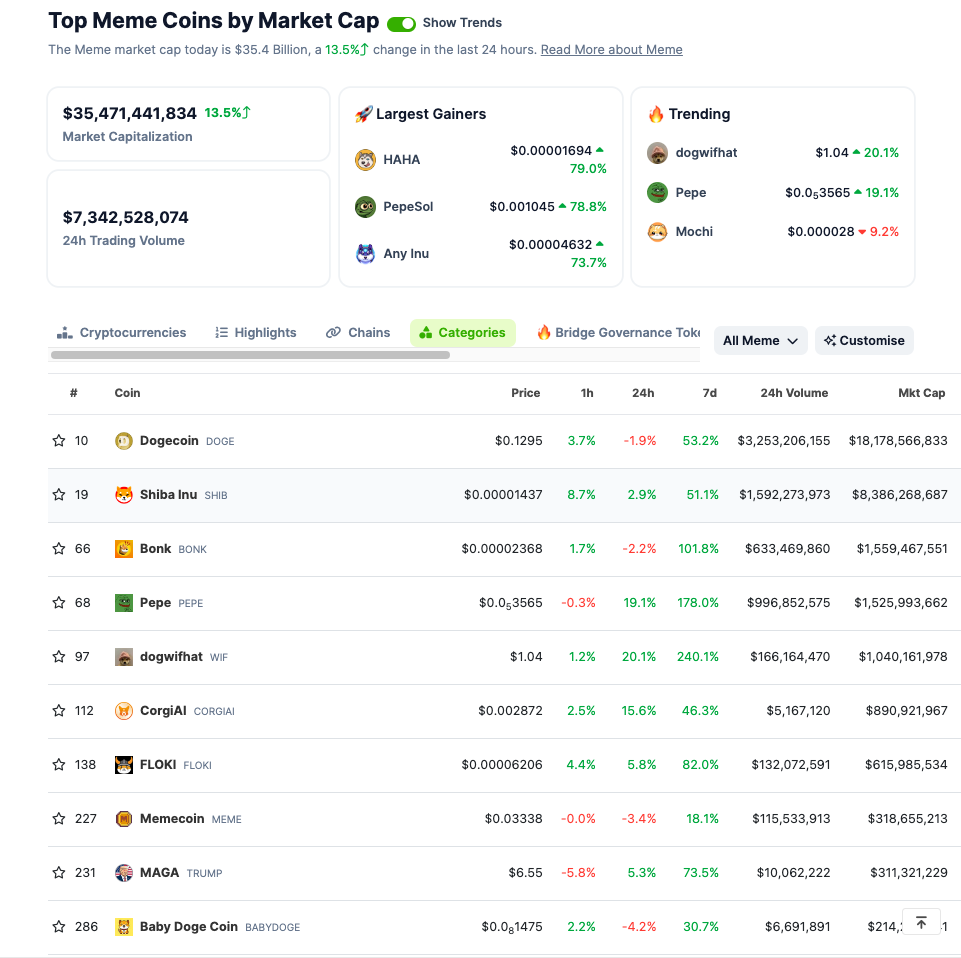

$35 billion

The market cap of memecoins, according to CoinGecko data.

The memecoin market has skyrocketed over 27% in just the last day.

Rest of the crypto market? A measly 5% gain on the same day.

So, which puppies are leading the pack?

Dogebonk: Up by 34%.

Bonk: Up by 54%.

Dogecoin - 33%

Bonk, and Shiba Inu increased 54% and 27% respectively.

But what's causing all this excitement?

Bitcoin's rising price is making investors more bullish on riskier assets, and memecoins are at the top of that list.

The broader crypto market rally is attracting risk-seeking speculators, who see memecoins as a potential high-reward gamble.

Venture capitalists are even getting in on the action, with DWF Labs announcing a $10 million investment in Floki, another popular memecoin.

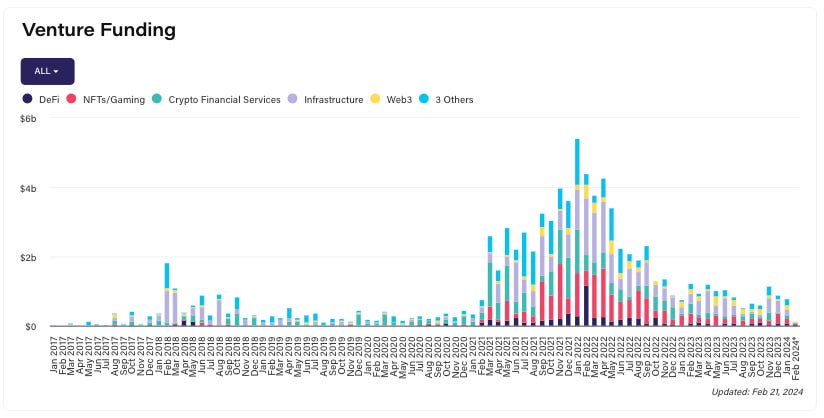

Crypto cash injection surpasses $90 Billion

We are talking about the total investment in the industry.

Over 50 new projects received funding in February alone.

While overall funding hasn't skyrocketed, there are positive signs: increased activity in early-stage investments and rising interest in DeFi & DePIN.

Investors are betting big on DeFi, infrastructure, NFTs/gaming, and web3 projects.

Where’s ETF?🚨

Brokerage units of Bank of America Corp.'s Merrill Lynch and Wells Fargo are offering Bitcoin spot ETFs to clients, with the banks first offering the approved ETF product to some wealth management clients with brokerage accounts👇

Venture capitalists are shifting their focus

Forget the "crypto craze" of the past hottest sectors for startups in 2024 are

Artificial Intelligence (AI)

Biotechnology

Climate Technology (Climate Tech)

"So, for the last decade, it was like: 'Oh, this is a little bit better. This is a little bit better. This is a little bit better.' And now it's like: Whoa, that's way better." says Zach Coelius of Coelius Capital.

What makes these sectors stand out?

GenAI: Experts predict a boom in AI, with "GenAI" (the next generation of AI) expected to make significant breakthroughs.

Problem-solving focus: Investors are drawn to startups that address real-world issues in creative and innovative ways.

Global mindset: Founders with a global vision and the potential to scale beyond their local market are more attractive to investors.

"This year, it feels like we're coming back, and we're on the verge of another sort of boom with GenAI," said Kevin Holmes of the Founders Network during a fundraising panel at Web Summit Qatar.

Microsoft just launched Copilot for Finance

An AI assistant that brings automation and smarts within the Microsoft 365 suite.

Think of it as a ChatGPT specifically for finance professionals. This isn't just about fancy tech jargon - it's about freeing up your valuable time.

Effortlessly streamlining tasks like variance analysis and data reconciliation in Excel.

Getting AI-powered insights and recommendations to accelerate your work.

Creating clear, compelling reports with data visualisations in minutes.

Copilot for Finance isn't just a hunch. It's been tested by thousands of professionals and is built on Microsoft's deep understanding of the finance world. Plus, it joins Microsoft's growing family of AI assistants like Copilot for Sales and Service.

The Surfer 🏄

Funds hacked in 2024 increased by 15.4% compared to 2023.

Robinhood is integrating with Arbitrum, an Ethereum layer 2 blockchain, to cut transaction fees for crypto traders.

Nigerian authorities are investigating Binance for facilitating terror finance and money laundering.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋