$3B Tokenised US Treasuries 💰

Will it hit that projection by the end of 2024? Is investing in the infrastructure that powers crypto the right strategy? Binance returns to India, pays $2.25M fine. Vitalik donates all animal coins.

Hello, y'all. There is always music. There is always games. So do it then👇

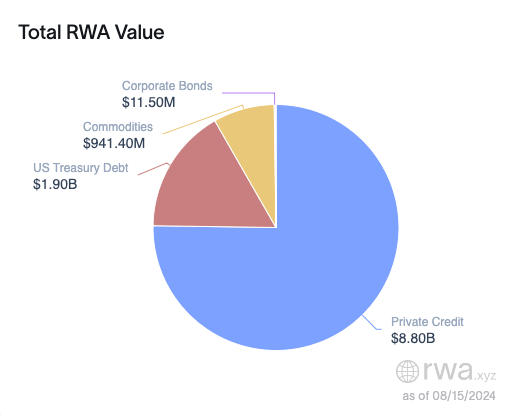

We know that real-world assets (RWA) tokenisation is the buzz.

There is close to $12 billion on-chain at the moment.

Will the increase in demand for the tokenised treasuries be the key to crypto adoption?

Why? Users can access government bonds within the crypto ecosystem.

Sure, it makes sense. What’s the lowdown?

The global cryptocurrency adoption has increased by 34% in the number of holders since 2023.

Led by the demand for stable, low-risk digital assets.

Tokenised US Treasuries are a viable option.

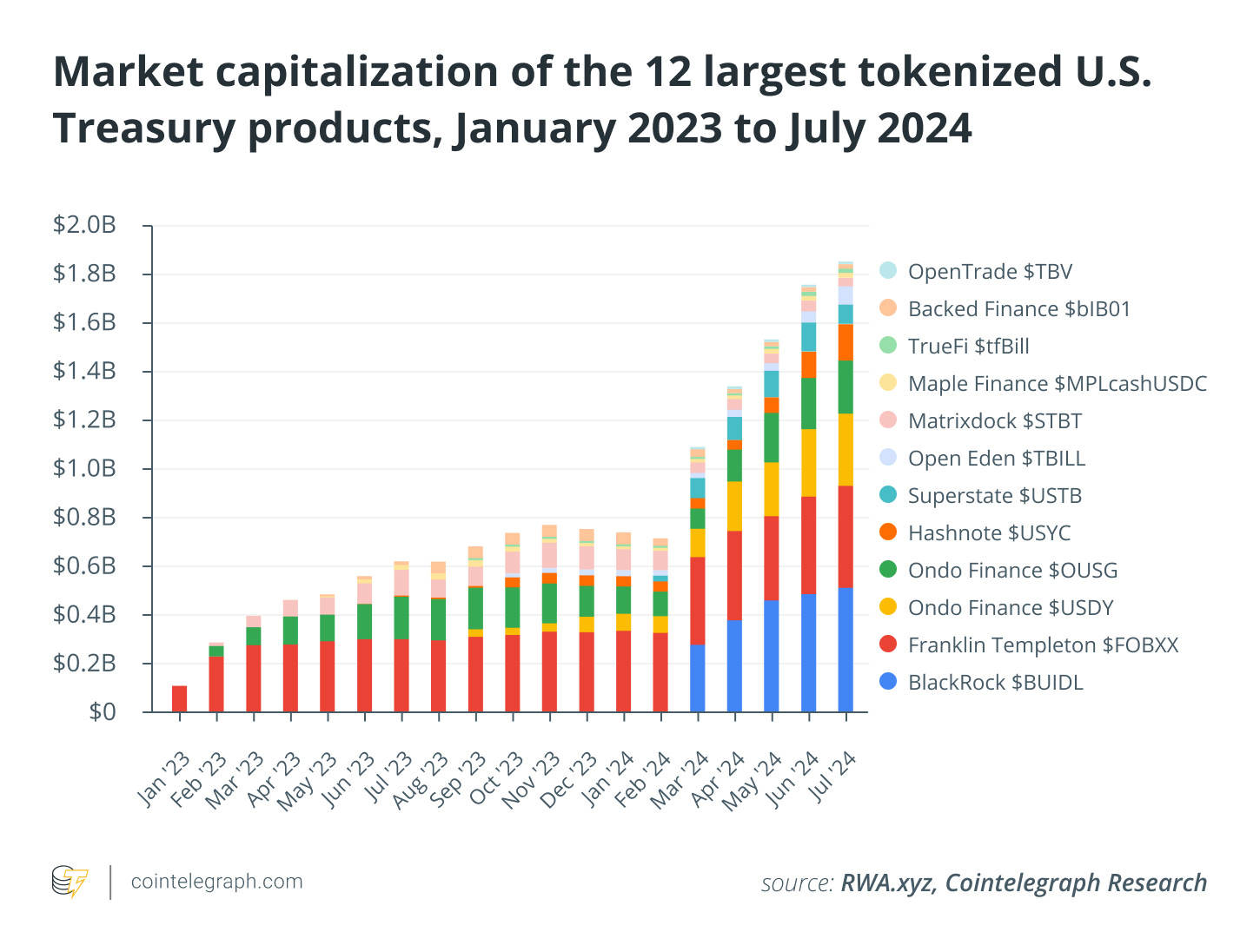

Since January 2023, the market capitalisation of tokenised products has surged by over 150%.

Projected market capitalisation by end of 2024

Cointelegraph's research team provides a fascinating analysis.

Three statistical models - ARIMA, GARCH, and linear regression - to forecast the potential market capitalisation of tokenised US Treasury products by the end of 2024.

ARIMA Model: $2.12 billion (bear case)

GARCH Model: $3.93 billion (bull case)

Linear Regression Model: $2.47 billion (base case)

A weighted combination of these models suggests a market capitalisation of approximately $2.66 billion by the end of 2024.

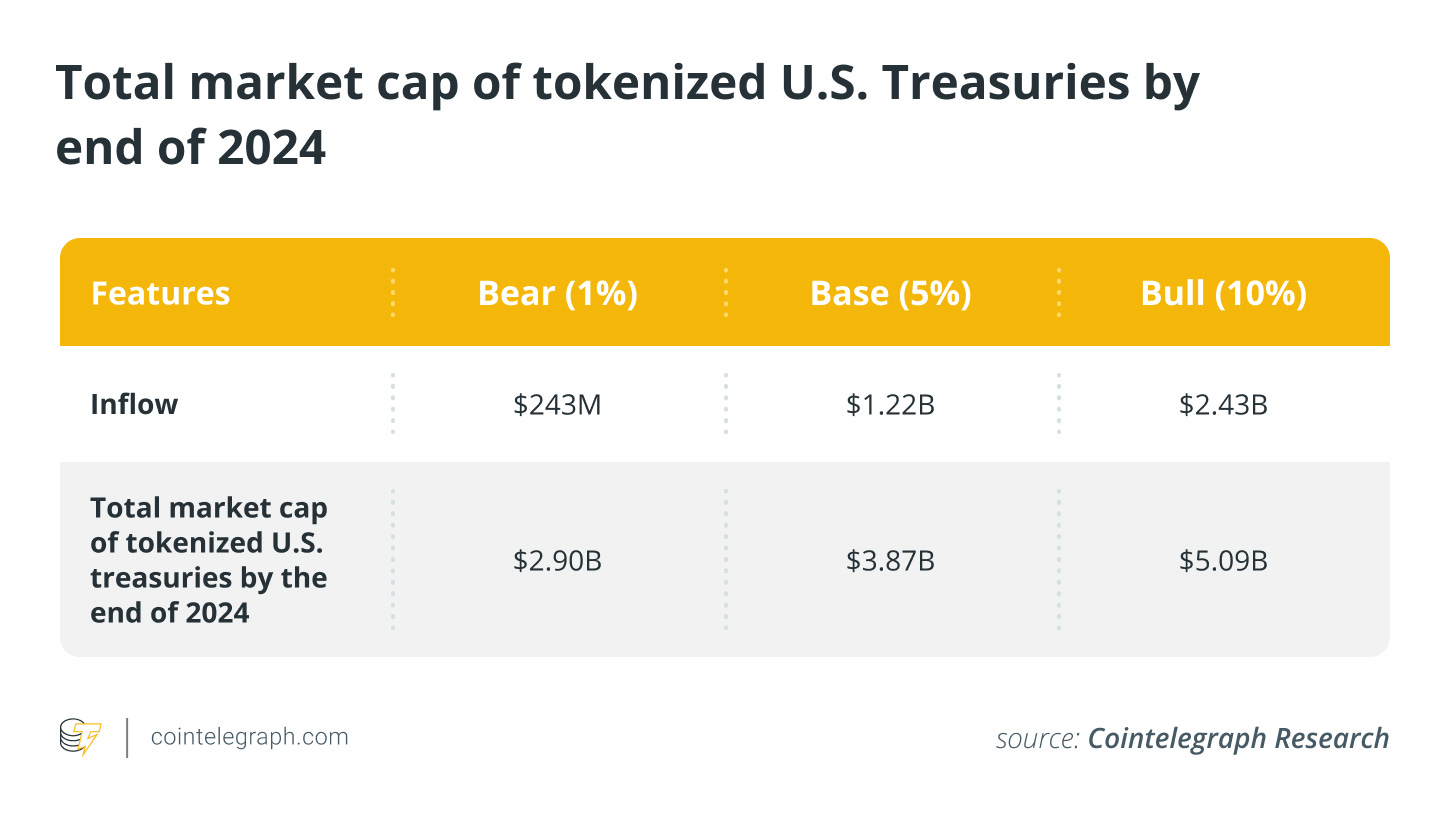

DAOs like tokenised US treasuries investment

Growing interest: Decentralised autonomous organisations (DAOs) prefer tokenised US Treasuries as a capital source.

Major allocations: Arbitrum plans to invest $25 million (1% of its treasury), while MakerDAO aims to allocate $1 billion (19% of its treasury) to these assets.

Total DAO treasuries: The total amount held in DAO treasuries currently stands at $24.3 billion.

Potential inflows: Allocating 1%, 5%, and 10% of DAO treasuries to tokenised US Treasuries could yield additional inflows of $243 million, $1.22 billion, and $2.43 billion, respectively.

Challenges with Federal Reserve rate cuts

Anticipated rate cuts: The Federal Reserve is expected to lower interest rates to 4.25%–4.5% by December, down from the current 5.25%–5.5% range.

Impact on appeal: These rate cuts could reduce the attractiveness of US Treasuries as an investment, potentially affecting demand for tokenised versions

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

Canadian investor and Shark Tank star, Kevin O’Leary

“I’m a big believer in picks and shovels.”

O'Leary uses the gold rush analogy to refer to the infrastructure that powers projects as his crypto investing strategy. That he refers to as "picks and shovels."

Focusing on regulated assets like stablecoins.

That clear legislation will drive up crypto's value, with stablecoins being the first sector to be regulated.

Bitcoin and Ethereum have a place in O’Leary’s portfolio, and he has invested in Circle, the company behind the stablecoin USDC.

He sees stablecoins as a key part of the puzzle for crypto mass adoption.

“If I want to buy a pièce unique, I have to do it in Swiss francs. It is an absolute pain in the arse to transfer the US dollars into Swiss francs, and it's [time-consuming] and expensive, and there's no added value there.

The narrative around stablecoins as digital payment systems has vastly changed over the last 24 months. It was a vilified asset, and now all of a sudden people are starting to see the merit of being able to transfer at a very low cost.”

He also believes that stablecoins can serve as a payment system for global transactions, avoiding the hassle and expense of converting between fiat currencies.

Binance Returns to India. Pays $2.25M Fine

Binance has registered as a "reporting entity" with India's Financial Intelligence Unit (FIU), allowing it to resume operations in India after being blocked since January 2024.

The registration reflects Binance's commitment to comply with anti-money laundering (AML) standards in India and enables the exchange to tailor its services to the Indian virtual digital asset (VDA) market.

In June, Binance was fined 188.2 million Indian Rupees ($2.25 million) for violating the Prevention of Money Laundering Act, which it has since paid.

Binance's website and app are now fully accessible to Indian users.

Binance resolves the issue in Brazil: Has reached an agreement with Brazil's Securities and Exchange Commission (CVM) after being banned from offering derivatives since 2020, agreeing to pay a fine of 9.6 million reais ($1.75 million).

The exchange confirmed it does not currently offer derivatives in Brazil and has taken steps to comply with local regulations.

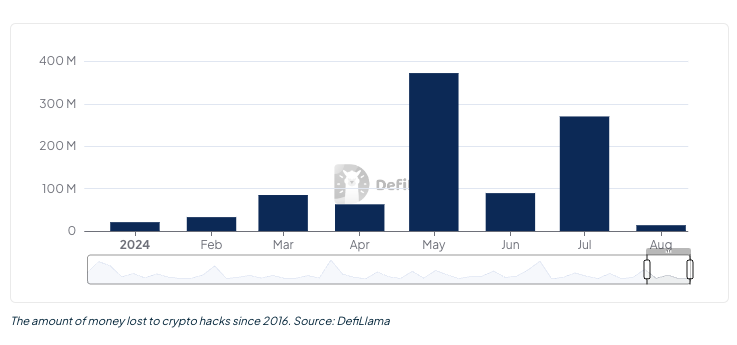

In The Numbers 🔢

$3 billion

The amount criminals are projected to steal in cryptocurrencies in 2024.

With $1.6 billion already stolen in the first half of the year, according to Chainalysis.

Eric Jardine, the cybercrimes research lead at Chainalysis.

“If you just just do a straight line out from where we’re at, you’re on track for somewhere in the $2 to $ 3 billion-plus range in terms of total number of dollars stolen this year.”

The amount stolen has nearly doubled from $857 million during the same period in 2023, with significant hacks contributing to the increase.

Despite the rise in theft, total illicit activity in the crypto industry has decreased by almost 20% this year compared to last.

One of the largest hacks occurred in July when $235 million was stolen from the Indian crypto exchange WazirX.

The hackers are shifting their focus back to centralised exchanges after a period of targeting decentralised finance (DeFi) protocols.

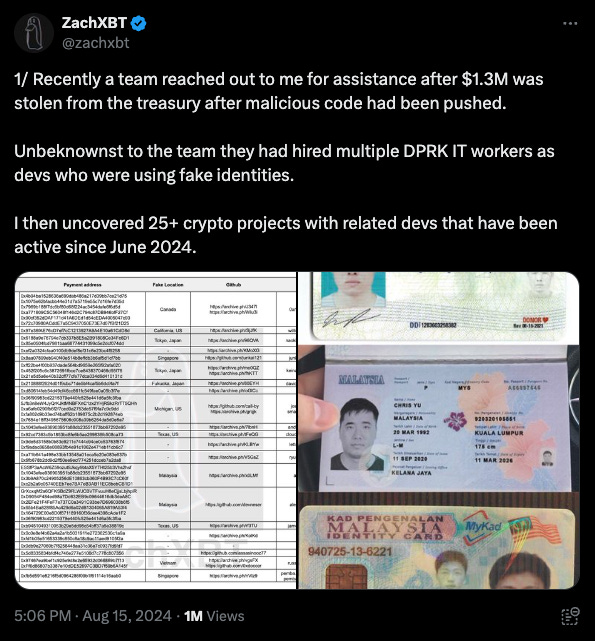

Crypto sleuth ZachXBT offers a beautiful breakdown of how DPRK hackers operate through one of the investigations carried out.

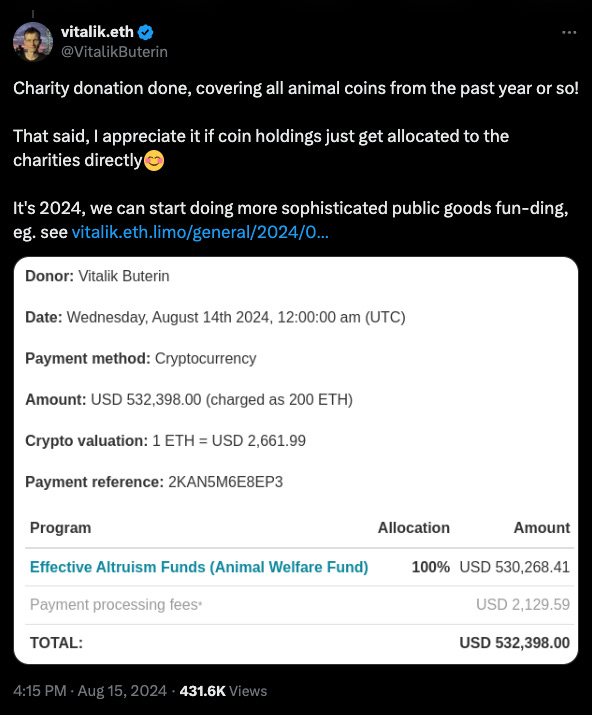

Vitalik Donates All Animal Coins

That’s about $530,000. Well done Vitalik Buterin.

All of the stash received in the past year, donated to charity (Effective Altruism Funds Animal Welfare Fund).

The Surfer 🏄

Crypto.com has announced a multi-year global sponsorship deal with UEFA to become the first official global cryptocurrency platform partner of the UEFA Champions League.

Miner Marathon Digital Holdings has purchased an additional $249 million worth of Bitcoin after raising $300 million through a senior note offering. Company's strategic Bitcoin reserve now exceeds 25,000 BTC.

The State of Wisconsin Investment Board has increased its holdings in BlackRock's iShares Bitcoin Trust by purchasing 447,651 shares, bringing its total to 2,898,051 shares valued at $98.9 million, while completely divesting from the Grayscale Bitcoin Trust.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋