A $4 billion trouble 💸

Binance gets a $4 billion encore from the DOJ. And SEC now sues Kraken. Tether plays hero, freezing $225 million. PYTH's $77 million airdrop. Bullish snags CoinDesk.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

We feel what?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

The US Department of Justice (DOJ) is seeking over $4 billion from Binance.

Why? It is part of a proposed deal to settle the ongoing criminal investigation into the exchange.

This demand represents one of the largest fines in the crypto space.

What does this mean? Changpeng Zhao, the co-founder of Binance, could potentially face criminal charges in the United States.

The resolution of the investigation involves addressing concerns related to money laundering, wire fraud, and violations of sanctions.

Year-Long Investigation: The DOJ has been conducting an investigation into Binance for the past year, scrutinising various aspects of its operations. The potential charges indicate a serious legal challenge for the cryptocurrency exchange.

Deal Dynamics: While the timing and structure of any potential deal remain undisclosed, reports suggest that it might materialise before the end of November.

Global Ramifications: Given Binance's status as the largest crypto exchange by trading volume globally, the outcome of this case could have broader implications for the regulatory landscape of the entire cryptocurrency industry.

As of now, Binance has not provided an official response to the reported DOJ demand.

If Binance agrees to the demand and pays over $4 billion, it would mark one of the most substantial fines ever imposed following an investigation in the crypto sector.

BNB Price Movement: BNB recorded a significant uptick of over 5% in the past 24 hours, reaching $254.51 and currently at $259.66.

TTD Tether 🪙

Tether, the stablecoin maestro, took on a real-life villain—part of an international human trafficking group pulling off a "pig butchering" scam in Southeast Asia.

The Biggest Crypto Freeze Ever

Tether, in collaboration with OKX and US law enforcement agencies, froze $225 million worth of USDT linked to the illicit operation.

Armed with blockchain analysis tools from Chainalysis, Tether and its partners embarked on a months-long investigation to trace the funds and put an end to the pig butchering saga.

Human Trafficking Connection: The frozen funds were traced back to a human trafficking ring based in Southeast Asia, specifically involved in a global 'pig butchering' romance scam.

The scam, named after the method of fattening a pig before slaughter, typically involves the perpetrator establishing a relationship with the victim before exploiting them.

During a Reddit Ask Me Anything session, the US Secret Service San Francisco Field Office disclosed that crypto-based pig butchering scams are prevalent and victim-focused.

Centralised Control: Tether's centralised smart contract management allowed it to wield the power of freezing specific addresses. Thirty-seven wallets were caught in the crypto deep freeze.

Tether pledges to work swiftly with law enforcement to thaw any lawful wallets that might have been inadvertently caught in the freeze.

Previous Tether Freezing Actions: In October, Tether took similar action by freezing wallet addresses linked to terrorism, both in Ukraine and the Middle East, with connections to Hamas.

TTD Kraken 🏦

Guess who's been sued by the SEC now?

The SEC's complaint, filed in a San Francisco federal court, accuses Kraken of facilitating crypto buying and selling without proper registration since 2018.

The SEC also claims Kraken commingled up to $33 billion of customer assets with its own, creating a "significant risk of loss."

Token Troubles: The SEC lists specific tokens, including Algorand (ALGO), Polygon's MATIC, and NEAR, as unregistered securities traded by Kraken.

The regulator claims Kraken actively promoted these tokens to the investing public. The lawsuit seeks a permanent ban on Kraken as an unregistered exchange, fines, and the return of ill-gotten gains.

Kraken doesn't back down. The exchange strongly disagrees with the SEC's claims, emphasizing that it never listed unregistered securities.

In a blog post, Kraken defends its actions, stating that the SEC's accusations about commingling are simply the exchange spending fees it has earned.

This isn't Kraken's first dance with the SEC. In February, the exchange reached a $30 million settlement with the regulator, agreeing to cease offering crypto staking products and services to US customers.

Now, it faces a new legal battleground.

Penalties and Relief: The SEC's complaint seeks penalties and injunctive relief against Kraken, urging the exchange to return any "ill-gotten gains."

TTD Airdrop🪂

Pyth Network's highly anticipated token, PYTH, made a splash with a robust airdrop that distributed over $77 million worth of tokens.

The Solana-based token's debut garnered an initial market cap of $765 million, showcasing strong community engagement.

Airdrop Details: Pyth's airdrop was not a modest affair, with 90,000 wallets being recipients of the token giveaway.

Eligible recipients now have a 90-day window to claim their PYTH tokens, which will play a role in on-chain governance voting.

Over 35,000 out of roughly 90,000 eligible wallets have already claimed their share, as per on-chain data from Dune.

PYTH's trading journey saw an initial surge to $0.53, followed by a brief dip to $0.28, and eventually settling around $0.34 at the time of writing.

Circulating Supply: The PYTH token starts with an initial circulating supply of 1.5 billion. A gradual increase is planned, expanding the total supply to 10 billion tokens over the next three years.

Exchange Airdrop: Backpack, a new crypto exchange led by FTX's former general counsel, contributed to the PYTH airdrop.

The exchange rewarded its users who staked SOL within the last two days. This initiative led to PYTH tokens being airdropped to 74,000 wallets.

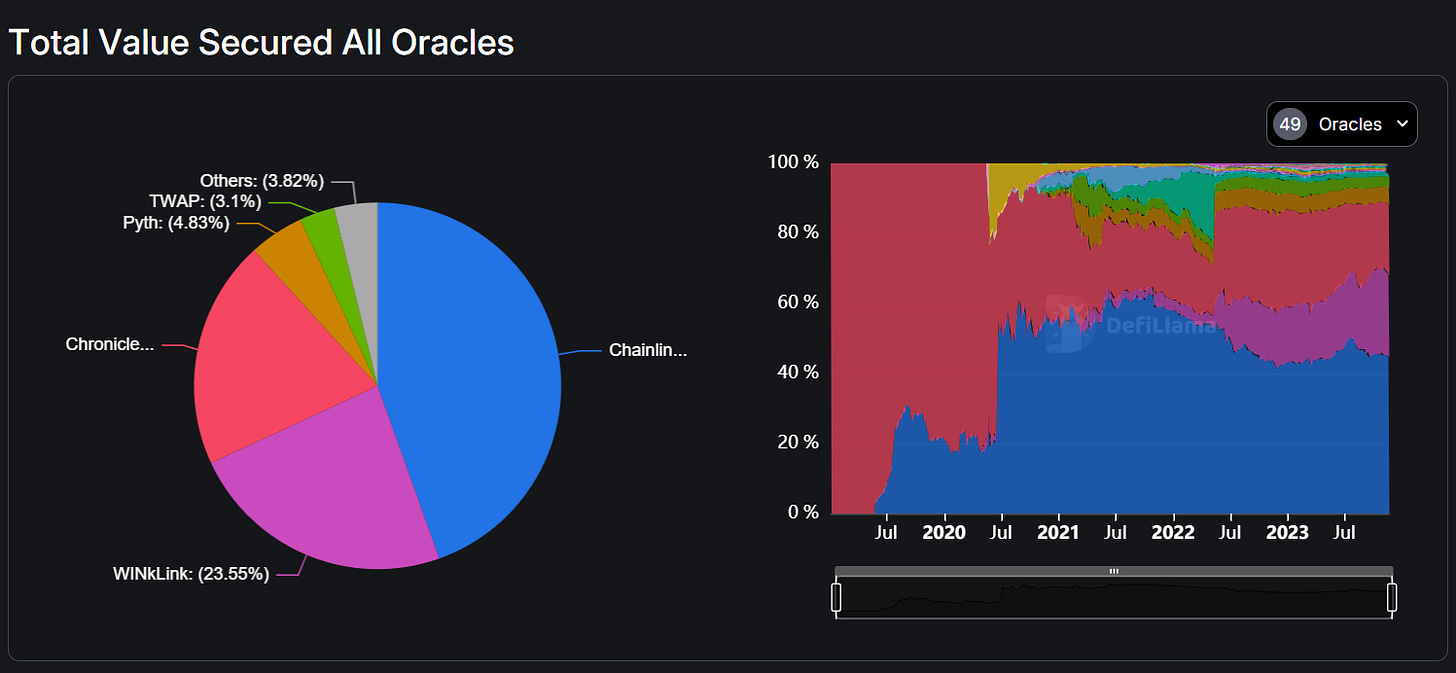

Pyth Network's Standing: As an oracle network, Pyth connects blockchains with off-chain data sources, facilitating real-world event integration into DeFi smart contracts.

Currently, Pyth holds the position of the fourth-largest oracle network, securing 4.75% of the market.

TTD Acquires 🫱🏻🫲🏼

Bullish, a crypto exchange led by former NYSE President Tom Farley, acquires CoinDesk, a leading crypto media company.

Digital Currency Group (DCG), CoinDesk's parent company, faces financial challenges post-FTX collapse, leading to considerations of CoinDesk's sale.

DCG bought CoinDesk for $500,000 in 2016.

Bullish now holds a 100% stake in CoinDesk, strengthening its position in the crypto industry.

Specific financial terms of the acquisition remain undisclosed.

Bullish CEO Tom Farley said in a press release. Farley was the president of the New York Stock Exchange.

“Bullish will immediately inject capital into several of CoinDesk’s most exciting growth initiatives which will power the launch of new services, events and products. We also want to express our unwavering support for CoinDesk’s commitment to journalistic independence.”

Concerns have arisen about potential influences on CoinDesk's editorial integrity following its acquisition by Bullish.

Speculations on how the exchange's ownership might shape the publication.

The media platform said that former Wall Street Journal editor-in-chief Matt Murray will chair an independent editorial committee, and the current CoinDesk editorial team will remain intact.

TTD Surfer 🏄

Microsoft and Nvidia stocks have reached all-time highs following the ousting of OpenAI CEO Sam Altman.

The Blockchain Association has backed six plaintiffs in their lawsuit against the US Treasury's OFAC over its sanctions on crypto mixer Tornado Cash.

Nearly all of OpenAI's employees have threatened to quit and join Microsoft if the current board does not resign.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋