AI vs Tinseltown ⚔️🤖

Studios' AI compromise, hoping to reboot their relationship with actors. Gary continues the 'tough love' card. 1,282 ETH go missing. HSBC jumps onto the crypto train. 'Dr. Doom' launches crypto.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

Is it time?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

AI has emerged as the unlikely mediator in the standoff between Hollywood actors and the bigwigs of the entertainment industry.

The months-long strike by the Screen Actors Guild‐American Federation of Television and Radio Artists (SAG-AFTRA) could finally be drawing to a curtain close, thanks to some crucial concessions involving AI.

AI's entry into the fray isn't exactly a cameo appearance.

The crux of the actors' discontent has been around the use of their voices and likenesses in generative AI models by the studios.

Read more bout it here.

The Studios’ Olive Branch

The major studios, after an intense negotiation session, have extended an offer that inches closer to the actors’ demands for control over AI replications.

This gesture, arriving in the aftermath of a “last, best, and final offer” last Saturday, hints at the studios' eagerness to resolve the conflict.

There's a buzz of optimism in Hollywood, as insiders suggest that the latest AI-related concessions could be the dealmaker.

Though there are still some wrinkles to iron out, particularly concerning streaming residuals, the newfound consensus on AI is being hailed as a major victory for the actors' guild.

The core of the case

Intellectual Property Concerns: There's a debate about whether AI systems should be able to use copyrighted material to train their algorithms. Artists and creators are concerned that this constitutes a mass pilfering of their work, potentially infringing on intellectual property rights.

Studio Stance vs. Union Stance: Major studios, through the Motion Picture Association (MPA), appear to be siding with tech companies, suggesting existing laws are adequate. In contrast, unions like SAG-AFTRA and the Writers Guild of America advocate for stricter legislation to protect the rights of creators, particularly regarding the unauthorised use of their works and likenesses in AI systems.

Scarlett Johansson's Case: An example cited is Scarlett Johansson taking legal action against an AI app developer for using her likeness and voice without permission. This raises questions about how current laws cover (or fail to cover) rights related to personal likeness and voice.

Fair Use and Legal Ambiguity: There's a significant legal debate over whether the use of copyrighted material in AI systems constitutes fair use. The unions argue that it doesn't under current case law, while the MPA believes fair use should be determined case-by-case.

Training Data Transparency: There's also an issue with the opacity of AI training datasets, making it difficult to prove infringement in court. This lack of transparency is a major hurdle for plaintiffs.

Need for New Rights

The Directors Guild of America (DGA) and WGA are advocating for the establishment of "moral rights," acknowledging creators as the original authors of their work. This recognition would offer greater financial and creative control over the use of their material, a crucial aspect in the era of generative AI tools.

The Stakes Are High

This isn't just about ending a strike. The deadlock has brought Hollywood's production machine to a screeching halt for over half a year, compounding the impact of a writers’ strike that has only recently been resolved. With the 2024 production schedule already in jeopardy, the studios are under pressure to get the cameras rolling again.

TTD Blockquote🎙️

SEC Chair Gary Gensler

"It's not just about one circumstance and one notorious fraudster, it's multiple notorious fraudsters."

Gensler has indicated that a rebirth of the embattled crypto exchange FTX is possible, provided it operates legally and under new leadership.

This comes in the wake of the great FTX court drama.

Read here: Can you ever forgive SAM?

Reports suggest that Tom Farley, former NYSE president and current digital asset exchange leader, is a top contender to take over FTX.

Gensler's remarks at DC Fintech Week signal an open-minded but cautious approach from the SEC on this potential shift.

“If Tom or anybody else wanted to be in this field, I would say - do it within the law. Build the trust of investors in what you’re doing and ensure that you’re doing the proper disclosures — and also that you’re not commingling all these functions, trading against your customers. Or using their crypto assets for your own purposes.”

Gensler insists that crypto firms need to play by the same rules as the old-school finance guys.

The SEC chair asserts that existing securities laws are sufficient for regulating the crypto industry; they just need effective enforcement.

Gensler emphasizes that fraudulent activities in crypto are widespread, not limited to isolated high-profile cases.

“There’s nothing about crypto that’s incompatible with securities laws. You’ve got just a lot of worldwide actors that are currently not complying with these time-tested laws.”

With the SEC involved in numerous cases, including high-profile disputes with Ripple and Grayscale, Gensler's remarks reflect a broader strategy to bring the crypto industry under established legal norms.

TTD ETF🚨

The ETF effect has begun - crypto in upswing👇🏻

TTD Trouble 🙊

CoinSpot's wallets seem to have sprung a leak.

The Situation at a Glance

ZachXBT Raises the Alarm: CoinSpot's wallets appear lighter by 1,282 ETH.

The Fast-Paced Crypto Shuffle: ETH quickly transforms into various other cryptos.

CoinSpot's Response: Still waiting in the wings.

CoinSpot's History: Not a hacking hotspot, but not immune to phishing.

Security Claims Under Scrutiny: CoinSpot's avowed high security is now questioned.

Background: CoinSpot, an Aussie crypto exchange, finds itself in a bit of a bind. Blockchain detective ZachXBT spots that a hefty sum of 1,282 ETH ($2 million) has seemingly taken a walk from two of the exchange's wallets.

The Rapid ETH Exodus

In a rather quick succession of events, two transactions indicated that a large sum of ETH exited CoinSpot's wallets. Specifically, one transaction involved the movement of 1,262 ETH, followed by another of 20.99 ETH, both heading to the same address.

This address then converted the ETH into various other cryptocurrencies, such as wrapped bitcoin, USDC, and USDT, through platforms like Uniswap and THORchain.

CoinSpot isn't known for dramatic headlines. Since its inception in 2014, the exchange has mostly kept out of hacking news, barring a phishing incident in 2021 targeting its users.

TTD Tokenised 🎫

HSBC, a global banking heavyweight with $9.1 trillion in custody assets as of 2022's end, is pushing further into the digital realm.

They're teaming up with Metaco, a tech whiz company recently scooped up by Ripple, to roll out an institutional custody platform for tokenised securities in 2024.

HSBC is already involved in digital asset issuance through its HSBC Orion platform and a fresh gold tokenisation venture.

Zhu Kuang Lee, HSBC's chief digital, data, and innovation officer, notes an “increasing demand for custody and fund administration of digital assets from asset managers and asset owners.”

Tokenised Securities 101

Blockchain-Based: These digital securities harness blockchain technology to create electronic counterparts of traditional assets like stocks, ETFs, or bonds.

Broad Application Spectrum: Beyond classic financial instruments, tokenisation can extend to real estate or even fundraising through digital tokens representing fractional company ownership.

Read more: Trillion dollar crypto opportunity 👀

Metaco's Role: Post its Ripple acquisition, Metaco is bringing to the table Harmonise, its flagship institutional platform that promises secure, unified digital asset operations.

HSBC's recently forayed into tokenised deposits with Ant Group, alongside the launch of Bitcoin and Ethereum ETFs tied to CME futures contracts in its Hong Kong division.

TTD WTF 🙄

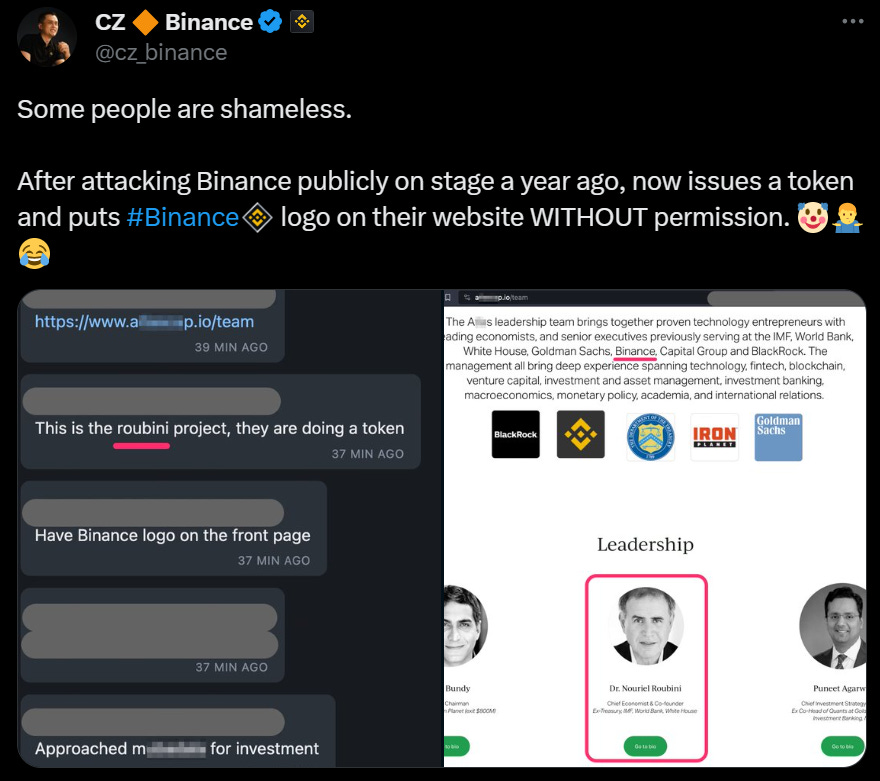

CZ criticises Nouriel Roubini's hypocrisy in new crypto venture.

Calls it 'shameless.'

Nouriel Roubini's Stance: Once a staunch critic of cryptocurrencies, including Bitcoin and Ethereum, Roubini, also known as "Dr. Doom" for his pessimistic financial predictions, has made a surprising shift.

After years of dismissing blockchain technology as trivial, he's now launching his own cryptocurrency.

Changpeng Zhao (CZ) has been on the receiving end of Roubini’s criticisms.

Despite previously disparaging the technology and entrepreneurs in the space, Roubini is now venturing into it himself.

Incident Trigger: Roubini's new venture, Atlas Capital, initially featured the Binance logo on its website, implying an endorsement or connection. This was particularly controversial given Roubini’s past harsh words against CZ and Binance.

CZ’s Response: Zhao called out this action on Twitter, using emojis to express his feelings of mockery and disbelief. He highlighted the irony of Roubini using the Binance brand for credibility after previously attacking it.

Following Zhao's tweet, Atlas Capital removed Binance's logo, along with those of other companies, from its website.

However, the site still mentions the involvement of former Binance executives, like Mayur Kamat, in Atlas Capital.

TTD Gucci 👜

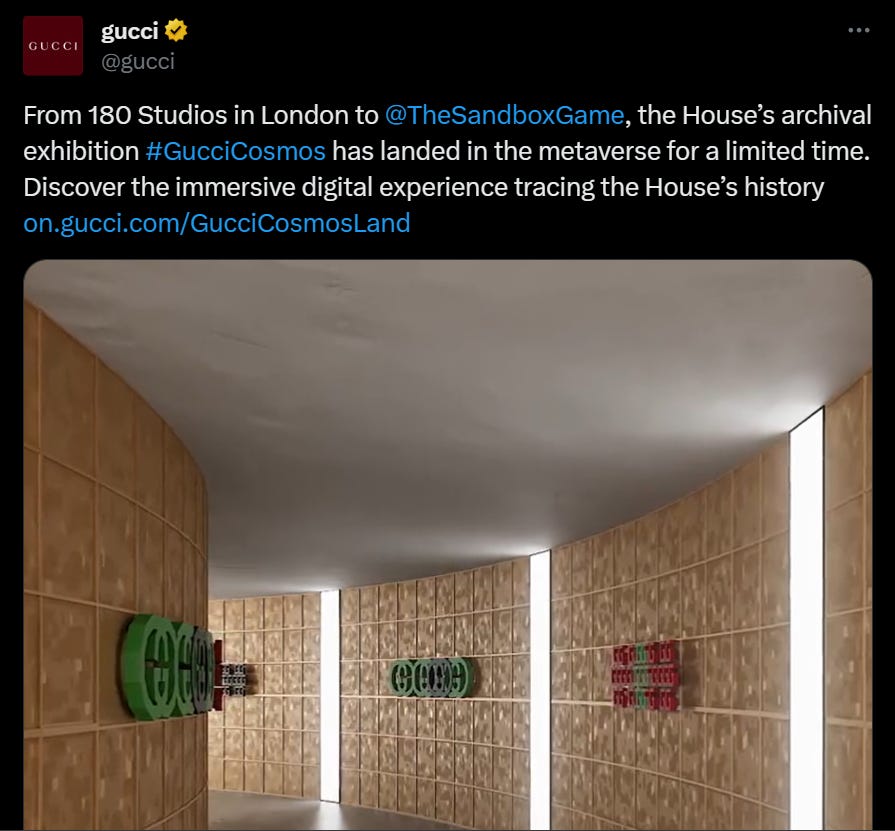

Gucci, synonymous with luxury and style, has made a chic leap into the metaverse.

The Italian fashion icon has introduced its historical London exhibit to the digital realm with "Gucci Cosmos Land" in The Sandbox game.

The Virtual Fashion Experience

Gucci Cosmos Land serves as a virtual bridge to Gucci's rich heritage. Fashion aficionados can now delve into the brand's iconic designs and historical milestones from anywhere around the globe.

It's a blend of history, fashion, and digital innovation.

The idea sprang from artist Es Devlin's vision and features an array of Gucci's archival designs curated by Maria Luisa Frisa.

Visitors to Gucci Cosmos Land can spiral through a digital narrative that captures Gucci's journey through different eras and themes.

What's Inside Gucci Cosmos Land

A showcase of Gucci's principles and inspirations.

Parkour adventures leading to discoveries of archival designs.

An interactive journey into the brand's past, present, and future.

The 'great' Sandbox

The Sandbox, operating on the Ethereum blockchain, lets players own virtual land as NFTs and create personalised gaming experiences. It's not just for the crypto-savvy; the platform is accessible to all, offering free gameplay without mandatory tokenised purchases.

The game is no stranger to high-profile collaborations, boasting partnerships with entities like McDonald’s, Adidas, Ubisoft, and Snoop Dogg.

Not Gucci's First Rodeo

This isn't Gucci's inaugural metaverse outing. The luxury brand dipped its toes into The Sandbox in 2022 with the Gucci Vault experience and showcased its Milan Fashion Week show across several metaverse platforms, including Roblox and Zepeto.

TTD Surfer 🏄

Wintermute CEO, Evgeny Gaevoy, has accused Near Foundation and Aurora Labs of failing to redeem $11.2 million worth of USN stablecoins.

The Bank of International Settlements (BIS) has criticised stablecoins, stating that they are not a safe store of value.

Swiss crypto bank SEBA has received a license from the Securities and Futures Commission (SFC) in Hong Kong.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋