Another Roller Coaster Week? 🛼

Bitcoin dips below $60,000 - the 33rd week blues. Saylor's Bitcoin gamble beats Buffett’s warning. Bitcoin ETF options before 2025? The $3.5B lawsuit against Tether. Ethereum gas fees hits 5-year low.

Hello, y'all. Who’s up for a little game of quiz. Music Monday anyone?👇

Bitcoin began the week below $60,000.

A historically jinxed trend during the 33rd week of the year.

An average decline of 1% over the past decade.

Historical performance: In the 33rd week, Bitcoin has experienced three double-digit drawdowns.

A 15% drop in the 31st week and a brief dip to $49,000 in the 32nd week.

Marking a 38% decline from its all-time high.

Ethereum has also shown negative performance patterns during the 33rd week, with an average drawdown of 5% since 2016.

What are the macro factors at play this week?

US inflation data is set to be released on August 13 and 14, with expectations for a slight decrease in the year-over-year inflation rate to 2.9% and core inflation to 3.2%.

Read: The Sahm rule was triggered. Is a recession near?

Market context: The anticipated inflation decrease could positively impact markets, coinciding with the release of most Q2 earnings reports, providing further insights for tech stocks and Bitcoin-related companies.

Three things Bitcoin

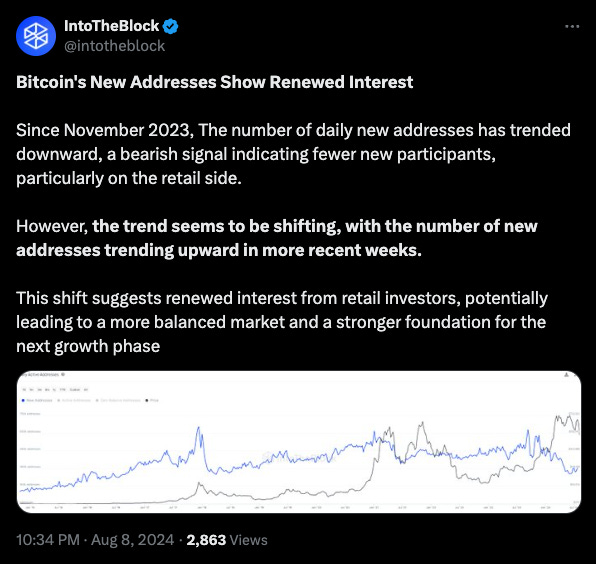

1/ Retail investors coming back?

On-chain data for daily new Bitcoin addresses has hit an upward trend.

After a downward trend since November 2023, the number of daily new Bitcoin addresses has started to rise, with figures ranging from 286,000 to 337,000 in early August.

Historical context: The number of new addresses hit a low of 203,536 on June 7, 2024, signalling reduced participation from new investors.

2/ In the times of Michael Saylor, it’s Bitcoin and nothing else.

3/ The city of Santa Monica, California launches Bitcoin Office.

Why? To educate residents and businesses about the digital asset and explore its economic potential.

Goal is to position Santa Monica as a Bitcoin innovation hub, to attract investments to support economic recovery and job creation.

The Bitcoin Office was unanimously approved by the City Council on July 11, 2024, and its website went live on August 8, 2024.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

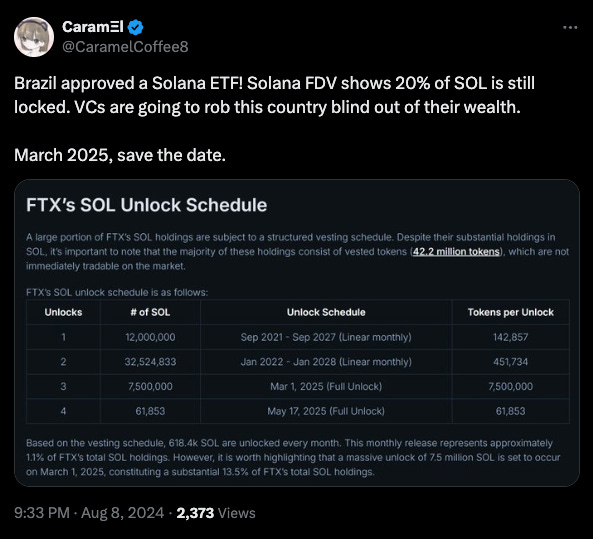

Pseudonymous X user, Caramel

“VCs are going to rob this country blind out of their wealth.”

Brazil has greenlit the first spot Solana (SOL) exchange-traded fund (ETF), but the approval of a US-Based Spot Solana ETF isn’t going to be easy.

Data from a Dune dashboard on August 11 showed an issuance of over 162,503 SOL, valued at approximately $25 million.

These tokens are rewards distributed to validators to maintain network security.

The high issuance rate might increase selling pressure, potentially destabilising the asset’s long-term value.

Valid questions over the market demand for SOL given its high emission rate.

BlackRock’s digital asset head, Robert Mitchnick, also expressed reservations about the feasibility of a Solana ETF.

“I don’t think we’re going to see a long list of crypto ETFs. If you think of Bitcoin, today it represents about 55% of the market cap. Ethereum is at 18%. The next plausible investible asset is at, like, 3%. It’s just not close to being at that threshold or track record of maturity, liquidity, and etc.”

Griffin Ardern, Head at BloFin Research & Options, discussed other potential obstacles for Solana, particularly its network stability.

Historically, Solana has experienced several severe downtime incidents, and even the entire blockchain network has rolled back transactions or been unavailable for more than 24 hours. SOL issuers may need to prove that the Solana network is mature and stable enough and that the probability of similar incidents is ‘low enough for investors to accept’ to protect investors’ rights and interests better.”

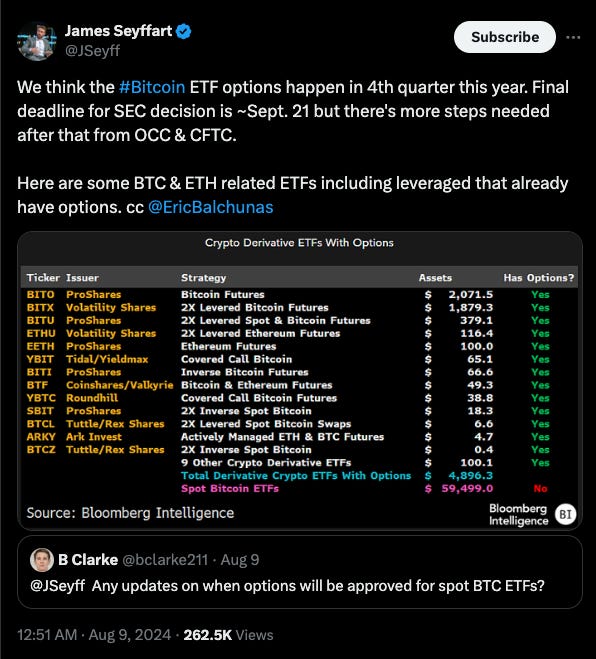

Bitcoin ETF options launching before 2025?

Bloomberg Intelligence analysts Eric Balchunas and James Seyffart estimate a 70% chance that Bitcoin ETF options will be approved by the end of the year.

Trading simplification: Allow investors to buy or sell Bitcoin at a predetermined price and date, eliminating the need for specialised crypto options platforms.

Market potential: Attract significant interest from institutional investors, marking a crucial step toward broader cryptocurrency adoption in traditional finance.

The odds of approval

The approval involves multiple regulatory bodies, including the SEC, OCC, and CFTC, with no set deadlines for completion, leading to potential delays.

Balchunas compared the approval process to a lengthy visit to the DMV, and that delays are due to governmental slowness rather than malicious intent.

“A bit like going to the New Jersey department of motor vehicles. You get stuck in there for days. There’s a couple agencies involved. It’s just a pain. I don’t think they’re delayed for any nefarious reason,” he added. It’s more just governmental, bureaucratic slowness.”

Historical context: Some ETFs, like those for gold and platinum, have taken years to receive options approval, highlighting the challenges in the regulatory landscape.

Recent CBOE action: The Chicago Board Options Exchange withdrew and immediately refiled its application for Bitcoin ETF options, with the new version being significantly longer, suggesting positive feedback from the SEC.

In The Numbers 🔢

$3.5 billion

The lawsuit against Tether.

What? Defunct cryptocurrency exchange Celsius has filed a lawsuit against Tether, alleging misappropriation of assets, damages, and legal fees.

Celsius is requesting the return of 57,428.64 BTC or its current market value of about $3.48 billion based on Bitcoin's price of $60,627 as of August 10.

Context: This lawsuit follows Celsius' bankruptcy filing in July 2022, raising concerns about asset management and the stability of cryptocurrency exchanges.

Following the collapse, former CEO Alex Mashinsky faced federal criminal charges and civil lawsuits. Late last year, Celsius creditors approved a $2 billion restructuring plan aimed at guiding the company out of bankruptcy.

Allegations: Celsius claims Tether provided a loan in USDT in exchange for collateral of 39,542.42 BTC. As Bitcoin's price fell, Celsius was required to provide additional collateral to avoid liquidation.

The lawsuit alleges Tether liquidated the BTC without allowing Celsius to post more collateral, covering the debt in the process.

Tether's response: Tether has denied the allegations, calling the lawsuit baseless and a "shake down."

The company claims Celsius directed Tether to liquidate the BTC collateral to settle an outstanding position of approximately $815 million in USDT.

Tether reassured its stakeholders, citing $12 billion in consolidated equity, and stated that Tether token holders would not be adversely affected by the lawsuit.

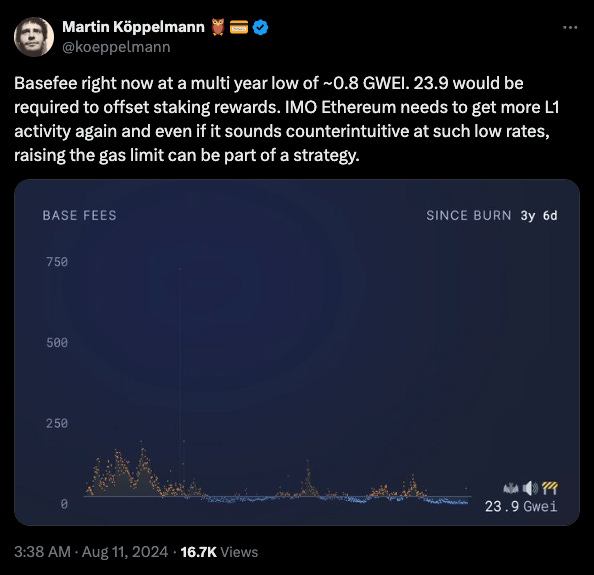

Ethereum Gas Fees Hits 5-year Low

Ethereum's daily ETH burn rate has hit a record low this year.

Base gas fees between 1-2 gwei.

The low burn rate has increased Ethereum's inflation, with net issuance exceeding 2,100 ETH on August 10.

On Saturday, only 210 ETH were burned, compared to 5,000 ETH on August 5 when fees reached 100 gwei.

How have we come this?

User migration to Layer 2 solutions and adoption of blob transactions from the Dencun upgrade have reduced costs and gas fees.

Gnosis founder Martin Köppelmann recommends temporarily increasing the gas limit to offset the inflationary trend.

EIP-1559, implemented in 2021, linked the burned base fee to network activity, with lower fees resulting in less ETH burned.

ETH is currently trading at $2,540, up nearly 10% year-to-date, with a market cap of around $305 billion.

The Surfer 🏄

Tornado Cash developer Alexey Pertsev seeks $750,000 to $1 million for his legal defense against money laundering charges, with the crypto community raising over $2.3 million through JusticeDAO. Pertsev, sentenced to 64 months in prison, argues he shouldn’t be liable for users' actions.

Thailand's Securities and Exchange Commission has launched a regulatory sandbox for cryptocurrency businesses, open to exchanges, brokers, and fund managers, to promote innovation while ensuring compliance. Applicants will be evaluated on capital adequacy and management structures.

Venezuela has blocked access to Binance and social media platform X amid unrest over disputed presidential election results. Binance assured users their funds are safe and recommended using VPNs to bypass the restrictions.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋