Banks can 10x the blockchain industry? 🤝 💪

Legacy financial infrastructure of banks and efficiency of blockchain networks can be great mix. Grammy's, Marvel, Wimbledom - all want a piece of AI. NFT gaming and sneaker NFTs are making waves.

Hello, y'all. First animated film funded by a DAO brings Nouns NFT Collection to life … makes us all happy, and gives reasons to continue dispatching✌️👇

Give your books a »» Muzify «« spin? This is The Token Dispatch, you can hit us on telegram 🤟

Today we’re going … who said what.

Ever heard of an unlikely pair turning out to be the best thing since sliced bread?

Banks and blockchain are coupling up and potentially about to 10X the industry.

Chainlink co-founder Sergey Nazarov claims that banks can 10x the blockchain industry size.

The context is a little partnership

Swift, the global financial messaging system, is expanding its experiments to encompass public blockchains.

They are leveraging Chainlink's Cross-Chain Interoperability Protocol (CCIP) for seamless integration.

The collaboration includes major financial institutions such as BNP Paribas, BNY Mellon, Citi, Euroclear, SIX Digital Exchange (SDX), and The Depository Trust & Clearing Corporation (DTCC).

Chainlink's "enterprise account abstraction layer" adds advanced capabilities to the partnership.

In a bid to explore how to serve customers on both private and public blockchain networks like Ethereum, Swift is expanding its experiments to encompass public blockchains 🌐

According to Nazarov, there's a ton of legacy financial infrastructure that banks want to preserve while also reaping the efficiencies offered by blockchain networks.

Nazarov said: "It shows that the largest financial institutions — even in a down market — are interested in blockchain technology reinventing how the capital markets work."

Meanwhile, is banking dying?

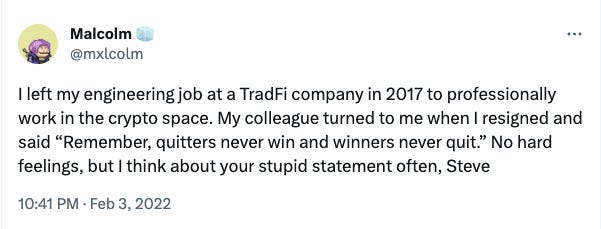

Meanwhile, a host of traditional finance executives are turning their backs on the old system and embracing the digital revolution. People like Lisa Wade (CEO of DigitalX) and Guy Dickinson (CEO of carbon trading platform BetaCarbon) have jumped ship from traditional banking roles to head up innovative crypto firms. And they don't regret even a bit!

"It is becoming very obvious Web3 financial rails are the future," Wade said, pretty much summing up the sentiment of the entire crypto industry. For them, it's not about chasing the big bucks, it's more about "building something great" in an industry where innovation is king.

They all agree

Now what do investors want?

Institutional investors are keeping an eagle eye on crypto. They want crypto, but not without TradFi backing. How do we know?

Here's everything from Nomura survey

The majority of institutional investors polled are still interested in crypto.

Professional investors want backing from large traditional financial institutions before investing in crypto.

Regulatory uncertainty in the US has stalled institutional investor interest in crypto.

90% of professional investors believe it's important to have backing from a large traditional financial institution for crypto investments.

96% see digital assets as an opportunity for investment diversification.

82% of professional investors are optimistic about the crypto asset class in the next 12 months.

Bitcoin and Ether (ETH) are regarded as the foundation of the Web3 economy and a long-lasting source of investment opportunities.

But two things

Nansen says that for the next big crypto surge, we need two things: regulatory clarity in the US and lower inflation.

Despite regulatory uncertainties surrounding crypto exchanges like Coinbase and Binance, Bitcoin has performed well, with a 66.5% increase in its price over the past six months. Nansen suggests that current shallow sell-offs and decreasing crypto-implied volatility indicate that much of the negative regulatory and macro news is already priced into the market.

Shhh...Powell is talking

Fed Chair Powell just dropped some crypto knowledge during a lively hearing on Capitol Hill.

He declared that stablecoins deserve some serious federal oversight. Powell also gave a nod to the mighty Bitcoin, claiming it has "staying power" as an asset class.

What else?

We do see payments stablecoins as a form of money, and in all advanced economies, the ultimate source of credibility in money is the central bank.

We believe that it would be appropriate to have quite a robust federal role in what happens in stable coins going forward.

Leaving [the Fed] with a weak role and allowing a lot of private money creation at the state level would be a mistake - about regulatory landscape for tokens collateralised by dollars.

We would not support…accounts at the Federal Reserve by individuals ... If we were to, and we're a long way from this, support at some point in the future a CBDC, it would be one that we're intermediating through the banking system and not directly at the Fed.

All of this led to: The S&P 500 and Nasdaq Composite indexes closing the trading session 0.5% and 1.2% lower, respectively.

It's not the first time Powell has sung the praises of stablecoins. Back in 2021, he called them a worthy addition to the "payments universe." And now, he's doubling down, suggesting they should be regulated like bank deposits and money market funds.

TTD Binance 🔯

From issuing cease and desist orders to fighting legal battles, Binance has been experiencing a rollercoaster of events lately.

Cease and Desist Drama

After recently issuing a cease and desist notice to "Binance Nigeria Limited," which was fraudulently soliciting Nigerian investors, the exchange has now sent a second cease and desist order. This time, it's directed at a UK-based company called Binance Ltd. Reddit users claimed that Binance had a utility closet listed as an office in the UK. Binance quickly dismissed the report, clarifying that they did not have a UK office and that Binance Ltd was in no way associated with the exchange.

Legal Battles

Binance.US, Binance Holdings Limited, and CEO Changpeng Zhao, affectionately known as CZ, are taking on the US Securities and Exchange Commission (SEC). Lawyers representing the entities have filed a motion alleging that the SEC misled the public with misleading statements regarding an ongoing securities lawsuit. The legal teams are asking the financial regulator to adhere to the "applicable rules of conduct." It seems like CZ and Binance are not afraid to fight back against the regulatory giants.

“The SEC has no evidence that BAM [Binance.US] customer assets have been dissipated, commingled or misused in any way,” said the June 21 filing. “The SEC’s press release also appears to be designed to introduce unwarranted confusion into the marketplace, which could have the effect of harming BAM customers rather than protecting them. It also risks tainting the jury pool with misleading descriptions of the evidence concerning the Defendants.”

Zero Maker Fees Galore

The exchange has announced zero maker fees for TUSD (TrueUSD) spot and margin trading pairs. But that's not all.

Binance is also extending zero trading fees on USD stablecoin pairs to all existing and new pairs. This means that trading in these pairs won't cost users anything in terms of maker fees.

Brazilian Summons and Regulatory Scrutiny

Guilherme Haddad, the Director of Binance Brazil, may be summoned before the Brazilian parliament as part of an investigation into alleged pyramid schemes in the country. Brazilian authorities are closely scrutinising Binance's activities, and the company is also under investigation for offering derivative market products without authorisation.

TTD NFT 🐝

With sneaker NFTs and NFT gaming making waves in the digital space, the future of digital experiences has never looked more enticing.

Sneaker NFTs

The groundbreaking collaboration between Puma, Gutter Cat Gang, and NBA player LaMelo Ball: The trio has come together to release a unique non-fungible token (NFT) sneaker collection called "GutterMelo MB.03."

This innovative digital collection will be available for minting on the NFT marketplace OpenSea starting June 29. But here's the twist – each digital sneaker comes with a physical counterpart that can be worn in the real world.

This collaboration, which forms part of LaMelo Ball's fashion partnership with Puma, aims to redefine hoops apparel and fashion, merging the worlds of physical and digital experiences. By owning the NFT sneakers, buyers not only gain access to exclusive virtual footwear but also receive a tangible pair they can flaunt on the streets.

Gods Unchained on Epic Games Store

In a groundbreaking move for the NFT gaming space, the beloved NFT card game Gods Unchained has made its grand entrance onto the Epic Games Store. With the Epic Games Store boasting a massive user base of 230 Million and 68 Million monthly active users, Gods Unchained is set to captivate a wider audience.

As players dive into the mystical realm of Gods Unchained, they'll find themselves immersed in strategic battles with collectible NFT cards. Sharing the marketplace with other prominent games, this epic integration paves the way for increased visibility and popularity for both NFT gaming and the Epic Games Store.

TTD AI 📍

The fusion of human ingenuity and artificial intelligence is taking us on a wild ride through the realms of music, entertainment, and sports.

Grammy Awards 🏆 🤖

The Recording Academy is getting hip with the times and has updated its rules for the 2024 Grammy Awards. Guess what? Music created with the help of AI tools can now compete for those coveted Grammy nominations.

Only humans can actually accept a Grammy award. That's right! While AI can lend a hand in the creation process, it's the human touch that steals the spotlight. The music must have meaningful human authorship relevant to the Grammy category.

Marvel's "Secret Invasion" 🎥 🤯

Lights, camera, AI action! Marvel's new TV series "Secret Invasion" on Disney+ has caused quite a stir among fans and creators. Why? Well, they decided to get creative and use AI tools to whip up the show's opening credits.

Director and executive producer Ali Selim defended the decision, stating that the AI-driven opening sequence perfectly matches the show's themes of deception and paranoia.

Wimbledon 2023 🎾 🤖

AI-generated commentary during the championship's highlights packages. How cool is that?

IBM's WatsonX technology, in collaboration with the All England Lawn Tennis Club (AELT), will be providing audio and captions for those thrilling match highlights. The AI commentary, designed with the tennis-specific language, aims to deepen fan engagement and cover a wider range of matches.

TTD Surfer 🏄

FTX has filed a lawsuit to claw back $800 Million from Bankman-Fried friends and affiliated funds.

Amazon Web Services (AWS) has introduced a fund of $100 Million to bolster startups focusing on generative AI.

Crypto.com has successfully obtained registration as a virtual asset service provider from the Bank of Spain.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋