Bitcoin ATH around the world⚡

Red alert for global inflation? Bitcoin surge crashes Coinbase. $7.7B trade volume for ETFs. US government $1B BTC for sale? Gemini to return over $1B to customers. Telegram AD platform on blockchain.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bitcoin's on fire.

Hit $64K on Wednesday.

Ethereum is on fire.

Hit $3.5k on Thursday.

BTC is not only is it nearing its all-time high in USD, but it shattered records against a 12 other currencies.

This includes: Japanese yen, Malaysian ringgit, Indian rupee, Taiwan dollar, South Korean won, Chilean peso, Australian dollar, Chinese yuan, South African rand, Norwegian krone, and Turkish lira.

How? It's a red alert for inflation in those countries, as their currencies lose value while Bitcoin charges ahead.

Here's why this BTC rally has staying power

ETF Explosion: New spot ETFs are smashing records, attracting billions and putting Bitcoin on the institutional radar. BlackRock's ETF alone is already a top contender.

Read: Crypto On One-Way Highway 🆙

Weekday Warriors: Gone are the weekend spikes, replaced by steady weekday trading, a sign institutions are operating on their turf.

Record-Breaking Bets

Open interest in Bitcoin futures is skyrocketing, especially on the regulated Chicago Mercantile Exchange (CME), favoured by big firms.

The FOMO liquidation

A classic case of FOMO (Fear of Missing Out) followed by a "blow-off top." As the price skyrocketed, over-leveraged traders jumped in, only to be crushed when the inevitable downturn hit.

The Transaction Fee? Still remains low. Thanks to lower Ordinals activity

More to go?

History buffs, take note: Bitcoin price has skyrocketed after every halving (when new coin creation gets cut in half).

2012 halving: Price jumped from $12 to $964 in a year.

2016 halving: Price surged from $663 to $2,500 in a year.

2020 halving: Price soared from $8,500 to $68,783 in a year.

In the Numbers 🔢

$7.7 Billion

Spot Bitcoin ETFs just shattered their daily trading volume record, clocking in this massive number on February 28th.

BlackRock's iShares Bitcoin ETF (IBIT): The star of the show, raking in $3.35 billion in volume, almost half the total.

Other notable players: Grayscale Bitcoin Trust (GBTC) at $1.86 billion and Fidelity Wise Origin Bitcoin Fund (FBTC) at $1.44 billion, making up another 43% of the volume.

$1 Billion

US Government moves seized Bitcoin from Bitfinex hack.

The $1 billion in Bitcoin seized from the infamous Bitfinex hack has vanished from US government wallets, raising questions about its destination and purpose.

The twist: This comes just hours after Bitcoin's wild price swing.

$1 Billion

The amount Gemini will return to customers. Will pay $37 million fine in a settlement with the NY regulator.

The settlement is related to compliance failures and the Gemini Earn lending program.

Why Coinbase Crashed?

The Bitcoin surge is causing a traffic overload for Coinbase.

Obviously.

Coinbase showing zero balances for some users.

The cause: Heavy traffic, exceeding even their anticipated 10x increase.

But fear not.

Coinbase assures it's just a technical glitch and your funds are safe.

Now back to normal.

This isn't entirely new territory for Coinbase, as they faced similar issues during past Bitcoin rallies.

Where’s ETF?🚨

Wall Street giant Morgan Stanley is performing due diligence to add spot bitcoin ETF products to its brokerage platform👇

Saylor Scores, Bukele Brags

Michael Saylor's Windfall

MicroStrategy purchased an additional 2,532 Bitcoins during the recent price dip.

This timely purchase, combined with the recent price surge, pushed Saylor's paper profits on Bitcoin holdings above $700 million.

MicroStrategy remains the largest corporate holder of Bitcoin, with over 130,000 coins in its treasury.

Nayib Bukele's Boast

El Salvador, the first country to adopt Bitcoin as legal tender, has also seen its Bitcoin investment appreciate significantly.

President Bukele, a vocal Bitcoin advocate, took to Twitter to celebrate the "millions" in profit El Salvador has made on its Bitcoin holdings.

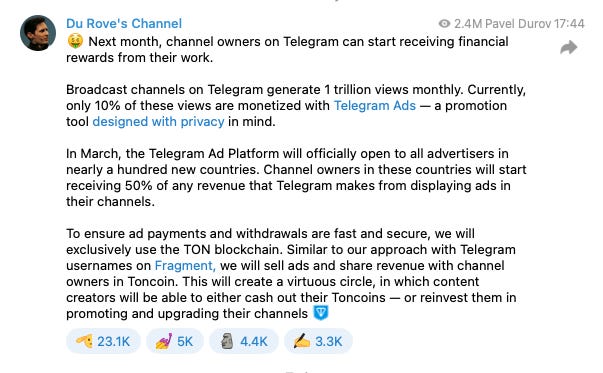

Telegram AD Revenue Share

Telegram is launching its ad platform, built on the TON blockchain, and you can start earning real money from your channel's views.

Here's the scoop

50% share of ad revenue: Earn half of all ad revenue generated on your channel.

Powered by TON blockchain: Secure and transparent payments with Toncoin (TON) cryptocurrency.

Over 100 countries eligible: Start monetising your content in March, if you're located in one of the participating countries.

Broadcast channels reach billions: Generate income from Telegram's massive user base of over 800 million monthly active users.

TON blockchain’s Toncoin (TON) has an $9 billion market capitalisation and is the 15th-largest cryptocurrency on CoinMarketCap.

The Surfer 🏄

SEC challenges Terraform Labs' payment of $166 million to lawyers in court filing.

Former President Donald Trump's Ethereum wallet holds nearly $4 million worth of MAGA (TRUMP) tokens.

Solana real estate project Parcl is planning a $160 million airdrop in April.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋