Bitcoin ETF approved ✅ Hallelujah.

US SEC greenlights 11 Spot BTC ETFs. Crypto community excited. Gensler not excited. Approval gets inscribed on blockchain. ETF-themed meme coins. Iconic tweet - Running Bitcoin. Ether ETFs on its way?

Hello, y'all. It's that kinda day boss …👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

SEC Says 'Yes' to Bitcoin ETFs! All 11 of them.

All 11 BTC ETF applicants filed Form 19b-4 amendments on January 5.

On Wednesday, both news media and traders were eagerly awaiting the SEC's decision on Bitcoin ETFs.

Bloomberg senior ETF analyst Eric Balchunas indicated readiness, stating "ALL SYSTEMS GO" on X.

Betting data from Polymarket shows significant wagers on the outcome of spot Bitcoin ETFs.

VanEck announces a 5% profit donation to support Bitcoin developers, following Bitwise's 10% commitment.

ARK released an ad 👇

This happened👇

Grayscale Investments officially announces its approval notice.

The first statement from SEC Chair Gary Gensler is posted on the SEC website.

And then came the happy news 👇

Spot bitcoin ETF applicants have had their S-1 forms go effective, paving the way for trading to start as soon as tomorrow.

The SEC approved 11 spot bitcoin ETFs

Final versions of the ETF prospectuses are now on the SEC's website.

Here’s how the voting went: Read

BlackRock, Valkyrie Investments, and VanEck expect trading to begin on Thursday.

Valkyrie and VanEck made these statements before official approvals.

Expected Fund Flows

Valkyrie expects $200 million to $400 million in initial inflows.

VanEck anticipates $1 billion in funds in the first few days and $2.4 billion within a quarter.

Galaxy predicts inflows of $14 billion in the first year.

Bitwise estimates the market for spot bitcoin ETFs could reach about $72 billion within five years.

Bitwise Announcement

Bitwise posted that its Bitcoin ETF (BITB) will begin trading on January 11.

The company plans to donate 10% of profits from the fund to Bitcoin open-source development.

Since 2013, Bitcoin advocates have sought SEC approval for a direct access spot product.

The SEC's approval marks a turning point, mainstreaming Bitcoin as an investable asset for retail investors.

Bitcoin futures ETFs already trade in the U.S., but the new spot products are simpler for average investors.

15 years since the Finney tweet

The fees reveal: Fingers Crossed🤞🏿

TTD Blockquote🎙️

SEC chair, Gary Gensler.

"We did not approve or endorse bitcoin."

The SEC lost a legal scuffle against Grayscale over a spot bitcoin ETF. Result? Gensler and team are now nodding along to about a dozen Bitcoin ETF proposals.

Read: SEC vs / Grayscale⚔️

Gensler's Take: "We did not approve or endorse bitcoin."

Read: "We're doing this because we have to, not because we want to."

Gensler's Words of Caution: "Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto."

The SEC had no choice but to approve about a dozen Bitcoin ETF proposals after losing in court over Grayscale's application.

Gensler pointed out Bitcoin's usage in illicit activities like ransomware, money laundering, sanction evasion, and terrorist financing.

He clarified that approval doesn't reflect the SEC's view on the status of other crypto assets under federal securities laws.

"It should in no way signal the commission’s willingness to approve listing standards for crypto asset securities. Nor does the approval signal anything about the commission’s views as to the status of other crypto assets under the federal securities laws or about the current state of non-compliance of certain crypto asset market participants with the federal securities laws."

SEC Commissioners' Reactions

Commissioner Caroline Crenshaw dissented, concerned about investor protection and the decision's path.

Commissioner Hester Peirce, known for supporting the crypto industry, welcomed the decision, referring to it as the end of a consequential saga. Also, criticized the agency for taking over a decade to approve spot Bitcoin ETFs.

But, Amidst the euphoria, the SEC's X account has been unusually quiet since its mishap with a hacked tweet about Bitcoin ETF approvals.

Read: Who's gonna protect SEC? 🪖

TTD Reactions 👀

Here's some essential reactions to the Sec's ETF approval:

Coinbase calls it 'Watershed Moment'

Also mentioned the 'Grayscale moment.'

"Today will be remembered in crypto history," said Binance's Richard Teng.

Saylor say 👇

"Donating 5% of our profits to Bitcoin core developers." - said VanEck CEO Jan van Eck.

Bigger impact on Asia, says Animoca cofounder Yat Siu.

Also a good read: Spot Bitcoin ETFs Approved: The Crypto Industry Reacts

Critique from Crypto Critics

The nonprofit economic organisation, Better Markets, denounced the Bitcoin ETF decision.

Stephen Diehl criticized Bitcoin as representing negative values and praised fiat currencies.

Gold advocate Peter Schiff commented on the lack of real-world utility in Bitcoin, seeing the ETFs as new avenues for speculation.

TTD Ethereum💎

After the SEC's green light for 11 Bitcoin ETFs, Ethereum ETFs seem poised for approval.

Ether's price spiked, signalling market optimism.

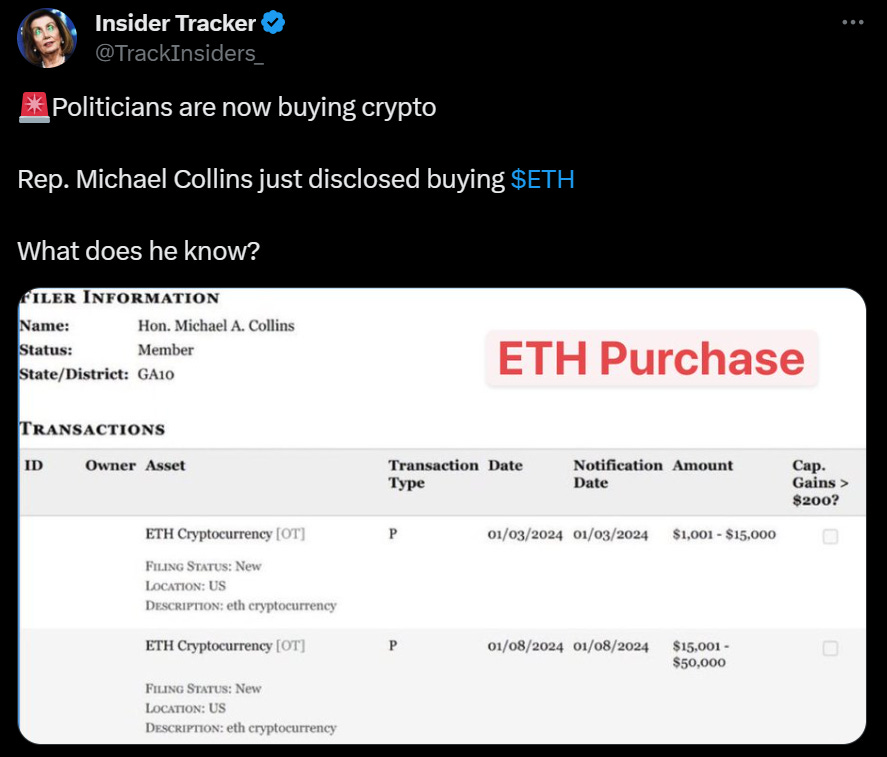

Michael Collins, a U.S. Representative for Georgia, reportedly purchased Ethereum in two transactions recently.

Analysts' Predictions and Insights:

Bloomberg's Eric Balchunas: Strong belief in Ether ETFs following Bitcoin's path. Predicts a 70% chance of Ether ETF approval by May.

‘DCInvestor’, a crypto investor believes Ethereum will retain more value than most assets post-cycle.

Digital Asset Lawyer Joe Carlasare: Anticipates approval but expects some delay.

Valkyrie Funds’ CIO Steven McClurg: Surmises that Ether and XRP ETFs could follow Bitcoin’s lead.

Fellow Bloomberg Analyst James Seyffart: Confident about SEC approval, citing previous acceptance of Ether as a commodity in futures ETFs.

Application Deadlines:

VanEck by May 23, ARK 21Shares by May 24, Hashdex by May 30.

Grayscale by June 18, Invesco by July 5.

Fidelity and BlackRock by early August.

TTD ETF Effect 🌊

Quick Creation of Meme Coins 🪙

Hot on the heels of the SEC’s Bitcoin ETF nod, Solana's traders whipped up some ETF-themed meme coins.

Electric Turkey Frier (ETF) Token: This Solana meme coin surged by 30,800% to over two cents, coinciding with the SEC decision announcement.

The ETF token witnessed $775,000 in trading volume from over 1,900 wallets but later faced significant fluctuations, reducing its market cap to around $93,000.

Etched in Bitcoin Blockchain✍🏻

Gary Gensler's statement on the approval of Bitcoin ETFs has been immortalised on the Bitcoin blockchain using Ordinals Inscriptions.

No take backs!

Inscription Details: Titled “Statement on the Approval of Spot Bitcoin Exchange-Traded Products,” it's marked as Inscription 54,114,539, featuring Gensler's photo and the date of the letter.

$12 Million Bet on Bitcoin ETFs💰

Polymarket, a Polygon-based decentralised predictions market, saw over $12 million in bets on whether the U.S. would approve a spot Bitcoin ETF before January 15.

The Wager Outcome: Bets placed since early December 2023 paid off for those who bet "YES" as the SEC approved 11 spot Bitcoin ETFs on Jan. 10.

TTD Surfer 🏄

A Hong Kong lawmaker is calling for swift action from the local government after the US approved spot ETFs.

Robinhood CEO Vlad Tenev has announced that the investment app plans to list spot bitcoin ETFs as quickly as possible.

The European Central Bank is offering a significant amount of money to contractors who can enable offline payments for a retail digital euro.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋