Bitcoin's Inflation Rate Falls Below Gold 🏆

Bitcoin bulls pin extended rally hopes on weaker dollar. 10.6M wallets in mid-March hold $1k BTC. Stablecoin holders nears 100M mark. Samourai wallet mixer co-founders arrested. CZ apologises.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bitcoin's inflation rate has officially dipped below gold's.

This is a big deal for Bitcoin bulls.

One reason: Better store of value.

Bitcoin supply inflation rate: Now 0.85%, lower than gold's 2.3% - Glassnode report.

This means limited supply.

Which means, it becomes more valuable over time as demand increases also since we know that there's only 21 million in supply.

And that means BTC has a better "store of value" than gold + inflation resistance.

Glassnode also say the amount of new Bitcoin is a tiny drop compared to daily trading - Less than 0.1% of the aggregate capital. So, the price impact might be minimal.

But miners are fine. Miner revenue is surprisingly up after the halving, thanks to Runes for driving up transaction fees.

Read: What Are Bitcoin Runes? 🙇♀️

There are more Bitcoin holders than ever

According to a new report by Fidelity Digital Assets, the number of wallets with at least $1,000 worth of Bitcoin has skyrocketed - record high of 10.6 million in March. That's double the number of wallets holding this amount in 2023.

Also, Bitcoin held on exchanges fell 30% in the first quarter to 2.3 million BTC, suggesting investors are moving their coins into secure storage.

We see a little swing?

This Friday, over $6.3 billion worth of Bitcoin options are set to expire on Deribit, a major crypto derivatives exchange.

Total options expiring: $9.4 billion (mostly Bitcoin)

Bitcoin options: $6.35 billion

Ether options: $3.08 billion

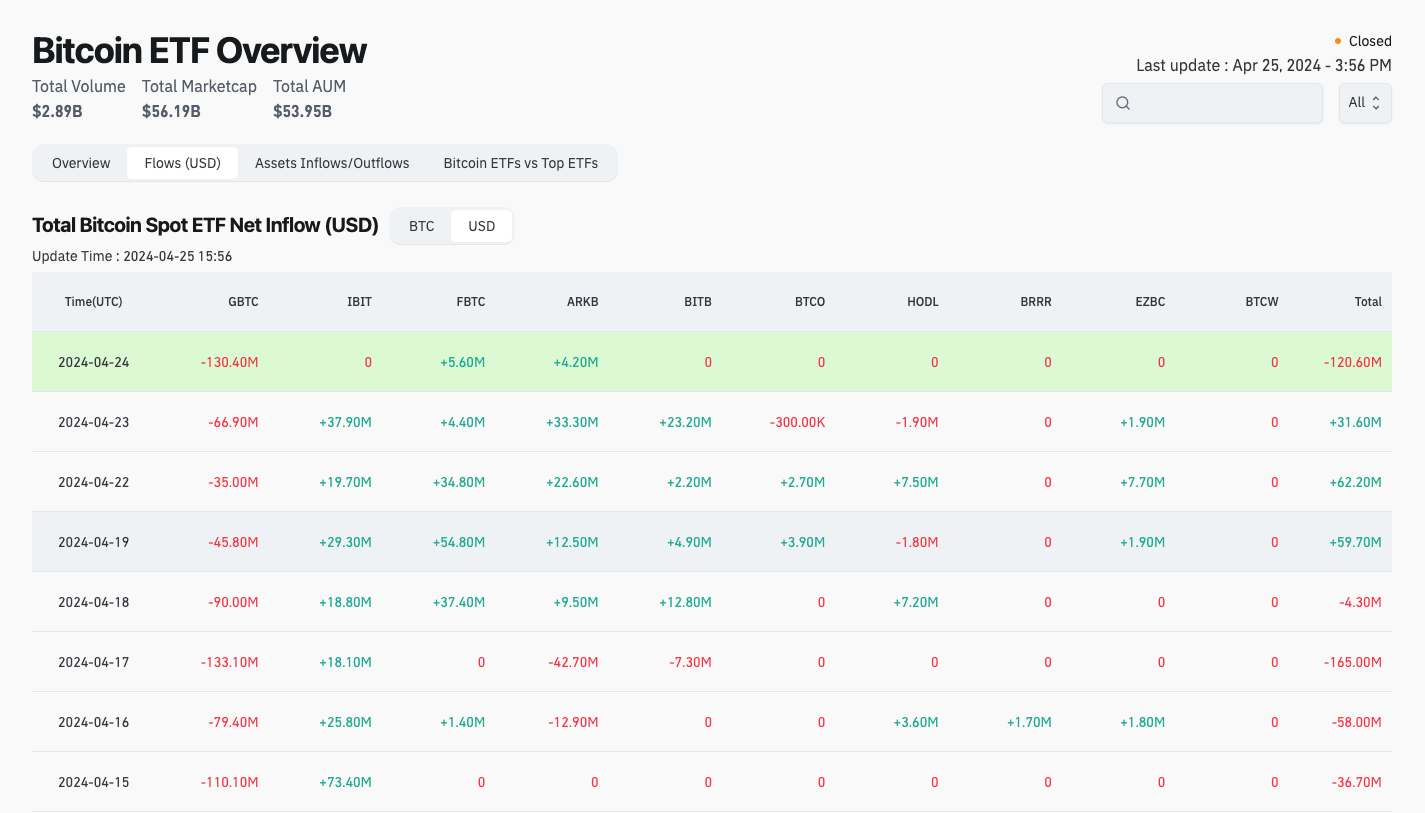

And the Bitcoin ETFs?

Experienced a daily net outflow of $120 million on Wednesday. Grayscale's GBTC saw the largest outflow of $130.42 million.

Morgan Stanley may allow its brokers to recommend Bitcoin ETFs to customers.

Standard Chartered says the ETF hype is cooling off but remains bullish on Bitcoin, predicting it will reach $150,000 this year.

Jack Dorsey's Square is making Bitcoin easier.

Square sellers can now convert 1% to 10% of their sales into Bitcoin.

The conversion fee is a flat 1%.

This allows businesses to participate in the Bitcoin economy and potentially diversify their holdings.

Block That Quote 🎙️

Crypto OG Arthur Hayes.

“If you sold shitcoins for Bitcoin, you get a pass”

Hayes predicts a "golden opportunity" and ‘prices will get sillier on the upside’ for Bitcoin investors in the coming months.

Why would that happen?

Governments will keep printing money to manage debt, weakening fiat currencies.

Bitcoin, the "hardest money ever created," will benefit from this.

Politicians need a strong economy to win, so more money printing is likely.

This fiat devaluation will fuel a crypto bull run.

“Bitcoin is the hardest money ever created. If you sold shitcoins for fiat that you don’t immediately need for living expenses, you are fucking up. Fiat will continue to be printed ad infinitum until the system resets.”

Hayes didn't give a price target, but suggested the jump from $70,000 to $1 million might be easier than the climb from zero.

Samourai Wallet Mixer Co-founders Arrested

The crypto market took a dive after news broke about the arrest of Samourai Wallet's founders for anti-money laundering and licensing charges.

Prosecutors allege Samourai Wallet's mixing service:

Processed over $2 billion in suspicious transactions.

Facilitated over $100 million in laundering from dark web markets.

Bitcoin and Ether saw dips exceeding 3%, with altcoins feeling the pain too.

This follows ongoing Middle East tensions and post-Bitcoin halving volatility.

The liquidations? Over $200 million.

In the Numbers 🔢

$100 million

The number of people holding stablecoins.

Over 93.6 million addresses now hold stablecoins, a 15% jump in 2024 alone.

This is the highest number of stablecoin users ever recorded.

Popular stablecoins include Tether (USDT), USDC, and BUSD.

Tether's stablecoin crown at risk? S&P Global thinks so.

A proposed US stablecoin bill might push banks to enter the market, increasing competition.

The bill limits non-bank stablecoin issuance to $10 billion, potentially hurting Tether (USDT).

CZ apologises

Binance founder Changpeng Zhao (CZ) apologised for his "poor decisions" related to anti-money laundering (AML) compliance in a letter to a U.S. judge.

Zhao faces sentencing on April 30th after Binance settled charges with the Department of Justice (DOJ) in November 2023. The DOJ is now seeking a 3-year prison sentence.

161 letters of support were submitted on Zhao's behalf, including letters from:

Family: Sister, wife, and children emphasized Zhao's positive character and contributions.

Binance colleagues: Co-founder He Yi defended his leadership, while Tigran Gambaryan (currently jailed in Nigeria) praised his integrity.

Industry figures: Former U.S. Ambassador to China Max Baucus, academics, and business leaders offered support.

The Surfer 🏄

Coca-Cola has invested $1.1 billion in a generative AI experiment with Microsoft. Microsoft will use services like Azure OpenAI Service and Copilot for Microsoft 365 to drive AI innovation for Coca-Cola and its bottlers.

39% of Canada's institutional investors have exposure to crypto assets, according to a survey by KPMG. This is an increase from 31% in KPMG's previous study in 2021. One-third of institutional investors have allocated 10% or more of their portfolios to crypto assets.

Melania Trump's NFT of a gold necklace with her signature is now available for purchase at $245, with buyers receiving an NFT version as well.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋