Church Of Smoking Chicken Fish 🐟

This memecoin is literally a religion. Community is 70% of memecoin's success. Vitalik hasn't sold Ether for profits. Blockchain’s $2.83T disruption. $15B BTC selling pressure. AI crypto transaction.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Memecoins. Don’t fail to surprise you. Never.

The narrative around it has come to establish it as the dominant play this season.

It’s also been the narrative for the absurd reality we often find ourselves in

We know what it has done to Solana.

Platforms like Pump.fun have pushed it crazier.

It’s made memecoin devs do wild things on livestreams to pump tokens.

The latest one will bring you to your feet - figuratively, at least (h/t: decrypt)

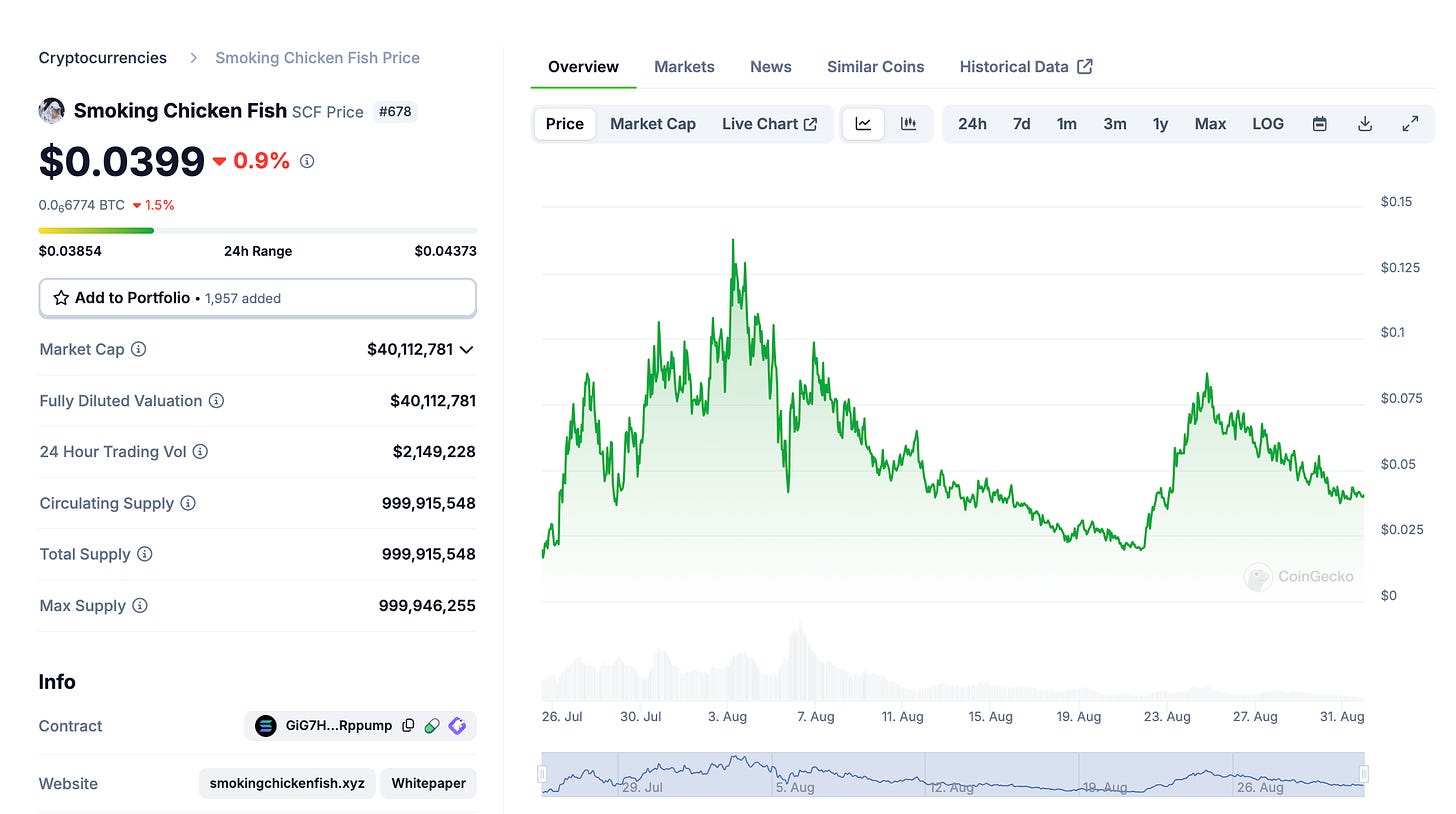

From meme to mission: The rise of Church of the Smoking Chicken Fish (SCF)

The founder of Solana-based memecoin has officially registered the project as a nonprofit organisation. Now they want to build a church.

That, after the token's market cap surged to $130 million, less than two weeks after its launch on Pump.fun … it’s fallen around 70% since then.

Daily sermons and self-help: The project evolved from a simple memecoin to a platform for spreading life lessons.

Pastor Kelby hosts daily sermons on Twitter Spaces, reading from self-help books like "Think and Grow Rich" and "The 21 Irrefutable Laws of Leadership," attracting hundreds of attendees.

The Chickenmandments

SCF has developed its own set of 10 laws called the "chickenmandments," which include humorous rules like "Thou shalt only smoke Marlboro Reds" - a reference to the cigarette smoked by the church's deity, "Lord Fishnu."

Plans for a physical church: Pastor Kelby, the church's founder, revealed plans to build a physical church in Marfa, Texas. The project has already identified potential property and Pastor Kelby has visited the plot and connected with a building company.

Despite its humorous facade, Pastor Kelby insists the project aims to "help humanity."

Plans for the physical church include inviting motivational speakers and creating a gathering place for followers, all while maintaining a lighthearted approach.

Community support key to success

Analyst Murad Mahmudov asserts investors are essentially "betting on people."

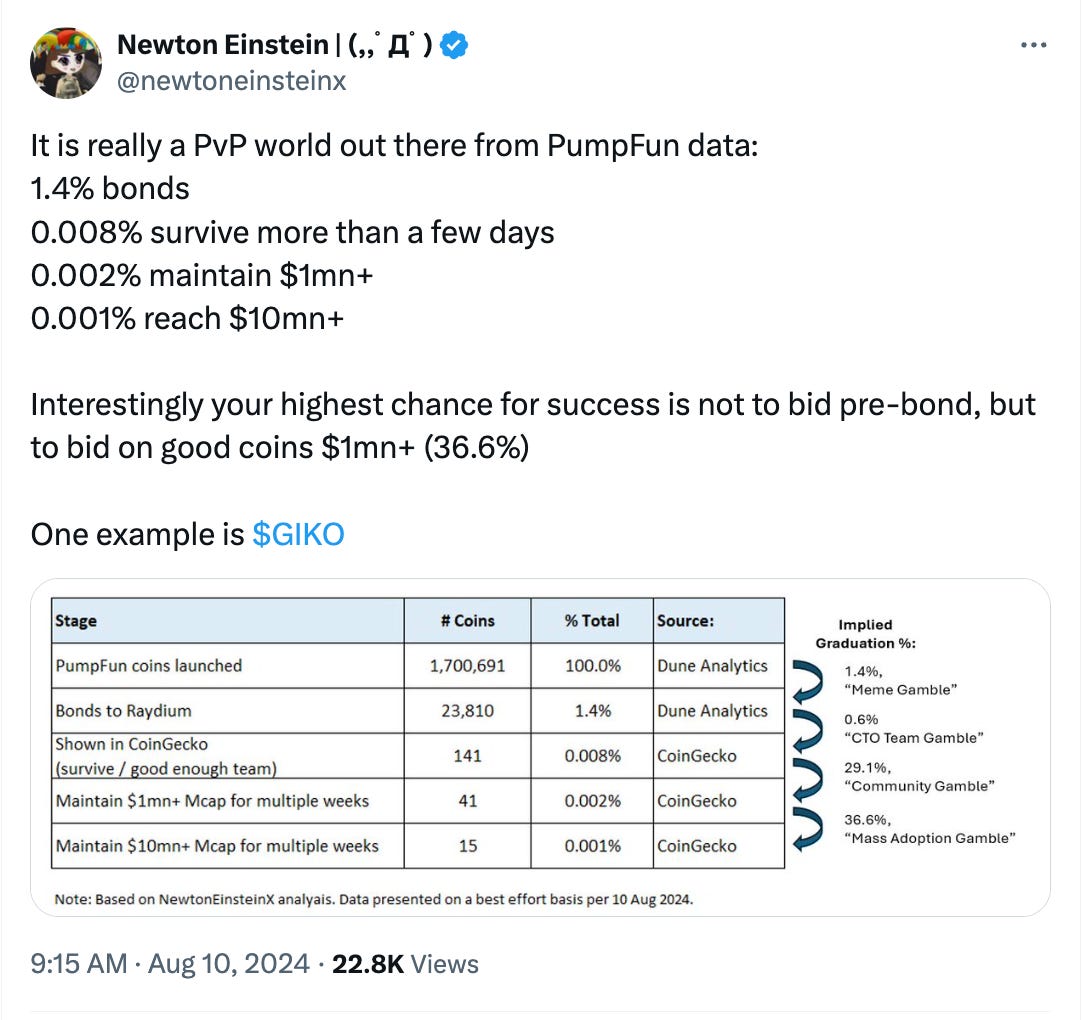

The reality is that many projects fail due to weak or non-existent community support. A mere 15 out of 1.7 million meme coins succeed, translating to a success rate of just 0.0001%.

Pump.fun key numbers

Rapid growth and popularity in the memecoin ecosystem.

Market performance: Cumulative revenue exceeded $50 million by July 2024 and surpassed $100 million by August 13, 2024.

Token creation: Over 1.18 million memecoins deployed, with a creation cost of less than $2.

Traffic and demographics

7.01 million visits in July 2024, with an average session duration of 22:11 minutes.

Audience: 76% male, 24% female, primarily aged 25-34.

Top locations: US (23.8%), Indonesia (11.41%), Canada (7.9%).

Website Ranking: Ranked #7,759 in the US and #10,436 globally.

Backlink profile: 113,030 backlinks from 9,810 referring domains as of August 14, 2024.

Token Performance: Memecoins like Shark Cat ($SC) reached market caps of $150 million.

Not without controversy, an employee spinning it in

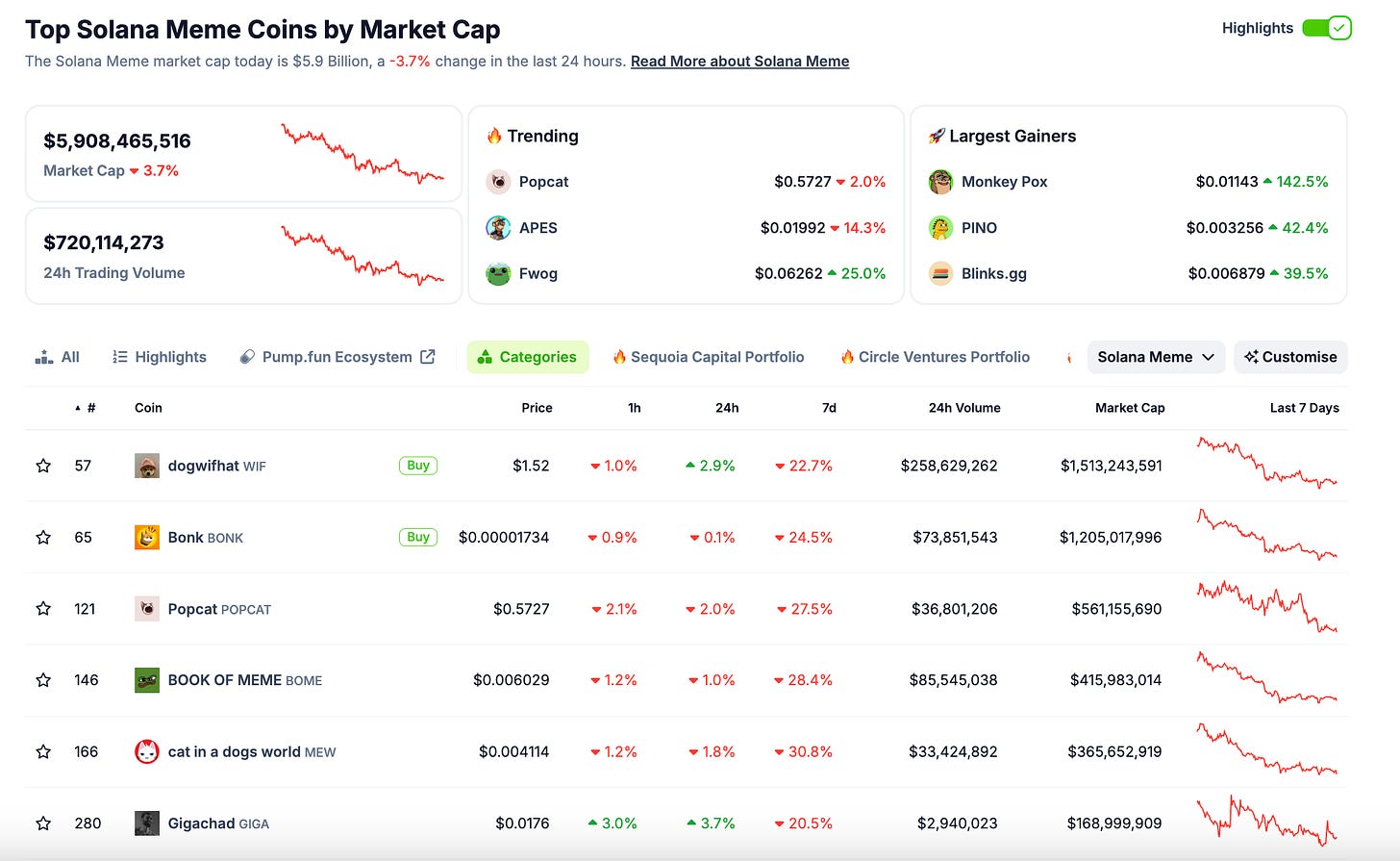

Solana has emerged as a popular blockchain for memecoins

A breeding ground for memecoins due to its fast transaction speeds and low fees.

As of August 2024, memecoins on Solana have a combined market cap around $6 billion.

Food for thought reading

Memecoins: Social Infrastructure For Crypto

Have memecoins always been the most important trend in crypto?

Stop calling dogecoin a memecoin — those are actually popular

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Block That Quote 🎙️

Ethereum co-founder, Vitalik Buterin

“I haven’t sold and kept the proceeds since 2018.”

Buterin has responded to allegations that he sold millions of dollars worth of Ether for personal gains.

The crypto community largely rallied behind Buterin, with widespread support for Buterin's right to benefit from his contributions to Ethereum.

Accusations of profit-driven ETH sales: The accusations surfaced on August 30 when a crypto community member on X claimed Buterin had dumped over $2 million in ETH after making a bullish tweet.

On chain analytics firm Lookonchain added fuel to the fire by suggesting that a wallet address linked to Buterin had received 3,000 ETH on August 9.

Ethereum's stance on DeFi and Buterin's vision for Ethereum: Buterin recently defended Ethereum against claims that the blockchain "doesn't care" about decentralised finance (DeFi).

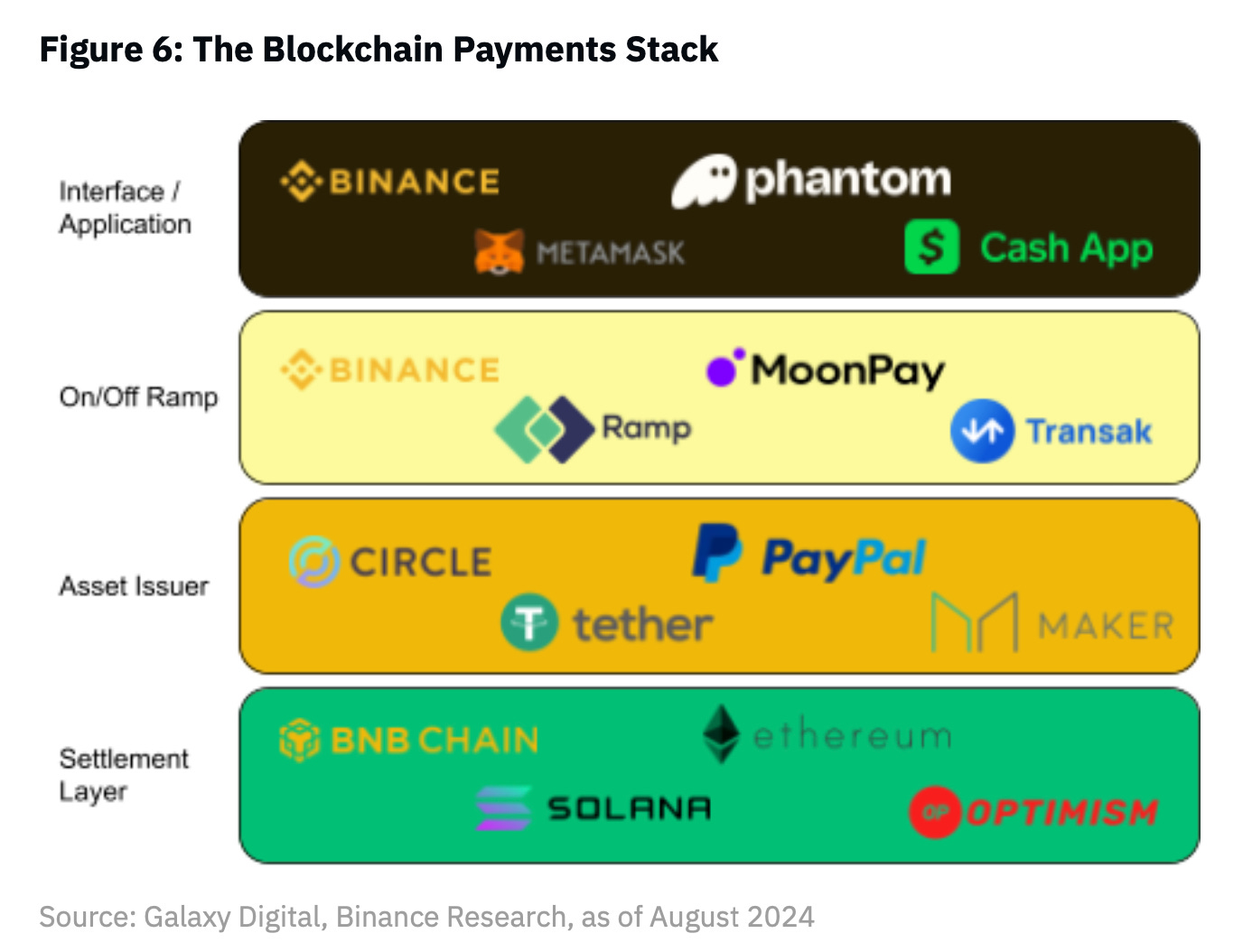

Blockchain Boost for Global Payments?

Binance Research highlights blockchain's potential to revolutionise $2.83 trillion payment industry.

The global payment industry suffers from inefficiencies due to outdated infrastructure and reliance on multiple intermediaries.

Blockchain's disruptive potential: By providing a unified, transparent system accessible via smartphones, reducing costs and increasing transaction speeds.

Key advantages of blockchain

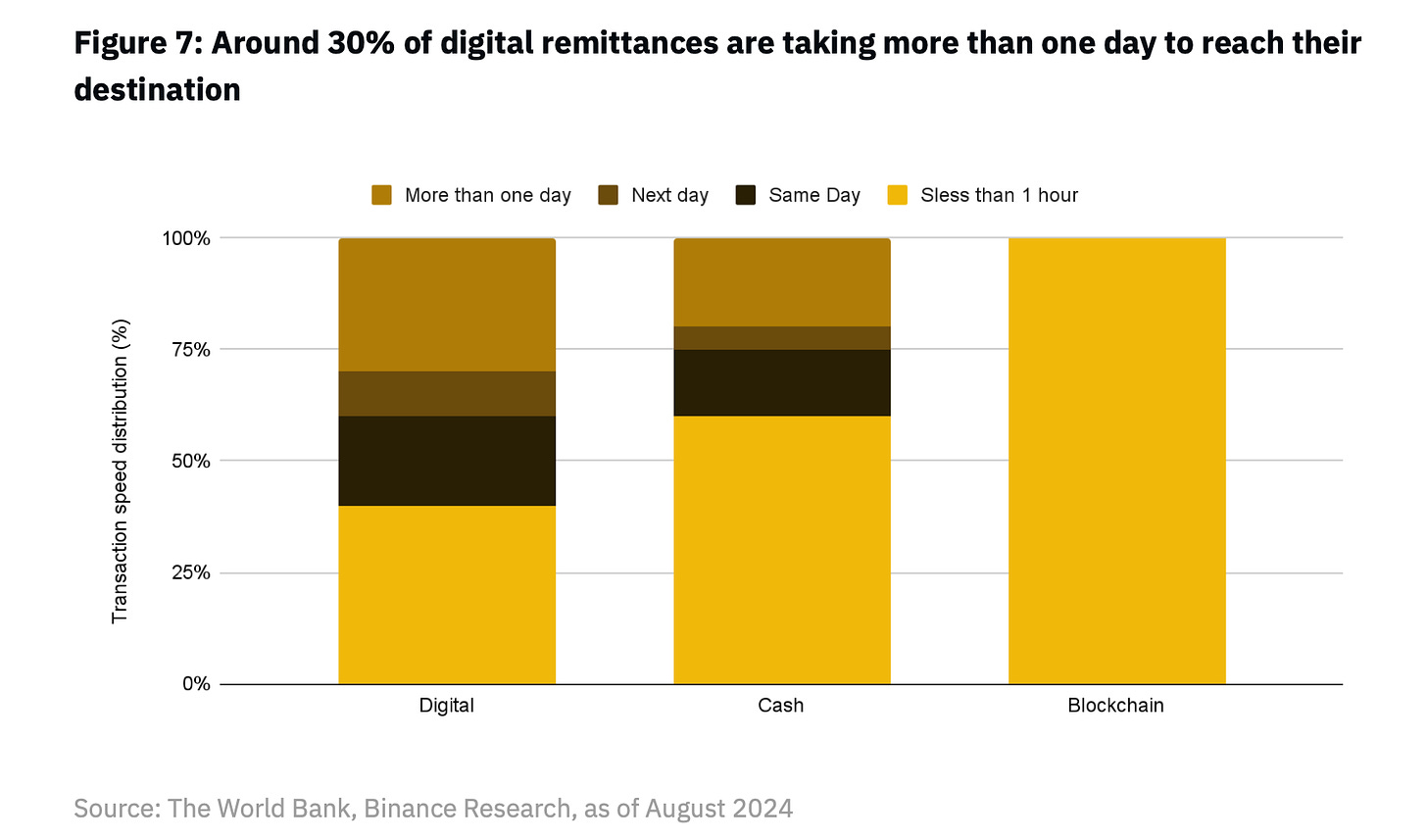

Faster settlements: Blockchain transactions can settle within an hour, unlike traditional methods that may take days.

Lower costs: Sending $200 worth of stablecoin on the Solana blockchain costs about $0.00025, significantly cheaper than traditional remittance fees.

Enhanced transparency: Blockchain's immutable ledger fosters trust and accountability, reducing fraud.

Challenges to adoption: Scalability, regulatory uncertainties, and complexities that may deter users.

Future outlook: As the payments industry is projected to grow to $4.7 trillion by 2029, blockchain solutions are expected to capture a substantial share by addressing traditional payment system inefficiencies.

In The Numbers 🔢

$15 billion

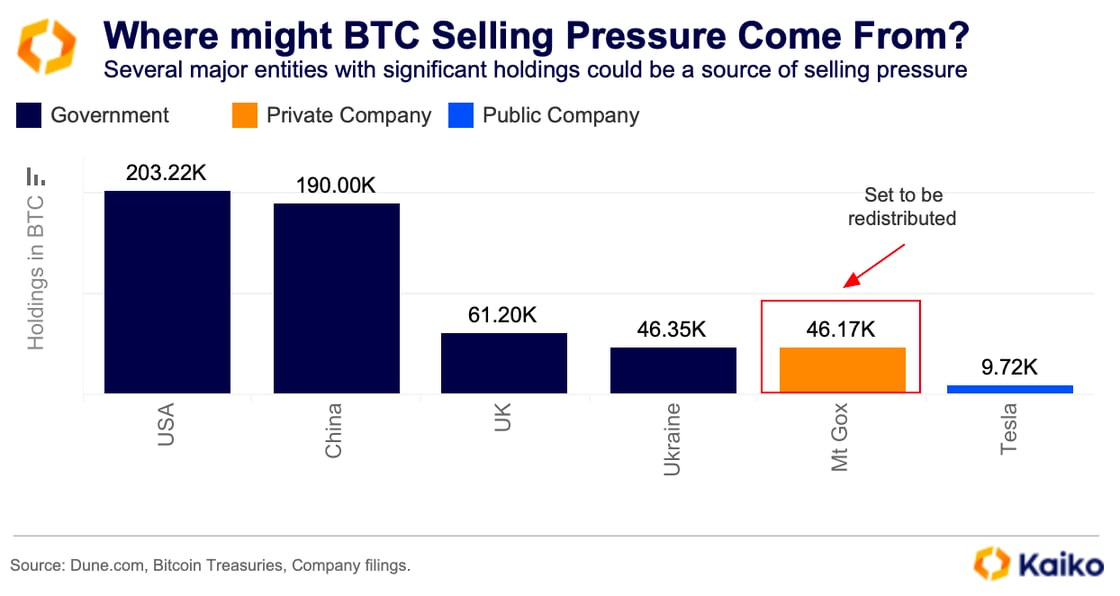

Potential Bitcoin selling pressure from Mt. Gox and the US government.

Looming sell-off concerns: Bitcoin's sluggish momentum may extend into September. Over $14.8 billion in Bitcoin could soon flood the market, potentially driving prices down.

Analysts warn that summer's lack of liquidity may continue into September, complicating the ability to break the $63,900 resistance.

Government and Mt. Gox holdings

The US government holds over 203,000 Bitcoin worth $12.1 billion.

Mt. Gox is set to distribute 46,000 Bitcoin valued at over $2.7 billion before the end of 2024 on Kraken.

Market impact analysis: Crypto analytics provider Kaiko suggests that Kraken's liquidity profile indicates minimal market-wide issues from Mt. Gox repayments.

Mt. Gox creditors have not sold during the last major $4 billion distribution in July, with many opting for BTC instead of fiat.

Historical performance: Bitcoin's average returns for September have been negative at -4.78% since 2013, contributing to a cautious outlook for the upcoming month.

First AI-to-AI Crypto Transaction

Coinbase CEO Brian Armstrong revealed on August 30 that Coinbase executed its first cryptocurrency transaction fully managed by AI bots.

Transaction details

One AI agent used crypto tokens to interact with another AI agent.

The transaction involved acquiring AI tokens, which are data strings that help algorithms learn.

Challenges for AI agents

Armstrong noted that AI agents struggle with transactions due to their inability to obtain bank accounts.

They can acquire crypto wallets, allowing them to use USDC on Base for transactions with humans, merchants, or other AIs.

Industry developments

Skyfire: Launched a payment platform in August enabling AI agents to spend money autonomously.

Biconomy: Onboarding AI agents for on-chain transactions via its delegated authorisation network.

Future Vision: Armstrong advocates for integrating large language models (LLMs) with crypto wallets, enhancing AI capabilities for tasks like booking travel and managing social media promotions.

The Surfer 🏄

A Brazilian Supreme Court justice ordered the suspension of X after Elon Musk failed to appoint a legal representative. The dispute escalates over accusations of political censorship and misinformation.

Chinese crypto data provider Feixiaohao is under investigation by Inner Mongolia police, with key executives reportedly arrested. The probe has lasted over six months, but reasons remain unclear, while the platform continues to operate despite China's crypto ban.

Chinese hackers reportedly exploited a zero-day vulnerability in Versa Director software, targeting US internet service providers. Researchers link the attacks to the Volt Typhoon group, while China denies any state involvement.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋