Circle's IPO Plans 🔈

Circle's joining the stock market party. Bitcoin’s millionaire club triples and miners hit the jackpot. Dr. Doom's Atlas anyone? Gaming tokens on a roll, outscoring Bitcoin and Ethereum.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

Before everything, watch👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Circle is planning the biggest bash of the year?

Yes. All set to go public.

Circle Internet Financial, the company behind the USDC stablecoin, is reportedly considering an Initial Public Offering (IPO) in early 2024, marking a significant step in the fusion of traditional finance and cryptocurrency.

This move follows its valuation of $9 billion in 2022.

Details about the IPO, including the valuation Circle might seek, remain under wraps.

A representative for Circle commented on the matter

"Becoming a US-listed public company has long been part of Circle's strategic aspirations. We don't comment on rumours."

Despite tight-lipped about their IPO specifics, their statement indicates a clear vision for future expansion and legitimisation in the financial market.

Circle boasts impressive financial support from giants like Goldman Sachs and Fidelity, underlining its significant role in the crypto sector.

This backing, coupled with a valuation of $7.7 billion in a 2022 funding round, positions Circle as a formidable player.

Circle's journey

Founded in 2013 by Jeremy Allaire and Sean Neville, Circle has navigated a dynamic path in the crypto world, amassing $1.1 billion in funding since its inception.

From providing retail access to Bitcoin to becoming a key player in the stablecoin market with USDC, Circle's evolution mirrors the broader growth of the cryptocurrency sector.

Previous SPAC Plans and Valuation: Circle's journey to a public listing has not been straightforward.

In 2022, the company backed out of a special-purpose acquisition company (SPAC) deal, which at the time valued Circle at around $9 billion, though some estimates suggested a lower valuation of $4.5 billion.

Circle's financing achievements include a significant $440 million from strategic investors in May 2021.

This funding round sparked discussions of an IPO, further fueled by talks in July 2021 of a SPAC merger with Bob Diamond's Concord Acquisition.

Circle's path to the IPO comes after it terminated the merger agreement with Concord Acquisition Corp last year.

Circle's journey hasn't been without challenges.

The company revealed a $3.3 billion exposure to the collapsed Silicon Valley Bank, an event that briefly destabilised USDC's peg.

Circle appointed Deloitte as its auditor and plans to publish regular financial reports.

IPO: Crypto Edition

An IPO in the crypto realm is a process where a private company, like Circle, offers its crypto assets to the public in a new issuance.

This is a big deal because it's not just about raising capital; it's about embracing transparency and compliance with tighter regulations.

How Does an IPO Work?

Interest in Going Public: When a company is ready to share its success with the world, it shows interest in launching an IPO.

Underwriter Assemble: They pick an investment bank or a bunch of underwriters to help with the process - from paperwork to picking the right price for their coins.

The Regulatory Hurdle: In the US, this means cozying up to the SEC and getting their nod of approval.

Marketing Madness: Before the big launch, there's a roadshow (think of it as a traveling circus) to drum up excitement and get a feel for the demand.

IPO Launch: Finally, the coins hit the market, and the company officially joins the public trading party.

TTD Atlas 🗺️

Nouriel Roubini, the economist better known as "Dr. Doom" for his gloomy financial forecasts and a staunch crypto skeptic, is stirring the pot with his latest venture – a cryptocurrency named Atlas.

This move is rich with irony, considering Roubini's past rants against Bitcoin and Tether.

And, we already know what CZ thinks about that: Read here.

The Atlas Pitch

Atlas, as Roubini pitches it, is a shiny new crypto token, promising to be a safe haven from inflation and global turmoil.

It boasts of an AI-powered trading bot that could, theoretically, outperform the US dollar.

It’s a cocktail of gold, US Treasuries, and a dash of climate-conscious real estate investments.

Sounds Familiar? The Atlas proposal rings a bell, reminiscent of the initial coin offering (ICO) frenzy of 2017-2018, a period marked by high promises and low deliveries.

On the surface, Atlas mimics Bitcoin but in practice, mirrors stablecoin Tether, which Roubini previously trashed as a fraud.

Inane Techno-Finance Jibber-Jabber: Roubini’s Atlas seems to be borrowing from the classic crypto playbook of buzzword-laden pitches.

The project's website is notably thin on concrete details, offering up an "executive summary" that's heavy on lofty promises and bullish charts, but light on the nitty-gritty.

Bitcoin vs. Roubini

Critics like Roubini have long argued that Bitcoin, with its lack of physical backing, falls short of being a true "digital gold."

Yet, Roubini's Atlas seems to be stepping into similar territory, its value hinging on market supply and demand.

As a vocal crypto critic, Roubini has slammed Bitcoin investors, calling them reckless.

His pivot to marketing his own speculative token is dripping with irony.

Atlas aims to do more than just mirror the US dollar.

It proposes fractionalised exposure to its basket of assets, tied to an ETF.

The use of AI and machine learning is touted as its secret sauce to outpace inflation and preserve purchasing power, especially in emerging markets.

Atlas aligns with the idea of "flatcoins" – stablecoins pegged to inflation rather than a currency.

It's a concept that crypto thought leaders have considered as a potential disruptor to the current stablecoin paradigm.

Read more: Here comes Flatcoins 🔵

TTD ETF 🚨

Ark Invest and 21Shares are set to launch five bitcoin and ether futures-based funds next week, as the industry continues to wait for the approval of spot crypto ETFs👇🏻

TTD BTC ₿

Millionaire wallets ⬆️

The number of Bitcoin millionaire wallets, holding more than $1 million in BTC, has tripled in 2023 - BitInfoCharts data.

The number of these wallets increased from 23,795 in January to 81,925 currently, a 237% increase.

Many of these wallets belong to crypto exchanges and financial institutions, so they don't represent individual users.

The number of wallets with at least 1 BTC, known as "wholecoiners," has also increased slightly this year.

Currently, there are 1,018,015 such addresses, a 4% increase from January.

Mining revenue ⬆️

Bitcoin mining revenue has reached a yearly high as the price of the cryptocurrency surged amid excitement over the potential approval of a US spot Bitcoin ETF by the SEC.

Data from Blockchain.com shows that BTC mining revenue hit $42.4 million on November 9, surpassing the previous yearly high of $41.7 million set in May.

The increase in mining revenue is attributed to the rising price of Bitcoin and the busyness of the network, which leads to higher transaction fees.

The surge in mining revenue in May was due to high demand for Ordinals inscriptions on the Bitcoin blockchain.

The efficient market hypothesis ✅

A team of researchers from Greek universities conducted a study on Bitcoin trading and found that models based on the efficient market hypothesis (EMH) outperformed the traditional "buy and hold" strategy by almost 300%.

EMH suggests that an asset's price reflects its fair market value and all relevant information, making it impossible to consistently beat the market.

The researchers developed AI models trained with various data sets and found that the optimal model generated significantly higher returns.

The study was based on historical data and simulated portfolio management.

TTD Loses 😵💫

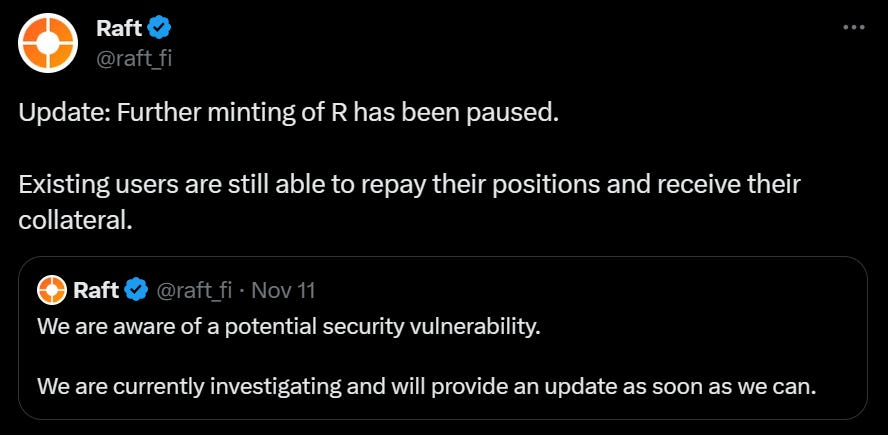

The Raft Vulnerability

DeFi platform Raft encountered a significant setback on Friday, November 10, 2023, as it discovered a "security vulnerability" leading to the temporary halt of its R stablecoin minting process.

The vulnerability was brought to light by social media users who observed on-chain activities, suggesting a hacker had exploited the platform, resulting in the burning of a substantial amount of ether.

Igor Igamberdiev, Wintermute's Head of Research, noted that an estimated 6.7 million uncollateralised R stablecoins were minted and then converted into ether.

What seems to be a coding error, the converted ETH did not go to the attacker but was instead sent to a null address, which is effectively inaccessible as it lacks a private key.

The $27 million hack

A crypto wallet, reportedly associated with Binance, has fallen victim to a hack, losing $27 million in Tether (USDT), as identified by on-chain detective ZachXBT.

This incident, highlighted just a week after the wallet received funds from a Binance withdrawal, involved the conversion of the stolen USDT to Ethereum (ETH) and subsequently to Bitcoin (BTC) via the THORChain network.

The wallet's connections to Binance were further underscored by a May 2019 transaction from an address marked as a Binance smart contract deployer by Etherscan.

TTD Gaming 🕹️

Ethereum-based gaming tokens Illuvium (ILV), Ronin (RON), and Immutable (IMX) are scoring big in the market.

Illuvium: The Star Player

Epic Gains for ILV: Illuvium, an NFT game running on Immutable X, is the talk of the town with an impressive 86% jump in just a week, soaring above $95.

Over the past month? It's more than doubled its value with a whopping 141% increase.

Epic Games Store Boost: Much of this surge comes after an announcement that Illuvium will launch on the Epic Games Store, one of the big leagues for PC games.

Plus, they've got a new beta test coming up, adding extra fuel to the hype train.

Immutable: Doubling Down on Success

IMX Token's Surge: Immutable's own token is riding the wave too, with a 50% increase this week, hitting around $1.04 per token.

In the past month? It's almost doubled, marking a nearly 103% rise. This boost follows news like their team-up with Ubisoft, the brains behind Assassin’s Creed.

Ronin and Others: Joining the Rally

RON's Rise: The Ronin network's token, RON, known for hosting Axie Infinity, isn't staying behind.

It's up 53% this week and 88% over the last month, thanks in part to the buzz around Pixels, a new play-to-earn game that’s got players hooked.

Others in the Race: GALA from the Gala Games ecosystem pumped 33% this week, and Axie Infinity's AXS token isn’t slacking either, with a 12% weekly increase.

Even the Sandbox’s SAND token jumped 12% this week, proving that it's not just about one or two tokens; it's a gaming token party.

Outshining the Crypto Titans

These gaming tokens are not just playing catch-up; they're leading the pack, outpacing heavyweights like Bitcoin and Ethereum.

Bitcoin's up nearly 8% this week and Ethereum by 16%, but these gaming tokens are showing them how it's done.

TTD Surfer 🏄

FTX has filed a billion-dollar lawsuit against Bybit, accusing the company of withdrawing funds and digital assets just before FTX's collapse.

Singapore-based cryptocurrency lending platform Hodlnaut has been ordered by the High Court to wind up and repay its 17,000 customers.

Coinbase has launched its Verifications platform, bringing know-your-customer (KYC) policies on-chain.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋