Crypto Goes Red 🔴 CZ Gets Jail ⛓️

Crypto markets clock worst month since FTX crash. Changpeng Zhao gets 4 months prison for money laundering violations. BlackRock BUIDL becomes largest tokenised treasury fund. Bitcoin Jesus arrested.

Hello, y'all. April is gone. May is here … Everybody, let's rock?

Everybody in the whole cell block | Was dancin' to the Jailhouse Rock please …. 🪗

A complete go for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bears are back. Markets are in red.

Goodbye April. Hello there, May is here.

Liquidations? Around $400M in last 24 hours.

This isn't just about crypto. Traditional markets are also down, with the S&P 500 experiencing its first bearish month since October 2023.

Crypto stocks tumble

MicroStrategy: - 17%

Coinbase: - 6.5%

Marathon Digital: - 10%

Riot Platforms: - 8.5%

But, what's causing the carnage?

The Fed might not cut rates this year despite earlier hints.

The Federal Reserve's policy meeting this week is keeping investors on edge.

Strong wage data suggests inflation isn't going anywhere.

Hong Kong spot crypto ETFs did not perform as expected.

Geopolitical tensions the ongoing turmoil in the Middle East is adding to the market's nervousness.

Speculations that Ethereum ETF approvals could be delayed. Even rejected by the SEC over classifying Ethereum as security.

March has been a dream with Bitcoin reaching new heights of $74,000.

April? the worst month since the year started.

Bitcoin has lost over 17%.

April the worst month since November 2022, the FTX collapse month.

Total market cap shed 18% of its value - the biggest decline since June 2022.

The Crypto Fear and Greed Index is back in "neutral" territory, a stark contrast to the bullish sentiment that dominated most of 2024.

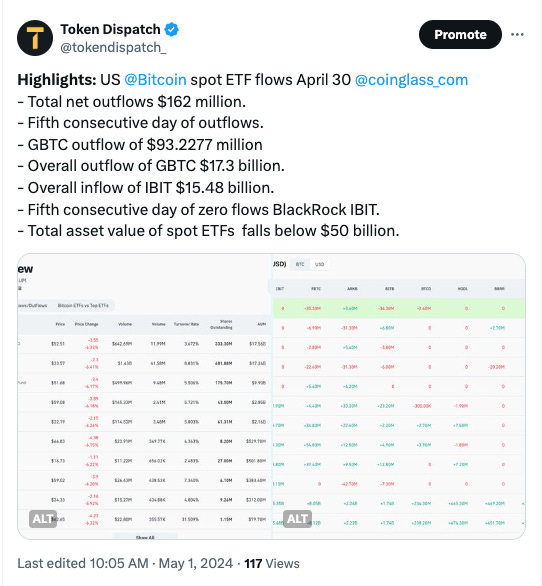

ETF outflows continues

Meanwhile, Hong Kong’s six new spot bitcoin and ether ETFs saw around HK$87.5 million ($11.2 million) in trading volume on their first trading day.

ChinaAMC’s spot bitcoin ETF led with HK$37.16 million on the day.

Leave April now. May is here.

And the age-old question for crypto investors returns: "Sell in May and go away?"

What will it be this time around?

Analysts are bullish

Crypto SunMoon sees a buying opportunity if Bitcoin stays above $59,000 (short-term holder average price).

Lark Davis predicts a supply shock, with limited Bitcoin and surging demand driving prices up.

Bill Barhydt forecasts a massive market cap increase to $50 trillion in a decade.

Now, buckle up. The next few days could be pivotal for the crypto market, with the Fed's decision and key economic data releases likely to influence future price movements.

Block That Quote 🎙️

MicroStrategy founder, Michael Saylor.

“It’s pretty clear that Bitcoin is the only crypto asset that’s going to be approved for sale in the form of a spot ETF in the United States.”

Saylor believes Bitcoin is the lone wolf when it comes to US-approved spot ETFs.

The SEC recently greenlit several Bitcoin ETFs, but Saylor expects Ethereum to be shut out.

Saylor points to Bitcoin's established status

Seen as the only crypto safe for public companies to hold.

Considered the only viable option for Wall Street ETFs.

This aligns with MicroStrategy's recent shift to a "Bitcoin development company."

They're doubling down on Bitcoin, despite losing $53 million in Q1.

MicroStrategy now holds 214,400 Bitcoin ($13.5 billion worth).

Note: MicroStrategy reported a net loss, but that's because accounting rules don't reflect Bitcoin's price jump. If they used the new standard, Bitcoin's value increase would've shown billions in gains instead of a loss.

Is Saylor right about Ethereum?

SEC secretly deemed Ethereum a security in 2023.

A lawsuit by Consensys alleges the SEC secretly classified Ethereum (ETH) as a security over a year ago.

Internal Order: In April 2023, the SEC authorised an investigation into Ethereum 2.0, treating ETH itself as a security.

“Certain securities, including, but not limited to ETH, as to which no registration statement was or is in effect… and for which no exemption was or is available.”

What about the ETFs in Hong Kong?

Head of custody firm OSL Digital Securities, Wayne Huang.

"Whether the United States defines Ethereum as a security does not affect the independent decision-making of the Hong Kong Securities Regulatory Commission. Ethereum is not a security … Hong Kong has already had a clear definition of Ethereum.”

CZ Goes To Jail

Changpeng Zhao (CZ), founder of Binance, the world's largest crypto exchange, was sentenced to 4 months in prison for money laundering violations.

CZ pleaded guilty last year to failing to implement anti-money laundering controls at Binance.

US officials say Binance enabled flows of illegal funds, prioritising growth over compliance.

Judge rejected calls for a harsher sentence, citing positive aspects of CZ's history.

This follows a $4.3 billion settlement where Binance agreed to exit the US market and CZ paid a $50 million fine.

Now, how did CZ avoid a harsh sentence despite admitting to major financial crimes?

A flood of glowing letters from friends and family painted CZ as a philanthropist and first-time offender.

Prosecutors didn't deny CZ's charitable work, but argued it shouldn't excuse his crime.

CZ surrendered and cooperated with authorities and had no prior criminal history. CZ took full responsibility of what happened in a letter submitted to the court on April 24.

Now, is this a sweet deal? Read what Better Markets CEO Dennis Kelleher says.

In the Numbers 🔢

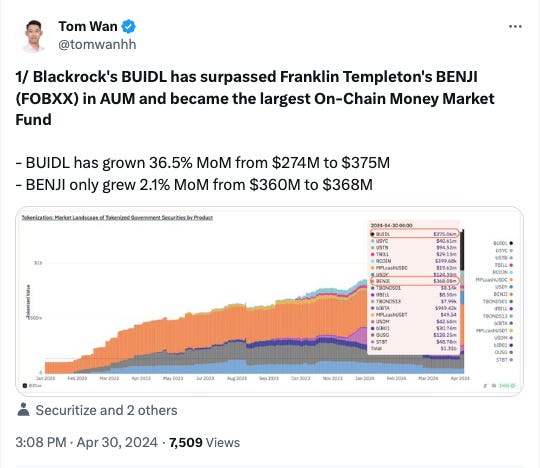

$375 million

The total value of assets in BlackRock's BUIDL fund. Making it the largest tokenised treasury fund.

Check out the Dune Dashboard: Tokenisation: Government Securities by 21co

Just six weeks after launch, it's surpassed Franklin Templeton's BENJI to become the world's biggest.

Raked in $70 million last week.

Partly thanks to Ondo Finance's OUSG token, which uses BUIDL as a reserve and saw $50 million inflow.

BENJI saw minor outflows and now sits at $368 million in assets.

The tokenised Treasury market has boomed from $100 million in early 2023 to nearly $1.3 billion currently, with BlackRock's entry being a significant factor.

Bitcoin Jesus Arrested

Roger Ver, the crypto entrepreneur also popularly known as "Bitcoin Jesus," has been arrested in Spain.

The US Justice Department is accusing him of dodging $50 million in taxes.

The breakdown:

The charges: tax evasion, mail fraud, and filing false tax returns.

Failing to report capital gains on selling Bitcoin (70,000 BTC) and other assets.

The alleged tax evasion totals roughly $48 million.

Ver reportedly sold those Bitcoins for $240 million in 2017.

The US is seeking his extradition to face trial.

Before the arrest and the silence on X, this is what Ver left us with👇

Ver has been involved in Bitcoin since the early days, he would give away cryptocurrency for free, which got him the nickname “Bitcoin Jesus.”

A resident of Santa Clara, California, he renounced his US citizenship in 2014 after gaining citizenship in the Caribbean island of St. Kitts and Nevis.

He previously pleaded guilty and served time for selling explosives on eBay.

An advocate for the hard fork Bitcoin Cash. He has been trying to grow the spinoff and its community, with claims that it’s the real Bitcoin.

The Surfer 🏄

April saw the lowest amount of losses from hacks and scams in crypto since 2022, with only $25.7 million lost - A 141% decrease from March. Private key compromises decreased significantly, contributing to the decline in losses.

Fantom Foundation launches $6.5M dev fund to support "safer memecoins." Fantom plans to introduce measures to prevent scams and rug pulls in memecoin projects.

FTX estate is finalising its second tranche of sales of locked Solana tokens. Bids around $100 mark have gone through in the auction. 1.8 million SOL ($232 million) is being offloaded in the auction.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋