Crypto Ownership Stopped Growing? ⏱️

Rate of cryptocurrency ownership isn’t rising with recent market growth, Fed survey claims. Bitcoin ETFs record combined $1.2B in outflows in 8 days. Are crypto markets entering a bear market?

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

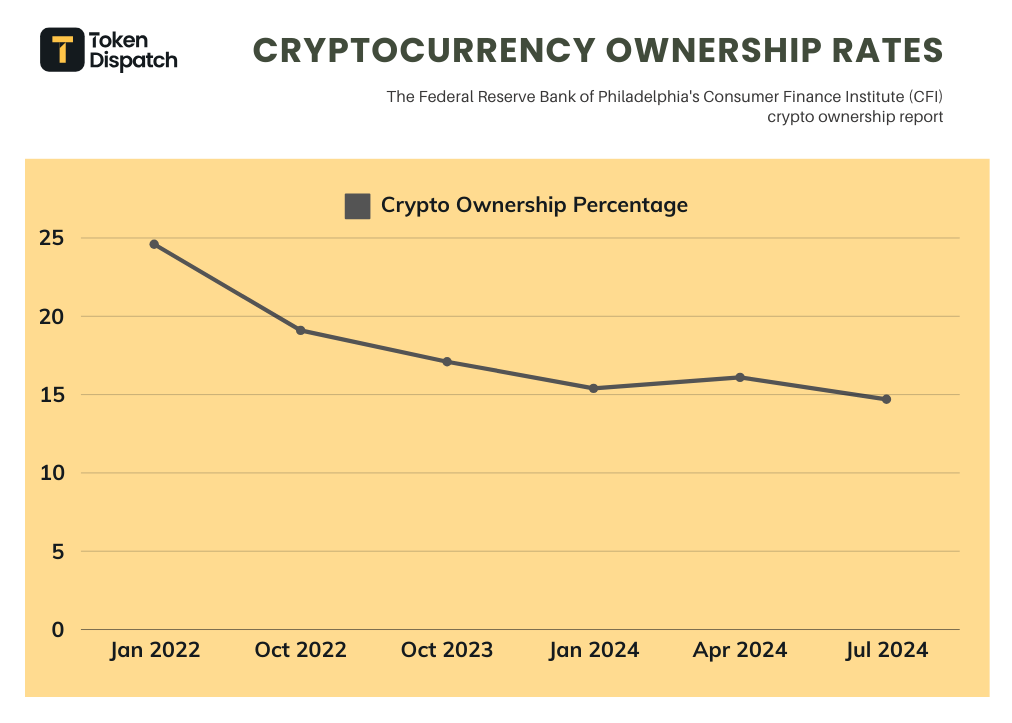

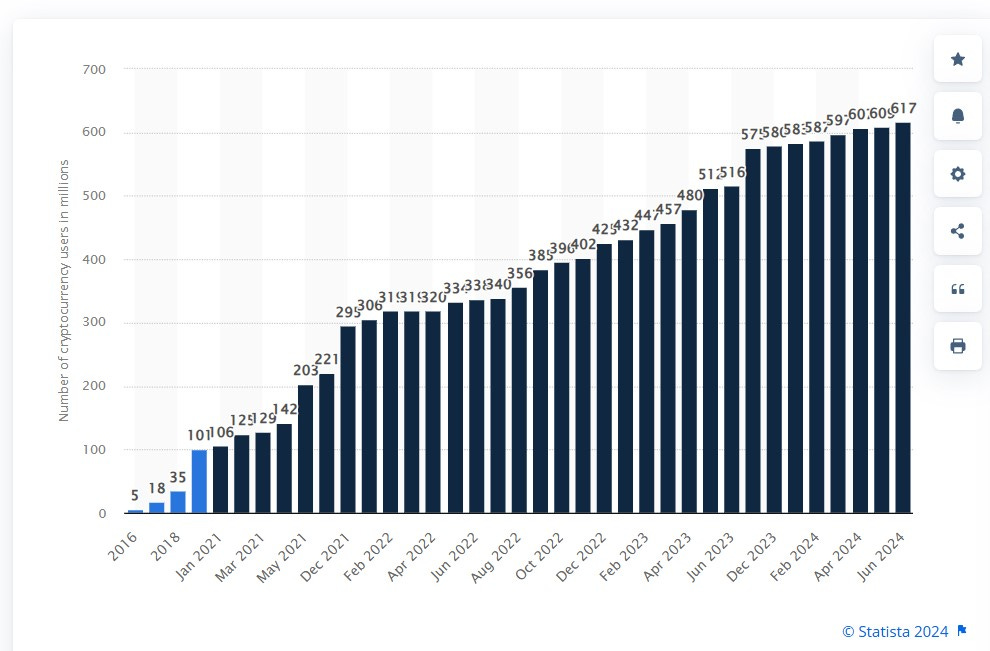

Cryptocurrency ownership rates have not increased in tandem with the market's recent growth.

Says who? The Federal Reserve Bank of Philadelphia's Consumer Finance Institute (CFI) crypto report.

The CFI collected data on cryptocurrency ownership through surveys between January 2022 and July 2024, using Bitcoin's price as a benchmark.

During the 2022 crypto winter, ownership rates fell sharply.

January 2022: 24.6% of surveyed population owned crypto

October 2022: Ownership dropped to 19.1%

No rebound despite market recovery: Over the following 18 months, ownership rates failed to bounce back.

October 2023: 17.1% ownership

January 2024: Further decline to 15.4%

April 2024: Slight increase to 16.1%

July 2024: Dropped again to 14.7%

No significant increase in ownership around Bitcoin's March price peak or its April halving event.

Methodology: Data collected through two web-based surveys targeting 5,000 nationally representative responses.

Market context: Crypto markets have gained nearly 150% since the beginning of 2023, despite a downtrend since mid-March.

Future purchase intent rises: While current ownership rates remained stagnant, the study found an increase in future purchase intent.

During 2022 crypto winter: Interest in future purchases declined from 18.8% to 10.6%

By April 2024: 21.8% of respondents indicated they were likely to purchase crypto in the future

Surge in interest coincided with the market's recovery, suggesting a potential for future growth in ownership.

Discrepancies in ownership estimates: The Fed's estimates contrast with other reports.

Fed survey (2023): Approximately 18 million crypto owners in the US.

Coinbase report (September 2023): 52 million Americans owned crypto.

The report highlights a disconnect between market performance and individual investment decisions.

The market might be thriving, yet the actual ownership rates might remain flat.

To gauge the accurate measure of crypto adoption and ownership across the country is not easy.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

In The Numbers 🔢

$1.2 billion

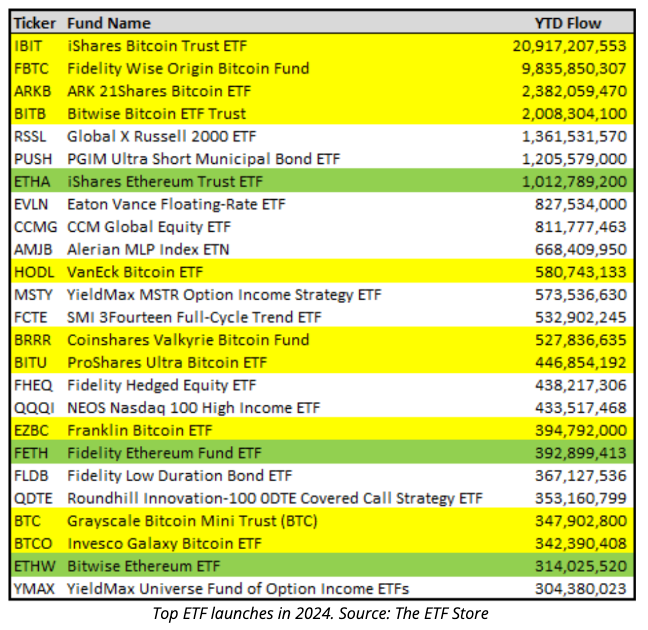

Amount of outflow recorded by the 11 US-based spot Bitcoin exchange-traded funds (ETFs) over eight days, reports Bloomberg.

This is the their longest outflow streak since launching in January.

Between August 30 and September 6, Bitcoin's price slumped 17.28% from a high of $64,668 to a low of $53,491.

Bitcoin has historically recorded poor performance in September over the years.

Despite these outflows, crypto ETFs have dominated the ETF market in 2024, with the four largest launches being spot Bitcoin ETFs.

Among the top 25 ETF launches this year, 13 are related to crypto, with the iShares Ethereum Trust ETF also performing well, surpassing $1 billion in cumulative inflows.

Are Crypto Markets Entering a Bear Market?

About $600 million of outflow of crypto funds in the last week, the 2nd largest on record. The worst week since the 2022 bear market.

ETFs not spared either. Registered $1.2 billion outflow in the last eight days.

Where will the price slump stop? Traders expect $52,500 to provide a support level crucial for any potential price recovery.

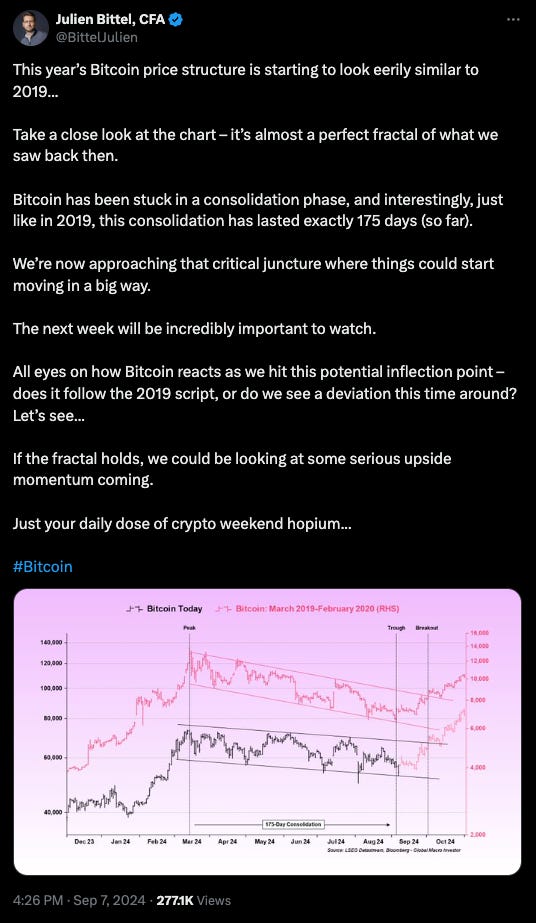

History repeating? Analysts expect possible inflection point ahead.

Despite a 7% decline in September, they draw parallels between current price movement and there trends observed in 2019.

Important week ahead: Consumer Price Index (CPI) and Producer Price Index (PPI), followed by Fed’s interest rate decision will impact cryptocurrencies.

Block That Quote 🎙️

Economist and podcast host Suze Orman

“Eventually it could very well catch fire.”

Orman, financial adviser and host of the "Women & Money" podcast, advocates for Bitcoin investment in a recent CNBC interview.

She believes Bitcoin will gain popularity among younger generations as they accumulate wealth.

“As younger people make more money and mature, [Bitcoin] will be one of their investments of choice, and that will cause it to go up.

I don’t think it will ever be a currency or a store of value, but because the younger generation has a fascination with it — and you see the energy — a whole lot of people having interest in it.”

Orman invests in Bitcoin through ETFs, citing concerns over direct ownership risks and wallet management. Cautions that exposure to Bitcoin should only be what you can afford to lose.

“Everybody should absolutely have exposure to Bitcoin … gotta be OK with losing that money.”

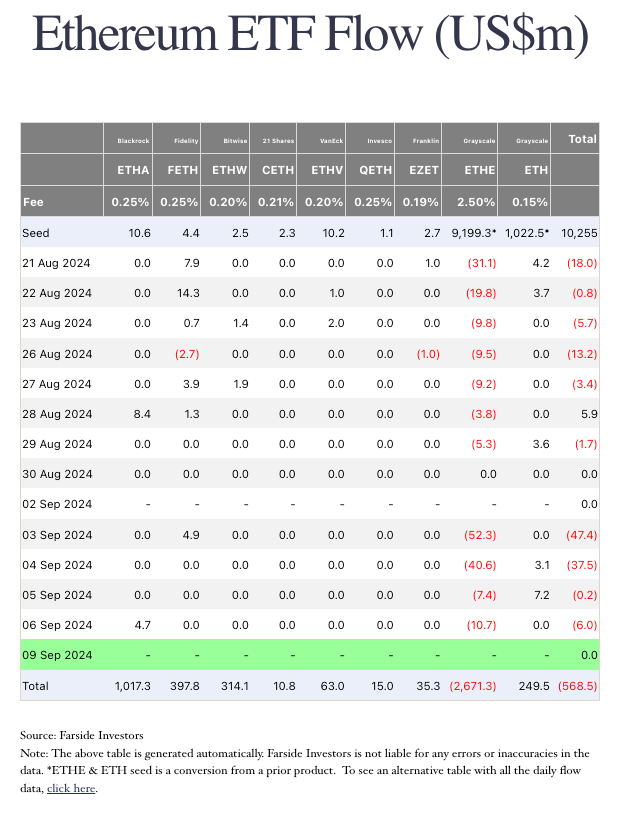

Ethereum-Bitcoin ETFs Comparison Unfair

JP Morgan Analyst dismissed the comparisons of Ethereum ETFs with Bitcoin ETFs.

“Comparing the magnitude of the ETH flows with its BTC counterparts is somewhat like comparing apples to oranges.”

Bitcoin ETF performance: Spot Bitcoin ETFs saw $5.4 billion in net inflows during their first full month of trading in January.

JP Morgan analysts caution against direct comparisons.

Bitcoin's established reputation as a "store of value"

Differences in market capitalisation and use cases

Absence of staking rewards in spot Ethereum ETFs

Spot Ethereum ETFs face rocky start

Launch date: Spot Ethereum ETFs launched on July 23, 2024

Net outflows: Cumulative net outflows reached $476 million through August

Price decline: Ethereum's price dropped 30%, from around $3,400 to $2,400, marking its lowest point since February

Institutional interest: Big buyers and even bigger seller

BlackRock's success: BlackRock's iShares Ethereum Trust ETF (ETHA) crossed $1 billion in cumulative net inflows

Fidelity's position: Fidelity's Ethereum Fund is the runner-up with $367 million in cumulative inflows

Grayscale Ethereum Trust (ETHE): Has seen $2.6 billion in cumulative net outflows since July 23

Expense Ratio Impact: High expense ratio and the disappearance of previous discounts are cited as reasons for outflows

The Surfer 🏄

Steven Nerayoff, an early adviser to Ethereum, is suing Covington & Burling for $100 million. Alleging the law firm mishandled his defense in a 2019 extortion case by failing to present exculpatory evidence. Covington has denied the allegations, calling the lawsuit “meritless” and pledging to fight it vigorously.

Tether has invested $102 million to acquire a 9.8% stake in Adecoagro, a Nasdaq-listed South American agricultural giant. Investment complements Tether's existing holdings in Bitcoin and gold. Reflects the company's focus on long-term yield and diversification in response to geopolitical instability.

Crypto-friendly platform Travala.com and Skyscanner have partnered to enable cryptocurrency payments for hotel bookings. Users can book over 2.2 million hotels using more than 100 cryptocurrencies, including Bitcoin and Ethereum.

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋