Crypto Rides Black Swan Event 🕊️

Donald Trump failed assassination boosts crypto back to green, but can the rally last? Spot Ethereum ETF approval this week? Crypto trading volume to exceed $108T in 2024. Tornado Cash trial updates.

Hello, y'all. Nobody can do it like him 🎙️

This is The Token Dispatch 🙌 find all about us here 🤟

Do try the Music Quiz Game 👉 Asset - Music Nerd 🎵

One very unexpected event in world history, and the crypto run is back.

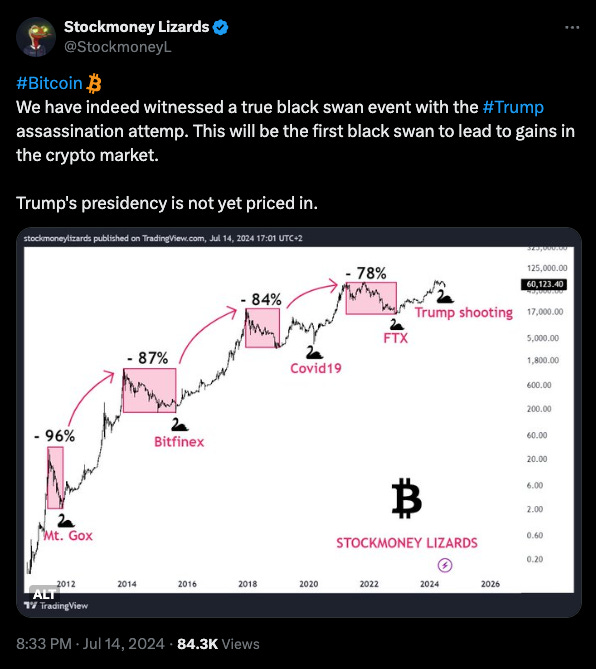

The usual pattern is crypto plummeting during black swan events.

Not this time around.

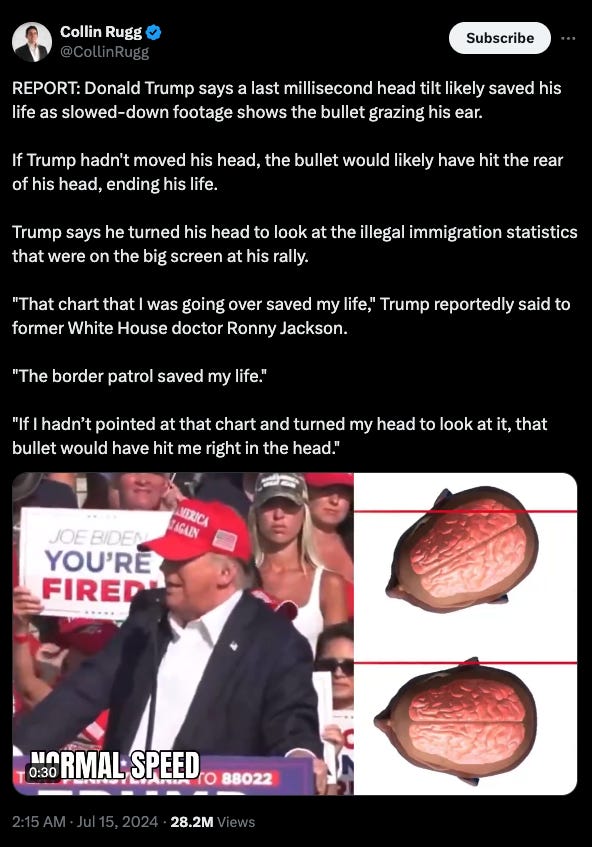

What happened? You might know: Donald Trump 🧨

An assassination attempt on former President Trump, and he is damn lucky to have even managed to escape this.

What does this do to crypto? Sends the market soaring.

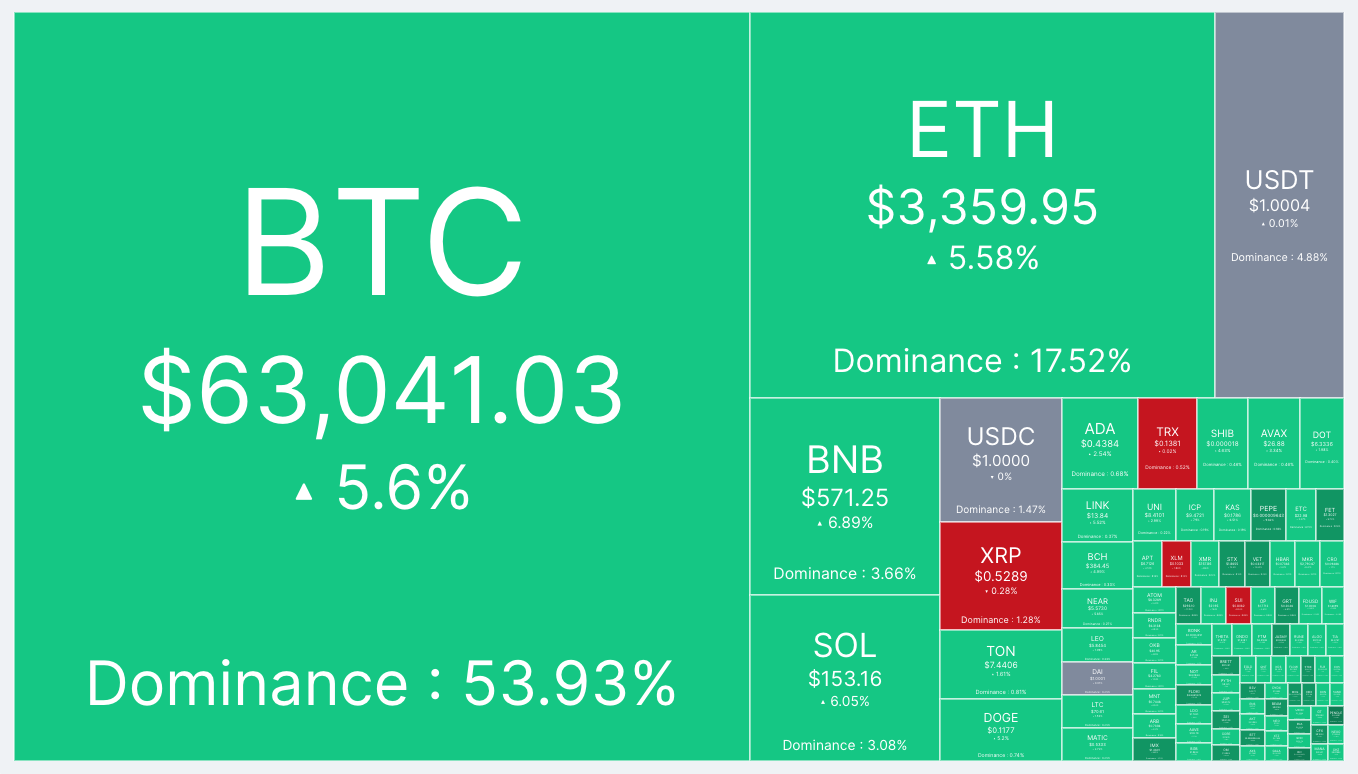

Bitcoin surged all the way up to $63,000.

And it's been a while since we saw the market this green.

Why is that? Well, it all comes down to Trump's love affair with crypto.

The former president has been a vocal supporter of digital assets, even accepting campaign donations in Bitcoin, Ethereum, Dogecoin, and Shiba Inu.

So when Trump took a bullet (don't worry, he's okay!) during a campaign rally, the crypto community saw it as a potential boost to his chances of winning the 2024 election.

Trump in the White House likely means more crypto-friendly policies.

The markets reacted accordingly, with Bitcoin skyrocketing as investors speculated that a Trump presidency would be a boon for the crypto industry.

And hence, the “Black Swan” is different this time around.

Bitcoin has survived multiple black swan events, leading to major price drops.

Mt. Gox collapse in 2012 caused a 96% drop in Bitcoin's price.

Bitfinex hack in 2014 resulted in an 87% decline.

COVID-19 pandemic in 2020 led to an 84% decrease in Bitcoin's value.

FTX collapse in 2022 caused Bitcoin to fall by 78%.

What is Trump’s relation with crypto?

In 2019: “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.”

In 2021: Bitcoin “just seems like a scam.” Cryptocurrencies seemed like a “disaster waiting to happen.”

In 2024:"If you’re in favour of crypto, you’d better vote for Trump."

“I will ensure that the future of crypto and bitcoin will be made in the USA, not driven overseas. I will support the right to self-custody to the nation’s 50 million crypto holders ... With your vote, I will keep Elizabeth Warren and her goons away from your bitcoin. And I will never allow the creation of a central bank digital currency.”

Read: 'Give Me Liberty, or Give Me Death!' 🤌

Now obviously, there are questions about the sincerity of Trump's love for crypto.

Some argue that his pro-crypto stance may be more about political expediency than a genuine belief in the technology.

Read: Hayes ain’t buying the Trump for crypto Republican script.

After the assassination attempt, support for Trump flooded social media.

Thee others weigh in too, with their full support - Bill Ackman and Elon Musk.

Trump is still speaking at Bitcoin Conference.

But let’s talk about the bull-run

Bitcoin grapples with critical support levels.

Analyst outlines two key scenarios.

Bullish Breakout

Reclaim recent range lows as support.

Push towards the previous range highs.

Open interest gap between $72,000 and $73,500 could be the next target.

Bearish Breakdown

Rejected at the range lows for several days.

False breakout followed by a drop below resistance could trigger a fall.

Support level to watch: $52,000 (aligns with 50-week EMA).

Full bull territory?

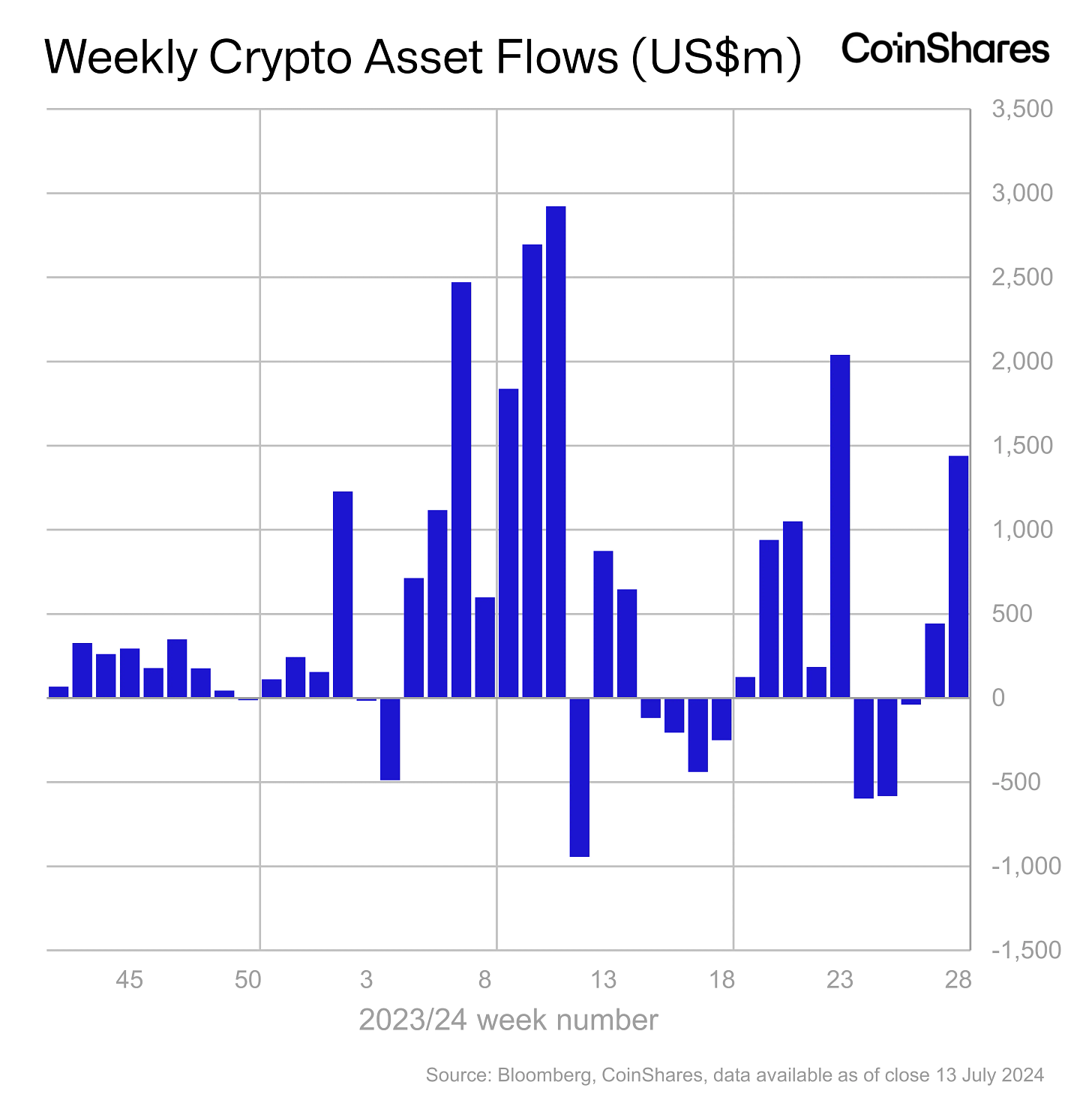

$1.44 billion inflows

Digital asset investment products saw inflows of $1.44 billion last week.

Bitcoin saw its fifth-largest weekly inflow ever, totalling over $1.35 billion.

Ethereum had the second-largest inflow with $72.1 million last week.

Inflows into crypto investment products hit a record high of $17.8 billion year-to-date (YTD).

This surpasses the previous record of $10.6 billion set in 2021.

US investors lead the charge, followed by Switzerland with record inflows.

Can the rally last?

Concerns remain about the sustainability of the price increase.

This week is packed with potentially market-moving events, starting with Fed Chair Jerome Powell's speech today, on July 15.

Also, German government's $3 billion in Bitcoin sales and negative sentiment towards Mt. Gox creditor repayments contributed to the price decline.

Bitcoin market is recovering as these factors are now priced in.

Whales are moving too: A dormant Bitcoin wallet address containing 1,000 BTC worth over $60 million has made its first transaction in nearly 12 years.

Block That Quote 🎙️

President of ETF Store, Nate Geraci

“Welcome to spot eth ETF approval week…”

Spot Ethereum ETFs might finally be getting the green light this week, according to industry experts.

The Signal: Nate Geraci, president of ETF Store, sparked the buzz suggesting there's "no good reason for any further delay."

Why it matters: This approval could be a game-changer for Ethereum and the crypto market as a whole. Analysts predict a surge in interest and investment, potentially mirroring the success of Bitcoin ETFs.

Industry voices chime in

Matt Hougan, Bitwise Asset Management's CIO: “I think what you’re hearing about this week or next, that makes sense to me.”

Daan Crypto (Crypto Trader): “We Should get the S1 approvals this week with the ETFs starting to trade soon after.”

Michaël van de Poppe (MN Trading Founder): The Ethereum ETF could solidify Ethereum's market dominance.

Tron founder Justin Sun has been on an Ethereum buying spree.

Since February, addresses linked to him have accumulated billions of dollars worth of ETH.

On July 13th, one of Sun's wallets withdrew $45.5 million in ETH from Binance.

This move came after depositing $45 million in Tether (USDT) just days prior, suggesting a potential purchase of ETH at that time.

Other wallets linked to Sun have reportedly accumulated 377,188 ETH since February, estimated to be worth over $1.15 billion.

That’s important? Tron initially ran on Ethereum before launching its own blockchain.

And this move suggests growing interest in the Ethereum ecosystem.

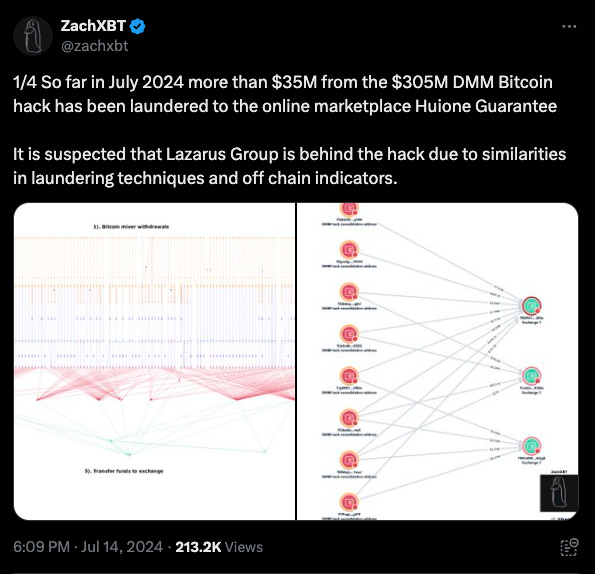

The Trouble Roundup: Lazarus On The Move

How’s the bad actors and scammers doing today? Huione Group leads the headlines.

Lazarus on the loose: The hacker group behind the $305 million DMM Bitcoin hack in May, have reportedly laundered over $35 million.

The funds have been moved to an online marketplace called Huione Guarantee in Cambodia.

Read: $11B Crypto Scam Operation 🥷

Huione Guarantee has been linked to Cambodia's ruling Hun family and has transacted $11 billion worth of crypto from various scams and hacks.

Tether takes action: Tether has frozen $29.62 million in USDT tokens tied to the Cambodian Huione Group.

The freeze is due to criminal activities involving the Huione Group's guarantee business.

The frozen wallet was activated on July 9, 2024, and is suspected of assisting in money laundering for fraud and crypto theft.

CoinStats hacked

Popular cryptocurrency portfolio tracker, CoinStats, suffered a $2.2 million attack in June. The Lazarus Group is again under suspicion.

CoinStats enlisted help from experts to trace stolen funds.

A rare ray of sunshine

A phishing scammer returned $9.3 million to a victim 10 months after stealing $24 million from them.

The funds were returned using the Dai stablecoin in two transactions.

The first transfer of $5.23 million was made on July 8, followed by another $4.04 million on July 13.

The victim fell for the phishing scam in September 2023, losing 9,579 Lido Staked Ether and 4,850 Rocket Pool tokens.

Ransomware woes

CDK Global reportedly paid $25 million in Bitcoin to resolve a ransomware attack.

The attack disrupted CDK Global's software, affecting around 15,000 US car dealerships.

The ransomware group BlackSuit received the payment of 387 BTC on June 21.

In The Numbers 🔢

$108 trillion

That’s how much the global crypto trading volume will hit by the end of 2024.

Says who? New study by CoinWire.

90% increase from 2022.

Who's leading the charge? Europe.

Europe accounts for a massive 37% of all global crypto transaction value this year.

This translates to a projected trading volume of $40.5 trillion, 270% jump from 2022's $15 trillion.

Factors contributing to Europe's crypto dominance.

Progressive regulations: Been at the forefront of crypto regulation, establishing a clear and progressive framework (MiCA anyone?).

Strong financial infrastructure: Boasts a robust financial infrastructure, fostering trust and confidence in crypto as an asset class.

Growing Adoption: Europeans are increasingly embracing digital assets, seeing them as valuable investment opportunities.

The study predicts Asia will contribute 36% of the global volume, reaching an estimated $39.3 trillion by year-end.

Other regions follow: Africa ($10.8 trillion), South America ($7.8 trillion), and North America ($7.7 trillion) in estimated 2024 trading volume.

Tornado Cash Dev Denied Bail Again

Alexey Pertsev, the mastermind behind Tornado Cash, just got hit with a major bummer.

The Dutch courts said "no way, José" to his bail request, meaning he'll be chilling in the slammer for a year while his lawyers scramble to get him out.

His request for a computer to work on the appeal was also rejected.

This is the third time Pertsev's bail request has been denied.

Pertsev argues he shouldn't be held responsible for how others used Tornado Cash.

A little background

Tornado Cash is a crypto mixer sanctioned by the US government for allegedly facilitating money laundering.

Pertsev was sentenced to over 5 years in prison in May for supposedly laundering $1.2 billion through the platform.

Supporters argue Pertsev is being unfairly punished for creating a tool with legitimate uses.

Read: Why Tornado Cash Matters? 🌪️

Trial delay in Manhattan

A judge in Tornado Cash developer Roman Storm’s case granted a three-month delay of his upcoming trial over the objections of the prosecution.

Reason for delay: Defense argued case complexity and voluminous discovery require more time to prepare.

Prosecution objected: Claimed defense already had sufficient time to review documents.

Judge's reasoning: Needs time to consider the legal issues raised by the defense.

Original trial date: September 23, 2024.

New trial date: December 2, 2024.

Key legal question: Should co-founders be liable for bad actors using their platform? (e.g., 1,000 users, 1 bad actor)

Other motions pending: Judge hasn't ruled on dismissal or additional discovery arguments.

The Surfer 🏄

According to L2Beat, Scroll TVL increased by 21.9% to $1.01 billion in the past 7 days, becoming the 8th Ethereum Layer2 network with a TVL of more than $1 billion. Of Scroll's $1.01 billion TVL, ETH accounts for 87.17%, stablecoins account for 11.22%, and others account for 1.61%.

The Russian Ministry of Finance proposed allowing traditional stock exchanges to provide cryptocurrency trading services to certain qualified investors, also consider allowing the central bank to start creating an experimental crypto platform for international settlements from September 1.

South Korea's right-wing political party proposes delaying crypto gains taxation until 2028. The bill aims to prevent investors from leaving the market due to higher risks and negative sentiment.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋