CYA Crypto Crusader? 🤦

Congress grills Gary Gensler as most ‘destructive’ US SEC Chair. Polymarket US presidential election bet crosses $1B. Caroline Ellison gets 2-year in prison. Iggy Azalea wants some ass in crypto.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Four hours.

That’s how long US Securities and Exchange Commission (SEC) Chair Gary Gensler was attacked in a war of words at the congressional hearing on Tuesday.

Who? Congressmen from both sides - Republicans and Democrats - hurled questions over his handling of regulating the crypto industry and other issues.

Not just them.

People on his team too. Fellow SEC Commissioners.

Handling DEBT Box case

Congressman Tom Emmer labeled Gensler as "the most destructive SEC Chair" and grilled him on the mishandling of the DEBT Box case.

ICYMI, a federal judge in Utah had criticised the SEC for acting in bad faith and ordered it to pay sanctions, including attorney's fees and costs totalling $1.8 million, in the DEBT Box case.

Emmer asked Gensler if the situation embarrassed him.

"The matters in that case were not well handled," Gensler admitted.

Agency’s definition of securities

Democrat Ritchie Torres didn’t pull his punches either.

The Congressman fired questions at Gensler about how the SEC defines securities.

He schooled the SEC Chair. On the definition of securities.

How? Using a New York Yankees ticket as an example.

Torres: Is there a legal difference between buying a Yankee ticket that offers you the experience of a Yankee game and buying an NFT that offers you the experience of an animated web series?

Gensler: It's about how something is offered and sold and if people are "looking to a common enterprise anticipating profits."

Torres argued that the expectation of profit could be attributed to almost any collectible, consumer good, art, or music.

Context: SEC had charged multiple entities with unregistered securities offerings, including Stoner Cats 2 LLC for conducting an unregistered offering of NFTs.

No room for loyalty: Gensler’s own peers - multiple SEC commissioners - publicly criticised his policies while sitting with him in the same room.

Commissioner Hester Peirce said the SEC's view on crypto regulations has led to a confusion about whether certain tokens qualify as securities.

“We’ve taken a legally imprecise view to mask the regulatory lack of clarity.”

Republican Tom Emmer minced no words.

“Your inconsistencies on [crypto], sir, have set this country back. We could not have had a more historically destructive, or lawless, chairman of the SEC.

Any support? Minimal.

Democrat Maxine Waters said the SEC was doing its job by protecting investors and "ensuring our capital markets remain the envy of the world.

End of the road for Gary G?

Looks like that.

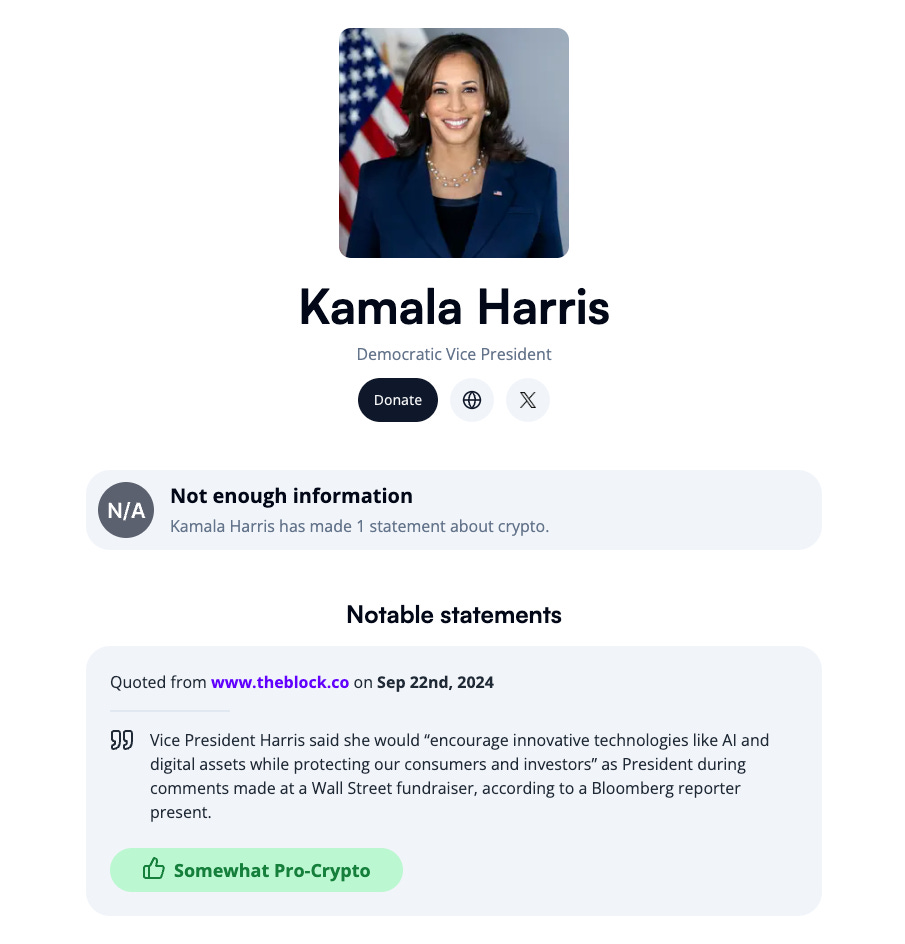

Emmer also questioned Gensler about Kamala Harris’ recent comments on crypto, where she said “we will encourage innovative technologies like AI and digital assets while protecting consumers and investors.”

"Is this your approach too sir, or do you think she's rebuking you because she doesn't think you've done a good enough job establishing these clear rules over the last three years of her administration?"

Gensler said laws are in place, but that Congress can change them.

Upgrade & downgrade

Harris’ comments at the fundraiser event did her some good.

Albeit, only for a short while.

Crypto advocacy group Stand With Crypto initially gave Harris a "B" rating, indicating that she "somewhat supports crypto."

But Crypto Twitter weren’t happy.

She didn’t deserve the rating for a sole mention of “digital assets”. They felt.

“It’s hard to take Harris’ comments on digital assets seriously when she’s part of an administration that has gone after the industry at every turn. Actions matter.” VanEck’s Head of Digital Assets Research Matthew Sigel told Decrypt.

Result? Stand With Crypto downgraded Harris' rating to "NA" (not applicable) from "B".

Lack of a clear crypto policy in her campaign, especially in contrast to the Republican side which has outlined specific crypto initiatives.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Bitcoin Mislabelled as a “Risk-on” Asset

Says who? BlackRock’s head of digital assets Robbie Mitchnick, in an interview with Bloomberg.

He argues that crypto research publications have incorrectly categorised Bitcoin as a “risk-on” asset.

Despite it is being a risky asset, Bitcoin should not be equated with equities and other traditional risk-on investments, Mitchnick says.

It is in fact closer to a “risk-off” asset.

What are these categories?

Risk-on assets: Tech stocks, growth equities, certain commodities, and many cryptocurrencies tend to maximise returns in favourable economic conditions.

Risk-off assets: Investments like gold, silver, government bonds, and the US dollar, which perform well during market uncertainty or economic downturns.

“When we think about Bitcoin, we think of it primarily as an emerging global money alternative. It is a scarce, global, decentralised non-sovereign asset and it is an asset which has no country-specific risk and traditional counterparty risk.”

Mitchnick labelled Bitcoin as a “unique diversifier” in BlackRock’s recently released Bitcoin white paper.

“The reality is, there’s probably two or three things a year that happen typically that actually impact the fundamental value of Bitcoin.”

In The Numbers 🔢

$1 billion

The total wager bet on Polymarket for the 2024 US presidential election winner.

Who leads? Vice President Kamala Harris is most likely with a prediction of 50% chance of winning and at least $157 million bet placed.

Next up is Republican presidential candidate Donald Trump, with $165 million wager for a 48% chance of winning the election.

Polymarket users have also put money on other outcomes. $65 million on another Republican candidate, and $64 million on another Democrat.

And a few more. Who are already out of race now.

Block That Quote 🎙️

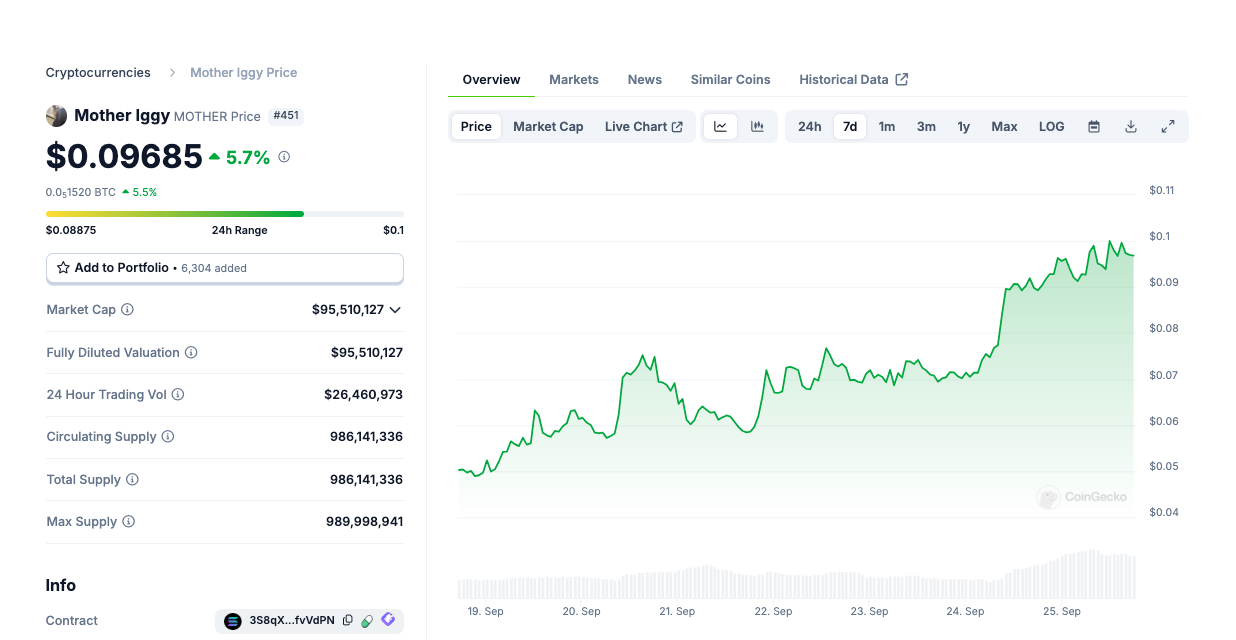

Australian rapper and creator of MOTHER memecoin Iggy Azalea

“Crypto WILL have ass.”

That was the rapper’s response to the crypto community’s criticism of her recent Motherland Rodeo Party in Singapore.

The event held to promote her meme coin MOTHER featured 36 hired dancers.

Crypto Twitter didn’t like it. "Cringe" and "Degenerate” is what they called it.

Did Iggy mind? Not one bit.

In fact, she finds current crypto parties boring. And she wants to change that.

She wants to inject more energy and excitement in the crypto world.

“Surely 36 butts will suffice? Surely it would be enough booty to be on brand. Enough ass to cut through this monotonous cycle of circle-jerking in empty clubs & calling them ‘parties’.”

Not everyone complained. At least the investors didn’t.

Azalea’s MOTHER meme coin is up more than 50% since the party, CoinGecko, with a market cap of $95 million.

BitMEX co-founder Arthur Hayes tagged Iggy in a post on X.

Caroline Ellison Gets 2-Year Prison Sentence

Plus, forfeit about $11 billion.

For? Playing a role in the collapse of the cryptocurrency exchange FTX.

The former co-CEO of Alameda Research pled guilty in December 2022 to multiple charges.

Conspiracy to commit money laundering and admitting to misappropriating about $8 billion from FTX customers.

Both FTX and Alameda Research were founded by her ex-boyfriend Sam Bankman-Fried, who was sentenced to nearly 25 years in prison in March this year.

Then why a shorter sentence for Ellison?

She played smart.

Cooperated with authorities and testified against SBF during his trial. Said he directed her to engage in fraudulent activities.

The difference between Bankman-Fried and Ellison is that she cooperated while “he denied the whole thing,” said Judge Lewis Kaplan, who also oversaw SBF’s sentencing.

SBF wants a fair retrial

His legal team submitted an appeal on September 13, seeking to overturn his fraud conviction.

On what grounds? Argues that he was denied a fair trial and requests a retrial with a different judge.

A group of eight doctors on Tuesday argued in support of the appeal that his autism spectrum disorder (ASD) and ADHD were misinterpreted during his trial.

Argued that his neurodivergence led to long-winded and clipped responses, misinterpreted as evasiveness. And limited access to documents and inadequate ADHD medication impaired his focus in court.

The Surfer 🏄

The US SEC has postponed its review of spot Ethereum ETFs options trading from September 26-27 to November 10-11, 2024. BlackRock, Grayscale, and Bitwise are among the firms waiting for options trading approval for their Ethereum ETFs.

Celsius Network's token (CEL) surged over 300% after a $2.5 billion creditor repayment, reaching $0.65 on September 23, but remains 1,287% below its all-time high of $8.05 amid ongoing bankruptcy proceedings and regulatory challenges.

The US SEC settled charges against TrueCoin and TrustToken for fraudulent sales of TrueUSD (TUSD), with each company fined $163,766. TrueCoin will also pay an additional $372,468 for misrepresenting TUSD as fully backed by US dollars while investing in risky offshore funds.

America's oldest bank BNY Mellon is set to enter the crypto ETF custody market after securing an exemption from the SEC's SAB 121 rule. Challenging Coinbase's dominance in the $300 million crypto custody market, growing by approximately 30% annually.

Solana Labs and Google Cloud launched Gameshift, a Web3 API, at the 2024 Solana Breakpoint conference to simplify NFT integration into traditional games, bridging Web2 and Web3 technologies.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋