Elections Pumping Polymarket? ⛽

Crosses $1B in cumulative volume, driven by US political bets. Is CFTC wrong about banning prediction markets? Pump.fun $100M revenue. Coinbase report on crypto's role in 2024 presidential election.

Hello, y'all. The coolest dope on Web3 is on Decentralised.co ✅

Insights and information by the founders and developers covering all things Web3. Their latest episode in on the changing dynamics of Web3 venture capital👇

The US political scene is a hotbed for speculation.

Polymarket, the decentralised prediction market platform tapped in, allowing users to bet on everything from election outcomes to Supreme Court nominations.

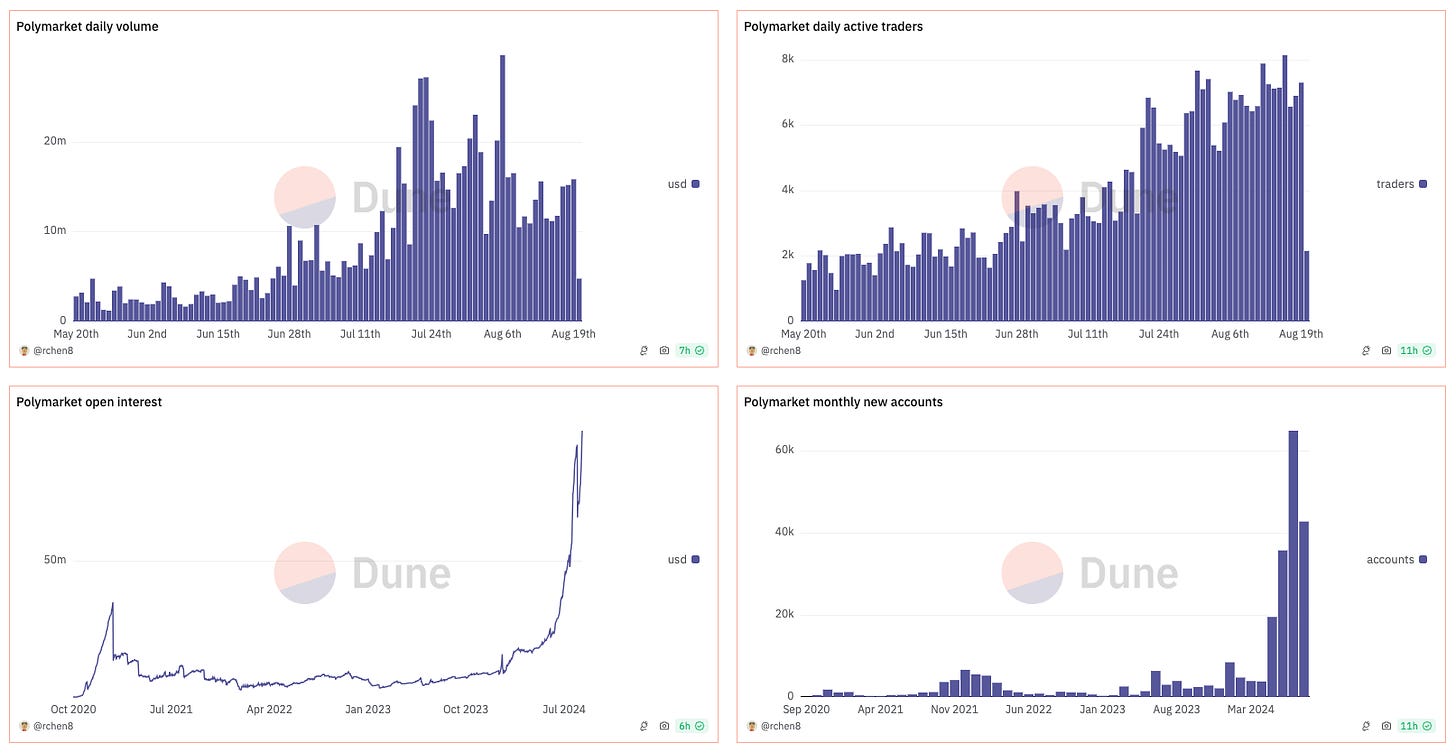

The result? In just a few months, Polymarket's trading volume went from $663 million to over $1 billion.

Record-setting month: July, with volumes topping $380 million.

User growth: Monthly traders increased from ~4,000 in January to ~44,000.

Rapid growth: From June to July, Polymarket's cumulative volume surged by 58%.

Market Mechanics: Users buy shares priced from $0.01 to $1.00 on outcomes of events; higher share prices indicate a perceived higher likelihood of those outcomes.

What’s behind this surge?

Political bets.

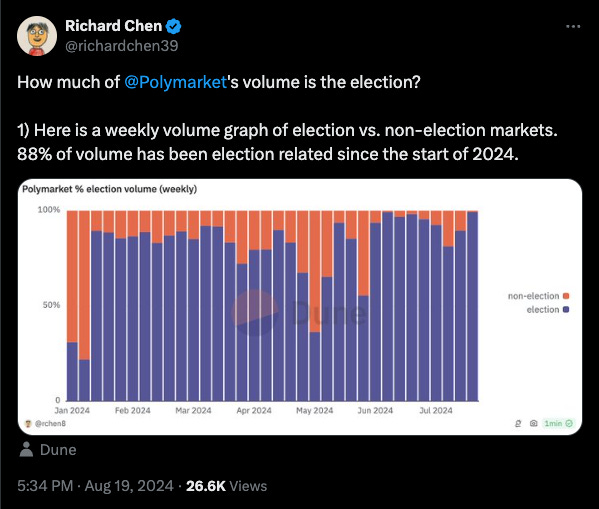

Political wagers are the hot ticket on Polymarket - gobbled up 88% of this year's trading volume.

Political bets grew from 55% in January to 96% in July, thanks to big election events like Joe Biden’s decision not to run and the Trump rally shooting.

Biden's exit from the elections spurred $28 Million daily volume on the platform.

Who's betting on what?

The biggest market on Polymarket? You guessed it – the next US President.

Over $651 million has been wagered on this high-stakes bet alone, making up more than 45% of the platform's total volume.

Right now, Kamala Harris is slightly leading the odds.

Non-election related bets also increased, with $24 million wagered in July, up from $15 million in January.

Crypto Bets: Despite the focus on politics, 41% of bettors predict Bitcoin will drop below $45,000 before September.

Cultural and crypto markets: Other popular betting topics include the legitimacy of the Martin Shkreli-backed DJT token, whether Caitlyn Jenner’s social media account was hacked, and the Olympics.

Are we looking at a decrease in volume after the elections are over?

Maybe. But for now, let’s look at the unique political betting pools.

Polymarket is making it easier

The platform has partnered with MoonPay to allow credit card and debit card purchases, making it easier for users to get in on the action.

This means, no need for crypto wallets. Use credit cards, Apple Pay, Google Pay and PayPal.

You can simply use your familiar payment methods to buy USDC, the stablecoin needed to place bets on Polymarket.

US residents are still restricted from using Polymarket. MoonPay's stance on VPN workarounds remains unclear, so American bettors might have to find alternative ways to join.

Unlock Web3 Insights by the Web3 Builders

Long-form articles trusted by the best in Web3. Hundred hours of research into 20 minute articles. No propaganda. Only good writing. Right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

CFTC Wants to Ban Prediction Markets

The cryptocurrency industry is rallying against a proposed rule from the Commodity Futures Trading Commission (CFTC) that aims to prohibit most prediction markets in the US.

These markets allow users to bet on the outcomes of various events, including elections and sports games.

Major exchanges like Coinbase, Crypto.com, and Gemini have expressed their opposition, citing concerns over innovation and public utility.

CFTC's concerns: Prediction markets pose moral and ethical dilemmas, claiming they could create financial incentives for harmful actions, such as political assassinations.

The agency also worries about the potential for manipulation, where participants might influence events to benefit their bets.

The CFTC has proposed rules to ban event contracts that allow betting on political events.

"Political bets change the motivations behind each vote”- Democratic lawmakers.

Last week Sen. Warren and other Democrats urged the CFTC to quickly finalise a ban on political event contracts.

"Allowing billionaires to wager extraordinary bets while simultaneously contributing to a specific candidate or party, and political insiders to bet on elections using non-public information, will further degrade public trust in the electoral process."

CFTC faces backlash

Paul Grewal, Coinbase's Chief Legal Officer

Crypto.com commented.

"Congress had the ability to draft much more simply 'the following types of event contracts are prohibited,' but it did not."

Gemini Co-founder Cameron Winklevoss.

“Decentralised prediction markets are a significant innovation with real public utility.”

Dragonfly Capital's associate general counsels Jessica Furr and Bryan Edelman commented.

"The CFTC is neither a gambling nor an election regulator and is not equipped to regulate this market; whether the CFTC has jurisdiction over election events contracts requires a court’s determination."

Block That Quote 🎙️

Robert Webb, a professor at the University of Virginia who studies speculative markets.

“The economic literature suggests that prediction markets are fairly accurate”

Despite the CFTC's concerns, economists argue that prediction markets offer valuable insights and are generally accurate.

Researchers Robert Webb and Robin Hanson contend that fears of manipulation are exaggerated.

They advocate for the legalisation of prediction markets, emphasizing their role in accurately forecasting events.

Robin Hanson, a professor at George Mason University and one of the earliest academic proponents of prediction markets.

“It’s a generic feature of having any information source people might rely on that people might want to try to distort it.”

In The Numbers 🔢

$100 million

The expected cumulative revenue of Pump.fun, currently at $94.5 million, up from $50 million in June.

Token generation: Over 1.8 million memecoins created since launching in January 2024.

Innovative pricing model

Bonding curve model: Prices increase with demand, providing structured price progression.

Liquidity transfer: $12,000 worth of liquidity is burned after reaching a market cap of $69,000.

Listing statistics: Less than 1.5% of tokens have been listed on Raydium.

Transaction fee: A 1% fee on all transactions.

Incentives for creators: Eliminated deployment costs and rewards of 0.5 SOL ($80) for tokens crossing the bonding curve.

Market dynamics and challenges

Low entry costs: Tokens can be launched for around $2, driving growth.

Quality concerns: Complaints about project quality and potential scams due to market saturation.

Future outlook: Addressing challenges is crucial for sustained success in the memecoin market.

Crypto's Role in the 2024 Presidential Election

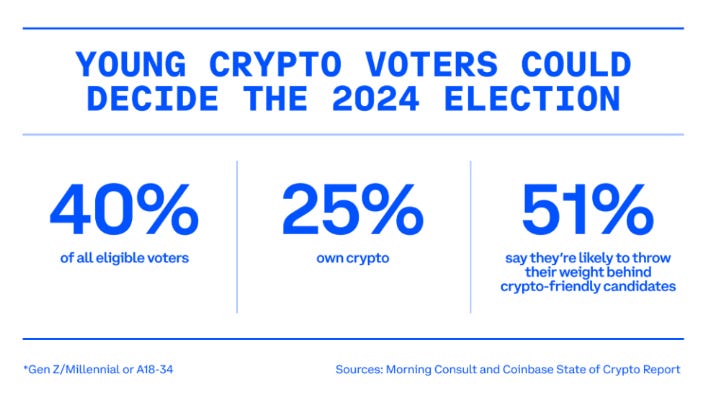

A Coinbase-commissioned study reveals a bipartisan support.

Crypto holders under 35 in swing states are nearly evenly split between Democrats (41%) and Republicans (39%).

Engaging pro-crypto voters: Candidates must engage with young, diverse, pro-crypto voters to secure electoral success in 2024.

Cryptocurrency's political impact: Cryptocurrency's influence on the election landscape will be closely monitored.

Young voters as a decisive factor

Importance of young voters: Young voters can significantly influence election outcomes, especially in battleground states.

Voter turnout: Voter turnout among 18-29-year-olds increased by 11 points in 2020 compared to 2016, but declined in the 2022 midterms.

Shifting political stances on cryptocurrency

Trump's stance: Shifted from calling Bitcoin a "scam" to advocating for its growth in the US.

Democratic ticket: Largely silent on digital assets, with no mention in the recent party platform update.

Polling and election dynamics

Current polls: Harris and Trump in a statistical tie nationwide, with slight leads in swing states.

2020 election: Decided by approximately 80,000 votes across three states.

The Surfer 🏄

The most expensive CryptoPunk #5822 was sold for an undisclosed amount amid a significant decline in NFT values, with the price floor for the collection dropping below $44,000. Sale coincided with two CryptoPunks failing to attract bids above $60,000 at a recent Sotheby’s auction, leading to lowered reserves.

Australia's ASIC has shut down over 600 crypto scams in the past year, with AI and deepfake technology making it harder for consumers to detect fraud, leading to $1.3 billion in losses in 2023.

Bitwise Asset Management has acquired London-based ETC Group, adding over $1 billion in assets and expanding its European presence, with plans to rebrand ETC's crypto ETPs under the Bitwise name.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋