Elon Musk Dodges Dogecoin Lawsuit 🐶

Judge dismisses class action lawsuit seeking $258B in damages. Crypto bankruptcies net law firms $751 in fees. El Salvador President accepts lack of Bitcoin adoption. Kylian Mbappé's pump and dump?

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Elon Musk and his businesses Tesla and SpaceX have been cleared of the $258 billion Dogecoin lawsuit.

US District Judge Alvin K. Hellerstein dismissed a class action lawsuit accusing Elon Musk and Tesla of manipulating the Dogecoin market.

“These statements are aspirational and puffery, not factual and susceptible to being falsified. They cannot be the basis of [a] lawsuit, and no reasonable investor could rely upon them.

It is not possible to understand the allegations that form the basis of plaintiffs' conclusion of market manipulation, a ‘pump and dump’ scheme, a breach of a fiduciary duty amounting to insider trading, or the state law claims.”

Lawsuit background: The lawsuit, first filed in June 2022, underwent four amendments and included accusations of insider trading.

The plaintiffs, representing investors who claimed significant losses, alleged that Musk's public statements about Dogecoin, primarily on social media between 2021 and 2023, misled investors.

Plaintiffs' response: Attorneys for the plaintiffs expressed disappointment, arguing that Musk's statements were "far more than puffery" and resulted in billions of dollars in losses. They indicated plans to appeal to the Second Circuit Court of Appeals.

“We live in a world where the richest people like Elon Musk do whatever they want and get away with it. The Second Circuit Court of Appeals has had the spine to rule against Musk before, and that is where we will receive justice in this case.”

Throughout the legal battle, Musk continued to publicly support Dogecoin, including temporarily changing X's logo to the Dogecoin mascot last year.

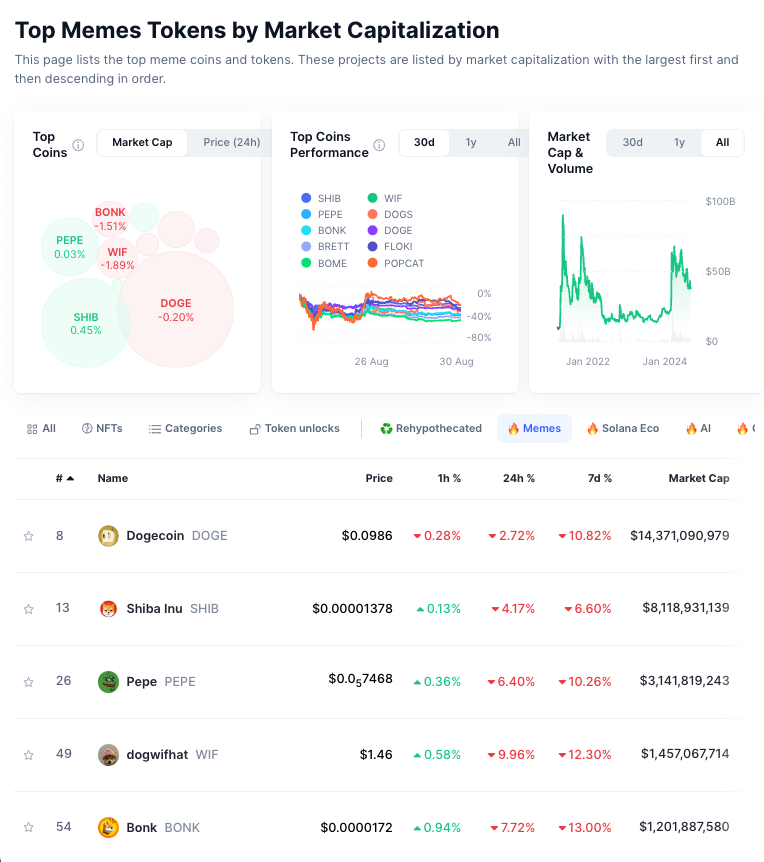

Dogecoin remains one of the world's most valuable cryptocurrencies, with a market cap of over $14 billion and a price around $0.10.

Implications: This ruling sets a precedent for how courts may view cryptocurrency - related statements by public figures, potentially making it more challenging for investors to pursue legal action based on social media posts about digital assets.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Block That Quote 🎙️

The president of El Salvador, Nayib Bukele

“Bitcoin hasn't had the widespread adoption we hoped for.”

In an interview with TIME Magazine when asked if bitcoin monetisation has “been a success.”

“You can go to a McDonald’s, a supermarket, or a hotel and pay with Bitcoin. It hasn’t had the adoption we expected. The positive aspect is that it is voluntary; we have never forced anyone to adopt it. We offered it as an option, and those who chose to use it have benefited from the rise in Bitcoin … Still, I do believe that the positive outcomes outweigh the negative, and the issues that have been highlighted are relatively minor."

Government initiatives

Bitcoin became legal tender on September 7, 2021.

$75 million spent to distribute $30 in Bitcoin to Chivo wallet users.

Bitcoin added as a long-term treasury asset.

Plans for a nationalised Bitcoin mine powered by a volcano.

International Reaction:

The IMF and World Bank expressed concerns about macroeconomic stability and environmental impact.

Credit agencies were skeptical about the move.

Economic Impact

Improved El Salvador's "branding" and attracted foreign investments.

Led to a spike in tourism.

Government claims its Bitcoin investments have been profitable.

On-ground challenges

Low understanding of Bitcoin among the population.

Preference for cash among many citizens.

Concerns about privacy and trust in the government-backed app.

Volatility of Bitcoin's value.

First country to accept: El Salvador became the first country in the world to use Bitcoin as legal tender in 2021.

Reason for adoption: Bitcoin aimed to improve the economy by making banking easier for Salvadorans and encouraging foreign investment.

Currency history: El Salvador replaced its official currency, the colón, with the US dollar in 2001 to achieve financial stability and encourage foreign investment.

Mbappé's X Pump-and-Dump Crypto Scam

Kylian Mbappé's X account was hacked late August 28, posting offensive comments about athletes and rival clubs.

The account also promoted the MBAPPE token on the Solana blockchain via pump.fun.

Market surge and collapse

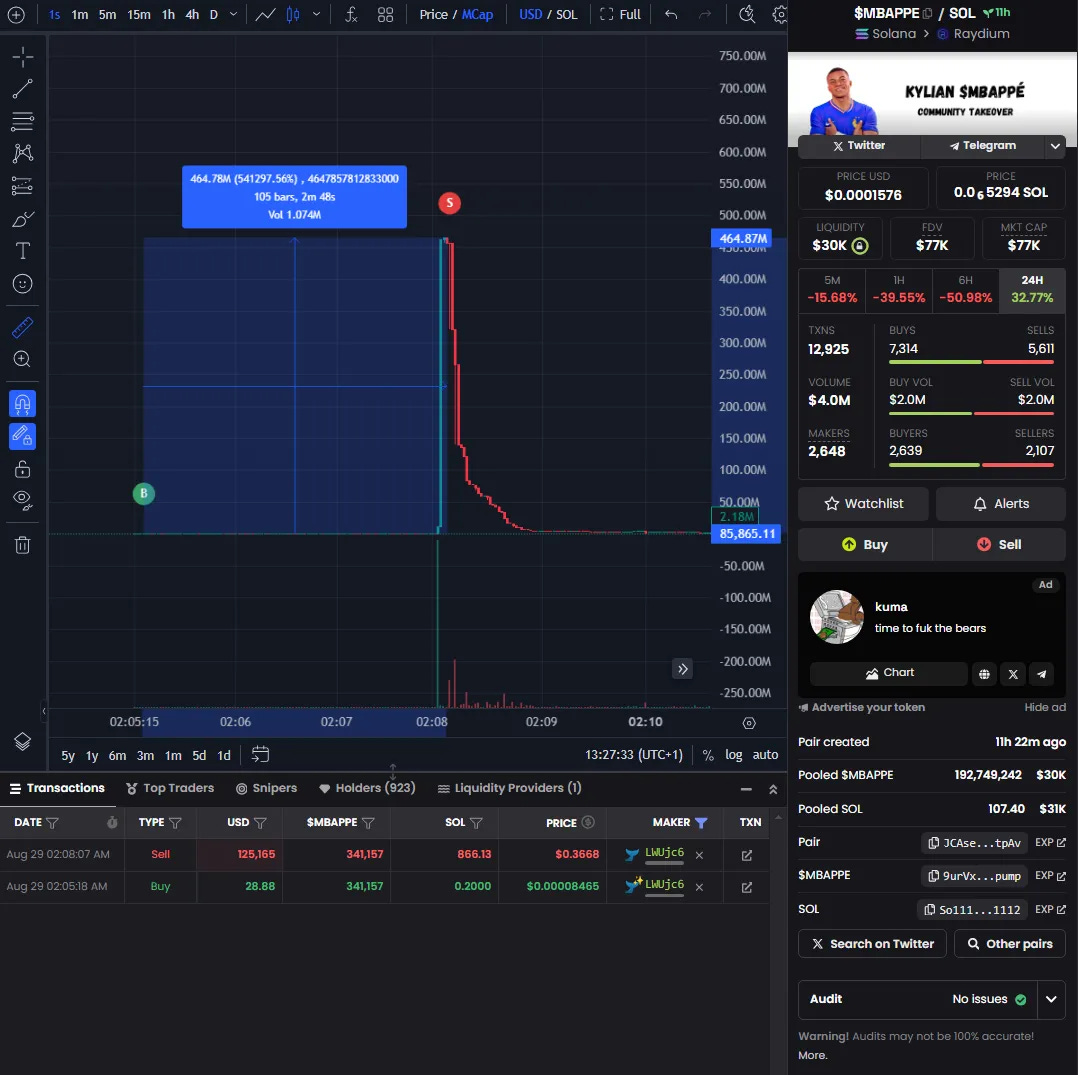

The MBAPPE token reached a market cap of $464 million before plummeting 99% within a minute.

This brief spike gave it a higher market cap than established tokens like Mog Coin, Raydium, and ApeCoin.

Trader outcomes

One trader turned a $29 investment into $125,790 in just three minutes.

Another investor who purchased $1 million worth of MBAPPE saw their investment drop to $14,600.

Wider trend of hacks: This incident is part of a growing trend of social media hacks targeting celebrities and brands, including McDonald's, Metallica, Hulk Hogan, and Doja Cat, used to promote pump-and-dump crypto scams.

In The Numbers 🔢

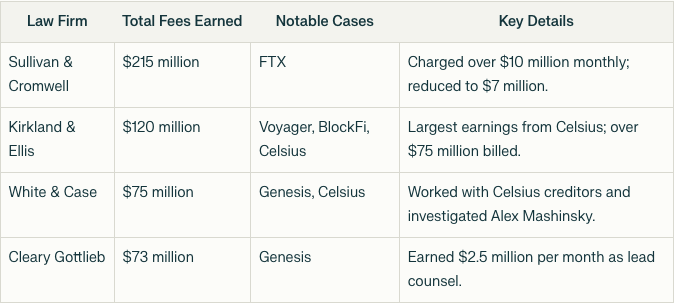

$751 million

The amount law firms handling seven Chapter 11 crypto bankruptcies from 2022 have requested and received $751 million in fees as of August 2024.

Four law firms have emerged as the biggest beneficiaries.

Collectively earning $484 million, which accounts for 64% of all charges from the Chapter 11 bankruptcy processes.

While some cases are wrapping up, others continue.

FTX's confirmation hearing is scheduled for October 2024.

Terraform Labs' reorganisation hearing is set for September 19, 2024.

Genesis completed its restructuring plan in August, paying $4 billion in compensation to affected parties.

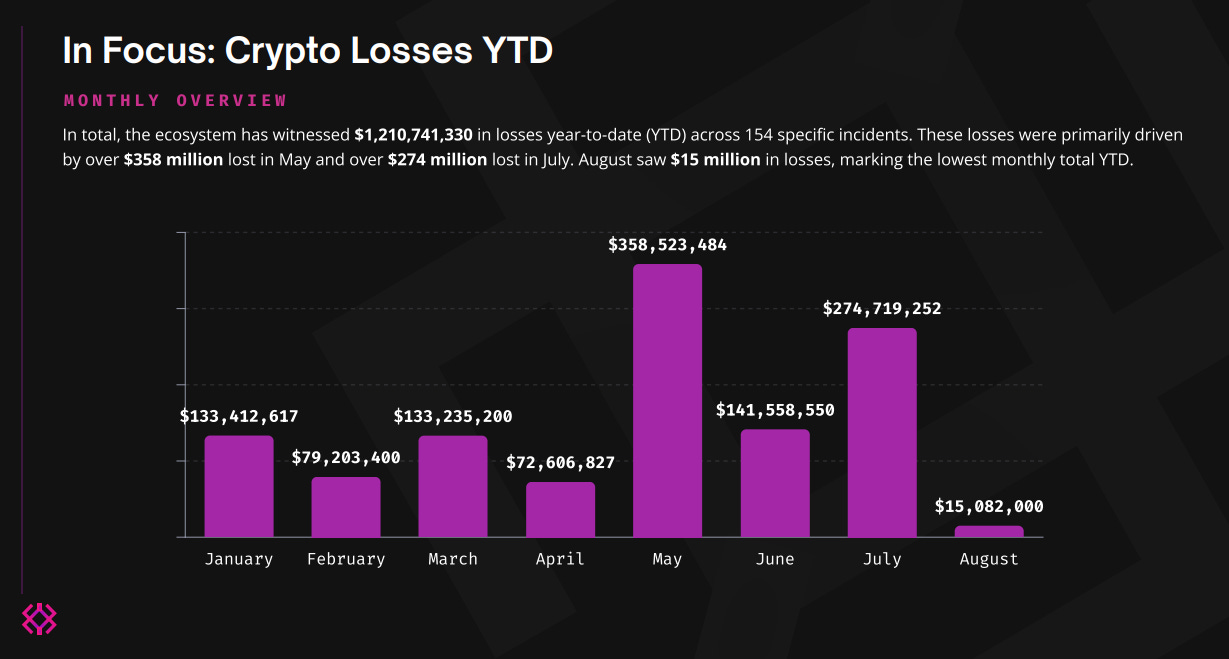

Crypto Industry Losses Surpass $1.2B in 2024

According to the report from Immunefi.

Overall Losses: Over $1.2 billion due to 154 hacks and scams in 2024.

Year-over-Year Increase: 15.5% rise in losses compared to 2023.

August Losses: Only $15.1 million, a 95% decrease from July's $274.7 million.

Overview - August 2024

Total incidents: Five specific incidents in August.

Lowest monthly loss: Year-to-date and a 38% decrease compared to August 2023.

Major loss: $12 million outflow from the Ronin Network bridge, later returned by white hats for a $500,000 bounty.

Historical context: Ronin bridge was hacked in March 2022, resulting in over $600 million lost. 173,600 ETH and $25.5 million USDC stolen, marking the largest DeFi exploit in history.

August losses and trends

Nexera loss: Second-largest loss in August with $1.5 million stolen.

Remaining losses: VOW, Convergence Finance, and iVest DAO accounted for the rest.

CeFi incidents: No recorded incidents in August; all losses due to hacks.

Most targeted networks: Ethereum and BNB Chain were the primary targets. Ethereum faced three attacks, while BNB Chain experienced two.

Immunefi's impact on blockchain security

Payouts: Surpassed $100 million in ethical hacker and researcher payouts over three years.

Largest bounty: $10 million awarded for a Wormhole vulnerability.

New initiative: Launched "Attackathon," a collaborative audit contest with the Ethereum Foundation

Research community: Operates with over 45,000 researchers.

User funds saved: Claims to have saved over $25 billion across protocols like Polygon, Optimism, Chainlink, The Graph, Synthetix, and MakerDAO.

The Surfer 🏄

A solo Bitcoin successfully mined block 858,978 to earn a reward of 3.275 BTC, worth approximately $199,101. The miner, operating with just 0.012% of the network's average hashrate, defied the odds to process the block containing 2,391 transactions at 4:21 pm UTC on August 29, 2024/

Australia's Bitcoin ATMs surged from 73 in September 2022 to 1,162 in August 2024, making it the world's third-largest market. The growth, driven by companies like CoinFlip, has raised regulatory concerns about potential illicit use.

WazirX has set aside $12 million for legal costs and to recover stolen crypto after a $230 million cyberattack in July. The exchange is also seeking a 30-day moratorium in Singapore to restructure its operations.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Elon Musk cleared of Dogecoin lawsuit? Guess it’s still illegal to lose money on memes, but not to make them

It's a fascinating time as to how memecoin can become a billion dollar asset and richest man is the world is being sued for manipulating its price... we are living in interesting times for sure.