Ethereum's 2024 game plan 🎊🎈

Vitalik unveils Ethereum's 2024 roadmap with "Six Pillars." Orbit Chain hack steals $82 million. ZachXBT and NFT Machine. Blast's rapid growth. Cohen's AI mishap and NYT's battle with OpenAI.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Vitalik Buterin of Ethereum just dropped the Ethereum roadmap for 2024.

What do we have?

There are a few changes compared to the previous year.

But, the overall game plan remains consistent.

Ethereum 2024: The Six Pillars

For 2024, Ethereum has set its sights on six main components: the Merge, the Surge, the Scourge, the Verge, the Purge, and the Splurge.

The Merge: Maintaining a robust proof-of-stake (PoS) consensus remains a top priority. The successful completion of "The Merge" in September 2022 - significant milestone in Ethereum's transition to PoS, reducing energy consumption.

The Surge: Scaling solutions and the pursuit of achieving 100,000 transactions per second across Ethereum and its L2 networks.

The Scourge: This enigmatic element appears focused on mitigating risks related to Miner Extractable Value (MEV) and liquid pooling.

The Verge: "The Verge" potentially signifies improvements in block verification processes, enhancing the efficiency and reliability.

The Purge: With "The Purge," Ethereum aims to simplify its protocol, streamlining the platform's operations.

The Splurge: "The Splurge" encompasses "everything else."

Single Slot Finality (SSF)

Single Slot Finality (SSF) is growing in importance in Ethereum's post-merge PoS design. SSF aims to ensure that blockchain block changes are irreversible unless at least 33% of the total staked ETH is burned. This concept provides a robust solution to some of Ethereum's current PoS design weaknesses.

Buterin did not provide a specific timeline for these changes, but they are generally ordered according to their perceived priority.

In a blog post, Vitalik expresses concerns about the fading vision of Web3 and also addresses the rise in transaction fees.

Vitalik shares some positive news for 2023

Rollups: Scaling solutions like rollups are becoming a reality.

Privacy Solutions: Second-generation privacy solutions are emerging, offering more privacy in crypto transactions.

Account Abstraction: Account abstraction, a technology for improving contract interactions, is gaining traction.

Light Clients: Light clients, a long-overlooked technology, are finally coming to fruition.

Zero-Knowledge Proofs: Zero-knowledge proofs, once considered a distant future, are now developer-friendly and suitable for various applications.

A Return to Cypherpunk Principles

Buterin has also hinted at a return to the original ideals of the "cypherpunk" revolution for blockchain.

Blog post - Make Ethereum Cypherpunk Again

Recent developments like rollups, zero-knowledge proofs, account abstraction, and second-generation privacy solutions could help Ethereum align more closely with cypherpunk principles.

ETH vs. SOL

Twitter is fighting over Ethereum or Solana.

Meanwhile, Solana co-founder Anatoly Yakovenko swiftly responded, dismissing Ethereum as a "cockroach settlement layer."

Who are the largest Ethereum (ETH) holders? Exchanges.

Beacon Chain Contract: Holds 35 million ETH (29% of total)

Wrapped ETH (WETH): Owns 3.2 million ETH (Approx. $7.7 billion)

Binance: Stores nearly 2 million ETH

Kraken: Holds around 1.6 million ETH

Robinhood: Possesses over 1.4 million ETH (1.24% of total)

Binance (additional wallet): Holds over 550,000 ETH

Binance (another wallet): Also contains over 550,000 ETH

Arbitrum: Bridge: Controls more than 1.3 million ETH

Bitfinex: Has over 450,000 ETH

Vitalik Buterin (VB 3): Ethereum's co-founder holds more than 240,000 ETH.

TTD Numbers🔢

$82 million

Hackers had better plans on New Year's Eve, targeting Orbit Chain's bridging service, Orbit Bridge.

$82 million in stolen funds. Better plan than us, indeed.

Deets of the Exploit

The exploit was detected just three hours before the start of the new year.

Twitter user Kgjr, Officer CIA and blockchain security firm Cyvers, highlighted the exploit through large outflows from the Orbit Chain Bridge protocol.

Data from blockchain analytics platform Arkham Intelligence confirms the theft of $81.68 million in various cryptocurrencies.

The stolen assets include $30 million in Tether (USDT), $10 million in USD Coin (USDC), $21.7 million in Ether (ETH), $9.8 million in Wrapped Bitcoin (WBTC), and $10 million in DAI.

The Orbit Chain protocol is closely associated with the Klaytn network (KLAY), a modular layer-1 blockchain.

Eight of the largest assets on the Klaytn network by total market capitalization are wrapped assets on the Orbit Bridge.

TTD Zach🙅🏻

ZachXBT, an on-chain sleuth, has raised concerns about an alleged scammer known as "NFT Machine" operating under the X user handle "scaredofboobs."

The big reveal unfolded in ZachXBT's Telegram lair on December 28, 2023.

NFT Machine was associated with the founder of OpenFT, a decentralized marketplace project.

The X account for NFT Machine was banned for violating platform rules.

Tyler Gaye, a "doxxed American citizen" residing in Denver, Colorado, managed the NFT Machine account.

Fraudulent Activities by NFT Machine

NFT Machine, managed by Tyler Gaye, allegedly conducted a fraudulent scheme, collecting $55,000 from investors for promoting OpenFT.

Instead of developing the promised NFT marketplace, Gaye used the funds to purchase NFTs for his personal collection, including MoonCats items.

Legal Consequences

Investors pursued legal action against Tyler Gaye.

Gaye's failure to appear in court led to a default judgment, ordering him to repay investors, along with damages and punitive costs, totaling $275,000.

ZachXBT asserts that Tyler Gaye, the alleged scammer, is the same individual operating under the X user handle "scaredofboobs." (we don't know yet).

This revelation is concerning, as Gaye has reportedly not complied with the court's order and continues to engage in crypto projects, including ArcadeDAO retro gaming.

Where’s ETF? 🚨

Asset managers BlackRock, Valkyrie, and Van Eck have submitted amended S-1 forms to the SEC for their Bitcoin ETF applications👇🏻

TTD Blast💥

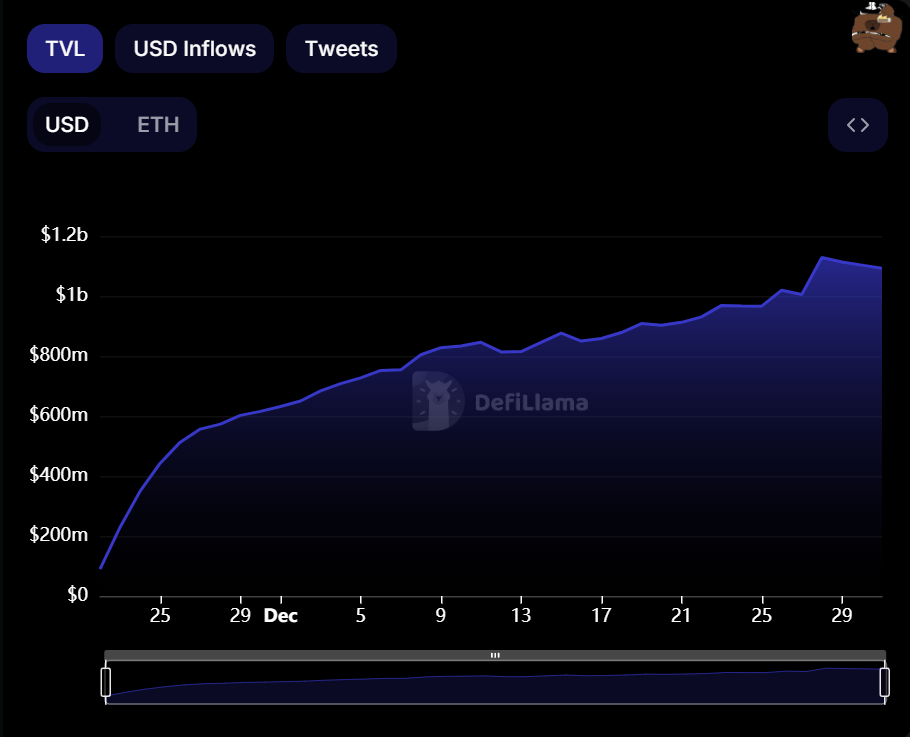

Blast, an Ethereum layer-2 scaling network developed by the creator of NFT marketplace Blur, surpasses $1 billion within 40 days of launch.

Hit $1.13 billion on Dec 28.

These deposits are part of an effort by users to earn yield and points for an upcoming token airdrop.

Over 86,000 users have contributed to Blast's deposits.

Users are earning approximately 4% annual returns on deposited Ethereum (ETH) and 5% on stablecoins.

The "Blast Points" earned will determine the share of the upcoming BLAST token airdrop.

The airdrop is scheduled for May 2024.

Controversy Surrounding Blast

Blast's rollout has been met with controversy, even within its backer, Paradigm.

Users are depositing cryptocurrency into a bridge disconnected from the actual Blast network, with withdrawal restrictions until February 2024.

The response👇🏻

TTD AI📍

Cohen blames Bard

Michael D. Cohen, former lawyer for Donald Trump, mistakenly used bogus legal citations generated by AI program Google Bard in a court motion.

These citations were submitted to Judge Jesse M. Furman as part of Cohen's request to end court supervision.

Cohen was unaware of the AI's limitations and thought Google Bard was a legitimate source.

The three citations in Cohen's case were generated by the Bard chatbot, which combined fragments of real cases with imaginative content.

Cohen admitted to previously using Bard as a search engine and not realizing its limitations.

NYT vs. OpenAI

The New York Times is locking horns with AI giants OpenAI and Microsoft over a copyright caper.

In a lawsuit NYT claims OpenAI and Microsoft snatched millions of its articles to train chatbots that now compete with the newspaper itself.

The lawsuit argues that AI models mimic NYT's style and content, siphoning off readers and revenue streams.

It highlights the potential damage to NYT's reputation due to AI-generated "hallucination" where false information is attributed to the source.

TTD Surfer 🏄

The Nigerian crypto license requirements will lead to a decrease in the number of local crypto exchanges in Nigeria.

United States prosecutors have decided not to pursue a second trial against Sam Bankman-Fried. Everyone is not happy about it.

Chai payments platform, promoted as a real-world use case of the Terra blockchain, actually settled payments using traditional methods.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋