Fire Sale 📉

July kicks off with a crypto bloodbath. The US and German governments' Bitcoin fire sale. Whales are selling on top? Robert Kiyosaki's biggest financial crash warning. BitMEX launches memecoin index.

Hello, y'all. As far as we can see 🔥 ♪

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Who spilled the cold coffee on the market?

Bitcoin took a nosedive, dropping 7.85% and crashing below $55,000.

The lowest since February.

Ethereum 10% down, and below the $3K mark.

Total value of the cryptocurrency market fell almost 9% to $2.08 trillion.

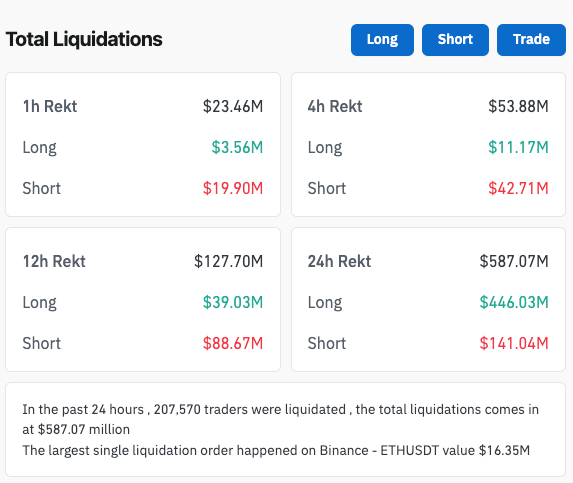

Look at the Rekt

Close to $600 million worth of crypto dreams got liquidated in the past 24 hours.

How did we get here?

Mt. Gox finally cracked open.

Culprit 1: The once-mighty exchange that went belly-up in 2014, just started shuffling a massive stack of Bitcoin.

Nearly 47,000 BTC to be exact ~ $2.7 billion.

This comes just before their planned $9 billion payout to creditors.

Earlier that day, Mt. Gox wallets saw smaller Bitcoin transfers, hinting at potential pre-distribution activity.

After the initial transfer, the receiving address sent some Bitcoin back to Mt. Gox's cold storage, before ultimately moving it to another new address.

A portion of the transferred Bitcoin (1,545 BTC) landed in a hot wallet on Bitbank, an exchange reportedly involved in the payout process.

And the market reacted.

A flashback

Rise and Fall: Founded in 2010, Mt. Gox dominated Bitcoin trading, handling 70% of transactions globally. But, security issues and regulatory woes plagued the exchange.

The Hack: In 2014, a massive hack resulted in the loss of 850,000 Bitcoins (worth nearly $58 billion today), forcing Mt. Gox to file for bankruptcy.

A Decade of Waiting: While some Bitcoin has been recovered, many creditors have waited ten years for any repayment.

Sell-off as creditors cash out their recovered Bitcoin, and hence, the bloodbath.

Silver Lining

But, here's why Bitcoin Cash (BCH) is in for a rougher ride:

Mt. Gox will return $73 million worth of BCH to its creditors. This represents 24% of BCH's daily trading volume, making a significant price drop very likely.

In contrast, the $9.5 billion in BTC being returned is only 6% of Bitcoin's daily trading volume.

Culprit 2: Government stash

The US and German governments have caused ripples with their moves.

This adds fuel to speculation that they might be preparing to sell a significant portion of their Bitcoin reserves.

Silver Lining

Tron founder Justin Sun has a big offer - buying Germany's Bitcoin holdings.

Aim: To stabilize the market after German government's large BTC transfers.

Sun seeks to buy $2.3 billion worth of Bitcoin (40,359 BTC) off-market.

So how bad will the downturn be?

David Brickell, head of international distribution at FRNT.

“This latest flush might be sufficient to attract the dip buyers who have been sidelined, but remain longer term bullish and may well fire the starting gun on the next leg of the bull market. Bulls will be on the lookout.”

Rachel Lin, co-founder and CEO of decentralised crypto derivatives exchange SynFutures.

“We might see a bounce-back if the selling is lower than anticipated … If there is enough selling to push the price lower, we might be looking at the $50,000 level soon.”

Adam Morgan McCarthy, an analyst at digital finance data company Kaiko.

“Liquidity tends to dry up over the summer months. We can already see this happening. This means there’s less support when there’s selling pressure and prices can move more sharply. I expect this to continue throughout July, August, and into September.

Block That Quote 🎙️

the author of Rich Dad Poor Dad, Robert Kiyosaki.

“Biggest crash in history coming”

Kiyosaki is back with his signature brand of financial prophecy.

This time, he's predicting the "biggest crash in history" for stocks, real estate, and even crypto.

The best thing, he follows this up with a glimmer of hope – a "great recovery" fuelled by a long-term bull market starting in late 2025.

Kiyosaki throws his weight behind Bitcoin, gold, and silver as the assets to hold during the downturn.

He even predicts Bitcoin to reach price of $10 million per coin.

“They know, after the crash…. gold, silver, Bitcoin will once again begin climbing to hit all time highs. Gold possibly $15,000 an ounce. Silver possibly $110.00 an ounce. Bitcoin easily to $10 million per coin.”

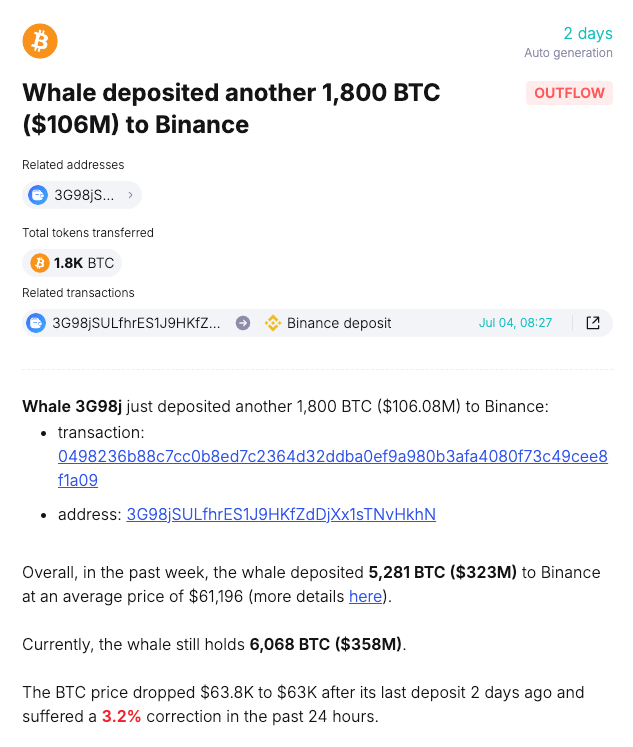

Whales On The Move

#1 A crypto whale transferred $423 million worth of Bitcoin to Binance in a series of transactions.

#2 A Bitcoin address containing 119 BTC ($6.8 million) stirred after over 12 years of inactivity.

The last transaction from this address occurred on Feb 28, 2012, when the balance was worth only $600.

The wallet sent out two transactions totaling 119 BTC:

Retail investors see a buying opportunity

Despite the whale's actions, retail investors are displaying surprising optimism.

Data suggests they're actively buying Bitcoin, particularly when the price dips below $60,000.

This "buy the dip" mentality reflects confidence in the long-term potential of Bitcoin.

In The Numbers 🔢

$664 million

That’s how much crypto investors lost in the first half of 2024.

50% increase compared to H1 2023.

Phishing attacks and compromised private keys are the main culprits behind these losses.

The emergence of open-source info stealers is a growing threat.

Malware programs steal sensitive information like passwords and private keys.

Previously available to cybercrime syndicates, they're now freely accessible.

This empowers amateur hackers, increasing attack frequency and volume.

$1.1 billion

Crypto losses H1 2024 according to a Certik Report.

This surpasses Q2 2023 losses.

Phishing attacks are the biggest culprit.

Over $497 million stolen through phishing scams in H1.

Most targeted blockchain with nearly $400 million lost in attacks.

Biggest loss? Japanese exchange DMM Bitcoin hacked for $304.7 million.

Another Memecoin Index

BitMEX launches its very own "memecoin index," the MEMEMEXTUSDT.

A Basket Index Perpetual Swap Contract.

This is on the back of VanEck Memecoin index.

What it Does: This contract tracks the top 10 memecoins by market capitalisation in a single instrument.

Rebalancing: The constituents are rebalanced monthly to reflect the best performing memecoins.

Margin & Leverage: It's a USDT-margined linear perpetual swap offering up to 25x leverage.

Benefits (as stated by BitMEX)

Easier diversification across memecoins.

Capitalise on memecoin trends while managing risk.

Similar to a well-known index (S&P 500) but for memecoins.

Improved liquidity for better trade execution.

Contract Specs

Symbol: MEMEMEXTUSDT

Margin: USDT

Contract size: 0.0001 MEMEMEXT

Lot size: 1000

Maker fee: -0.015%

Taker fee: 0.075%

Initial margin: 4.00%

Maintenance margin: 2.00%

Launch Celebration: Prize pool of $10,000 in USDT for top performers using the new contract.

Context: This launch follows BitMEX's recent introduction of ultra-high leverage (up to 250x) for perpetual swaps.

The Surfer 🏄

South Korean government to launch crypto transaction monitoring system. System will allow authorities to receive reports on suspicious transactions. Implementation to occur on July 19, when new law goes into effect.

Symbiotic, a competitor to EigenLayer, has crossed $1 billion in deposits in under a month. The protocol reached its deposit cap of 210,600 wrapped stETH, worth about $800 million, in just four hours.

Crypto startup Hamilton has launched tokenised US Treasury bonds on Bitcoin layer-2 blockchains. The tokenised assets offer the stability of the Bitcoin network with a better yield than stablecoins.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋