Gold To Trigger Bitcoin Bull Run? 🔑

Five things Bitcoin this week amidst falling markets. Gold bear market to trigger BTC bull run? Kamala Harris' election odds surge. Crypto lending platform hits $1.6B processed in digital asset loans.

Hello, y'all. This Sunday help yourself with all them insights from Decentralised.co.

Long-form articles trusted by the best in Web3. Hundred hours of research into 20 minute articles. No propaganda. Only good writing. Right in your inbox 👇

The cryptocurrency market has once again dived head first in the sea of red.

Look at the carnage.

The downturn coincided with a sharp decline in US stock indices, as the S&P 500 experienced its worst session in nearly two years following disappointing jobs data.

Political concerns impacting sentiment: Concerns regarding Kamala Harris's improving odds in the upcoming US presidential election, which could lead to stricter cryptocurrency regulations.

Options market signals bearish sentiment: The Bitcoin options show a 25% delta skew indicating higher implied volatility for out-of-the-money puts compared to calls. Traders are hedging against further downside risks.

Potential Fed rate cut in September: Michaël van de Poppe, founder and CEO of trading firm MNTrading, argued that recent events had likely cemented the likelihood of the Federal Reserve cutting interest rates in September, a key bullish catalyst for crypto and risk assets.

Mixed macroeconomic signals: The macroeconomic landscape is full of mixed signals, with discussions centred around whether the Fed will implement a 0.25% or 0.50% rate cut in September. Market odds favour a smaller 0.25% cut.

Bullish perspectives remain: Despite the market shock, Jeff Ross of Vailshire Partners suggesting that rising global liquidity will support BTC price action going forward.

Bitcoin's trading range: Bitcoin has been trading within a range for over five months, with key levels identified at $59,000 and $74,000.

Five things Bitcoin this week

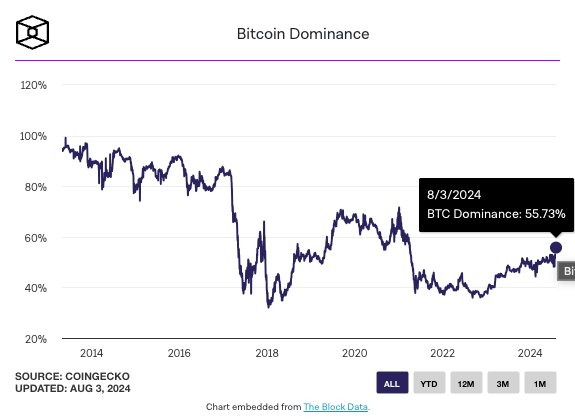

1/Bitcoin dominance has surged to 55.7%, its highest level in three years, following a rapid increase from 48.2% after the launch of ETH ETFs.

This rise occurred despite a market-wide dump, with Bitcoin showing resilience while altcoins, including ETH, weakened, as factors like the absence of Grayscale's GBTC conversion and the Bitcoin 2024 conference contributed to BTC's relative strength.

2/Bitcoin technical charts build the case for traders looking for action in Bitcoin (BTC) may want to pay attention as the "Bollinger bandwidth" indicator, which successfully predicted late 2023's volatility, has dropped to 20% on the weekly chart.

This level, last seen before Bitcoin broke out of its $25,000 to $32,000 range in late October, suggests that a significant price movement could be on the horizon after four months of trading between $60,000 and $70,000.

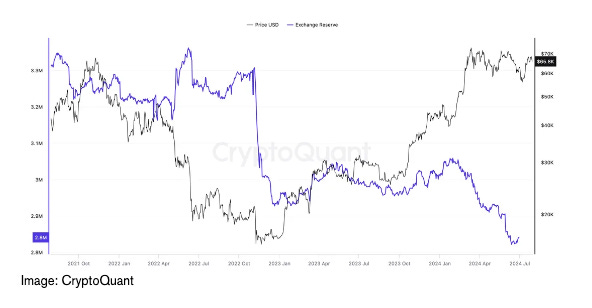

3/Bitcoin exchange reserves have plummeted to around 2.8 million coins, their lowest levels in years, amid a sustained price surge that has Bitcoin testing $70,000.

The sharp decline in exchange reserves, which began in early 2022 and accelerated over the past year, suggests investors are increasingly storing their BTC offline for long-term holding rather than preparing to sell.

4/ Bitcoin risk-reward remains compelling even though Bitcoin's price has more than doubled over the past year. On-chain indicator suggests it still offers an attractive risk-reward ratio for investors.

The "reserve risk" metric, which reflects long-term holders' confidence, remains in the green zone below 0.002, indicating favourable demand-supply dynamics and potential for significant returns if investments are made now.

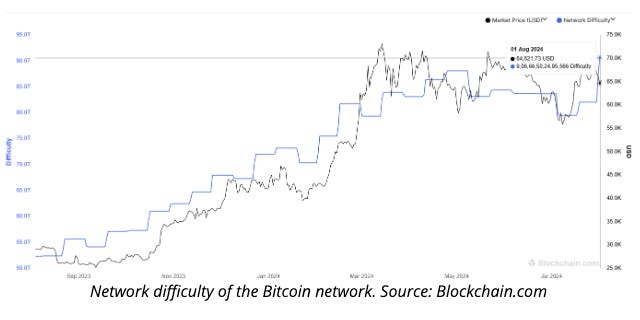

5/ Bitcoin's mining difficulty surged by over 10.5% on August 1, reaching a new all-time high of 90.66 trillion, which is expected to increase operational costs for miners.

This rise follows a three-month decline in difficulty, and while some miners reported higher earnings in July, the new difficulty level may negatively impact future profits as miners hold onto their BTC rewards in anticipation of better market conditions.

Unlock Web3 Insights with Decentralised.co

Three articles each week for people who like to stay updated on Web3 without being glued to Twitter. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

If you like stories with depth, insight & numbers on how the internet is evolving.

Written by

, , andBlock That Quote 🎙️

Former President and Bitcoin lover, Donald Trump

"Who knows, maybe we'll pay off our $35 trillion [in debt]. Hand 'em a little crypto check, right? We'll hand 'em a little Bitcoin, and wipe out our $35 trillion."

In an interview with Maria Bartiromo of FOX Business Trump has doubled down on his support for Bitcoin.

Trump's proposal is unlikely to be feasible, as the total market cap of all Bitcoin in circulation is only $1.2 trillion, and the federal government holds a tiny fraction of that, worth about $13 billion.

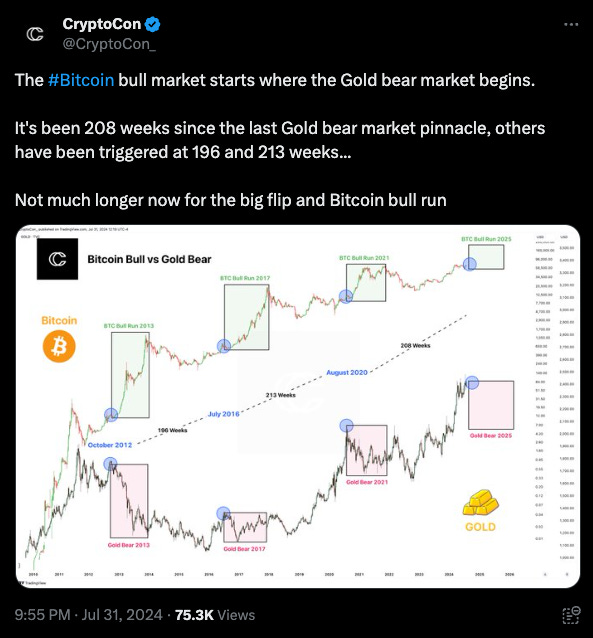

Gold Bear Market to Trigger Bitcoin Bull Run?

Crypto trader CryptoCon builds a case for the next Bitcoin bull run.

The trigger? Impending gold bear market.

Historically, Bitcoin bull markets have begun alongside gold bear markets, as seen in 2013, 2017, and 2021.

Current market conditions: Gold is currently experiencing bullish momentum, surpassing $2,400 amid geopolitical tensions in the Middle East.

Bitcoin is facing bearish sentiment, falling below $60,000. Trading in the range of $60,000 - $70,000 for the last six months.

Coinbase analysts David Duong and David Han reckon that August is usually marked by reduced cryptocurrency market activity and a slump in the value of major tokens.

"Seasonality hasn’t typically worked in crypto’s favour for the month of August."

In The Numbers 🔢

$1.6 billion

The amount Ledn has processed in digital asset loans during the first half of 2024, primarily driven by institutional activity.

The crypto lending platform was boosted by the approval of various spot Bitcoin ETFs in the US and a rally in Bitcoin prices.

Institutional loans accounted for $969 million.

Retail processing $150 million in loans.

Reflecting a trend of investors taking out Bitcoin and Ethereum-backed loans.

Ledn employs a rigorous due diligence process for vetting institutions and has managed to navigate the challenges faced by other crypto lenders in 2022.

Clients are increasingly using digital asset-backed loans for tax purposes, as borrowing against cryptocurrencies typically does not trigger a taxable event.

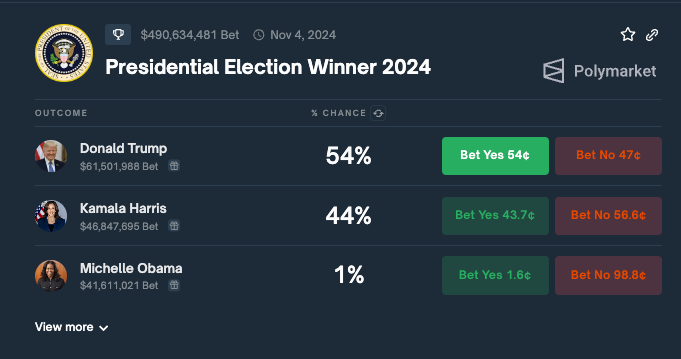

Kamala Harris' Election Odds Surge on Polymarket

Presumptive Democratic nominee Kamala Harris' odds of winning the 2024 US presidential election have climbed to 44% on August 4, while Republican nominee Donald Trump's odds decreased to 54%

Hit a new all-time high on crypto prediction market Polymarket.

Analyst Ruslan Lienkha from YouHodler warns that strengthening election odds for Kamala Harris could negatively impact Bitcoin's price, as investors fear stricter cryptocurrency regulations under a Democratic administration.

"If investors believe a Democratic administration might impose stricter cryptocurrency regulations, bitcoin’s price could suffer. Harris’s momentum in crucial swing states could intensify these concerns."

Polymarket has surpassed $1 billion in cumulative trading volume since its launch.

A significant surge to $1.05 billion in July alone, driven by increased interest in US political events.

The decentralised prediction market platform's user base has expanded dramatically, with over 44,000 monthly traders and a record trading volume of $380 million in July, primarily focused on political markets.

Read: Is the crypto market wrong about a Harris Administration?

The Surfer 🏄

Genesis Global and related entities have completed their bankruptcy restructuring and begun distributing approximately $4 billion in digital assets and US dollars to creditors, with an average recovery of 64% depending on the type of cryptocurrency owed.

Morgan Stanley is allowing its 15,000 financial advisors to offer select clients the opportunity to invest in two spot Bitcoin ETFs - BlackRock's iShares Bitcoin Trust and Fidelity's Wise Origin Bitcoin Fund - starting August 7. Eligible clients must have a net worth of at least $1.5 million

A US grand jury has indicted North Korean national Rim Jong Hyok for allegedly leading ransomware attacks on hospitals, extorting funds, and laundering the proceeds to finance further cyber intrusions into defense and government entities. The State Department is offering a reward of up to $10 million for information on Rim's whereabouts.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Appreciate the deep dive into each company's performance. The mixed results show just how volatile and unpredictable the crypto market can be. The insights into token unlocks for August were particularly useful!

Thanks for the comprehensive update! The BTC Yield metric introduced by MicroStrategy is an interesting concept. It will be intriguing to see if other companies adopt similar metrics to justify their crypto holdings.