Good, Bad and Ugly of Rate Cuts 👀

What does interest rate cut mean for crypto? Crypto critic Sen. Warren asks for big Fed rate cut. Another Bitcoin miner adopts MicroStrategy playbook. Tokenisation for cross-border payment system?

Hello, y'all. We are going to be at Token 2049, are you?

Please DM us on X with a link to your project. We are going to publish friends of Token Dispatch at Token 2049 list starting tomorrow until September 20, 2024.

Check out today’s list below 👇

That’s you and your project landing in over 130,000 inboxes. Seven days in a row - September 14-20, 2024. Limited to five people and projects each day.

Is the much awaited interest rate cut finally here?

Very likely.

The US Federal Reserve is expected to announce a 25 to 50 basis-point cut in its benchmark interest rate.

When: During the Federal Open Market Committee (FOMC) meeting on September 18.

This will be the first rate cut in four years.

At least that’s what is expected.

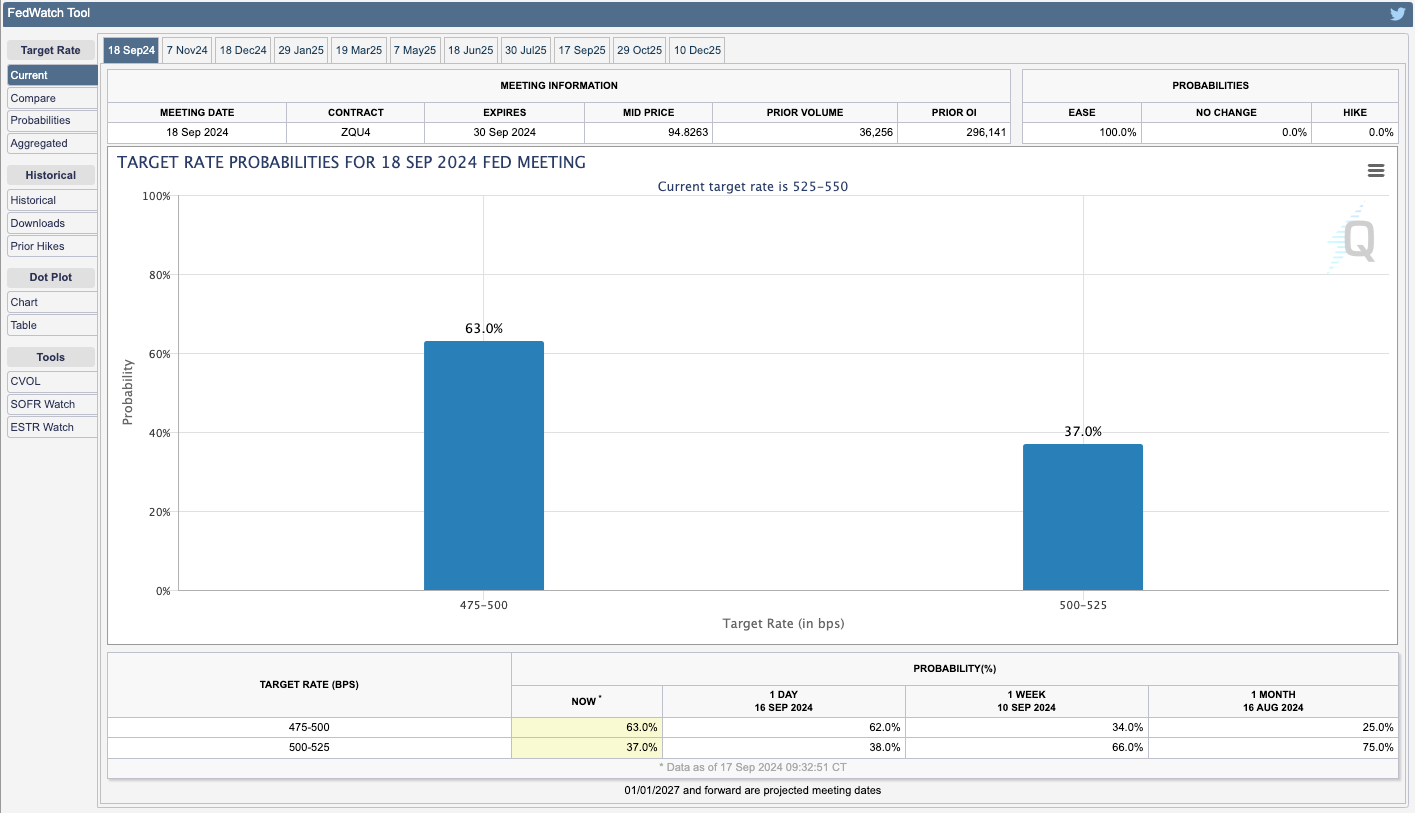

Interest rate traders predict a 67% likelihood of a 50 basis-point reduction, CME FedWatch tool shows.

What it means for crypto?

Interest rate cuts influence market sentiment. Often, positively.

Lower rates mean lower borrowing costs. So, more investment in risk assets.

Think of the interest in cryptocurrencies and Bitcoin.

Friends of Token Dispatch at Token 2049

Tweed: Embedded payment infrastructure for simplified payments on Web3.

Bastion: Wallet infrastructure for enterprises, fintechs, payments, and trading platforms.

Open Payd: Financial services infrastructure to streamline operations and manage payments globally.

Akash: Open network for users buy and sell computing resources, built for public utility.

Bob: Hybrid Layer 2 that combines the security of Bitcoin with the versatility of Ethereum.

How much impact?

Lower interest rates have historically been bullish for crypto currencies.

But the impact of a rate cut on Bitcoin? Could be tough to call.

Says who? Jonathan de Wet, the chief investment officer at Zerocap.

Bitcoin has the potential to fall as low as $53,000 or rise as high as $65,000 depending on the size of the cut and market sentiment.

In fact, Bitcoin price has moved in the range of $53,000 and $73,000 in the last 6 months.

So, would a bigger interest rate cut mean more investment in Bitcoin?

Maybe.

Higher liquidity could drive more investment in high risk assets. True.

Bitcoin has been more than just a risk asset.

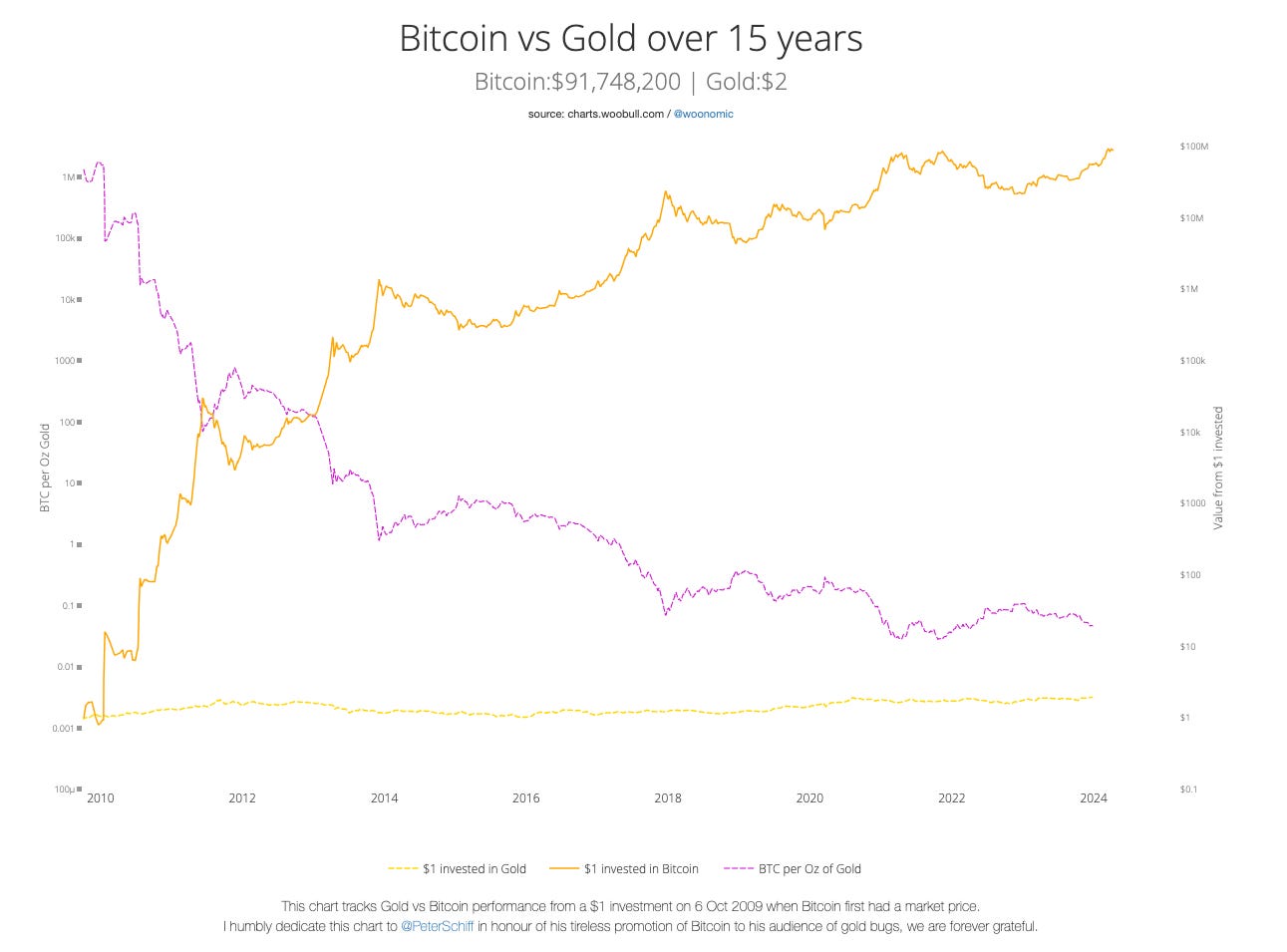

Investors look at it as store of value. Think of gold. But more rewarding.

So, the world’s going all bullish on Bitcoin post a rate cut?

Maybe not.

Bitcoin shot up from $17,000 at the start of 2023 to $72,000 this year.

That’s more than 300% returns.

Saturated asset class to bet more on?

Perhaps this could deter an investor from betting more on Bitcoin.

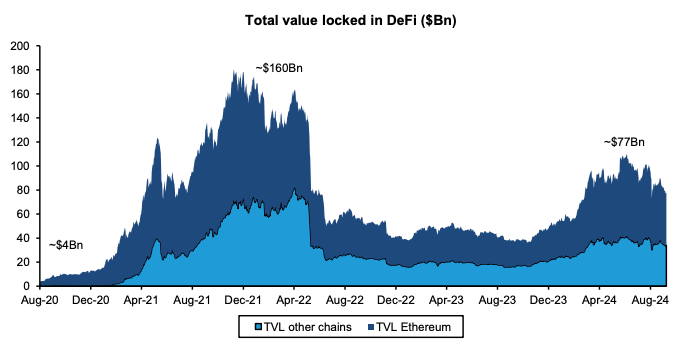

What about DeFi?

Lower rate cuts? No problem, says crypto credit markets.

Lending markets on DeFi platforms could rise yield above 5% if the Fed cuts the rates, says analysts at Bernstein.

Total value locked in DeFi has doubled from the 2022 bottom to $77 billion.

Monthly DeFi users? Up three to four times since the lows.

BitMEX co-founder Arthur Hayes—a near perennial Bitcoin bull—says it's more complicated than that.

The Quiz Game For The Music Lovers

The music quiz game that’s got over million plays. Who are you playing with then 👇

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Block That Quote 🎙️

A letter to US Federal Reserve Chair Jerome Powell by Democratic Senators Elizabeth Warren, John Hickenlooper and Sheldon Whitehouse.

“For months we have been calling upon you to cut the federal funds rate … Your delays have threatened the economy and left the Fed behind the curve.”

Warren is a crypto critic. She wants Federal Reserve to implement a significant interest rate cut.

Letter to the Fed: Warren, alongside Senators John Hickenlooper and Sheldon Whitehouse, called for a 75-basis-point rate cut at the upcoming FOMC meeting.

Economic concerns driving the push

Rising unemployment rate from 3.5% in July 2023 to 4.2% currently.

Revised job growth data shows 818,000 fewer jobs created than initially estimated.

Inflation has cooled to 2.5% from its mid-2022 peak of 7%.

Alignment with market sentiment: Rate cuts are perceived bullish for risk assets. Unexpected alignment with many market participants and crypto traders.

Some analysts warn that a larger-than-expected cut could lead to increased market volatility.

Another Miner Mimes MicroStrategy

This time it’s Cathedra Bitcoin.

The company has moved from traditional Bitcoin mining to developing data centres and to buy Bitcoin as a treasury asset.

Merged with high-density compute infrastructure maker Kungsleden to build capabilities.

Why? Unpredictable profit margins in mining due to tighter competition.

Not been able to maximise Bitcoin per share.

In the past, more companies have followed the MicroStrategy’s playbook to build a Bitcoin reserve.

What does this do? A Bitcoin reserve allows investors to have exposure to the crypto through regulated markets.

Dwindling profits for miners

US mining companies’ hash rate has gone up in the last couple of months.

What does this mean? More competition in mining space. Lesser revenue.

Hashprice, showing daily profitability, has decreased over 50% since before the halving.

What’s MicroStrategy doing: Doubling down on its strategy.

It plans to sell $700 million worth convertible senior notes to fund additional Bitcoin purchases and buyback debt.

As of June 2024, MicroStrategy's total debt stands at $3.90 billion.

The company purchased 244,800 BTC worth nearly $10 billion, including an 18,300 BTC purchase worth over $1 billion last week.

To purchase more Bitcoin, reinforcing its position as the largest corporate holder of the crypto with over $14 billion in assets.

In The Numbers 🔢

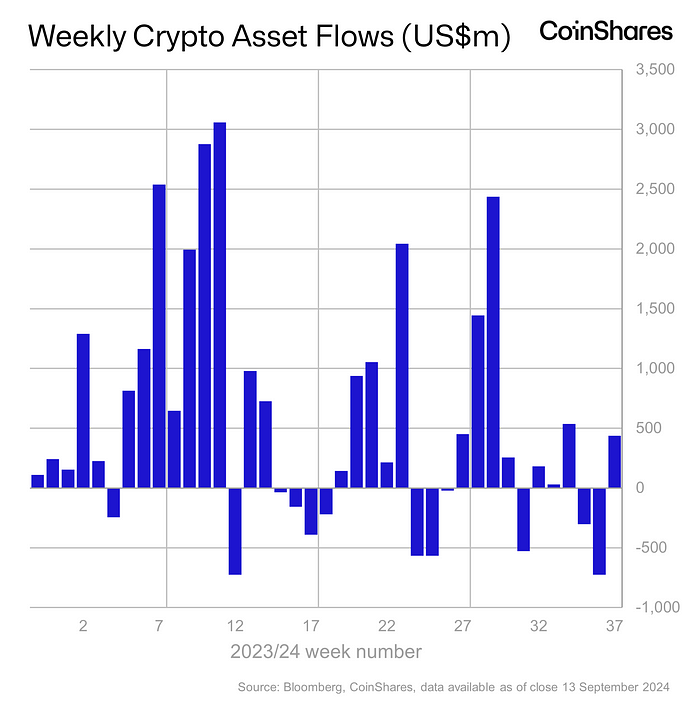

$436 million

Net inflows in digital asset investment products, a significant rebound after two consecutive weeks of outflows amounting to $1.2 billion - Coinshares weekly report.

Bitcoin dominates inflows as Ethereum struggles

Bitcoin-based funds led the recovery, with short Bitcoin investment products reversed their trend, seeing $8.5 million in outflows following three weeks of inflows.

Ethereum-based funds continued to struggle, with $19 million in outflows, adding to the previous week's $98 million negative flow.

Solana investment products saw positive inflows for the fourth consecutive week, totalling $3.8 million.

Bitcoin-Ethereum ratio hits multi-year low

Dropped below 0.04 over the weekend, reaching its lowest point since April 2021 - growing disparity in investor sentiment between the two leading cryptocurrencies.

It might drop further, to the 0.02-0.03 range, unless there's a change in investor sentiment or regulatory clarity to favour riskier assets like Ethereum and other altcoins.

CoinShares Head of Research James Butterfill

“We believe the surge in inflows towards the end of the week was driven by a significant shift in market expectations for a potential 50 basis point interest rate cut on September 18. However, trading volumes remained flat at $8 billion for the week, significantly below the 2024 average of $14.2 billion.”

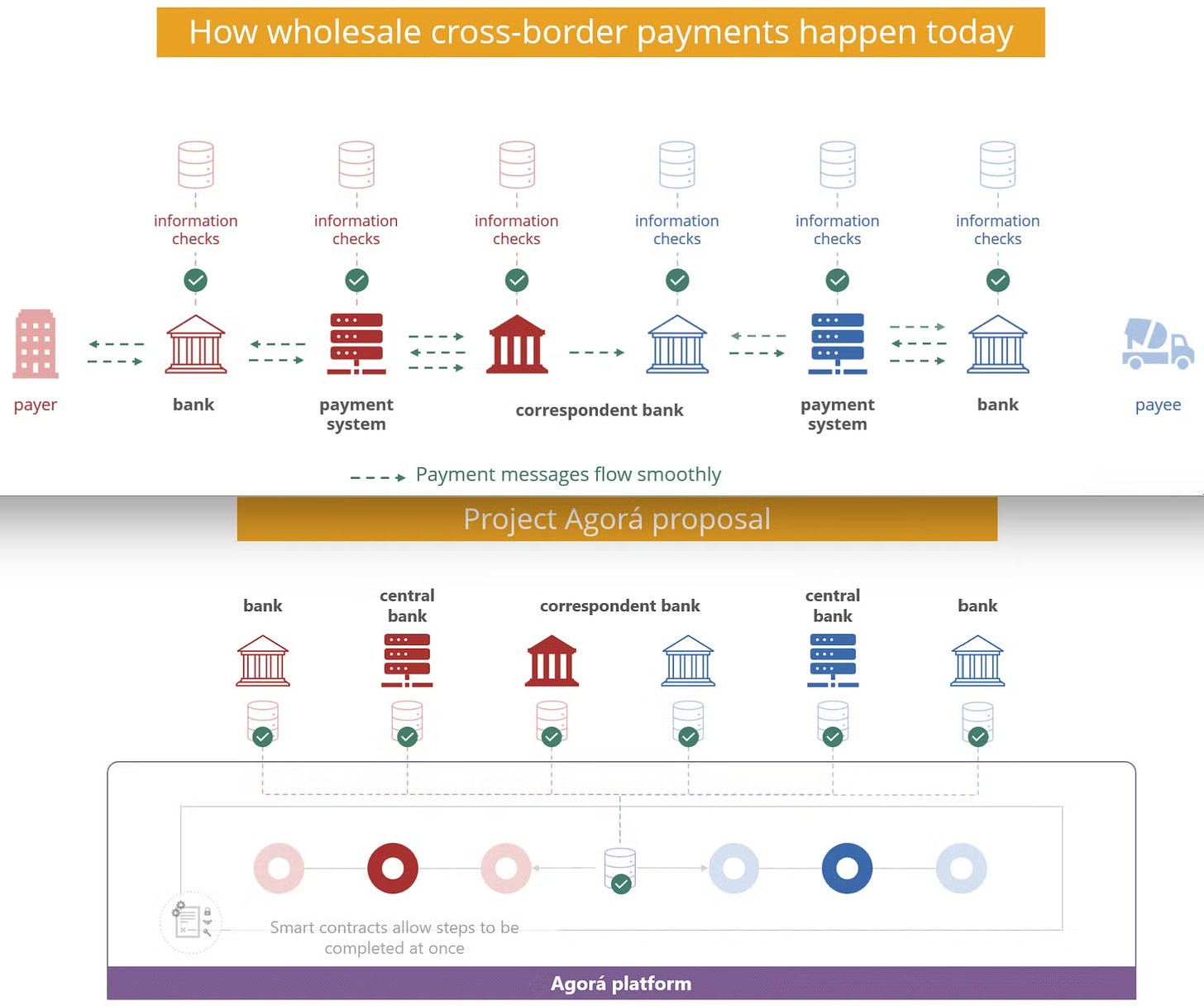

Tokenisation for Cross-Border Payment System?

The Bank for International Settlements (BIS) has launched the design phase of Project Agorá - focusing on integrating tokenised commercial bank deposits with wholesale central bank digital currencies (CBDCs) on a unified ledger.

It involves over 40 financial firms and seven central banks to explore tokenisation on a public-private programmable core financial platform.

Objective? Address inefficiencies in current cross-border payment system and make it cheaper, faster, more transparent and accessible.

Private sector participation: 40 regulated private-sector firms have joined the project, including - Visa and Mastercard, SWIFT, Swiss SIX Digital Exchange, Japan's Monex Group and various clearing companies and major banks.

Central Bank collaboration: Seven central banks are involved - Bank of France (representing the Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England and Federal Reserve Bank of New York.

It project is set to run until 2025 and the participants will identify legal and regulatory issues across the seven jurisdictions involved.

The Surfer 🏄

Flyfish Club, an NFT-based private restaurant project in NYC, has agreed to pay a $750,000 settlement to the US SEC for conducting an unregistered offering of crypto asset securities. It sold 1,600 NFTs, making $14.8 million in the process.

DeFi platform Delta Prime has suffered a $6 million hack on the Arbitrum network due to a compromised admin private key. The attacker gained control of the admin wallet, upgraded proxies to malicious contracts, and drained funds.

Binance founder Changpeng "CZ" Zhao is set to be released on September 29, concluding his four-month prison sentence for violating the Bank Secrecy Act. Zhao paid a $50 million fine as part of his guilty plea, reportedly the wealthiest person to serve time in a US prison, with an estimated net worth of $25.3 billion.

Crypto-backed Super PAC Protect Progress has invested $7.8 million to support Democratic Senate candidates Ruben Gallego in Arizona and Elissa Slotkin in Michigan for the 2024 elections. The PAC, affiliated with Fairshake and Defend American Jobs, has spent over $14.5 million combined on these races.

Remy St Felix, a 24-year-old Florida man, has been sentenced to 47 years in prison for leading a violent crypto theft ring that stole $3.5 million through home invasions and SIM-swapping attacks. The 13 co-conspirators received sentences ranging from 12 to 25 years.

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋