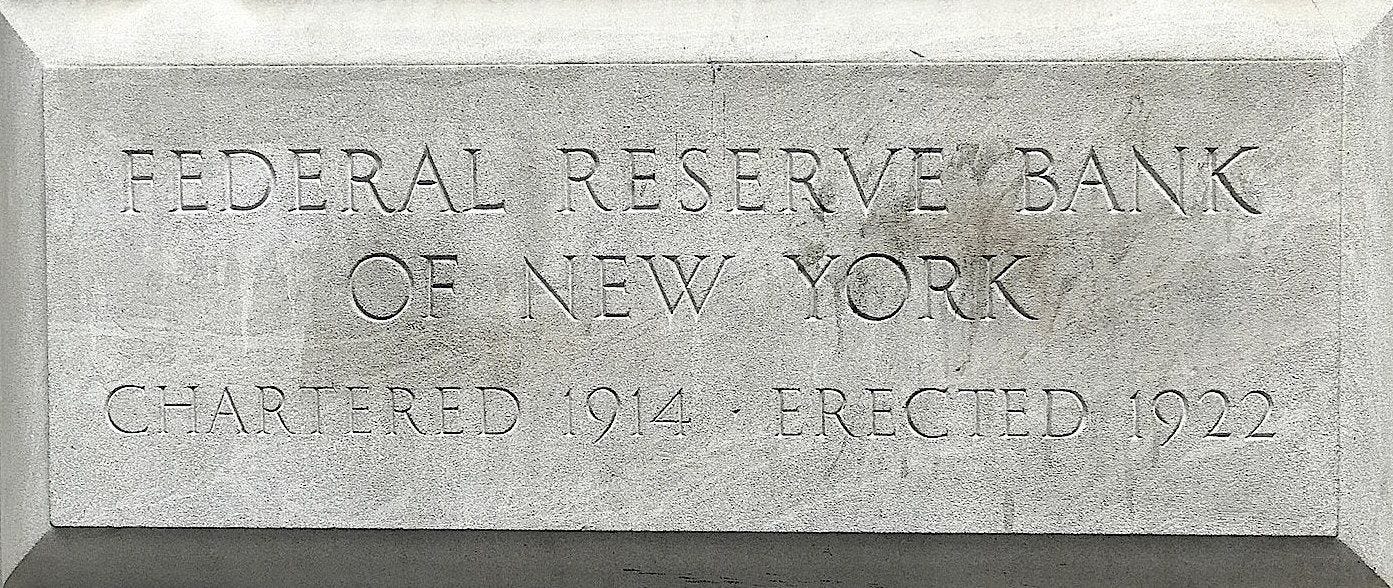

Is Digital Dollar the way forward? MasterCard and 4 global banks want to find out

With the failure of FTX, the crypto world is in shambles. Meanwhile, banking giants are teaming up with the New York Fed to launch a 12-week digital dollar pilot. What a Timing!

The proof-of-concept pilot programme will examine how banks use digital dollar tokens and also see how their presence in a common database can help speed up payments.

They will explore blockchain's "technical feasibility, legal viability, and business applicability" while also exploring regulatory frameworks. According to the NY Fed, the project could "potentially be extended to multi-currency operations and regulated stablecoins."

Along with payments giant Mastercard, Citigroup (C), HSBC (HSBC), BNY Mellon (BK) and Wells Fargo (WFC) are among the banks taking part in the project.

Excited for the launch of the Regulated Liability Network POC today to test the interoperability of tokenized deposits. https://t.co/xi3jbbA9yA

— Rob Morgan (@RobAMorg) November 15, 2022

NY Fed said the program would explore the viability of an "interoperable network of central bank wholesale digital money and commercial bank digital money operating on a shared multi-entity distributed ledger."

The programme will also explore the use of something called a Regulated Liability Network (RLN) in which banks issue tokens that represent customer deposits that are settled on a central bank reserve on a shared distributed ledger.

The project will be carried out in a test environment using only simulated data.

On November 4, the centre released a report on the first phase of its Project Cedar wholesale central bank digital currency (wCBDC). The first phase tested foreign exchange spot trades to see if a blockchain solution could improve "speed, cost, and access to cross-border wholesale payments."

Anyway, NY Fed clarified that the project is not intended to advance any specific policy outcome, nor is it intended to signal that the Federal Reserve will make any imminent decisions on whether to issue a retail or wholesale CBDC.

Cristiano Ronaldo Launches First NFT Collection with Binance

One of the world's greatest football players, Christiano Ronaldo, is teaming up with Binance to debut his first-ever NFT collection. The NFTs depict Ronaldo in an iconic moment from his life with seven animated statues with four different rarity levels—Super Super Rare, Super Rare, Rare, and Normal. It will go live on the Binance NFT marketplace on Friday, November 18.

Each rarity level will come with its own set of exclusive perks, ranging from:

Personal message from Cristiano Ronaldo

Autographed CR7 & Binance merchandise

Guaranteed access for all future CR7 NFT drops

Complimentary CR7 Mystery Boxes

"It was important to me that we created something memorable and unique for my fans as they are such a big part of my success," said Ronaldo. "With Binance, I was able to make something that not only captures the passion of the game but rewards fans for all the years of support."

Sony submits a patent for tracking in-game assets with NFTs.

The global video game business Sony Interactive Entertainment has made available patents for blockchain and NFTs. The patent focuses on monitoring digital assets created for video games.

The company intends to employ a distributed ledger, or blockchain, to store digital media assets, gameplay, and video clips and to include a unique token for the digital item with a particular identifier and metadata that would identify the attributes of the digital asset, according to the application.

Although the application is simply for a patent, it demonstrates Sony's interest in participating in the expanding NFT gaming market.

Sony's pursuit of NFTs is not new. Sony and Theta Labs collaborated to release a line of 3D NFTs in May 2022. The limited-edition NFT collection may be viewed on the Sony Spatial Reality Display tablet.