JPMorgan goes crypto-chic 😎

TCN's now the digital safety deposit box in town. Ellison spills the FTX tea. Stars Arena's money is back. Ethereum gas is on a discount. What is L’Oréal's "Le Visionnaire"?

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

Are we rapping today?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

JPMorgan is now striding into the world of blockchain and digital tokens.

Their new TCN? A home run.

Introducing the Tokenised Collateral Network (TCN)

Date of Debut: Oct. 11.

What is it?: An in-house blockchain-based application developed by JPMorgan.

Main Function: TCN is like a digital safe. Instead of physically moving valuable items, like shares, TCN creates a secure digital copy (token) of them. Using blockchain, this token can be quickly and safely transferred, representing the actual item.

Platform Used: JPMorgan employed its Ethereum-based Onyx blockchain and its newly debuted TCN.

First Successful Use: JPMorgan and asset management titan BlackRock took it for a spin, converting shares of a money market fund into digital tokens. These tokens were then handed off to Barclays Bank, acting as security in a derivatives exchange between JPMorgan and BlackRock.

Why was TCN created? 🤔

Trial Run: The first internal poke around the TCN happened in May 2022.

Purpose: JPMorgan saw the potential to simplify and magnify the traditional settlement process by leveraging blockchain, adding speed, security, and efficiency into the mix.

Benefits and Features of TCN 💡

Unlocking Capital: The platform can free up capital and use it as collateral for ongoing deals, enhancing efficiency on a grand scale.

Speedy Movements: Assets can be moved as collateral almost in real-time, a stark difference from the slower methods of yesteryears.

Intraday Liquidity: Clients can tap into intraday liquidity using tokenised collateral via a secured repo transaction, sidestepping the need for pricier unsecured credit lines.

Client Nodes: Clients who nod (pun intended!) in agreement to a blockchain trade get their own node, a hub where they can settle trades and access various reports.

Onyx: Setting the Stage

What is Onyx? JPMorgan's Onyx Coin Systems is a permissioned distributed ledger that was unveiled in 2020.

Tyrone Lobban, the head of JP Morgan Onyx Digital Assets & Blockchain, stated that they currently handle between $1 billion to $2 billion daily.

First Abu Dhabi Bank (FAB) recently concluded a successful pilot phase of blockchain-based cross-border payments on the Onyx system. The pilot was executed smoothly, garnering positive feedback on its response times.

A few weeks before FAB's venture, Bank ABC in Bahrain had already tested the Onyx system waters, proceeding later to a restricted service launch.

Since June, Onyx has facilitated euro-denominated payments.

Onyx ventured into interbank USD settlements in India, teaming up with a consortium of six banks.

“Onyx Digital Assets already enables clients to access intraday liquidity via repo transactions,” said Tyrone Lobban, JPMorgan’s Head of Onyx Digital Assets, in a statement. “Now with the launch of TCN, clients can benefit from additional utility from their MMF investments by posting tokenised MMF shares as collateral – a faster, more cost-effective way of meeting margin requirements.”

TTD Blockquote 🎙️

Caroline Ellison, the former CEO of Alameda Research.

‘I Didn’t Have to Lie Anymore’

Caroline took the stand in an emotionally charged testimony about the downfall of FTX.

Things she said

"I was in sort of a constant state of dread."

"I knew that we would have to take the money from our FTX line of credit and I knew that that was money that could be called at any time."

"And every day, I was worrying about the possibility of customer withdrawals from FTX and the possibility of this getting out and what would happen to people that would be hurt by that."

About FTX collapse - “I just felt a sense of relief that I didn’t have to lie anymore.”

When Ellison shared her relief amidst the firms' downfall with SBF, he responded with an attempt at light-heartedness, saying:

"Wow ... uh ... congrats ... because shit’s exciting?"

"Written communication 'could be used against us in a court case'".

She spoke of “disappearing” Signal messages, “coded” language, and other clandestine means of communication directed by Bankman-Fried.

Regarding the supposed bribes of Chinese government officials that Alameda allegedly engaged in sometime in 2021:

“I didn’t want the fact of our crime to come out.”

TTD SocialFi 🫂

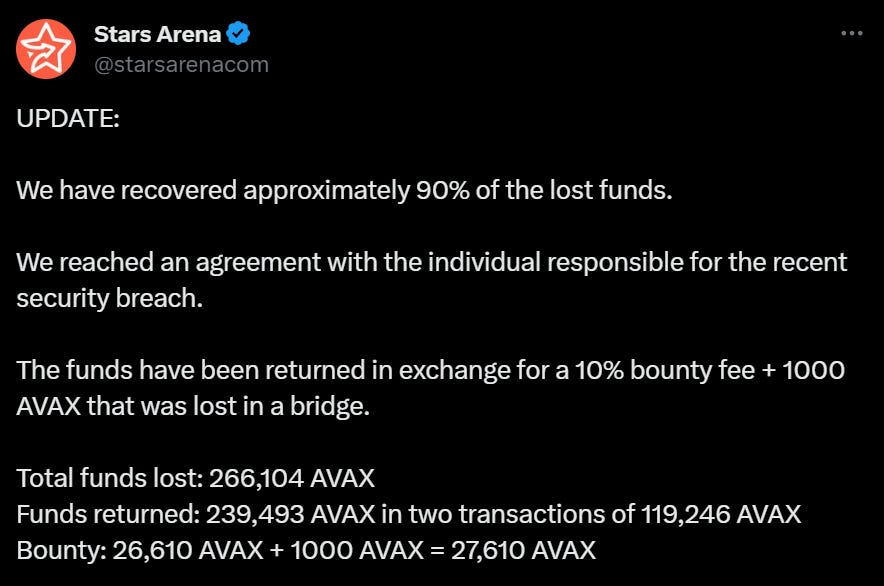

After a not-so-fun exploit, Stars Arena managed to get back 90% of the stolen crypto.

Let's spill the beans

On October 7, Stars Arena faced a mini heartbreak—266,000 Avalanche (AVAX) tokens, or $3 million, went on an unplanned vacation.

Stars Arena chatted with the exploiter and struck a deal where exploiter can keep 10% and give the rest back. The exploiter agreed.

That's 27,610 AVAX (around $257,000) for the trouble, including a bit they lost in a digital hiccup.

Not just resting on their laurels, Stars Arena is also sporting a brand-new smart contract. They're now dotting the i's and crossing the t's with a security audit.

A bit of a rewind, but on October 5, there was a mini-oops moment with a $2,000 exploit. A tiny glitch in the contract let attackers play a game of "sell and earn." That's been patched up.

Where’s ETF?🚨

ARK Invest and 21Shares have made amendments to their spot Bitcoin ETF application, which is seen as a positive indication of progress and potential approval👇🏻

TTD ETH 🔷

The gas fees associated with Ethereum transactions have hit their lowest levels for the year.

Why? decreased activity across a variety of applications, including DeFi, NFTs, and others.

On October 8, Ethereum's average gas fee decreased to 8.8 Gwei, the lowest since October 2, 2022, when it was 8.4 Gwei.

How Gas Prices Work: Ethereum's gas prices are measured in Gigawei (Gwei), equivalent to 10^9 Wei. In Ethereum, Wei is the smallest unit, with 1 ETH equaling 10^18 wei.

Reasons Behind the Decline 📉

DeFi and NFTs: A significant drop in user activity on DeFi platforms and NFT marketplaces has been observed. The NFT weekly trading volume has reached its lowest in two years.

Telegram Bots: Trading bots on Telegram, which gained popularity in Q2 of this year, have also seen reduced activity.

Major Ethereum Entities: High-traffic platforms on Ethereum, such as Uniswap, 1inch, and MetaMask, have shown a double-digit drop in gas consumption.

Analytics platform Nansen 2.0 reveals that gas consumption by top entities, including exchanges like Binance and Coinbase, and layer-2 networks like Arbitrum, Optimism, and Base, fell by 30% compared to the previous week.

This marks the first time that there's been a decline in consumption on these low-fee layer-2 networks since the previous year.

Ethereum's Inflation dynamics 🪙

Ethereum became inflationary in early September 2023 due to the drop in gas fees.

The quantity of Ethereum being burned reached its nadir for the year on Monday, with only 7,084 ETH being consumed.

This is reminiscent of the scenario on September 19, shortly after the Ethereum Merge update, which introduced the burning mechanism.

Presently, Ethereum's supply is increasing at approximately 1,450 ETH per day, equating to a value of $2.2 million.

Forecast by Standard Chartered 💰

On October 11, analysts at Standard Chartered predicted that the price of Ethereum could surge to $8,000 by the end of 2026.

Geoff Kendrick, the Head of the bank's digital assets research, believes Ethereum's increasing usage in areas like smart contracts, gaming, and the tokenisation of traditional assets will drive its price upward.

Going even further, Kendrick hinted at a long-term 'structural' valuation estimate of between $26,000-$35,000 for Ethereum that extends as far out as 2040.

TTD AI📍

Mirror, Mirror in Paris...

L’Oréal's latest glam spot, "Le Visionnaire," is less like a hub and more like a futuristic crystal ball.

Nestled in the heart of Paris, L’Oréal's modern five-story mirrored structure stands in stark contrast to the adjoining 18th-century buildings.

Dubbed "Le Visionnaire," this space is designed to be the birthplace of L’Oréal's future, marrying tradition with advanced technology.

What is it?: Central to "Le Visionnaire" is an expansive AI-enabled digital tool called the Visionary Wall.

A trend monitor and inspiration wellspring. Unlike static archives, the content is dynamic, presenting new and relevant data.

Employees use this tool as a foundation for brainstorming sessions and strategising about upcoming products and retail experiences.

The AI system curates theme-based mood boards. Once a theme is picked, the AI suggests content based on semantic and chromatic elements. In simpler terms, it offers resources based on meaning and colour.

"Le Visionnaire" houses an extensive multimedia library with individual stations equipped with screens.

Brand Room: Here, L’Oréal's iconic products are on display. The room features projections on a domed ceiling and touch-sensitive walls that can play campaign videos.

Bluetooth is employed to send chosen content directly to an employee’s email. This is triggered when their smartphone is docked, connecting it to the virtual pass used for building access.

TTD Surfer 🏄

Hamas and its affiliates have received millions of dollars in cryptocurrency donations, according to a report by the Wall Street Journal.

The native token of Reddit's Fortnite community, Bricks (BRICK), has more than doubled in value after a two-month decline.

Democratic senators, including Sen. Elizabeth Warren, have called on the IRS and Treasury Department to speed up the implementation of tax reporting requirements for crypto brokers.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋