Jupiter boosts Solana 🚀✨

Jupiter's $700 million Solana airdrop and all the criticism. Arthur Hayes eyes Solana's potential rebound. FTX's SIM-swap attack. Larry David regrets now. Meta's Reality Labs rakes in revenue.

Hello, y'all. If you think you know your music, then this is for you frens👇

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

JUP Airdrop; one of the biggest airdrops on the Solana Blockchain.

Jupiter distributed about $700 million worth of its JUP token to nearly a million Solana wallets.

Price Increase: The JUP token price increased from an early bid of around $0.41 to $0.72, giving it a market cap exceeding $6 billion.

Eligibility and Distribution

Within the first hour, over 20% of the 1 billion JUP reserved for the airdrop was claimed.

And now?

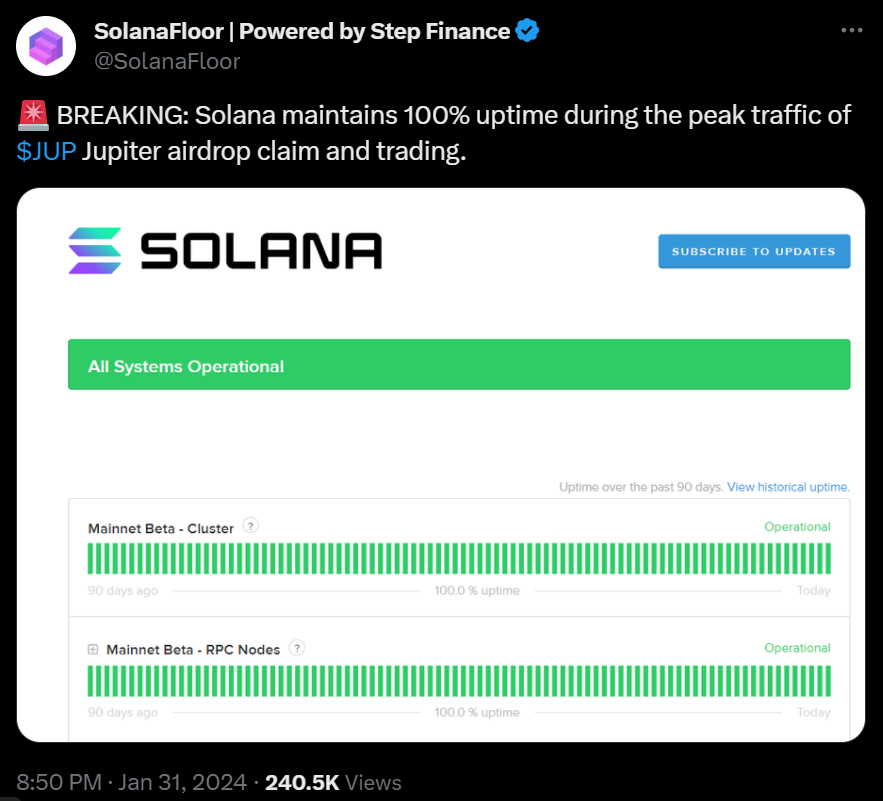

During all this, The Solana network managed the increased activity without significant issues, processing claims and trades smoothly.

Transaction Spike: Transactions on the Solana nearly doubled moments after the airdrop commenced, with TPS increasing from around 1,900 to over 3,000.

The average ping time (time it takes to complete a process) tripled from approximately 20,000 milliseconds to over 60,000 milliseconds.

Stablecoin Transfer

Solana experienced a rapid increase in stablecoin transfer volume.

Jumps from $33 billion to over $144 billion in less than two months.

The spike largely stemmed from Phoenix, a Solana-based exchange.

So, this is an illusion? The surge stems from deposits on the Phoenix exchange, not actual trades. These deposits mistakenly inflate transfer volume metrics, misleading analysts who compared it to other blockchains. This creates a false impression of booming activity when it's just market maker shuffling.

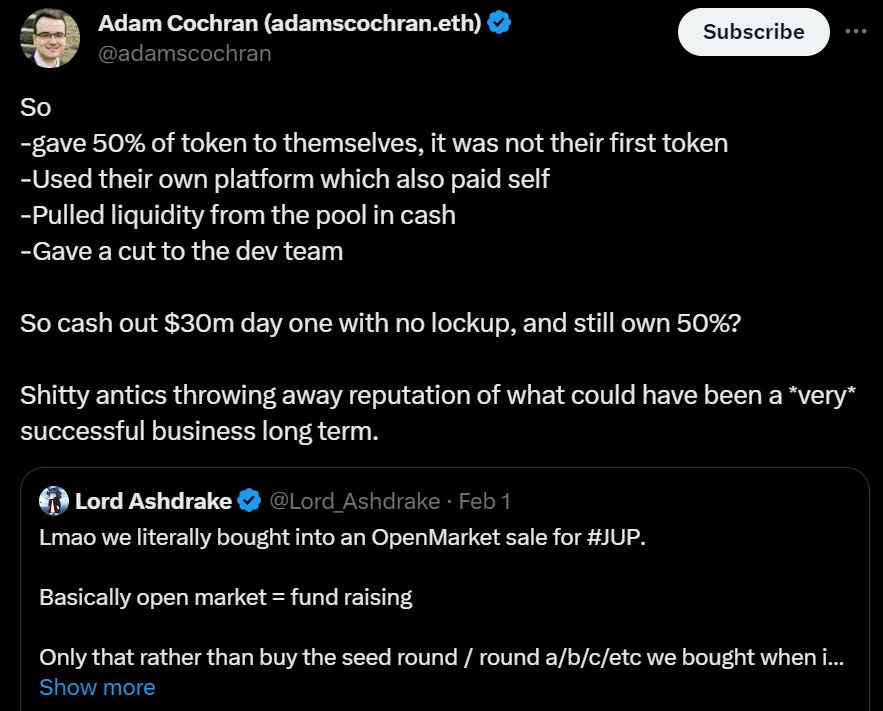

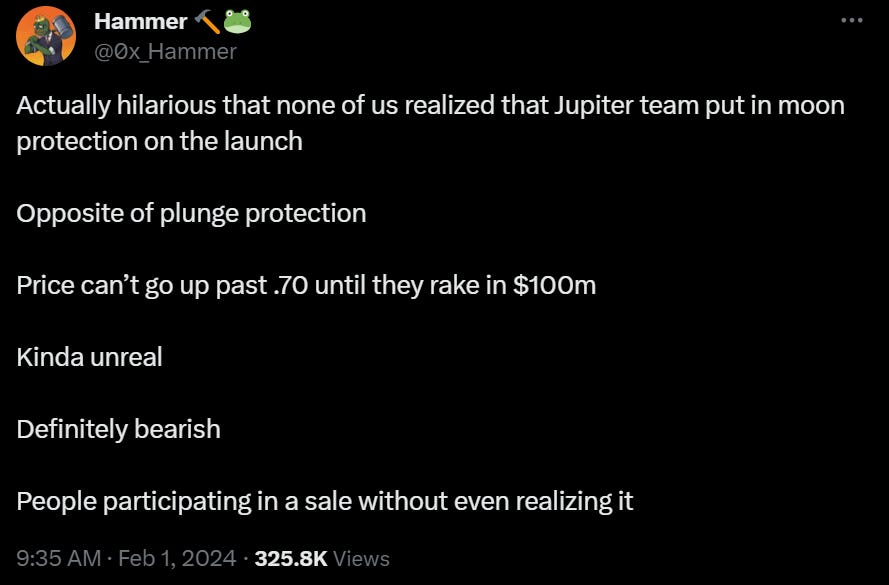

The Airdrop Faces Criticism

Following Jupiter's airdrop, critics have voiced concerns about the launch strategy, suggesting it might have doubled as a fundraising effort without clear communication.

Capital-Raising Strategy: Critics argue that Jupiter used its open market offering as a covert capital-raising strategy without explicitly informing participants.

Transparency Issues: Concerns about potential misunderstandings of the project's intentions, leading to debates over the transparency of Jupiter's communication.

Moon Protection Mechanism: The implementation of "moon protection" to limit JUP token prices until $100 million was secured, criticized for making participants unknowingly partake in a sale.

Price Range Mistakes: Admission by Jupiter's founder, meow, of errors in selecting the token's launch price range, which may have impacted market dynamics.

Accusations of Fake Demand: Allegations that the ICO was used to generate artificial demand for JUP tokens, despite detailed tokenomics documentation provided by Jupiter pre-airdrop.

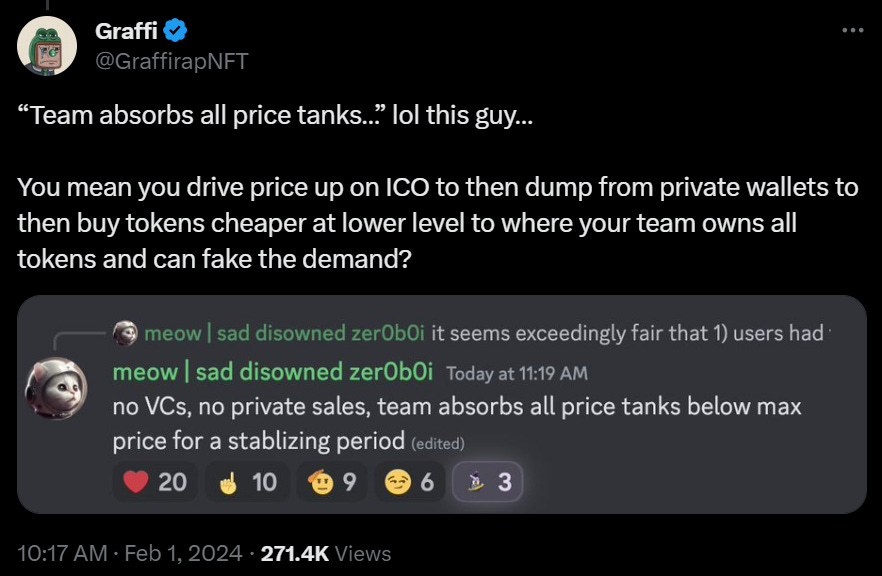

And they addressed it

TTD Blockquote🎙️

Arthur Hayes, the former CEO of BitMEX

Time to “Get Back on the Solana Train”

Despite the FTX mess and Sam-Bankman Fried's legal drama, Arthur Hayes, BitMEX's ex-CEO, is eyeing Solana (SOL) for a potential rebound.

He's also betting on Bitcoin dropping further but plans to snag some Solana when the tide turns.

Just this week, Hayes talked about a potential dip for Bitcoin and even sold off some Solana and Bonk, taking a minor hit.

Since last October, Solana's been all over the place – shooting up to nearly $126 by Christmas, then slipping back to $78.14 in late January.

But it's been clawing its way back up, currently chilling at around $100.

With Bitcoin chilling around $42.3K, all eyes are on altcoins like Solana.

They're a bit riskier, sure, but they also promise bigger wins when things go well.

TTD Hack 🦹🏻

Shortly after its bankruptcy filing, the $400 million hack of FTX in 2022 is now connected to a SIM-swap attack.

After FTX filed for bankruptcy in 2022, it was hacked for $400 million, initially suspected as an inside job.

Charges: US prosecutors charged Robert Powell, Carter Rohn, and Emily Hernandez for conducting SIM-swap attacks, impacting 50 victims, including FTX.

The accused impersonated victims and employees, manipulating telecoms to gain unauthorised account access and transfer $400 million in crypto from FTX.

Elliptic and Bloomberg reports suggest FTX is the "Victim Company-1" in the indictment, corroborated by the timing and method of the hack.

Some stolen funds were traced to Kraken, with efforts to identify the user and recover funds.

Where’s ETF?🚨

Asset management firm Valkyrie has added BitGo as a custodian for its spot Bitcoin exchange-traded fund (ETF)👇

TTD Laryy 👨🏻🦰

"So, like an idiot, I did it."

Larry David, known for "Seinfeld" and "Curb Your Enthusiasm," got real about regretting his gig in a Super Bowl ad for FTX back in February 2022.

Despite consulting friends knowledgeable about cryptocurrency, David admitted he made a mistake by agreeing to the ad.

He lost a significant amount of money from the deal, with part of his compensation being in cryptocurrency.

Super Bowl Ads: The presence of crypto ads in the Super Bowl has waned since FTX's downfall, with none appearing in 2023 and uncertainty about 2024.

Repayment Plan: No Restart, Just Refunds

FTX is focusing on paying back customers and creditors, not on bringing the exchange back to life.

The legal team highlighted how FTX's record-keeping was a disaster, complicating the repayment process.

But wait, FTX suggested paying claims based on crypto prices at bankruptcy time, which the court agreed with, overruling creditors' wish for "in kind" crypto repayments. Not getting benefit of the price hike at all.

TTD Meta ♾️

Meta's metaverse crew, Reality Labs, pulled in some serious cash last quarter but still ended up in the red.

They made over $1 billion in revenue but faced losses of about $4.6 billion.

For a bit of a throwback, they made $727 million around the same time last year.

The boost in cash flow? Thank the Quest 3, their latest VR headset that got snapped up during the holiday rush.

Yearly Lookback: Zooming out to the whole year, Reality Labs was down $16.1 billion.

Mark Zuckerberg, the big boss, is still hyped about AI and the metaverse, saying they've come a long way.

"We’ve made a lot of progress on our vision for advancing AI and the metaverse"

Heads-Up: But, Meta’s hinting at even bigger losses ahead because they're doubling down on augmented and virtual reality, plus expanding their digital playground.

TTD Surfer 🏄

Tether is launching Tether Edu, an educational branch providing courses and resources for skills development in blockchain technology and other digital fields.

OPNX, the exchange created by the founders of failed hedge fund Three Arrows Capital, is shutting down.

Hong Kong finance firm VSFG is planning to apply for a spot Ethereum exchange-traded fund (ETF) in the second quarter of this year.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋