Looking For The Bottom? 👀

Bitcoin ⬇️ $60k. Ethereum ⬇️ $3k. ETFs record outflows. Bulls still believe. Standard Chartered calls BTC below $50k. Tether's $4.5B Q1 profit. AI to find money laundering on BTC? Why CZ got out easy?

Hello, y'all. Slippin, sliding to the May music … let's start with some rap, eh?

A complete go for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Inflation is still stubborn.

The Federal Reserve surprised no one today by keeping interest rates unchanged.

It still stays around 5.25-5.50%.

Their bigger message? Don't expect rate cuts anytime soon.

Read the FOMC message.

Inflation isn't going down as quickly as hoped.

In fact, it's ticked up slightly this year.

The Fed is also slowing down its plan to reduce its bond holdings.

From $60 billion per month to just $25 billion per month.

Prioritising economic growth over aggressive inflation control - this could give the economy a slight boost.

But here comes the silver lining: Federal Reserve Chair Jerome Powell said it was unlikely that the central bank’s next move will be a rate hike.

“I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely.”

When asked about what it would take to have a rate increase.

“I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we think we’re seeing.”

Why is the no-rate cut decision not a big surprise? Inflation gauges like PCE and CPI are holding above target, fuelled by consumer spending and low unemployment.

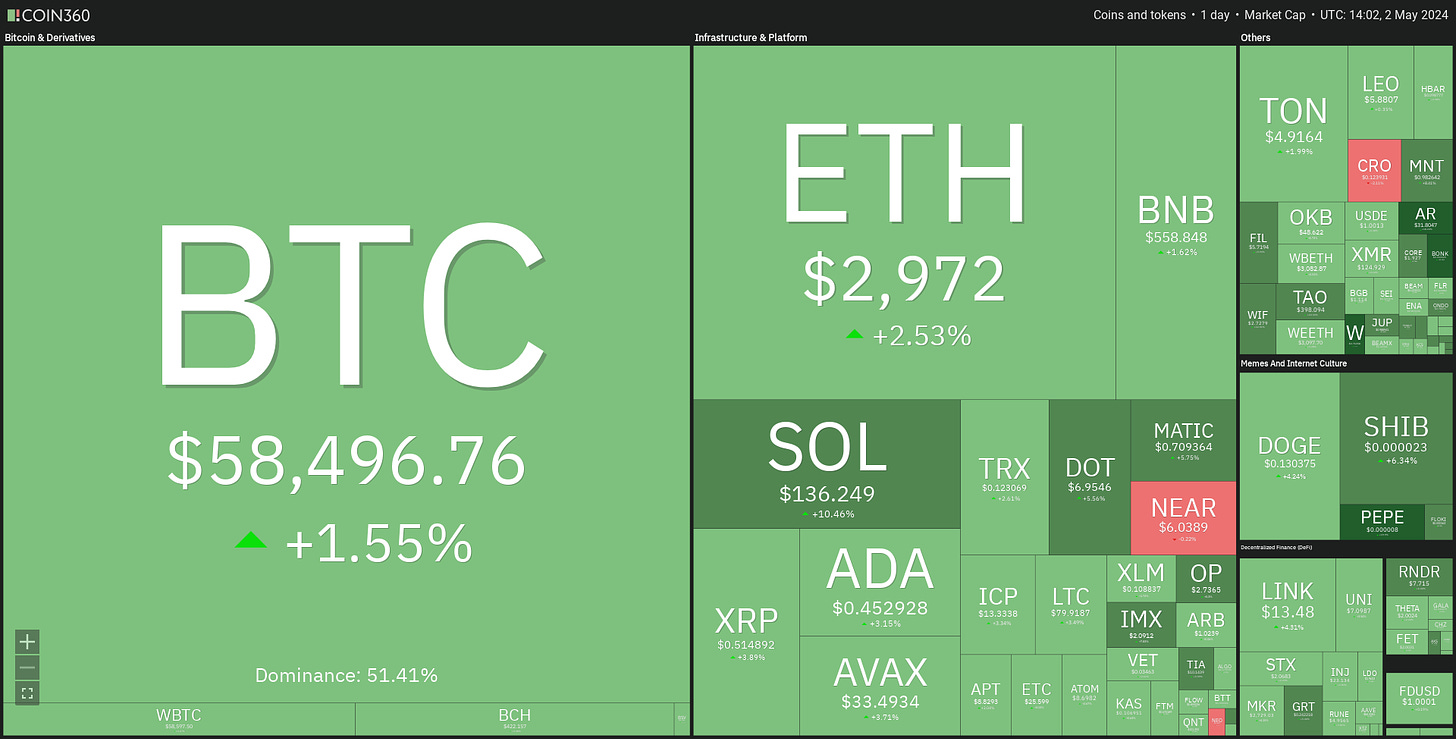

The price reaction?

This whole thing caused a small dip in Bitcoin and Ethereum prices.

The S&P 500 and Nasdaq Composite indexes were also down.

But they rebounded a bit (as Powell spoke).

On May 2, at the time of writing - prices are below par, but it all looks stable.

But ETFs bled: Bitcoin spot ETF had a total net outflow of $564 million, a record high. Grayscale GBTC had a single-day outflow of $167 million, and BlackRock ETF IBIT had its first net outflow, with $36.93 million.

Bitcoin price could fall to $50,000: Standard Chartered

Investor outflows from Bitcoin ETFs and a lukewarm reception for Hong Kong's Bitcoin ETFs are cited as crypto-specific reasons.

But, Standard Chartered maintains its bullish long-term outlook, predicting a climb to $150,000 by year-end, potentially reaching $250,000 in 2025.

But there might be light at the end of the tunnel.

Here are four reasons why:

Fed Meeting Clarity: After the Federal Reserve release, uncertainty in the market could decrease. This could bring investors back to Bitcoin, especially if the Fed maintains current interest rates.

The Institutional Interest: VanEck reports that approximately $175 billion worth of bitcoin is held by ETFs, nations, and companies. This amount represents around 15% of the total bitcoin supply.

Resilient Bitcoin Miners: Despite the recent halving that cut their rewards, Bitcoin miners haven't started selling their coins in a panic. This suggests they believe the price will rebound.

Rising Stablecoin Demand in China: A surge in demand for USD Coin (USDC) in China indicates investors there are moving money into crypto, potentially fueling a Bitcoin price increase.

Block That Quote 🎙️

US Senator Cynthia Lummis.

"I will do everything I can to fight for your rights to hold your own keys and run your own node.”

Lummis is criticising the Department of Justice's stance on private crypto wallets.

Lummis argues that the DOJ's position contradicts existing Treasury guidance and violates the rule of law.

She believes that arguments against self-custody software threaten fundamental property rights. Lummis accuses the Biden Administration of criminalising aspects of the Bitcoin network and decentralised finance.

Ex-SEC lawyer Ladan Stewart.

“The SEC is not trying to kill crypto. Our main concern has always been about ensuring investor protection and compliance within the industry.”

Former SEC lawyer denies claims of a government agenda against crypto.

According to Stewart SEC's actions have never aimed to stifle innovation in the crypto industry and SEC's approach has always been technologically neutral.

Can AI Help Find Money Laundering on Bitcoin?

Crypto forensics firm Elliptic is upping its game in the fight against money laundering.

They're using AI to identify suspicious Bitcoin transactions.

Elliptic developed a deep learning AI model to spot:

Dirty Money: Proceeds of crime deposited at crypto exchanges.

New Laundering Tricks: Previously unseen money laundering patterns.

Hidden Wallets: Illicit wallets that were flying under the radar.

They trained the AI on a massive dataset of over 200 million transactions.

Elliptic focuses on identifying "subgraphs" - chains of transactions that suggest laundering rather than just specific suspicious wallets. This approach helps catch multi-step laundering schemes that would be harder to detect otherwise.

Elliptic believes blockchain data, unlike traditional finance, is well-suited for AI analysis because it's transparent and readily available.

In the Numbers 🔢

$4.5 billion

Tether's record profit in Q1 2024.

Profit Powerhouse: This massive profit comes mostly from their holdings of US Treasury bills, with some additional gains from Bitcoin and gold.

Tether's BTC holdings rose from $2.8 billion last quarter to $5.4 billion.

Tether now holds over $90 billion in U.S. Treasuries, directly and indirectly.

Gold position rose from $3.5 billion to $3.7 billion.

Net Equity Boost: For the first time ever, Tether disclosed their net equity – $11.37 billion as of March 31, 2024.

Why CZ Got out easy

Two crypto giants, Sam Bankman-Fried (SBF) and Changpeng Zhao (CZ), received vastly different prison sentences in the US. Why?

SBF (25 years)

Charges: Defrauding investors, misusing customer funds (7 felony charges)

Defense: Maintained innocence, pleaded not guilty

Outcome: Found guilty, sentenced to 25 years

CZ (4 months)

Charge: Anti-Money Laundering program failure

Defense: Guilty plea

Outcome: 4-month sentence

The difference?

SBF's fraud charges were far more serious than CZ's regulatory violation. Strong evidence against SBF, while authorities may not have had enough for harsher charges against CZ. SBF's defense strategy and public statements may have hurt him.

CZ's defense

He cooperated with authorities.

He had a clean record before this.

He risked everything for Binance's success.

He even turned himself in.

Read this: CZ’s Trial Proves it Pays to Cooperate

The Surfer 🏄

MicroStrategy plans to launch a decentralised identity (DID) solution built on the Bitcoin blockchain. The MicroStrategy Orange, aims to provide secure digital identities with lower fees and reduced energy consumption.

US prosecutors are investigating Jack Dorsey's fintech firm Block, Inc. over alleged compliance violations. A whistleblower provided roughly 100 pages of documents to NBC News showing that Square and Cash App processed transactions for users in sanctioned countries - Iran, Russia, Cuba, and Venezuela.

Worldcoin is expanding its presence in Latin America, with its recent move into Mexico. Mexico is now the third-largest market for Worldcoin in Latin America, after Argentina and Chile.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋