MakerDAO in a fix?🤔

Why is MakerDAO making Vitalik upset? Singapore leader thinks crypto is "slightly crazy." But Turkey loves crypto. How did Stake lose $41.3 million?

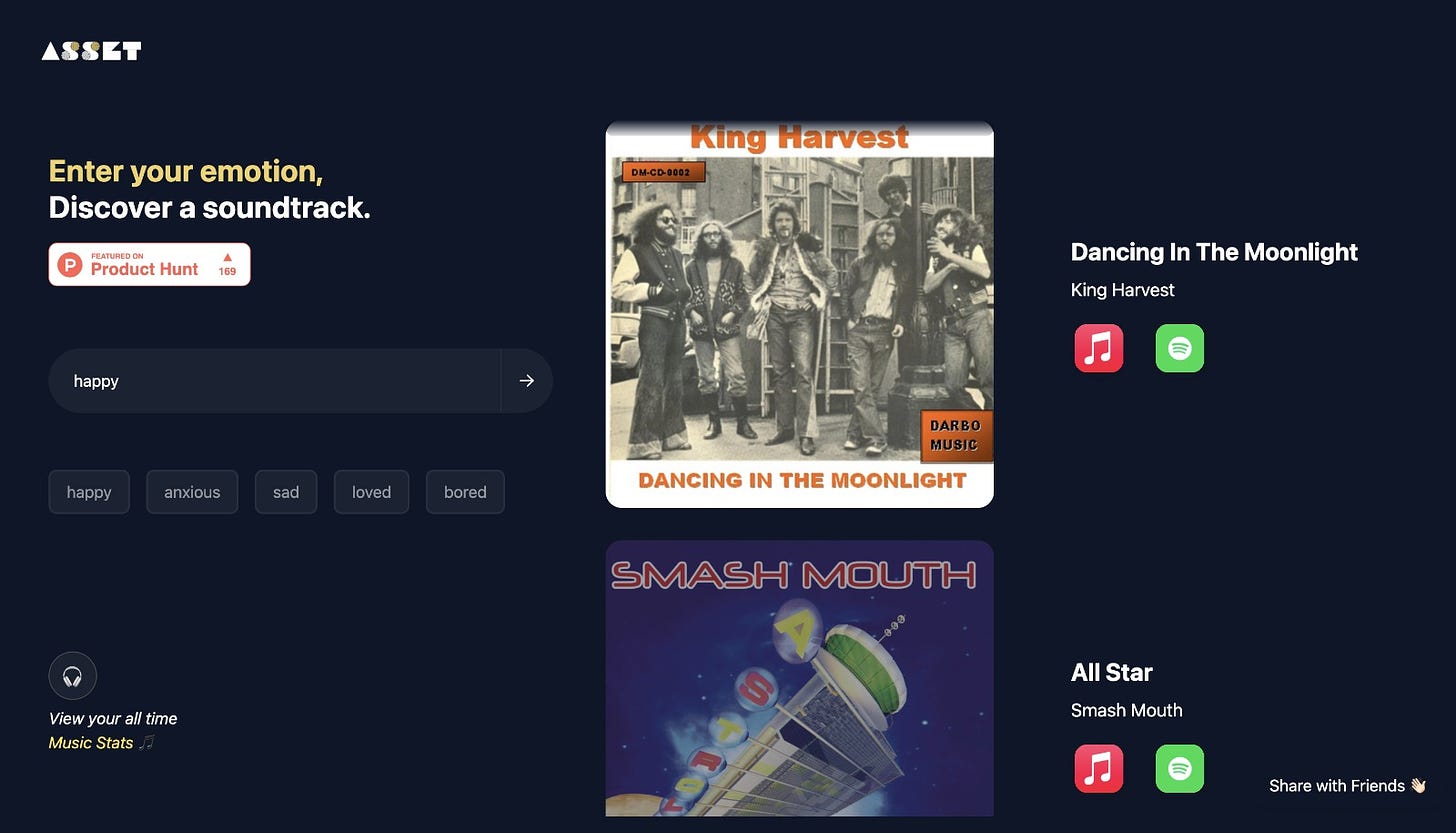

Hello, y'all. When words fail you, a song can come to your rescue 🎼

ImFeeling - does just that. A platform that understands your emotions and crafts the perfect soundtrack for them 👇

Whether you're riding a wave of happiness, navigating through anxiety, or just feeling a bit blue, let music be your companion. 🙌

This is The Token Dispatch, you can hit us on telegram 🤟

Vitalik Buterin, Ethereum's co-founder, cashed out on his MakerDAO tokens while the project is gearing towards a significant makeover.

Buterin offloaded $580,000 worth of the MKR tokens.

What happened?

What's Up with MakerDAO? 🔄

MakerDAO, the brains behind the stablecoin DAI, is amidst a huge revamp termed "Endgame". Christensen, MakerDAO’s CEO, revealed that "Endgame" would culminate in the creation of a new native blockchain for Maker, intriguingly termed "NewChain".

The twist? Christensen believes Solana’s codebase is the ideal foundation for this new venture. MakerDAO's historical affiliation with Ethereum suggests a potential migration from its long-time ally to a former competitor.

Christensen's nod to Solana as the desired basis for MakerDAO's next iteration prompted mixed reactions in the crypto community. On Crypto Twitter, some users highlighted the deep-rooted allegiance of MakerDAO's user base to Ethereum, suggesting that this migration might not sit well with everyone.

The Ethereum vs. Solana rivalry is well-documented. With public comments in the past about Ethereum’s perceived inefficiencies, the rivalry's flame has always been well-fueled. However, 2023 seems to be offering a changed narrative.

Solana's Take

Anatoly Yakovenko, Solana's co-founder, stepped in to clarify that this new brainchild of Maker doesn't actually intertwine with Solana's primary network, and it’s independent of the Ethereum vs. Solana rivalry.

Also👇🏻

Amid the din, Christensen seems to be on the same page as Yakovenko. Taking to Twitter once more, he championed the excellence of multiple chains including Ethereum, Solana, and Cosmos.

But, Vitalik wasn't too thrilled with Christensen's choice, promptly selling his MKR stash that he's held onto since 2020. This translated to a sale of 500 MKR for 353.4 ETH (approx. $579,000) using the CoW Protocol.

Vitalik's 2 cents to reflexer 💬

Buterin also dropped by Reflexer Finance's Discord. His advice? Enhance their collateral options with liquidity staking derivatives on Ethereum. Reflexer is known for its RAI stablecoin, which doesn’t peg to a fixed value but rather depends on ETH’s price and RAI's demand. Vitalik stressed the significance of introducing “staked ETH” in active community governance, starting with "non-dominant forms of staked ETH". He also voiced concerns about Lido's increasing dominance in the staking scene.

Buterin's words carry weight. Post his endorsement, Reflexer Finance’s token, Reflexer Ungovernance (FLX), experienced a surge of almost 75%! MakerDAO’s MKR token, on the other hand, observed a brief dip but has stabilised. Currently - $1,128.96.

The five-phase plan

Beta launch

Initiation of a harmonised brand, distinct from DAI and MKR.

Addressing the brand fragmentation between Maker and Dai to form a unified concept.

Offering DAI and MKR token holders an option to retain or upgrade to the new tokens.

SubDAO launch

Introduction of six Maker SubDAOs, each possessing unique governance tokens.

SubDAOs will operate autonomously but remain rooted in Maker's overarching mission.

This strategy aims to distribute the governance workload and enhance overall efficiency.

Governance AI tools launch

Rollout of AI-backed governance tools to elevate "Alignment Artifacts", ensuring continuous governance improvements.

The tools will be open-sourced, bolstering both MakerDAO's governance structures and serving public good.

Governance participation incentive launch

Implementation of the Sagittarius Lockstake Engine (SLE) to motivate active participation of the new governance token holders.

The mechanism will encourage token delegation to specific voter committees through an intuitive and gamified frontend.

NewChain launch & final endgame state

Debut of a revamped chain as the culmination of the Endgame plan.

The new chain aims to centralise backend tools of MakerDAO, ensuring streamlined operations across different platforms, including Ethereum.

Notably, this chain has provisions to hard fork during grave governance disputes, offering an added layer of security to users and businesses.

TTD Blockquote🎙️

Singapore's new president is Tharman Shanmugaratnam.

Crypto is "purely speculative" and "slightly crazy."

The Lion City has a new leader, Tharman Shanmugaratnam, who isn't afraid to voice his opinions on crypto.

Meet the Man 🎓

At 66, Tharman Shanmugaratnam isn't new to the world of finance. A former finance minister and central bank chairman, his financial literacy might influence more than just ceremonial aspects of his new role. Notably, he scooped up a whopping 70.4% of the presidential votes.

He's described crypto as "purely speculative" and "slightly crazy" but also maintained a laid-back approach early on.

Back in 2018, he noted no threats from crypto to Singapore's financial system.

In 2023, while addressing the World Economic Forum, Shanmugaratnam emphasised that the crypto market should remain unregulated. However, he firmly believes in providing "ultra clarity" regarding the associated risks rather than getting into the "never-ending game" of regulating products.

In 2022, he mentioned that Singaporean banks should maintain a capital of $125 for every $100 exposure to cryptocurrencies like Bitcoin and Ether.

Though cautious, Shanmugaratnam does recognize the potential in the crypto world. He believes regulated stablecoins might play a significant role in traditional payment systems in the future. Furthermore, he envisions a space for crypto beyond just speculation and illicit finance.

Where’s ETF?🚨

The winds are changing, and the focus is swiftly shifting beyond Bitcoin. Bernstein's latest report highlights the unfolding ETF landscape in the digital assets realm👇🏻

TTD Hack 🦹🏻♂️

On September 4th, a crypto betting giant, Stake, experienced an immense setback as hackers reportedly drained a whopping $41.3 million from its reserves. However, the platform was back up in just five hours post-breach.

What Happened?

Stake experienced a series of unusual transactions, resulting in roughly $16 million in Ethereum, Tether, USD Coin, and DAI being drained. Additionally, about $25 million vanished from Binance Smart Chain and Polygon, reports suggest.

Stake confirmed the hack.

Then, Stake quickly reopened for deposits, withdrawals, and user services at 9:28 pm UTC on September 4th. This was a mere five hours after they confirmed unauthorised transactions from their ETH/BSC hot wallets.

The Drake Connection: Drake, the Grammy-award-winning artist, is among the high-profile backers of Stake. The rapper cemented a whopping $100 million/year endorsement deal with Stake in 2022.

While their Bitcoin (BTC), Litecoin (LTC), and XRP wallets emerged unscathed, Stake has not yet detailed the specifics of the breach or the exact amount lost.

Estimated losses

Blockchain security firm Beosin estimated the breach to be around $41.35 million:

$15.7 million on Ethereum

$7.8 million on Polygon

$17.8 million from the BNB Smart Chain

Sequence of breach

The breach began at 12:48 pm UTC, with a transaction transferring roughly $3.9 million in Tether (USDT) from Stake to the attacker's account. The hacker didn't stop there, extracting over 6,000 Ether (worth about $9.8 million).

Within a short span, they also siphoned about $1 million in USD Coin (USDC), $900,000 in Dai (DAI), and 333 Stake Classic (STAKE), tallying the initial $15.7 million taken from Ethereum.

TTD NFT 🐝

Japanese tech powerhouse Casio is making a grand entry into the world of the metaverse, bringing its iconic G-Shock watch along for the journey. Partnering with Polygon Labs, Casio is weaving the future of fashion and technology together with an exciting initiative.

Virtual G-Shock's Entry:

Casio's move involves the launch of the Virtual G-Shock – a "community co-creation" project that rides on blockchain technology.

The first phase includes 15,000 free G-Shock Creator Pass NFTs, offering holders access to a freshly launched Discord channel.

Inside the Discord community, there's a contest where participants can design unique looks for the Creator Pass, with the winning design chosen through community voting.

Minting Details:

Casio will kick off the NFT rollout on its official website.

Those holding a Casio ID can claim their NFT between September 23-26.

The public minting window follows, set for September 26-29.

All these NFTs will be minted using Polygon, a renowned Ethereum scaling solution.

Casio aims to tap into the emerging Web3 space and the thriving metaverse to reach new audiences and redefine brand experiences.

Senior General Manager of Casio’s timepiece division, Takahashi Oh

“In recent years, with the spread of the decentralised internet known as Web3, demand for experiences in virtual spaces has increased. We have launched this initiative to further expand the G-Shock brand by establishing points of contact with previously unreachable segments of the population,”

Co-Creation: A New Trend?

The Web3 era is witnessing a rise in co-creation loyalty programs.

Brands such as Lacoste have already tested these waters.

Tommy Hilfiger collaborated with DressX in March’s Metaverse Fashion Week, hosting an AI-driven design contest.

Polygon, the Ethereum scaling network, has caught the attention of major brands like Adidas, Nike, and Starbucks, which are building their metaverse projects on its platform.

TTD Adoption 🫂

Amidst the backdrop of mounting inflation, Turkey sees an impressive surge in crypt adoption, with over half of its citizens now owning some form of crypto, says a new report by KuCoin.

Based on KuCoin's research, crypto ownership in Turkey has leaped from 40% to 52% within the span of just 18 months.

KuCoin, one of the world's top crypto exchanges, arrived at these figures after analysing the responses of 500 individuals for their "Understanding Crypto Users" report.

A significant catalyst for this adoption appears to be the country's spiralling inflation. With the Turkish lira plummeting over 50% against the USD, many view cryptocurrencies as a protective hedge. KuCoin identified similar trends in Brazil and Nigeria, both grappling with inflationary challenges.

Other findings

58% invest in crypto for long-term wealth accumulation.

37% view crypto as a store of value.

Bitcoin held by 71% of respondents.

45% hold Ethereum and other stablecoins.

Men dominate the crypto scene.

47% of crypto investors aged 18-30 are female.

57% were influenced to invest by friends and family.

Turkey isn't just witnessing a grassroots crypto movement. On a national scale, there's an ongoing exploration of a central bank digital currency - Digital Lira.

TTD Surfer 🏄

Blockchain developer Cronos Labs is searching for eight startups to participate in its $100 million accelerator program.

OpenAI has partnered with Canva to create a plugin for its chatbot, ChatGPT, to simplify creating visuals for businesses and entrepreneurs.

Crypto infrastructure provider Qredo has cut around 50 jobs, including some senior executives, in an effort to save about 35% on annual expenses.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋