Manic Monday 🫨

Mt. Gox to start creditor's repayment - $9B fire sale. Crypto dives head first. Crash or profit booking? More pain to come? Are traders shorting MicroStrategy? Japan to go big on crypto investment?

Hello, y'all. It's just another manic Monday (Ooh-oh) I wish it were Sunday (Ooh-oh) 'Cause that's my fun day (Ooh-oh) 🎵

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Not a Monday many fancied.

Still, a Monday you’ve got to endure.

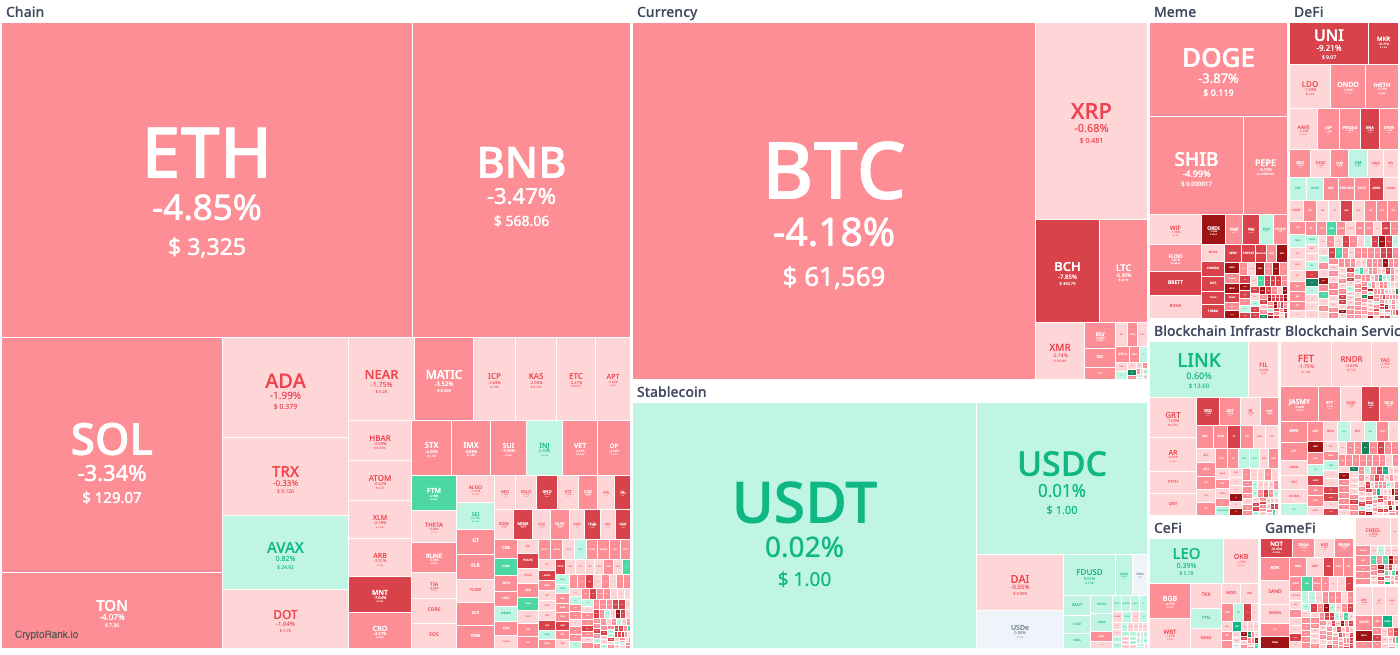

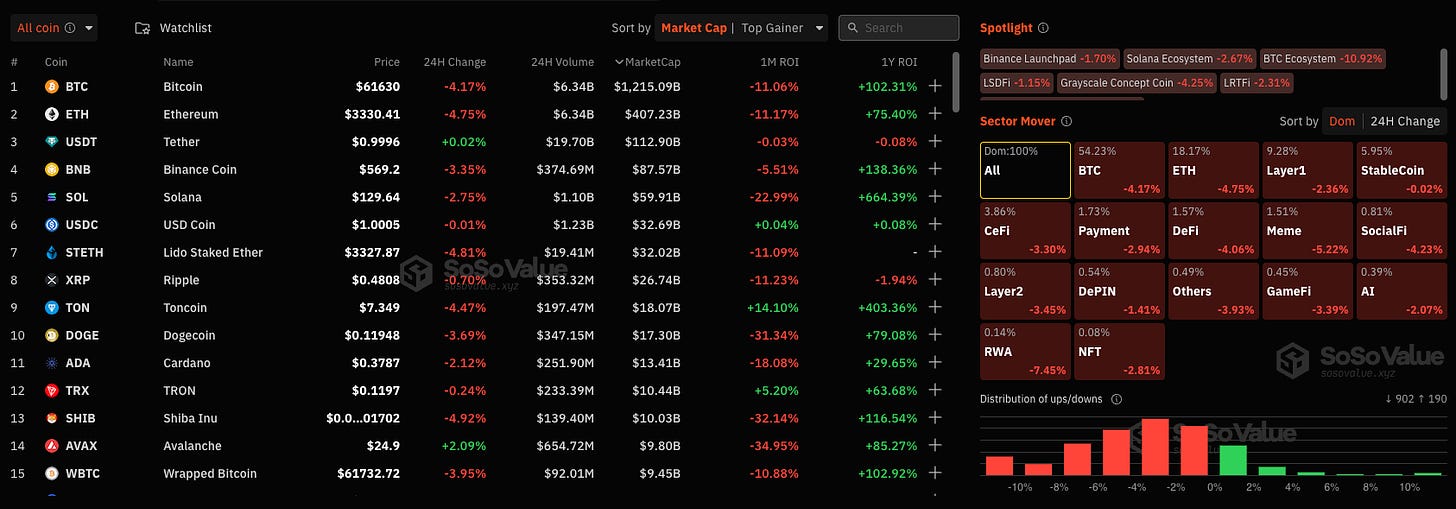

Last week of the month, and we are seeing a carnage.

Alright, what happened? The market got spooked.

With what? Mt. Gox fire sale announcement.

Mt. Gox creditors will start receiving repayments in Bitcoin and Bitcoin Cash in early July, more than a decade after losing their funds.

The distribution will include 142,000 BTC and 143,000 BCH, approximately $9 billion.

The now-defunct Japanese cryptocurrency exchange, once processed more than 70% of Bitcoin’s trading volume before ceasing operations in 2014.

The note by Mt. Gox Rehabilitation Trustee Nobuaki Kobayashi.

Crash or profit booking?

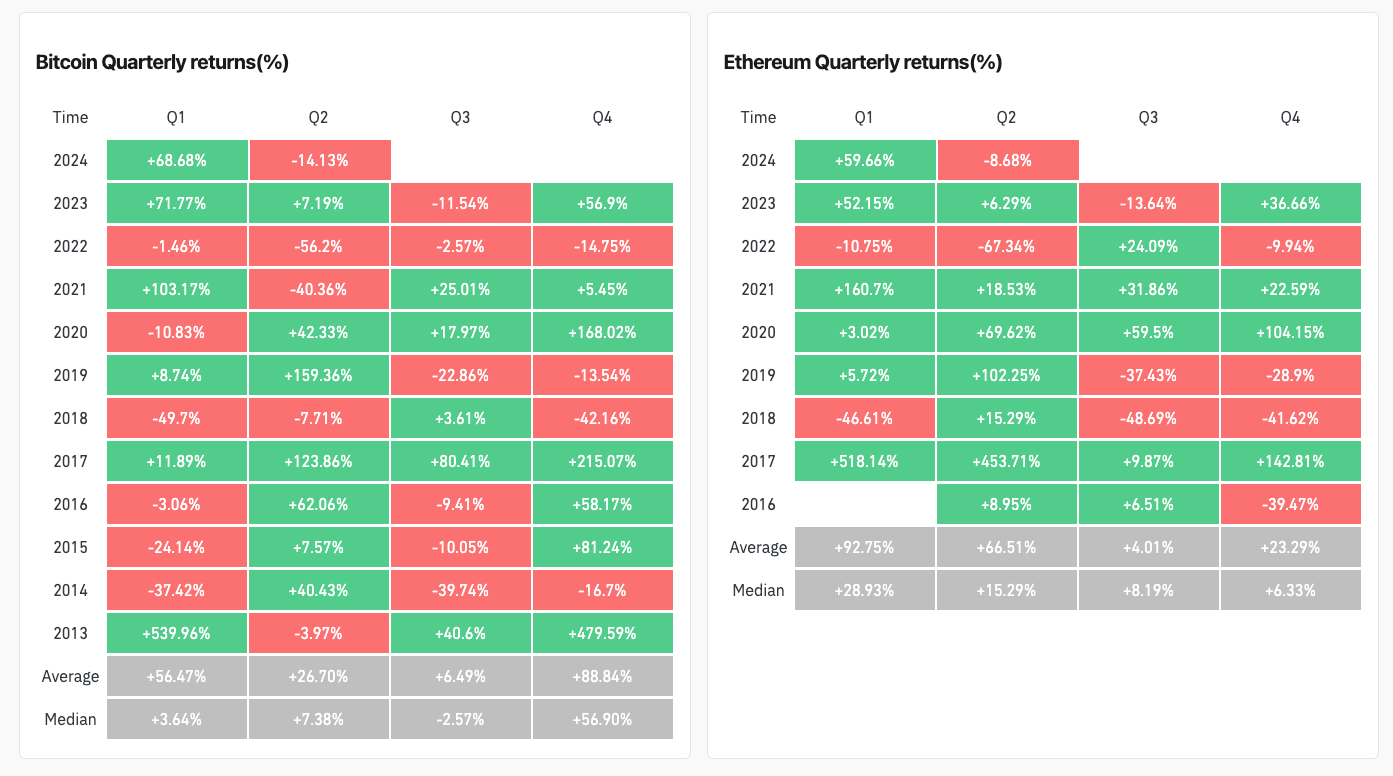

Bitcoin's price has experienced June blues.

From the highs of $72,000 to the lows of $60,000.

Total rollercoaster this month.

It has also decoupled from Nasdaq which is scoring all-time highs.

Why? Few reasons. Miners has been selling, investors booking profit, and the broader cooldown in US listed spot Bitcoin ETFs.

Read: Who's Selling Bitcoin? 📉

Look closer, and it is still a healthy return on Bitcoin and Ethereum in year-to-date metric for 2024. Profit booking then?

Is there more pain to come?

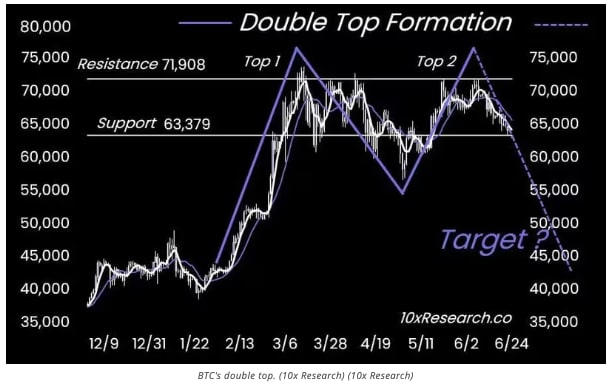

Technical analysis offers a grim picture.

Bitcoin price action has formed a double top.

Double top? Bearish technical analysis pattern, has two peaks with a valley in the middle, usually seem after an longer uptrend.

The second peak represents uptrend exhaustion.

The eventual breach of the low hit between the two peaks confirming a bearish trend change.

Markus Thielen, founder of 10x Research explains.

"Technically, bitcoin appears to follow a double top formation, whereas the support level is being tested. This chart formation should be our base case unless it becomes invalidated. This formation could easily see a drop to $50,000—if not $45,000 … Yes, the US election and CPI should be bullish later this year, but we can still have a steeper correction."

Bitcoin has not been this oversold since $26,000

The price drop to sub $61,000 indicates oversold RSI.

On the daily chart, Bitcoin’s RSI has reached 28, signalling that the BTC is in “oversold” conditions.

Relative strength index (RSI): Popular momentum indicator used to measure whether an asset is oversold or overbought based on the magnitude of recent price changes.

The last time Bitcoin’s RSI was below 30 was in August 2023, when BTC was trading at the $26,000 mark.

What does all this mean? Long-term bullish, short-term choppy.

Block That Quote 🎙️

MicroStrategy Co-founder, Michael Saylor.

“Bitcoin is Economic Immortality”

Believers don’t back down.

That’s Saylor for you.

Why would you when your treasury portfolio looks like this, eh?

In a recent podcast, Saylor predicted a sky-high price.

$10 million per coin for Bitcoin.

Saylor suggests Bitcoin allows companies to transcend the limitations of traditional finance and achieve "economic immortality."

Read: Two Michaels One Bitcoin 🛒

What is "economic immortality"?

Economic immortality is achieved by storing your economic energy in an asset that has a long enough frequency that you can expect to keep your money forever.

What Saylor argues?

“What’s the difference between perfect money and imperfect money? Perfect money is economic immortality. Imperfect money is: we all have a short, brutal life.

Economics is pseudoscience before Satoshi. It’s a quasi-religious liberal art, and it’s full of people’s opinions and prejudices and biases. […] All the economists before Satoshi were trying to work out the laws of economics with seashells and glass beads and pieces of paper and credit instruments.

The average life expectancy of a corporation is something like 10 years. […] We’re talking about eliminating corporate mortality; we’re talking about stretching economic vitality easily by a factor of 10, maybe by a factor of a hundred, maybe by a factor of a million.”

MicroStrategy now holds 1% of all Bitcoin.

Why Are Traders Shorting MicroStrategy?

Investment firm Kerrisdale Capital is shorting MicroStrategy stock.

Why? It reckons that the is trading at an “unjustifiable premium” to Bitcoin.

MicroStrategy's stock has tripled in price since December 2023.

Outperforming Bitcoin.

Sahm Adrangi, chief investment officer at Kerrisdale Capital explains.

“The software business is worth a billion, maybe a billion [point] five, somewhere in between — it’s not worth very much. Michael Saylor has bought all this Bitcoin [...] If he wants to buy more Bitcoin, he issues $1 billion of debt and he buys $1 billion more Bitcoin. It doesn’t increase the enterprise value of the company.

Bitcoin prices have to go up for the value of the company to increase. If they go down the value of the company goes down. The company should be trading at the value of Bitcoin. Our argument is ‘go short MicroStrategy, go long Bitcoin.’”

They are not the only ones, big shorters are betting $6.9B against MicroStrategy stocks.

In The Numbers 🔢

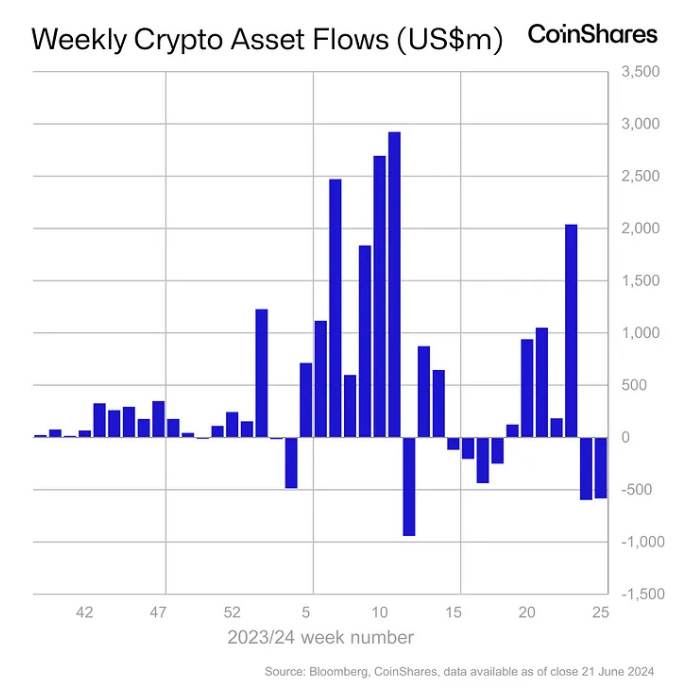

$584 million

Digital asset investment products outflows last week, Coinshares report.

Bitcoin outflows $630 million.

Ethereum outflows $58 million.

Second consecutive week of outflows, shaving off $1.2B in last two weeks.

We believe this is in reaction to the pessimism amongst investors for the prospect interest rate cuts by the FED this year.

The latest fund flows data comes amid a broader cooldown in the crypto ETP space. Last week also saw the lowest volumes traded on ETPs globally since the US ETFs were launched in January, seeing just US$6.9 billion for the week.

Multiple asset products inflows reaching $98 million, indicating that investors see weakness in the altcoin market as a buying opportunity.

A true correction is underway?

Japan’s Investment Managers To Invest In Crypto?

A survey by Nomura Holdings and its digital asset arm Laser Digital found that over 54% of investment managers in Japan intend to invest in crypto assets over the next three years.

Finding from the survey of 500 managers in April.

Primary drivers include the development of crypto products like ETFs, investment trusts, staking and lending.

About 25% held a positive impression of Bitcoin and Ether, while 62% saw crypto as a diversification opportunity.

The survey comes after Japan's cabinet approved a proposal in February to allow local investment limited partnerships to acquire crypto.

The revision to the Limited Partnerships Act is expected later this year.

As part of Prime Minister Fumio Kishida's "new capitalism" policy, Japan is pushing to develop its Web3 industry.

In December, the government approved a tax regime revision to exclude corporations from paying tax on unrealised crypto gains if they hold the assets long-term.

Japan's Metaplanet plans to purchase an additional $6 million worth of Bitcoin, to add to its existing $9 million investment.

The funds will come from an upcoming bond issuance, and the company's stock price jumped 12% following the announcement.

Metaplanet is currently the largest corporate holder of Bitcoin in Japan, with 141 BTC in its possession.

Read: Bitcoin Treasuries 💵

The Surfer 🏄

CoinStats, a crypto portfolio tracking platform, experienced a security breach affecting some iOS users. Scam notifications claiming a reward directed users to a malicious website, compromising 1,590 wallets created within CoinStats app.

MakerDAO delegate lost $11M in tokens in a phishing scam. Scammer tricked the user into signing multiple phishing signatures.

Binance freezes $5 million in funds stolen from BtcTurk after alleged $54 million hack. BtcTurk, a Turkish exchange, experienced a cyberattack on its hot wallets. Majority of BtcTurk's assets stored in cold wallets remain secure.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋