NFTs Are Securities? SEC v OpenSea🚨

US SEC alleges that NFTs on the platform should be classified as securities. Can creative goods be securities? Reactions. Trump’s NFT collection nets $2M in 24 hours. Berkshire Hathaway $1T valuation.

Hello, y'all. The music quiz game that’s got over million plays. Who are you playing with then? Have you played it as yet 👇

Another Wells Notice.

This time it’s a NFT platform. One of the largest.

Devin Finzer, the CEO of the company posted on X that they have received a Wells notice from the US Securities and Exchange Commission (SEC), indicating the regulator's intent to sue the company.

The SEC alleges that NFTs traded on OpenSea's platform should be classified as securities.

OpenSea argues that NFTs are fundamentally creative goods, including art, collectibles, and event tickets, which should not be regulated in the same way as financial securities.

CEO Devin Finzer announced the company's readiness to "stand up and fight" against the SEC's allegations.

Brian Frye, a law professor at the University of Kentucky specialising in NFTs and securities law, told Decrypt.

“The NFT market is identical to the art market, which existed long before the SEC was created and which the SEC has never regulated. If the SEC thinks the art market is a securities market, it should say so and try to regulate it. If not, it should leave OpenSea alone.”

Read: Artists Sue US SEC 🤦

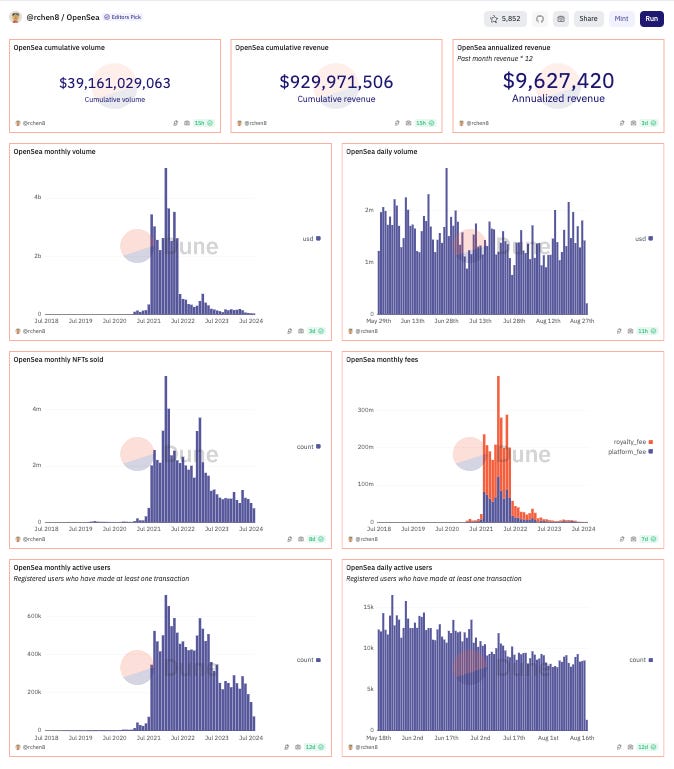

OpenSea's business struggles

Valuation decline: Tiger Global marked down OpenSea's valuation by 76%, from $13 billion in 2022 to around $3 billion.

Market downturn: NFT trading volumes and active uses have significantly dropped since the highs of 2021.

Business model challenges: OpenSea faced backlash for stopping enforcement of creator royalties, damaging relationships with artists.

Operational issues: Rapid growth led to security vulnerabilities, and the company only hired its first chief security officer in December 2021.

Staff reductions: OpenSea laid off 50% of its staff in November 2023, reflecting severe financial pressures.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to the fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

The industry comes out in support of OpenSea.

Trump’s NFT Collection nets $2M in 24 hours

Former US President Donald Trump unveiled "Series 4: The America First Collection" on August 27.

Sales performance: The collection saw over 22,000 sales in the first 24 hours.

Generated more than $2.17 million at a mint price of $99 per NFT.

Represents only 6% of the total supply of 360,000 NFTs.

Potential Revenue: If all NFTs are minted, total revenue could exceed $35 million.

Trading restrictions

The NFTs cannot be sold on secondary markets until January 31, 2025.

Buyers will need to hold the cards until the trading date.

Performance of Past Collections:

The first NFT collection saw a 100% increase in floor price.

The second and third collections experienced notable losses for initial minters.

Overall earnings: Trump has earned over $7 million from his NFT collections overall.

In The Numbers 🔢

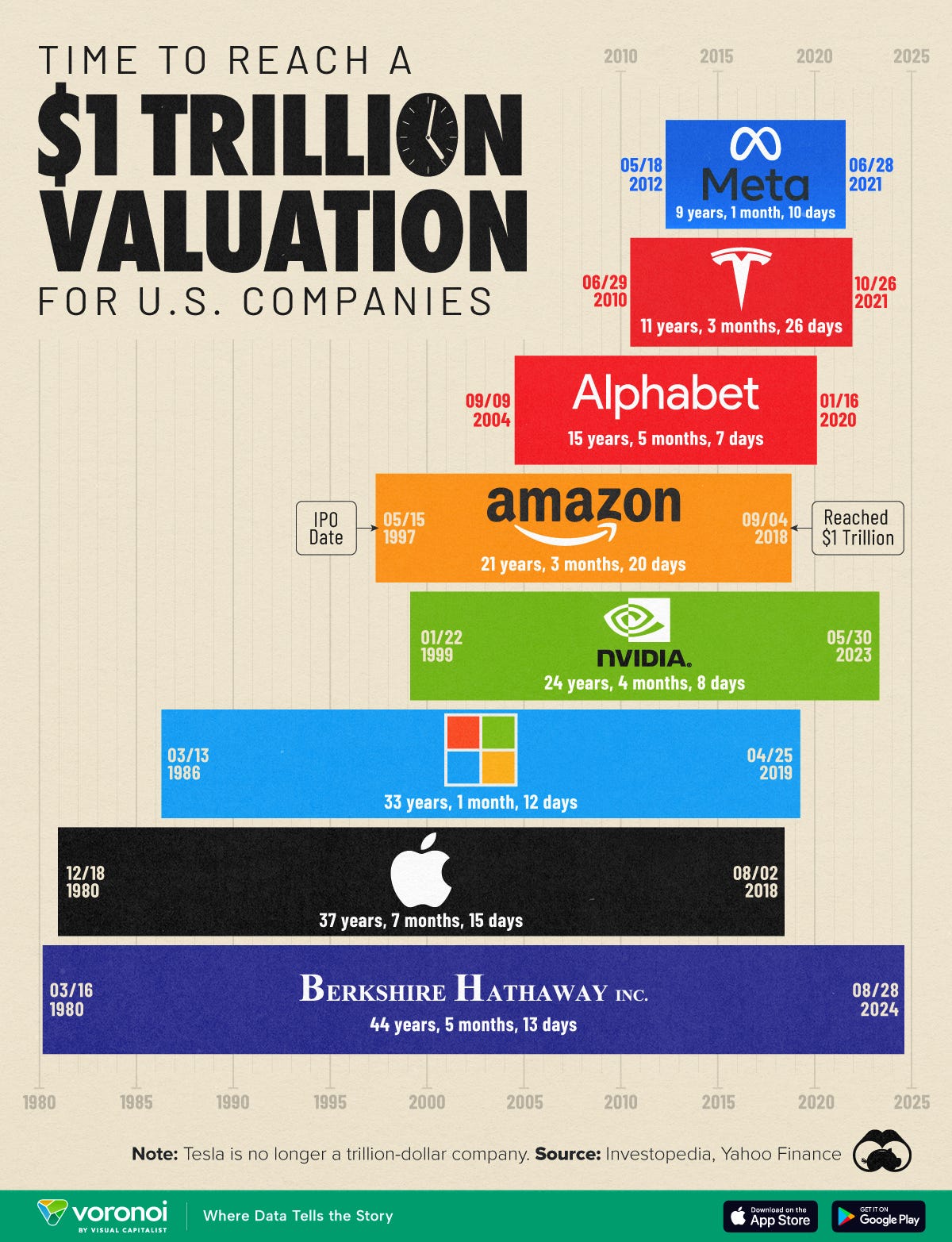

$1 trillion

Berkshire Hathaway (BRK.A) valuation.

Stock Surge: Rose 0.75% on August 28, surpassing a $1 trillion valuation.

Year-to-date performance

Berkshire's stock has increased over 29% in 2024.

This outpaces the S&P 500's 17% rise and closely follows Bitcoin's 31% gains.

Berkshire vs Bitcoin

Market cap: As of August 29, Bitcoin's market cap is $1.19 trillion, slightly higher than Berkshire's valuation.

Buffett's aversion: Despite Warren Buffett's criticism of cryptocurrencies, Berkshire's performance has nearly matched that of Bitcoin in 2024.

Decade Comparison: Bitcoin has consistently outperformed Berkshire Hathaway over the past decade, with BRK.A dropping 99.98% since its 2011 peak.

Profit drivers in Berkshire's portfolio

Diverse business interests: Berkshire's profits are driven by sectors including insurance, energy, manufacturing, retail, and services.

2024 profits: The company reported $22.8 billion in profits for the first half of the year, a 26% increase compared to the previous year.

Cash holdings and investment strategy

Apple stake: After selling half of its Apple holdings earlier this year, Berkshire now holds $276.9 billion in cash and cash equivalents, primarily in US Treasury bills.

No Bitcoin plans: Buffett has no intention of investing Berkshire's cash in Bitcoin, despite its growing relevance as a financial asset.

Simulated impact: Allocation of Bitcoin in Berkshire's portfolio.

A 1% could have increased five-year returns from 185% to 207%.

A 5-10% allocation could have yielded returns between 130.97% and 279.64%.

NFL Players Union Sues DraftKings

The NFL Players Association (NFLPA) has sued DraftKings in New York for breaching a licensing agreement regarding its NFT product, Reignmakers.

Allegations: The NFLPA claims DraftKings owes approximately $65 million for using NFL players' likenesses without fulfilling payment obligations.

Background on Reignmakers

Launched in 2021 on the Polygon network.

Allowed users to engage in fantasy sports using NFTs, generating $287 million in sales.

Shutdown of NFT experience: DraftKings closed its NFT platform in July 2024, citing legal issues after a court denied its motion to dismiss a related class action lawsuit.

NFLPA's position: The union argues DraftKings is abandoning the deal due to a market decline and highlights significant executive compensation as evidence of the company's financial capability.

Legal implications: The case is assigned to US District Judge Analisa Torres, with potential implications for future NFT licensing agreements in sports and gaming.

The Surfer 🏄

The CEO of Haru Invest, Hugo Lee, was stabbed multiple times in the neck during a court trial in Seoul related to accusations of stealing $826 million from investors. The attacker, a 51-year-old investor who lost money when the company froze withdrawals, has been charged with the assault.

Crypto.com, in partnership with Standard Chartered Bank, has launched global retail services for users in over 90 countries, allowing deposits and withdrawals in USD, EUR, and AED, starting in the UAE.

BlackRock has launched its iShares Ethereum Trust (ETHA) on Brazil's B3 exchange, trading under the ticker ETHA39. This follows the earlier introduction of its Bitcoin ETF in March in Brazil.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

I think Warren Buffett secretly loves Bitcoin; he just won’t admit it while holding all that cash.

OpenSea's business is doomed without creator royalties. Artists deserve better.