“Recalibration” 🧮

The US Fed rate cut is here - 50 bps. Crypto community is happy. Bitget reported 1,614% user growth in Africa. SEC settles with Rari Capital and Trump buys a burger with Bitcoin in New York.

Hello, y'all. We are going to be at Token 2049, are you?

Please DM us on X with a link to your project. We are going to publish friends of Token Dispatch at Token 2049 list starting tomorrow until September 20, 2024.

Check out today’s list below 👇

That’s you and your project landing in over 130,000 inboxes. Seven days in a row - September 14-20, 2024. Limited to five people and projects each day.

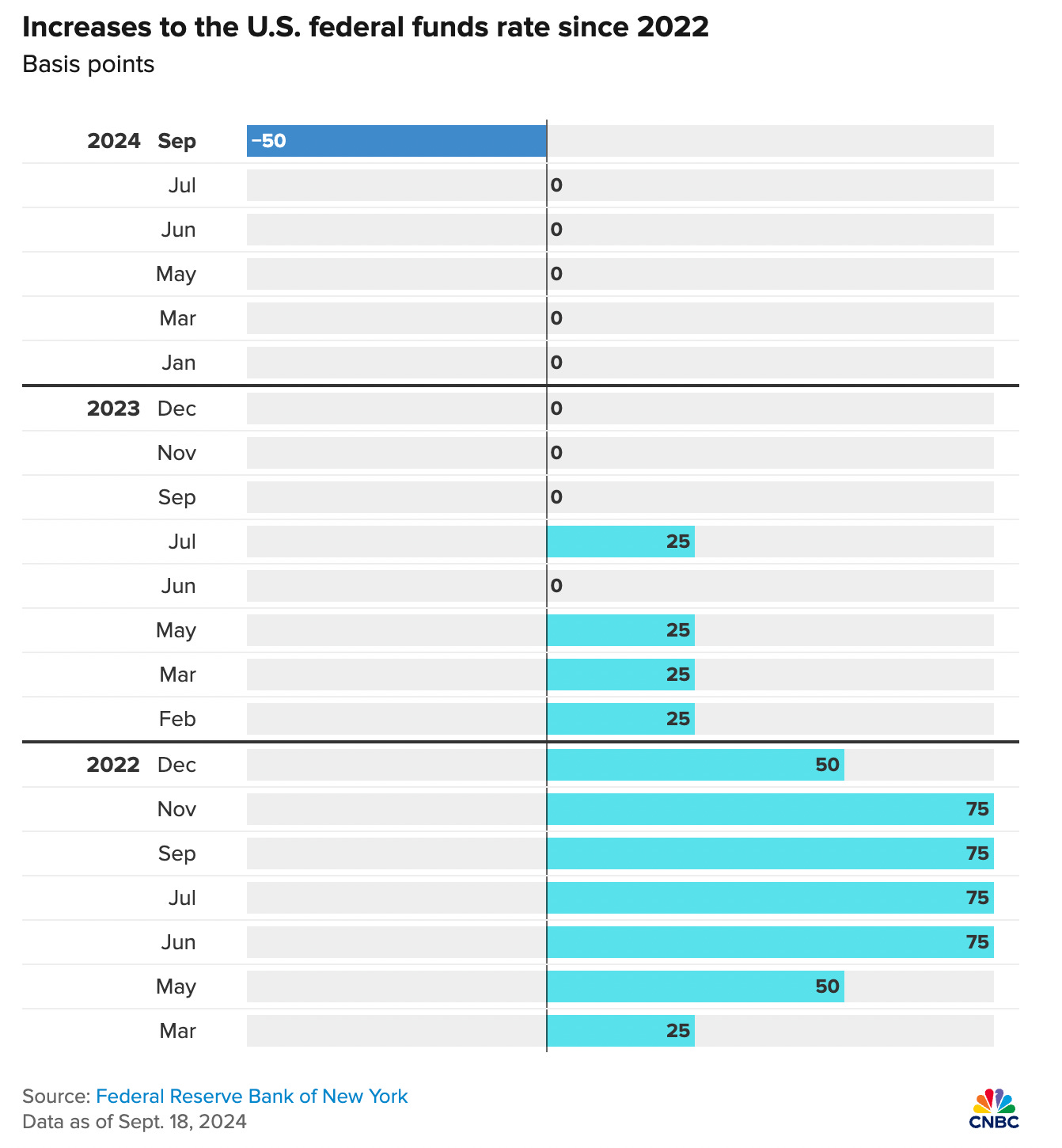

50 basis points.

First time after COVID 19 (yeah it was four years ago).

Soft landing? Federal Reserve’s rate cut has made crypto a little bit happier.

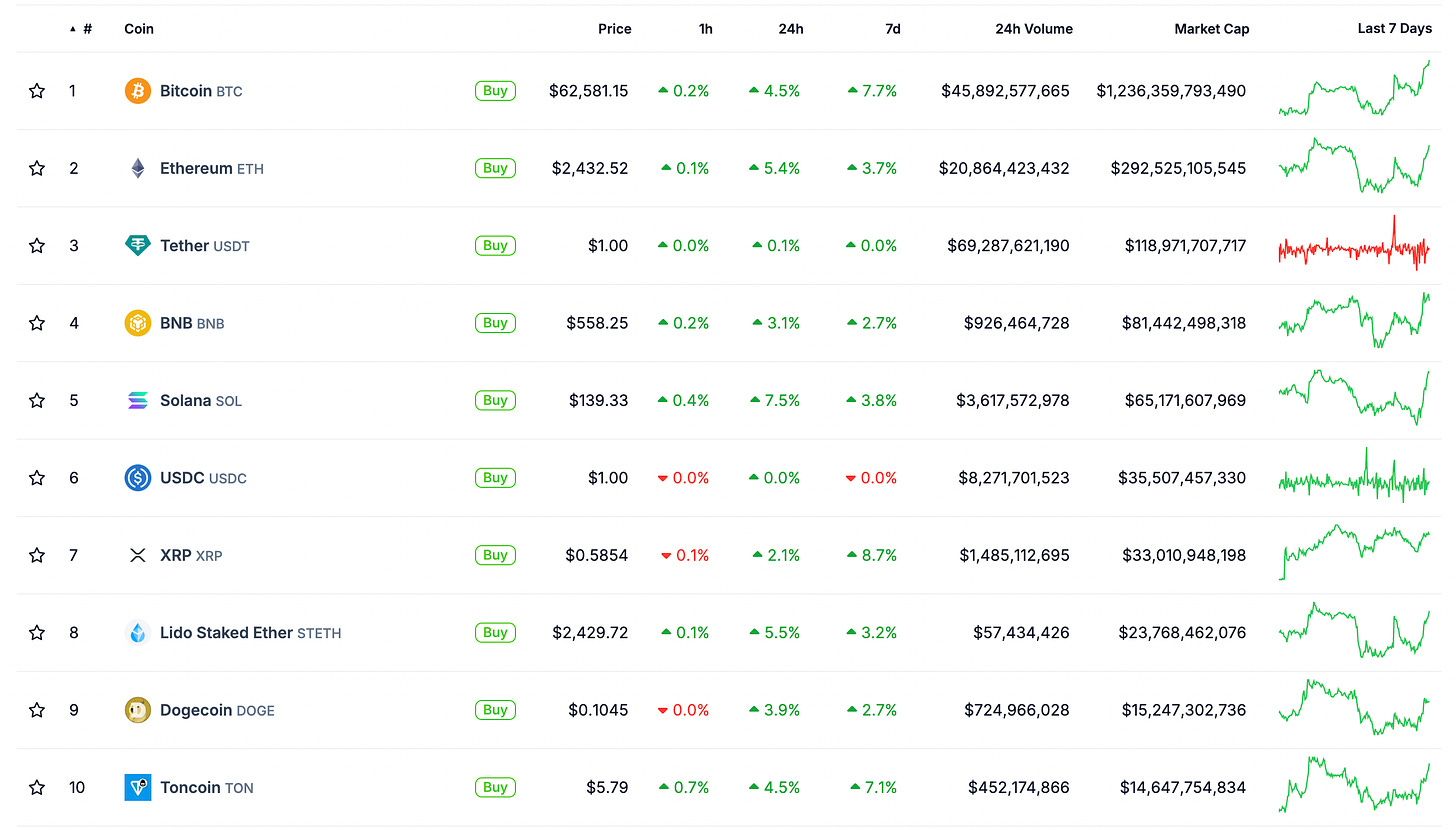

Bitcoin - $62,581(+4.5%)

Ethereum - $2,432 (+5.4%)

Solana - $139 (+7.5%)

Dogecoin – $0.1045 (3.9%)

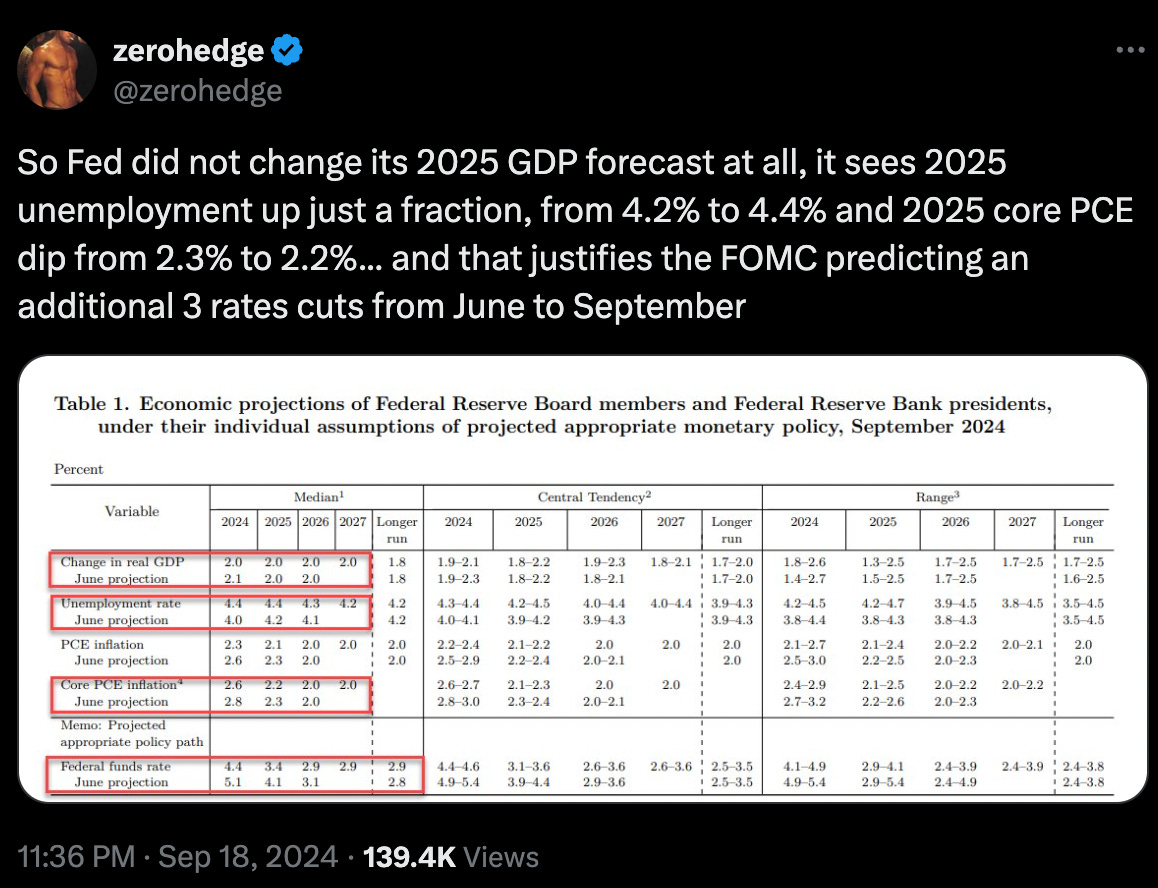

Context and rationale

This rate cut is seen as a response to?

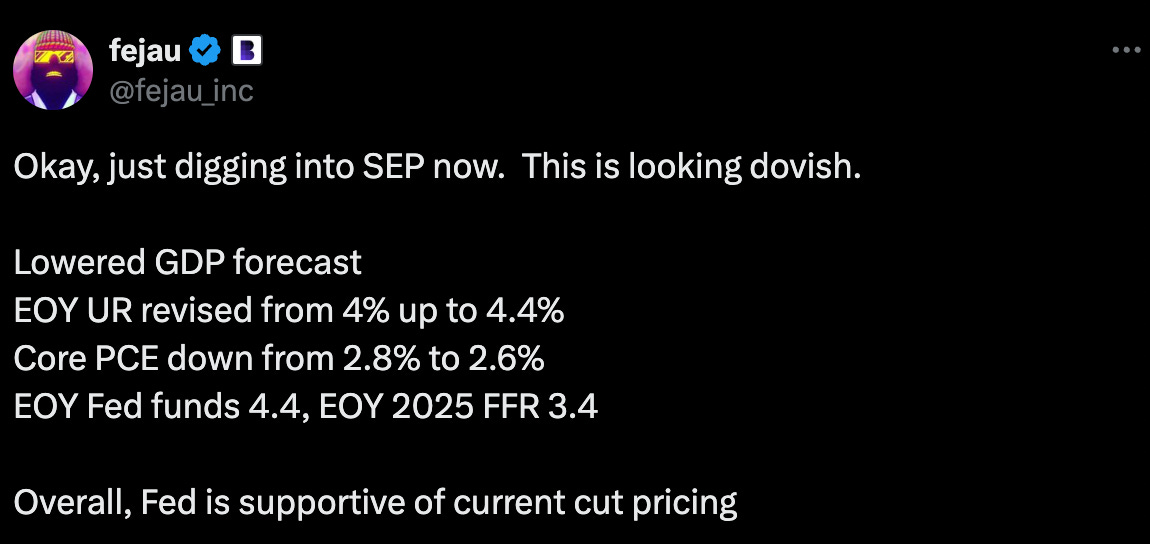

Inflation trends: The Fed has gained confidence that inflation is moving towards its target of 2%. Current inflation stands at approximately 2.5%, down from a peak of 9.1% in June 2022.

Labour market conditions: Job gains have slowed, leading to an uptick in the unemployment rate, which now sits at around 4.4%.

Market expectations: Prior to the announcement, market expectations had shifted towards anticipating a larger cut, with probabilities for a 50 basis-point reduction rising from 50% last week to 57% just before the meeting.

Details of the cut

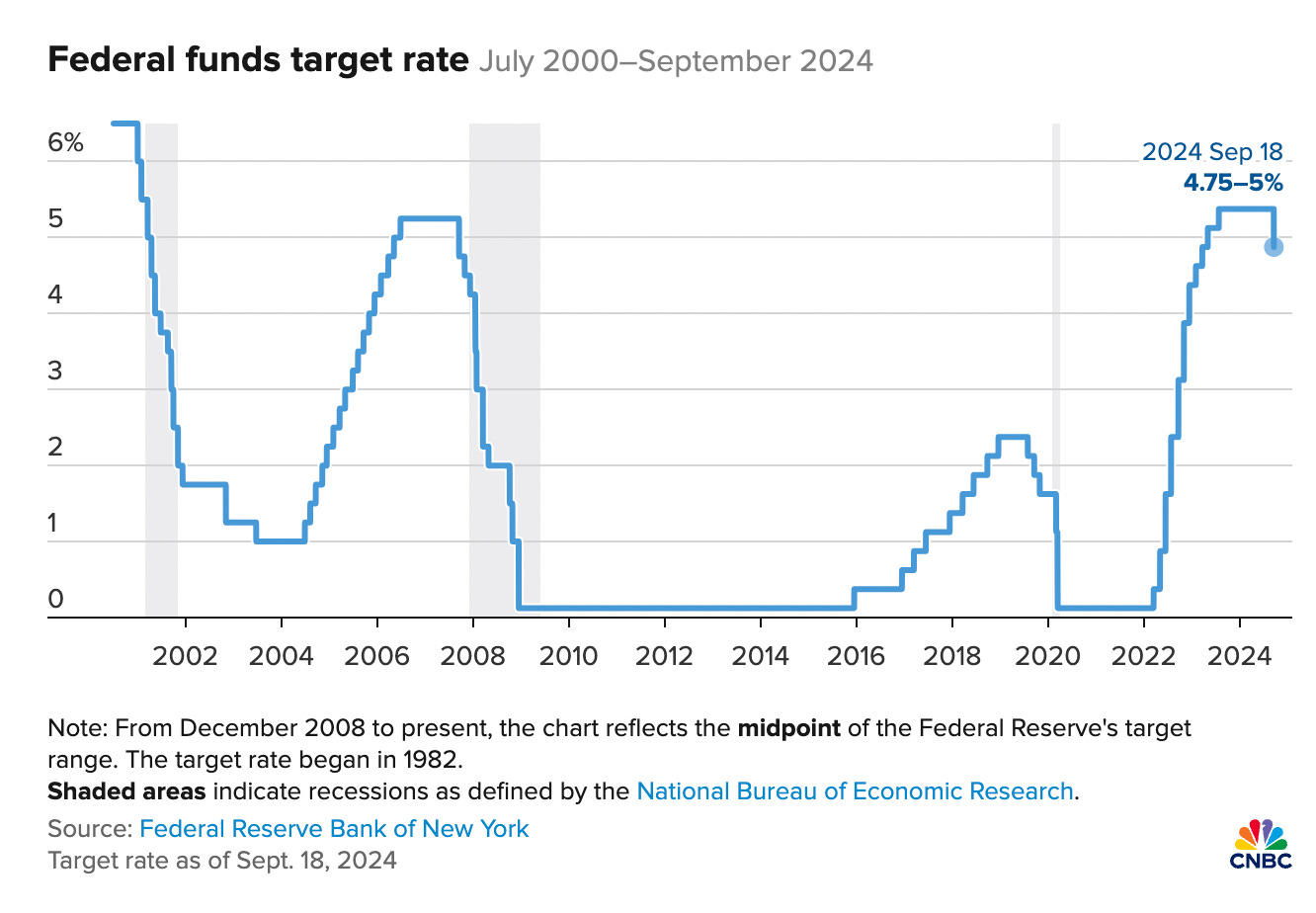

The Federal Open Market Committee (FOMC) decided to lower the federal funds rate to a target range of 4.75% to 5.00%.

The Fed lowered interest rates by 50 basis points, a larger cut than expected by many traders.

First rate cut since 2020.

The FOMC's vote was notably one-sided at 11-1, with only Governor Michelle Bowman dissenting in favour of a smaller, 25 basis-point cut.

The Fed cited progress on inflation and increased downside risks to employment as reasons for the cut.

The Fed's "dot plot," which illustrates individual members' projections for future rate changes, suggests that further cuts may be on the horizon.

Impact on Bitcoin and crypto markets?

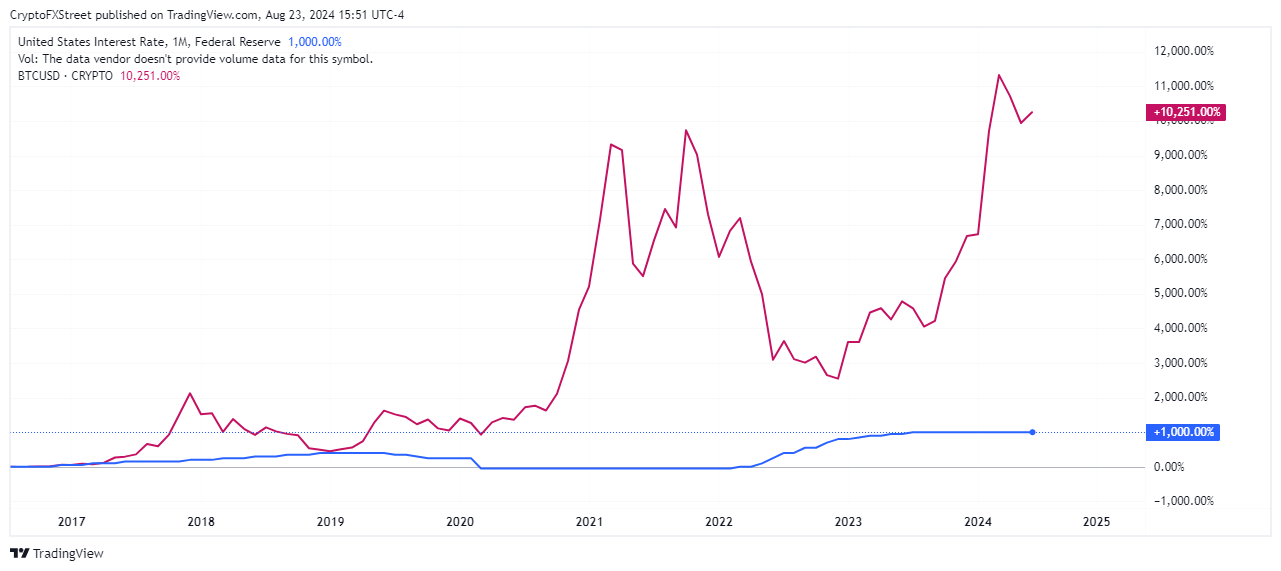

Lower borrowing costs: The rate cut reduces the cost of capital - cheaper for investors to borrow money. This encourages spending and investment in riskier assets, that includes crypto.

Capital inflows: Interest rates decline - there is a tendency for capital to flow into higher-risk investments. Investors are more likely to seek out assets that promise higher again, that’s crypto.

And with inflation concerns still prevalent, many investors view Bitcoin as a hedge against currency devaluation.

Historically, Bitcoin has performed well during periods of low interest rates. Previous rate cuts have coincided with bull runs in the crypto market.

If the Fed continues its rate-cutting cycle, it could support sustained demand for crypto.

Powell's said what?

Fed Chair Jerome Powell described the cut as a "recalibration" rather than a catch-up.

What else did he say?

"We made a good strong start to this, and that's frankly a sign of our confidence in inflation coming down toward 2% on a sustainable basis … I'm very pleased that we did … but I think we're going to go carefully, meeting-by-meeting.

We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with this inflation. That’s what we’re trying to do, and I think you could take today’s action as a sign of our strong commitment to achieve that goal.

We're not saying mission accomplished or anything like that … But I have to say, though, we're encouraged by the progress that we have made."

50 bps brings trouble?

This is only the third time in recent history that the Fed has started rate cuts with a 50 bps cut, joining the ranks of 2001 and 2007.

In both prior instances, big economic downturns followed:

In 2001, the Nasdaq fell 76% over three years.

In 2007, the market dropped 56% from its peak.

Despite the Fed’s upbeat talk about a strong economy, this aggressive rate cut feels a bit like they’re preparing for something not-so-great.

Friends of Token Dispatch at Token 2049

Gnosis Pay: On-chain spending account with a Visa Debit Card linked to a self-custodial blockchain wallet.

Chainbase: Omnichain data network for AI. An open stack connecting all blockchains

Startale: Cloud services for developers to deploy and manage blockchain infrastructure easily.

Lido: Liquid staking token to decentralise Ethereum validation.

Telos: Zero knowledge to unlock real world use cases for scaling Web 3.

X Reacts to the Fed Rate Cut

The Quiz Game For The Music Lovers

The music quiz game that’s got over million plays. Who are you playing with then 👇

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Block That Quote 🎙️

Donald Trump, Republican presidential candidate.

"This a crypto burger."

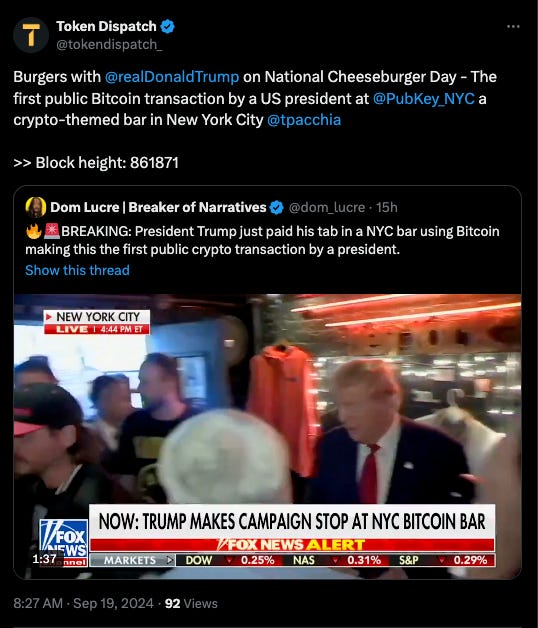

Trump ❤️ Crypto

Trump bought burger.

Why is it a big deal? Is he on a diet?

No. But, he bought it with Bitcoin.

The purchase happened at PubKey bar, New York.

Trump used the Strike app.

He spent $998.70.

The transaction was recorded at block height 861871.

PubKey's co-owner said this is a "coming of age" moment for Bitcoin. It shows Bitcoin's growing acceptance.

Trump handed out the burgers to patrons in the bar.

And Trump claims to be the first US president to do this.

Trump is obsessed with crypto. As part of his 2024 campaign, Trump is even accepting cryptocurrency donations and launching a DeFi project called World Liberty Financial (WLFI).

Read: Trump's WLF: Triumph or Fiasco?

In The Numbers 🔢

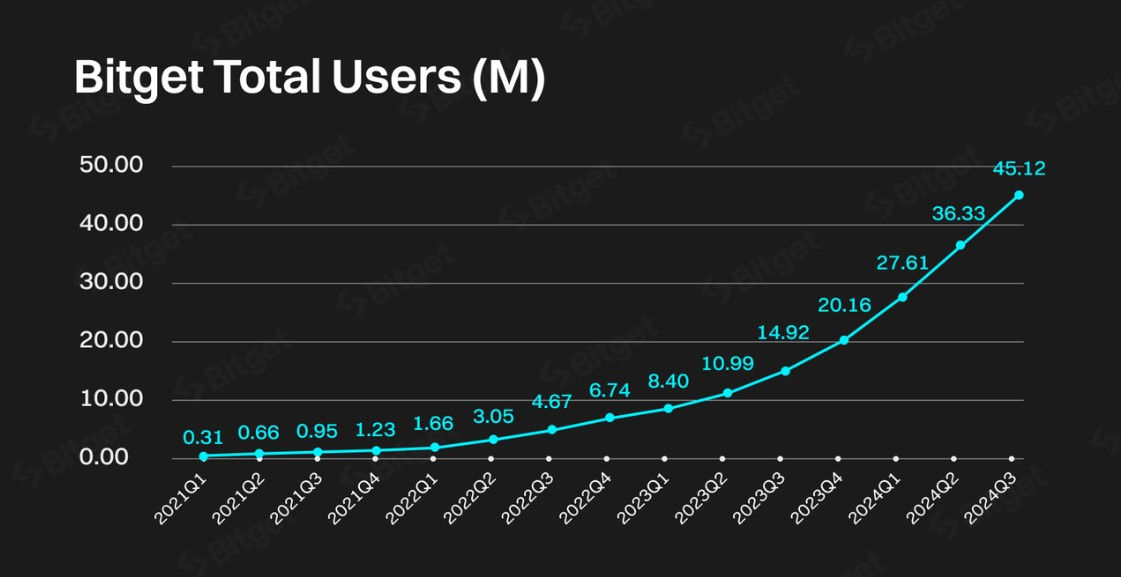

45 million

Number of users Bitget surpassed globally as it celebrates its 6th anniversary.

400% increase since 2023.

Africa led with an impressive 1,614% growth

South Asia followed with 729% growth

Southeast Asia recorded 216% growth

Trading volume: Bitget now handles over $10 billion in daily trading volume.

Net inflows: The platform saw a net inflow of $779 million in assets during the first half of 2024.

New Features:

Bitget’s PoolX attracted 350,000 users shortly after its launch.

Pre-market trading engaged 35,000 traders within months of its introduction.

The rise of memecoins popularity of TON and peer-to-peer (P2P) trading played a crucial role in attracting new users. Millions of Africans use Telegram, which has become a gateway into Web3. Bitget positions itself as a "TON-friendly" platform.

Events at Token2049: Bitget is showcasing its growth at the Token2049 event in Singapore, sponsoring awards to recognise blockchain innovators.

SEC settles with Rari Capital

The US Securities and Exchange Commission (SEC) has reached a settlement with Rari Capital and its co-founders.

Allegations? Misleading investors and engaging in unregistered broker activity related to their DeFi pools.

The SEC says that Rari Capital's Earn and Fuse pools operated like investment funds. this allows users to deposit crypto assets and earn returns.

The SEC claimed these pools involved unregistered securities sales.

The SEC says Rari told investors their Earn pools would automatically optimise yields, but in reality, manual intervention was often required, which was not consistently performed.

Co-founders charged: The SEC charged Rari's co-founders—Jai Bhavnani, Jack Lipstone, and David Lucid—with engaging in unregistered broker activities through the Fuse platform.

They have agreed to various penalties, including permanent injunctions and a five-year ban from serving as officers or directors.

The settlements are subject to court approval.

Background on Rari Capital: Launched in 2020, Rari Capital gained popularity for its automated yield farming services.

The Surfer 🏄

Tigran Gambaryan, a Binance executive, has been detained in Nigeria for over six months, with his health reportedly deteriorating. His mother, Knarik Gambaryan, is urging the US government to intervene and secure his release, claiming he is "detained wrongfully."

Michelle Bond, partner of ex-FTX exec Ryan Salame, pleads not guilty to four campaign finance violations in federal court. She is free on a $1-million bond and restricted from traveling outside the continental US.

Louisiana has officially accepted its first crypto payment for state services. Residents can now pay using Bitcoin (BTC), the Bitcoin Lightning Network, and USD Coin (USDC).

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋