Saga is the star🎢

Demand for the Solana Saga phone is going BONKers. The SEC denies Coinbase's petition: not a nice move. Blockchain-based lending is booming. Ankex closing down and SafeMoon filing for bankruptcy?

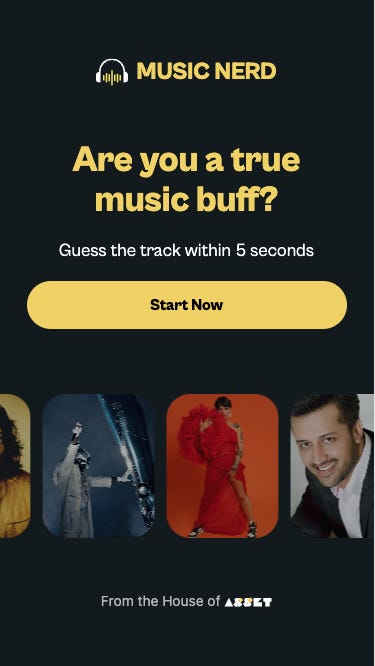

Hello, y'all. If you think you know your music, then this is for you frens 👇

Guess-the-song game for the artist you pick.

Leaderboard to share your scores with other fans.

Bragging rights to take home.

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Demand for the Solana Saga phone is skyrocketing, and it's fetching prices far beyond its $599 sticker.

Why? Cause traders are going absolutely BONKers.

Well, it's all about BONK, the sensational Solana-based meme coin.

You see, each Solana Saga phone comes with BONK tokens.

Read here: BONK Fest 🎉

And Saga is worth $5000 now.

From Sales Struggles to Sold Out

Solana Saga initially faced sales woes, with only 2,500 units sold and a far cry from their 50,000 targets. But then, the tide turned.

The phone started selling out in the US and became a hot commodity, especially as it included a generous 30 million BONK tokens, currently worth more than the phone itself.

Now, with demand reaching new heights, the Solana Saga phone is making waves on secondary marketplaces like eBay.

The phone, originally priced at $599, is being resold for ten times its value.

Bids for the Solana Saga range from $2,000 to $5,000, with some lucky sellers scoring the higher end of that spectrum.

The key factor here is that these sellers actually have the phone in hand, while others are still awaiting their shipments.

And the fact that memecoin prices can swing very quickly.

Saga's Rocky Start

Solana Saga smartphone offered advanced Android features with deep crypto integrations.

However, it struggled to gain traction due to the bear market and its initial price tag of $999.

Although the price was later dropped to $599 in August, the future of the Saga phone and Solana's mobile ecosystem remained uncertain.

Reports suggested that only a few thousand devices were sold in the first few months.

But this week, everything changed.

Solana Labs reported a sudden spike in sales.

The US market sold out completely, and European devices are also vanishing from the shelves at a rapid pace.

According to Solana Labs, a total of 20,000 Saga phones were ever produced, confirming the statistic shared by co-founder Raj Gokal on Twitter.

Fun fact: Apple's latest iPhone 15 Pro starts at a relatively modest $999 USD, approximately one-fifth of the price of the Saga phone in the secondary market.

TTD Coinbase🧿

The SEC is under fire as pro-XRP lawyer John Deaton accuses SEC Chair Gary Gensler of "gaslighting" regarding crypto.

Coinbase's rule making petition: Denied.

The SEC has given three main reasons:

Applying existing securities laws to crypto

Tinkering with crypto securities markets through rule making

Keeping the commission's rule making priorities intact

Deaton points out Gensler's contradicting statements on crypto, highlighting a shift from uniqueness to mundanity.

In it, Gensler boldly declares, "there is NOTHING unique or new about cryptocurrencies."

Deaton reminds us of Gensler's earlier congressional testimony in 2023.

During that performance, Gensler seemed to sing a different tune, claiming that crypto was a unique beast, different from anything the commission had seen before.

Coinbase has now filed a petition for review in the US Court of Appeals for the Third Circuit, asking the court to assess the legitimacy of the SEC's denial of its rule making petition.

This move comes after Coinbase's mandamus petition compelled the SEC to formally deny the request, clearing the path for judicial review.

TTD Hack 🦹🏻

Hackers have swiped millions of dollars’ worth of NFTs in a daring cyber heist, leaving the crypto world shaken.

Here's the lowdown on this audacious digital art robbery.

Peer-to-peer trading platform NFT Trader has confirmed the security breach, which occurred on December 16.

According to the platform, the attack targeted old smart contracts.

Stolen NFTs: The stolen NFTs included 37 from the Bored Ape collection, 13 from the Mutant Ape Yacht Club, and others, totalling nearly $3 million in losses.

The hackers are demanding a ransom to return the pilfered NFTs.

One hacker posted a public message, claiming the initial exploit was the work of another user.

They demanded a ransom for the return of the pilfered NFTs, shedding a nefarious light on this cyber caper.

The attackers have refunded a Bored Ape and 31 ETH to one user while returning certain staked Bored Apes to their rightful owners.

Yet, they've held onto the ApeCoin rewards.

Auxiliary Hacks: It doesn't end with the main hacker. Reports are surfacing of auxiliary hacks that have drained tokens like Cool Cats and Squiggles from users' wallets.

Where’s ETF?🚨

Analyst Nate Geraci believes that if the ETF is not approved, it could result in a significant market pullback, potentially one of the biggest in crypto history👇🏻

TTD Numbers 🔢

$582 million

Blockchain-based lending has surged to $582 million in 2023.

A 128% increase compared to a year ago.

Are loan seekers checking out blockchain alternatives?

Blockchain-based credit is highly competitive.

Competitive APR

Average APR from blockchain credit protocols: 9.65%.

Traditional small business bank loan interest rates: 5.75% to 11.91%.

Substantial Loans

Total blockchain-based loans: $4.5 billion.

Average loan size: Approximately $2.5 million.

Market Leaders: Ethereum-based Centrifuge dominates the blockchain-based loans market with over 43% share, reaching $255 million.

Goldfinch and Maple follow, with $143 million and $103 million in active loans, respectively.

Currency of Choice: Stablecoins like Tether (USDT), USD Coin (USDC), and Dai (DAI) play a pivotal role.

Blockchain-based loans span various sectors

Consumer sector: $197.7 million.

Automotive sector: $186.8 million.

Other sectors involved: Fintech, real estate, carbon credit, cryptocurrency trading.

But still, blockchain-based loans as a fraction of the traditional private credit market: 0.3%.

TTD ShutDown 🔐

Ankex Closure

Ankex, a cryptocurrency exchange launched last year, has ceased its operations and closed down.

The exchange was headed by former Genesis Trading CEO Michael Moro, who had taken the helm of Ankex earlier this year.

However, Michael Moro appears to have left the organisation, as indicated by changes to his profile on X.

Qredo, a custody firm associated with Ankex, communicated to its community that "Ankex development has been paused."

Ankex had been prepared for a public beta launch but had to halt its progress at this point.

SafeMoon Bankruptcy

Crypto firm SafeMoon has filed for Chapter 7 bankruptcy as its executives face criminal charges in the US.

The company, which is associated with the SafeMoon token, has between 50 and 99 creditors and owes between $100,000 and $500,000.

SafeMoon's executives, including CEO John Karony and CTO Thomas Smith, were arrested last month on charges of securities fraud conspiracy, wire fraud conspiracy, and money laundering conspiracy.

TTD Surfer 🏄

Jupiter, a Solana-based DeFi aggregator, is set to begin its airdrop in January, with a billion JUP tokens being distributed to Solana DeFi users.

Canadian Bitcoin mining firm Hut 8 has signed a deal to develop a new mining site in Texas as part of the Celsius Network bankruptcy proceedings.

Crypto wallet provider Blockchain.com is set to expand its workforce by 25% in Q1 2024 and has hired a new senior vice president.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋