Seismic Shift in Crypto Market 🌸

What's driving the crypto market? Bitcoin ETFs bleed as investors cash out. Franklin Templeton lists Ethereum ETF. Runes offers miners a lifeline. Yuga Labs lost its way’ says CEO.

Hello, y'all. It’s another week of crypto swings, and now will the real Slim Shady please stand up? Aye Captain👇

American rapper Marshall Mathers, Eminem, is the latest celebrity to advertise “fortune favours the brave” for Crypto.com, after Matt Damon’s ad spot in 2021.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

As we look ahead to closing of another month in crypto, one with fair swings and consolidation. A month that showed crypto's resilience in the face of geo-political issues and macro economic concerns with US debt and economic growth.

We break down the 2024 Chainalysis Spring Report.

What's been the seismic shift in crypto market?

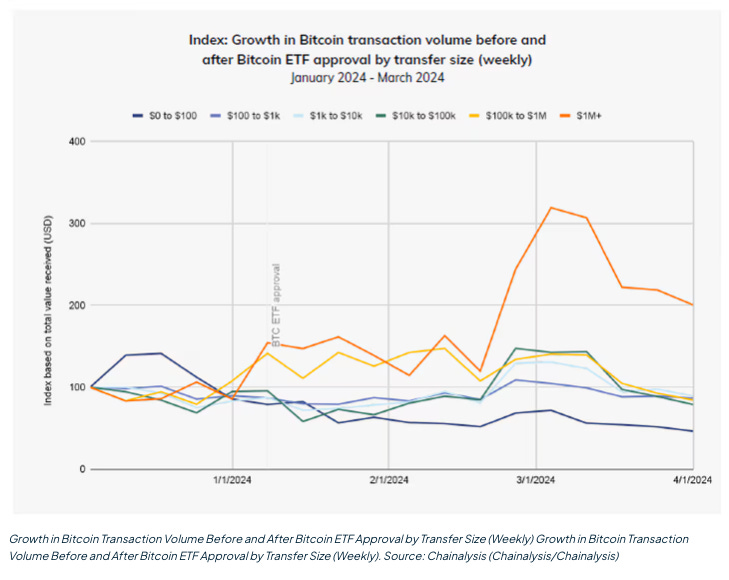

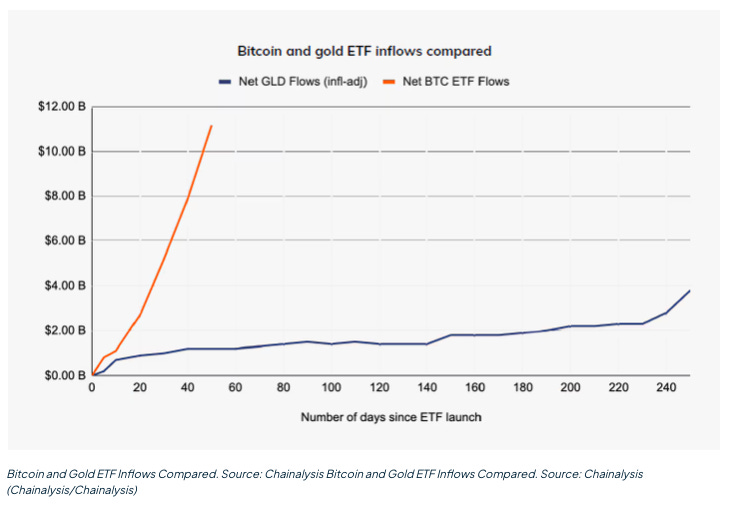

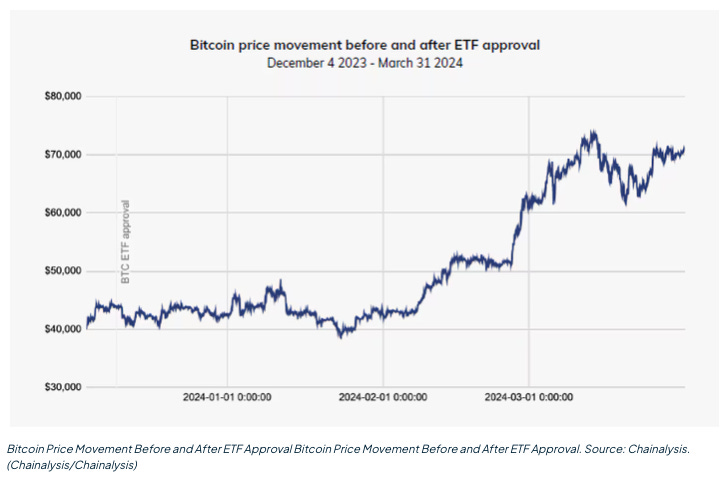

Surging Demand for Bitcoin: Bitcoin ETFs have generated significant new demand for the cryptocurrency. According to Chainalysis, in less than 50 days, net flows into Bitcoin ETFs have soared past $10 billion - far outpacing the first days of the first gold ETF launch in 2005.

Comparisons to Gold: Comparisons between gold and Bitcoin have hit a fever pitch since the launch of Bitcoin ETFs. In terms of inflows, the first days of the Bitcoin ETF launch far outpaced the first days of the first gold ETF.

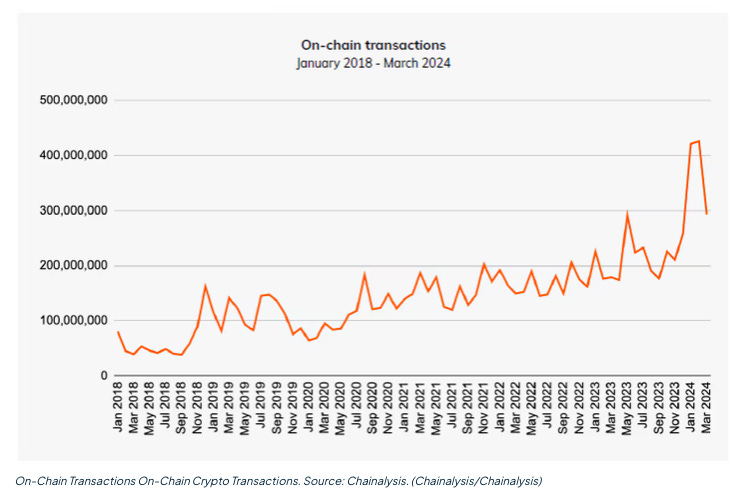

Boom in On-Chain Activity: The 2024 increase in the number of on-chain Bitcoin transactions is far more pronounced than in previous years, underscoring the wider impact ETFs have had on the crypto market.

Soaring Bitcoin Prices: Bitcoin has soared to all-time highs well in advance of its halving event, which typically leads to price increases. The halving refers to a programmed reduction in Bitcoin's mining rewards every four years.

Rebranding of Crypto Sector: Bitcoin ETFs have done more than just drive up prices - they have also provided the crypto sector with a rebrand. Chainalysis said "It's clear that we're experiencing a seismic shift in both perception and usage of crypto."

Block That Quote 🎙️

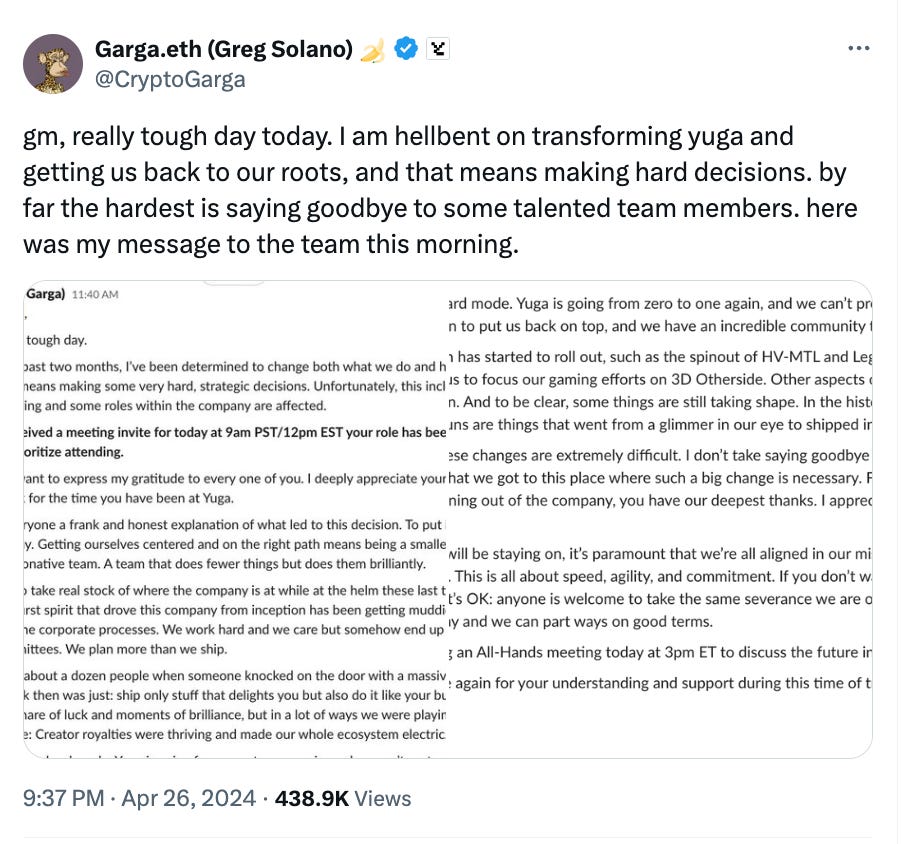

Yuga Labs co-founder Greg “Garga” Solano, who returned as CEO in February.

“I owe everyone a frank and honest explanation of what led to this decision. To put it simply: Yuga lost its way.”

Yuga Labs, the creator of the popular Bored Ape Yacht Club NFT collection, announced a restructuring initiative that includes layoffs.

In a message to employees, Solano acknowledged that the company had "lost its way" and said he is "hellbent on transforming Yuga and getting us back to our roots."

He stated that the "hardest" decision was having to say goodbye to some "talented team members" as part of the restructuring.

The layoffs are seen as another setback for the BAYC NFT creator, as the overall NFT market has experienced a significant downturn in sales volume from its peak in early 2022.

Runes Offers Miners A Lifeline

The Runes protocol has generated over $135 million in transaction fees on Bitcoin within its first week.

The Runes token standard was recently launched on the Bitcoin network and allows for the minting of tokens, typically memecoins, directly on top of the Bitcoin network.

Nazar Khan, the co-founder and COO of TeraWulf, on the rise in transaction fees from Bitcoin Runes, told CoinTelegraph.

“Runes significantly increased the transaction fees, so if anything, there was an increase in the hash price in the first 24-30 hours [after halving]. Since then, we’ve seen transaction fees come down, but compared to the average fees in 2023, they’re still pretty high.”

Read: What Are Bitcoin Runes? 🙇♀️

In the Numbers 🔢

$328 Billion

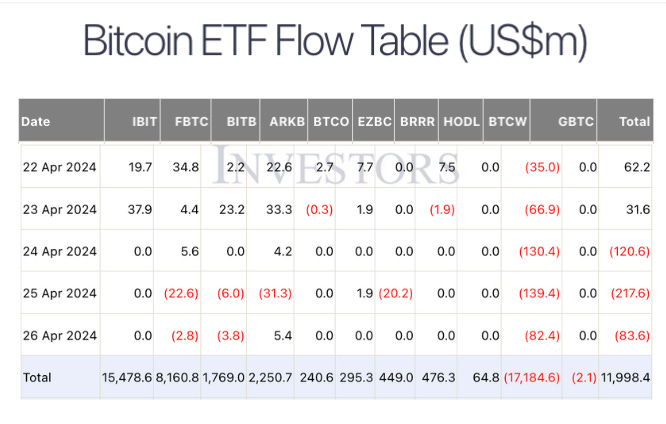

The outflows of the US spot Bitcoin ETFs in the last week.

BlackRock's Bitcoin ETF, IBIT, reported zero inflows on the last three trading days, breaking a 71-day run of consecutive inflows.

Fidelity's spot Bitcoin ETF also saw its first net outflows since launching in January 2024.

The overall outflow from US Bitcoin ETFs on Thursday was $218 million, one of the worst daily outflows as demand for risky investments has declined due to expectations of higher interest rates from the Federal Reserve.

The decline in Bitcoin ETF inflows is attributed to the macro environment, with higher Treasury yields making speculative investments like crypto less attractive.

Franklin Templeton Lists Ethereum ETF

Franklin Templeton, a $1.5 trillion asset management firm, has launched its Ethereum ETF - the Franklin Ethereum TR Ethereum ETF (EZET) — on the Depository Trust and Clearing Corporation (DTCC) website, a significant platform for securities transactions in the United States.

The DTCC listing allows creation and redemption of shares, keeping the ETF price close to its net asset value.

SEC approval is still pending. The SEC postponed its decision on April 23rd, extending the evaluation period by 45 days to June 11th.

Bloomberg Analyst Eric Balchunas estimates a 35% chance of SEC approval.

The Surfer 🏄

Arkham Intel found wallets associated with WBIT, a physical Bitcoin exchange-traded product (ETP) from WisdomTree. WBIT holds 8,900 BTC across 134 wallets, valued at around $579 million.

Crypto trader known by the Solana Name Service username "paulo.sol" has netted over $22.8 million in profits by strategically trading Solana-based meme coins such as Dogwifhat (WIF), Jeo Boden (BODEN), and Bonk (BONK).

Prosecutors in Taiwan are recommending 20-year prison sentences for the four main suspects in the fraud and money laundering case related to the cryptocurrency trading platform Ace Exchange.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋