Should You Invest in MicroStrategy’s Bitcoin Bet? 🍔 🤔

Bitcoin as treasury reserve has turned a mid-size software company into de facto BTC investment vehicle. MicroStrategy's all-in approach is a double-edged sword, a complex proposition for investors.

Hello, y'all. The music quiz game that’s got over million plays. Who are you playing with then 👇

Look at this man in the picture. Not for the mystique, not for the intrigue. For the sheer audacity and unshakable belief that this is it. This is Bitcoin. It works.

This is Michael Saylor. Possibly the biggest Bitcoin salesman that ever is.

The co-founder and executive chairman of MicroStrategy.

The company that has championed the cause of Bitcoin, like no other.

They are the largest Bitcoin holding public company, more than the US government. Also dwarfing some of the large fund houses who manage spot Bitcoin ETFs in the US.

It’s a software company that provides solutions and business intelligence to companies, they have got nothing to do with crypto or Bitcoin.

Four years ago they decided to make Bitcoin their primary treasury reserve.

It has built an entire Bitcoin treasury with 252,220 BTC valuing worth over $15 billion in the last four years.

How much is that? About 1% of the total Bitcoin supply.

An asset that they reckon will beat the US dollar blues. An asset that knows just one way - up. Bitcoin hasn’t disappointed so far.

That was the beginning, and now it’s a legacy that is catching on with other corporate companies - adopting Bitcoin as their treasury reserve.

But, why Bitcoin?

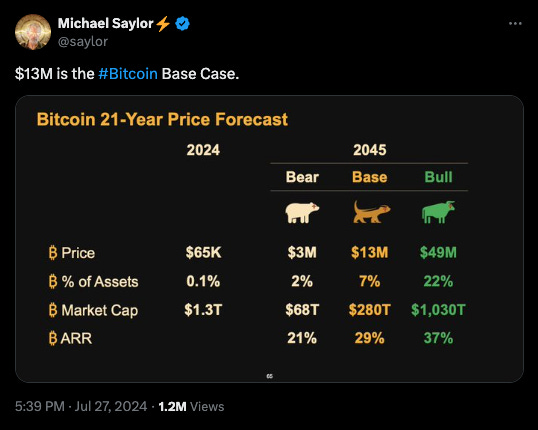

Saylor has been bullish about Bitcoin since 2020.

When he saw the core unit of the business stagnate, he threw his weight behind the most popular cryptocurrency.

He believed Bitcoin allowed companies to transcend the limitations of traditional finance and achieve "economic immortality”.

It considers itself “the world’s first Bitcoin development company”.

MicroStrategy’s Bitcoin shopping strategy in 2024

The company has been raising debt funds to buy Bitcoin. Through convertible senior notes.

In September 2024, MicroStrategy offered $875 million of convertible senior notes due 2028, which was later upsized to $1.01 billion.

What are convertible senior notes? Debt, with a twist.

Public lends money to MicroStrategy. They get long tenure unsecured debt notes. Plus a low interest on the funds they have lent. At the end of the tenure, they can swap these notes for shares of the company.

The notes are unsecured, senior obligations of MicroStrategy.

They bear low interest rates.

Interest is payable semi-annually.

The notes are convertible into cash, shares of MicroStrategy's class A common stock, or a combination, at MicroStrategy's election.

Conversion is only allowed upon certain events before maturity, then freely convertible near maturity.

Simple, right? Not really.

This is not the first time for an offering like this. It’s a playbook.

September 2024: $875 million of 0.625% convertible senior notes due 2028, later upsized to $1.01 billion.

June 2024: $700 million of 2.25% convertible senior notes due 2032 (upsized from initially announced $500 million).

March 2024: A $600 million convertible notes due 2031 (interest at a rate of 0.875% per annum, payable semi-annually in arrears)

December 2020: $650 million of 0.75% convertible senior notes due 2025.

All these additional funds for what? Three things.

Pay off existing debt.

As of June 2024, there’s $3.90 billion outstanding debt in MicroStrategy’s books.

And?

Buy more Bitcoin.

Then, if there’s more funds, put them in general corporate purposes. Remember, it’s got a core business in software that it may also want to grow?

The Home for All the Music Lovers

Muzify - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

MicroStrategy’s Bitcoin trajectory

Its Bitcoin strategy helped the company shoot up its market cap to $29 billion from $3.6 billion in December 2020. More than 7x growth.

And about 60% of the market cap is accounted by Bitcoin. Yes, not the ‘core’, but the Bitcoin treasury that it has built over the past four years.

Time for a pivot?

Is this the sign of repositioning itself from a software company to a proxy for the world’s biggest cryptocurrency?

One of the biggest signs is the fact that the company has come up with Bitcoin Yield as a KPI in its quarterly results to inform its investors about the performance of its crypto buying strategy.

And Saylor’s not alone. His strategy has earned him some followers.

More companies - even those who were traditionally into mining Bitcoin - have now pivoted into building Bitcoin treasuries.

Read: Maximising Bitcoin per Share: A New Corporate Strategy

Cathedra Bitcoin, Marathon Digital, Metaplanet and Semler Scientific. All of them have started adding Bitcoin to their balance sheets.

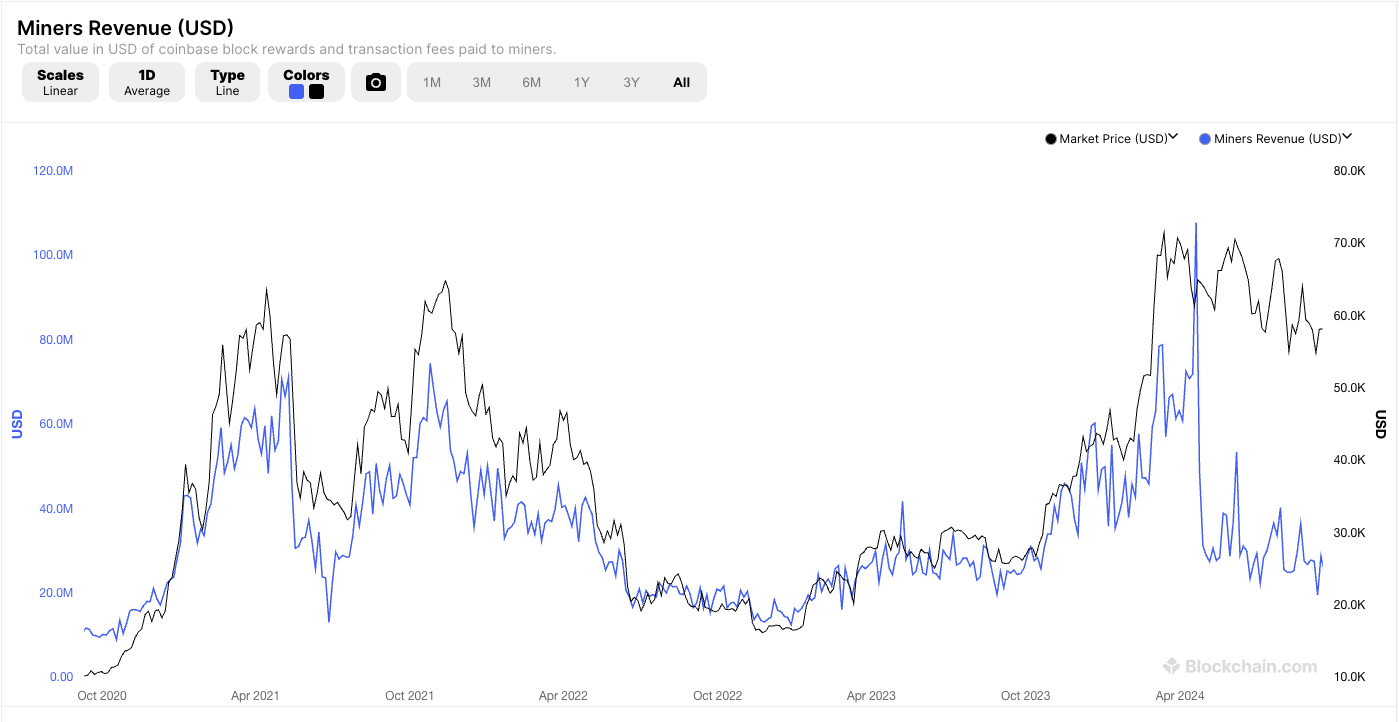

What’s driving some of these mining companies into building Bitcoin treasuries?

Dropping mining revenues.

Does the strategy work?

MicroStrategy is bullish. Kerrisdale Capital isn’t.

“The days when MicroStrategy shares represented a rare, unique way to gain access to bitcoin are long over. Bitcoin is now easily obtainable through brokerages, crypto exchanges, and more recently low fee ETPs and ETFs,” the investment management firm said in its March 2024 analyst note.

Why is MicroStrategy bullish?

The company allows investors to have exposure to Bitcoin, but through regulated markets. And, since the company is piling its reserves, it does not sell off even when the larger Bitcoin market goes through a panic selling slump.

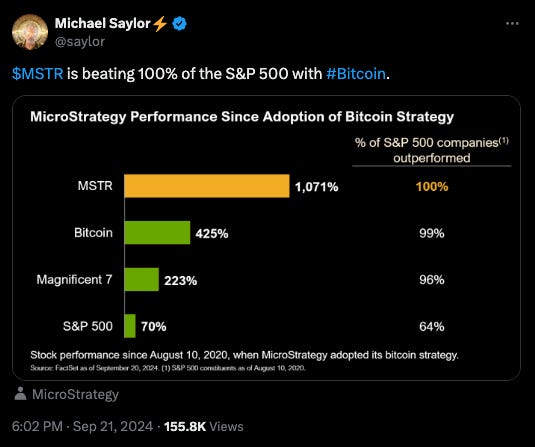

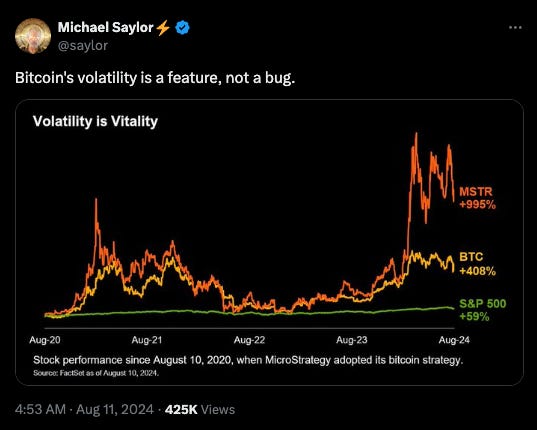

Result? MSTR shares have outperformed even Bitcoin spot price movement.

Think of it - a derivative financial instrument outperforming its underlying.

Plus, it’s got the backing of the who’s who in the capital markets.

Vanguard and BlackRock hold $2.6 billion and $2.1 billion worth of stake in MSTR.

“A lot of people, they don’t want to own or they can’t own bitcoin. Some would say, ‘Give me the volatility of the S&P and half of the performance of bitcoin, and I’d be totally happy’,” Saylor said.

So, should you buy into MicroStrategy’s Bitcoin bet?

Kerrisdale doesn’t feel so. It is one of the most shorted stocks in the US.

Ranks 53 in Fintel’s list of The Big Shorts.

Kerrisdale’s note highlights a list of reasons for not choosing MSTR.

Unjustified premium: Stock is trading at over 2.5 times the spot price of Bitcoin, implying a Bitcoin price of $177,000.

ETF alternatives: With the approval of spot Bitcoin ETFs, investors now have easier and potentially cheaper ways to gain Bitcoin exposure, reducing MicroStrategy's unique appeal.

Inflated market cap: Market capitalisation of the company exceeds the value of Bitcoin holdings (currently over $29 billion market cap and almost $16 billion BTC holdings)

Diminished uniqueness: MicroStrategy is no longer a rare or unique way to access Bitcoin investments, investing in crypto has many channels.

Potential for contraction: Kerrisdale believes there's a "compelling opportunity" for the premium on MicroStrategy's shares to contract.

Short position: Kerrisdale has taken a short position on MicroStrategy while maintaining a long position on Bitcoin/ They believe in Bitcoin's value but not in MicroStrategy's current valuation.

Market overreaction: Kerrisdale reckons that MicroStrategy's stock price surge following Bitcoin's recent uptrend is an overreaction typical in the crypto market.

MSTR shares face potential downside of up to 50% - like Bitcoin, MicroStrategy is also stuck in a range.

Token Dispatch View

MicroStrategy's risky treasury play.

This unorthodox approach has turned what was once a mid-sized software company into a de facto Bitcoin investment vehicle.

MicroStrategy's strategy is Saylor’s rationale: Bitcoin is a superior store of value compared to cash. It’s a hedge against inflation, which he describes as turning cash into a "melting ice cube."

By adopting Bitcoin as its primary treasury reserve asset, MicroStrategy aims to protect and grow shareholder value in an era of unprecedented monetary expansion.

To fund this audacious plan, MicroStrategy has repeatedly tapped capital markets, raising billions through convertible notes at surprisingly low interest rates. This financial engineering has allowed the company to accumulate vast Bitcoin holdings while minimising immediate shareholder dilution.

For investors, it's a complex proposition. MicroStrategy offers Bitcoin exposure through a public company, attracting those wary of direct crypto investments.

The stock has soared, but so have the risks.

The company's aggressive use of debt to finance Bitcoin purchases is concerning. The low interest rates on their convertible notes are attractive now, any future tightening of credit markets could pose challenges for refinancing or further capital raises.

The company's fortunes now rise and fall with Bitcoin's volatile market, and its debt-fuelled strategy could backfire if credit markets tighten.

MicroStrategy's Bitcoin treasury strategy represents a radical departure from traditional corporate finance practices. It's a high-stakes bet on the future of money and a challenge to conventional wisdom about corporate treasury management.

It challenges corporate finance norms and has turned heads on Wall Street.

As other companies cautiously explore adding Bitcoin to their balance sheets, MicroStrategy's all-in approach is a double-edged sword.

For investors, it offers a unique vehicle for Bitcoin exposure, but one that’s in tune with high risk and high reward.

Week in Funding 💰

Drift. $25M. Solana on-chain asset trading platform that offers perpetual contracts and prediction market.

Helius. $21.75M. Provide APIs to understand on-chain data and query transactions, and webhooks that enable automations and bots.

Hemi Network. $15M. Modular Layer 2 network facilitating Ethereum smart contract functionality secured by the Bitcoin network.

Yellow Network. $10M. Decentralised clearing network for digital assets to address the inefficiencies of traditional crypto trading systems.

Sorted. $1.5M. non-custodial cryptocurrency wallet that provides access to funds for unbanked and underbanked individuals in developing regions

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋