Solana Slump and Pump.fun fizzle? ⛽

Solana is down over 30% from March 2024 highs. Are Degens dumping Pump.fun? Ethereum's layer-1 network revenue down 99%. Monthly NFT sales fall below $400M, marking yearly low. Crypto outflow $305M.

Hello, y'all. Music quiz that’s got over million plays 👇 Game for winners only, you 🤔

Solana's market cap fell by over $10 billion in August 2024.

The fifth-largest cryptocurrency by market capitalisation is down to $60 billion from the highs of $90 billion in March 2024.

Bitcoin's own $100 billion market cap loss in the past 30 days has likely impacted Solana, as the largest cryptocurrency often dictates overall market direction.

What has contributed to Solana’s decline?

Decreased on-chain activity: Solana has seen a significant reduction in daily transactions, which have fallen by 22% over the past 30 days.

This decline in transaction count has led to a 45% drop in transaction fees, reflecting decreased demand for Solana's network services.

Stagnant total value Locked (TVL): The total value locked in Solana's leading projects has seen minimal declines.

Lack of new capital inflows and reduced investor confidence in the network.

Declining interest in memecoins: The waning interest in Solana-based memecoins has contributed to a sharp decrease in user activity on the blockchain.

Fewer daily active addresses and a reduction in network fees and revenue.

Reduced network revenue: Solana's network revenue has dropped by 46% in 30 days, reaching its lowest point in six months.

Due to the reduced on-chain activity and lower transaction volumes.

Lower decentralised exchange (DEX) volume: The volume on Solana's decentralised exchanges has hit a six-month low, indicating less trading activity and interest in the network.

DEX volume on Solana declined by 30%.

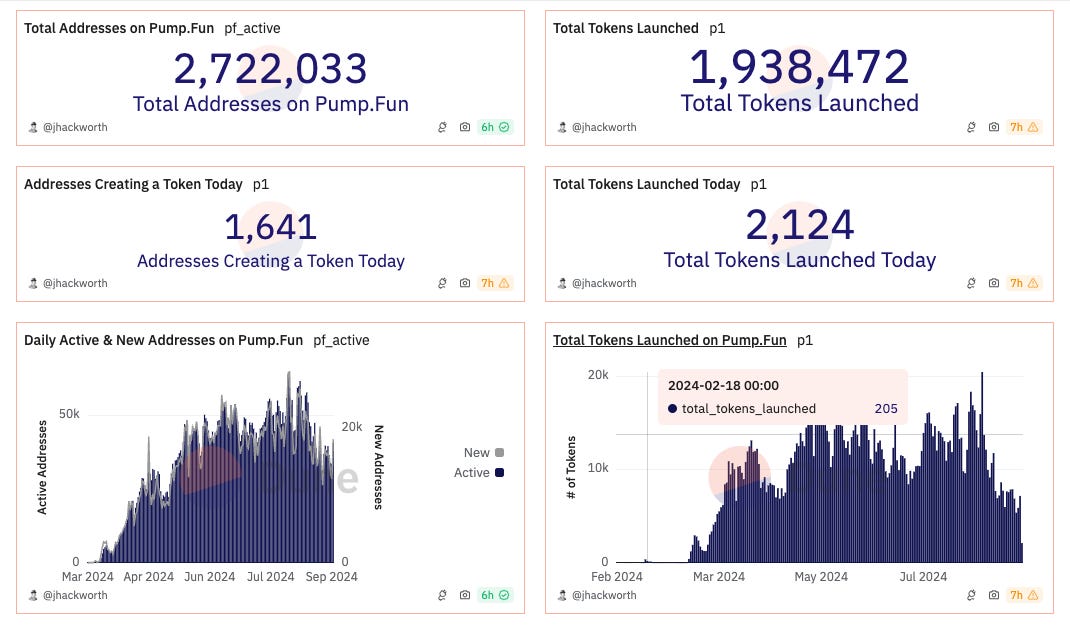

Are Degens dumping Pump.fun?

Solana’s slump has come along with the memecoin market’s decline.

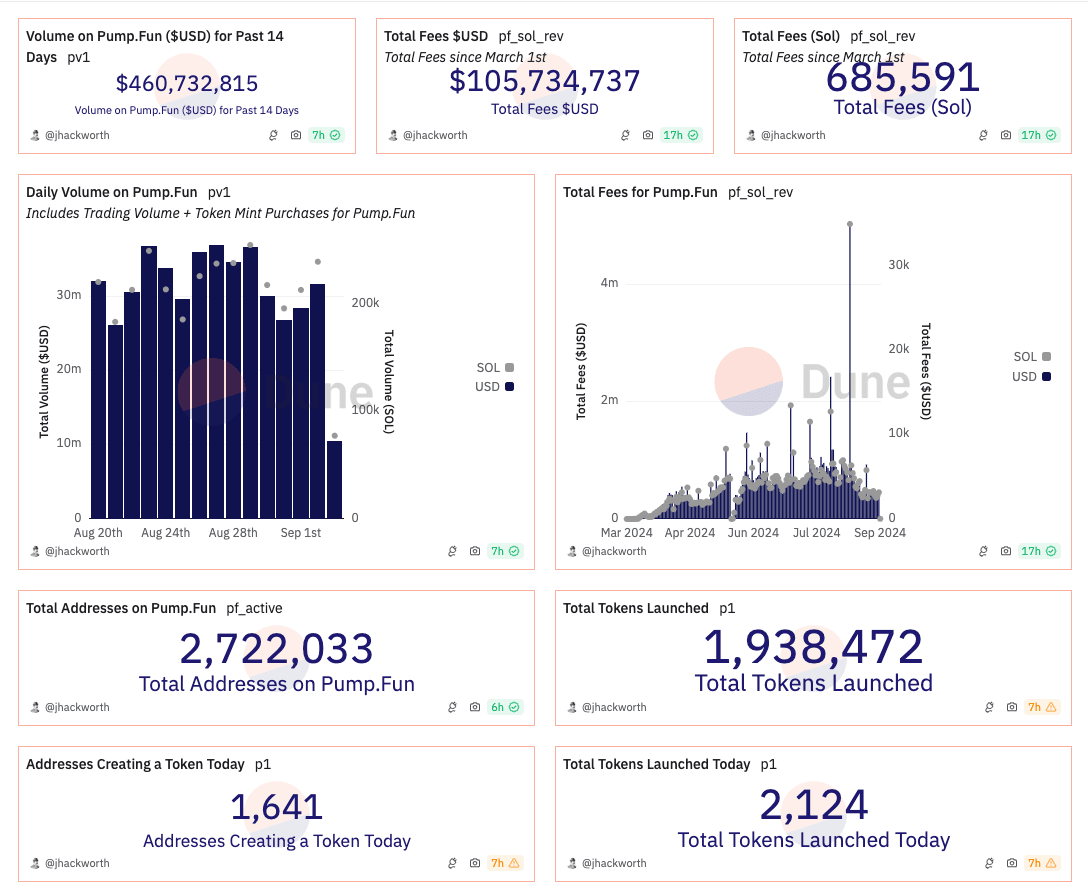

The downturn comes as the popular token launchpad, Pump.fun, witnessed a drastic drop in user activity and new token creation.

Steady decline in activity from its peak, three weeks ago when the launchpad deployed 20,465 tokens in a single day to just 5,388 on a August 31.

Daily revenue has fallen to an average of 2,819 SOL, about 20% of its all-time high.

Factors contributing to decline

Backlash against the high volume of token launches.

Introduction of free token launches and incentives for successful releases.

Launch of competing platform SunPump on the Tron network.

This on the back of record-breaking growth

Pump.fun, the Solana-based memecoin launchpad, has achieved a remarkable milestone by reaching $100 million in revenue in just 217 days since its January launch.

This makes it the fastest-growing protocol by revenue in the cryptocurrency ecosystem, outpacing its nearest competitor by 34 days.

Experts predict further downside

Analyst Scient suggests Solana is in a bear pennant formation, potentially leading to another bearish breakout in the next 4-6 weeks.

Crypto strategist Benjamin Cowen draws parallels to 2019, predicting significant drops for altcoins following their earlier 2024 gains.

Solana's success attracts competitors

Solana has emerged as a frontrunner among smart contract blockchains this market cycle.

Ethereum continues to be the most relevant comparison point for Solana.

The two blockchains have captured the majority of attention among non-Bitcoin chains, with Solana often touted as an "ETH killer" in its early days.

Several competitors are vying for a share of its success.

Sui: A layer-1 blockchain built on the Move programming language.

Aptos: Another Move-based layer-1 blockchain.

Sei: Emerging as a potential challenger.

Monad: Claims to achieve 10,000 TPS in testing.

Base: Gaining traction as a competitor.

Ethereum: Longtime rival, often compared to Solana.

Move-based blockchains

Transaction costs: Sui and Aptos offer transaction fees of a fraction of a cent.

Transaction speed: Average 30-50 transactions per second (TPS).

DeFi metrics: Currently, Sui and Aptos hold $611 million and $418 million in total value locked (TVL), respectively, compared to Solana’s nearly $5 billion.

Solana's ecosystem advantage: Non-vote TPS averaging 500-750 and nearly $5 billion in TVL, significantly higher than competitors.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

Binance Executive Tigran Gambaryan on trial for money laundering in Nigeria.

“I’ve been complaining about this since forever, and nothing was done.”

Gambaryan pleaded with a judge for back surgery due to a herniated disc causing severe mobility issues. He has been denied a wheelchair, exacerbating his condition.

“I’ve been complaining about this since forever, and nothing was done. The lack of appropriate care has left me with permanent nerve damage and that’s why I’m in this present state where I can no longer walk.”

Legal proceedings: Gambaryan's health has become a central issue in the trial against him and Binance, accused of currency speculation and money laundering involving $35 million.

His lawyer, Mark Mordi, filed a new bail application citing medical neglect, which was previously denied.

Allegations of neglect: Gambaryan's legal team accuses prison officials of worsening his health by denying adequate medical care and access. Prosecutors argue that his condition is exaggerated and that he receives necessary medical attention.

Trial adjournment: Justice Emeka Nwite ordered prison officials to provide a wheelchair and adjourned the trial to September 4 for a ruling on the bail application. Gambaryan's employer, Binance, denies the charges against him.

Read: Nigeria's Crypto Crime Thriller 🇳🇬

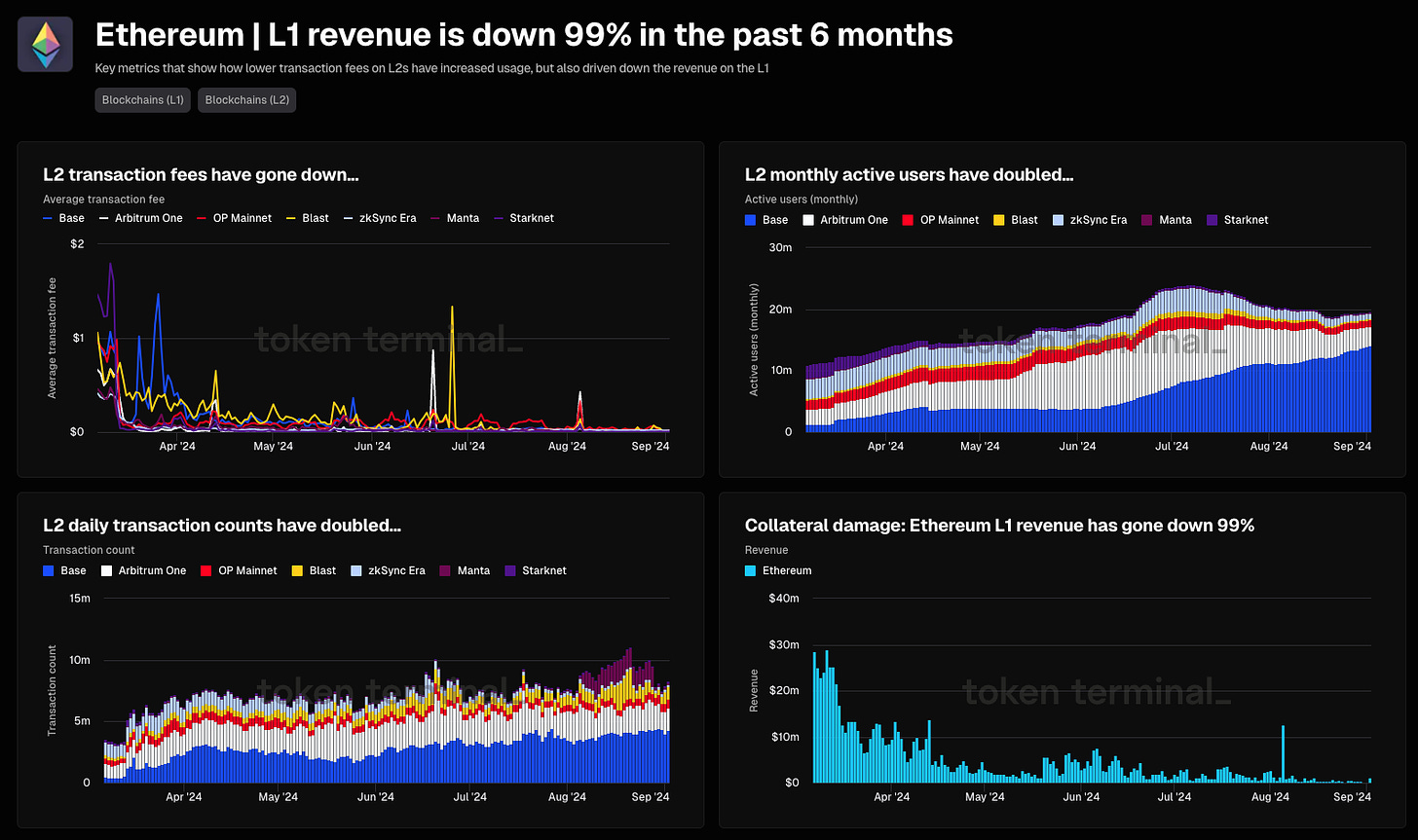

Ethereum's Layer-1 Network Revenue Down 99%

The network fees fell from a peak of $35.5 million on March 5 to just $578,000 on September 2.

Dencun upgrade impact: The dramatic decrease followed the Dencun upgrade on March 13, which significantly reduced fees for Ethereum layer-2 transactions.

Explosion of layer-2 solutions: The reduction in fees led to a surge in competing layer-2 solutions, with 74 Ethereum L2 projects and 21 layer-3 projects listed on L2Beat.

Market Saturation: Adrian Brink, CEO of Anoma, estimates there are about 10 times more layer-2 solutions than needed, intensifying competition.

Economic implications

Inflationary Supply Pressure: Lower transaction costs have offset the deflationary effects of EIP-1559, leading to a growing supply of ETH.

Price Impact: The lack of demand for ETH, combined with low transaction costs, has pushed its price below the $3,000 level.

Balancing Act: Ethereum faces challenges in balancing layer-1 revenue with the advantages of layer-2 scaling.

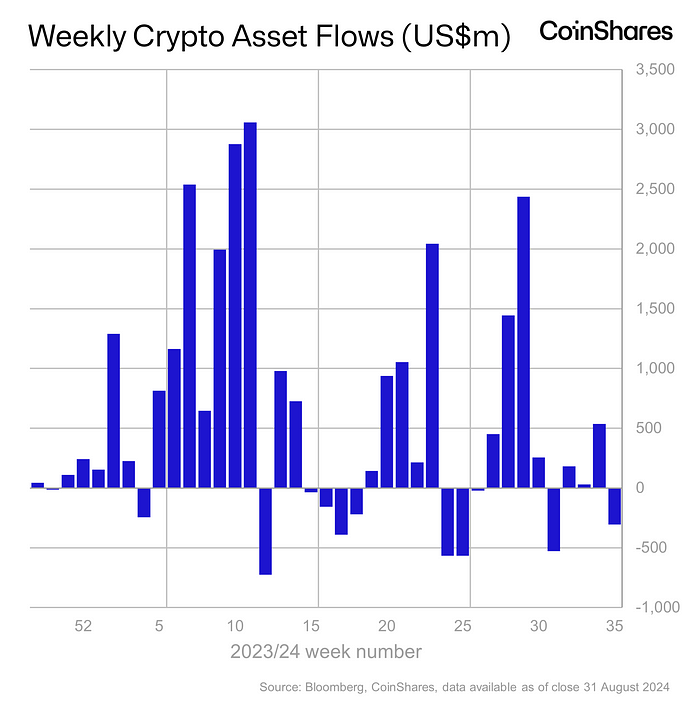

In The Numbers 🔢

$305 million

Total outflows for global crypto investment products last week, reversing the previous week’s $543 million inflows, Coinshares report.

CoinShares Head of Research James Butterfill.

“We continue to expect the asset class to become increasingly sensitive to interest rate expectations as the Fed gets closer to a pivot.”

Market sentiment: Outflows were driven by negative sentiment and stronger-than-expected US economic data, denting the chances of a significant interest rate cut.

Bitcoin Outflows: Bitcoin-based investment products saw $319 million in net outflows, with short Bitcoin funds registering $4.4 million in inflows.

ETF Impact: U.S. spot Bitcoin ETFs accounted for $277.2 million in outflows, leading to monthly negative flows of $94.2 million for the first time since April.

Ethereum Outflows: Ethereum investment products faced $5.7 million in net outflows, with trading volumes dropping to just 15% of levels seen during the U.S. spot ETF launch in late July.

Blockchain Equities: Investment products focused on bitcoin miners saw net inflows of $11 million, indicating selective interest in specific areas of the crypto market.

NFT Sales Hit 2024 Low

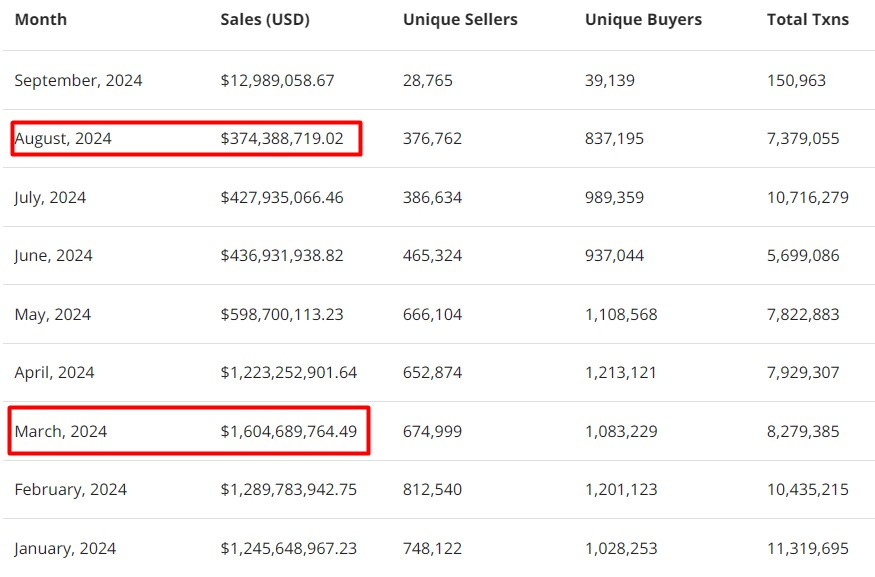

NFT sales fell to $374 million in August 2024, marking the lowest monthly volume this year and a 76% drop from the March peak of $1.6 billion.

Quarterly performance: The NFT market saw a strong first quarter with $4.1 billion in sales, but volumes dropped by 45% in the second quarter to $2.24 billion. Despite a surge in weekly sales at the end of August, the overall decline continues.

Transaction dynamics: The number of transactions decreased by 31% in August compared to July, the average sale value increased by 27% to $50.74.

Is speculative capital moving from NFTs to memecoins?

Solo Ceesay, co-founder and CEO of social wallet Calaxy

“Speculative capital in the space has disproportionately flowed into memecoins versus NFTs so far this cycle. Additionally, institutional capital preceded retail, which could influence those future inflows to flow into safer investments to avoid being overexposed too late in the cycle.”

Andreas Brekken, CEO and founder of trading platform SideShift.ai, criticised the value of NFTs.

“At this point, there are two possible views: Either NFTs are over or this is the bottom.”

The Surfer 🏄

The Qatar Financial Centre has launched a digital assets framework focused on tokenisation and smart contracts, aiming to enhance transparency and align with international standards in Qatar's financial sector.

BNB, Binance's native token, fell 16.1% from August 23 to September 2, recovering slightly to $517 amid declining activity on BNB Chain, particularly in DEX volumes, raising investor concerns about a bearish market.

Crypto whales selling off $326 million worth of Cardano's (ADA) tokens following the Chang hard fork. price struggles to break out of its bullish pattern due to overvaluation and lack of support from key investors,

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋