Stablecoin Slide 🛝

Stablecoins on downhill race, losing 35% in 18 months. Sam Altman likes Bitcoin but not CBDCs. Twice in a row; Stars Arena gets exploited. Yuga Labs, Ledger and Chainalysis chop their staff.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

This is what we feel 👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Stablecoins have been riding a downhill track for the past 18 months.

But is this a mere thrill ride or a descent into oblivion?

Think back to May last year when the stablecoin market was thriving with a whopping $189 billion in capitalisation.

Flash forward 18 months, and the numbers tell a gloomy tale—35% drop, nestling the value at $124 billion.

And it's not without cause. The disastrous collapse of Terraform and its native stablecoin UST was a significant blow.

But it wasn't alone.

What caused the crash?

For starters, retail participation dwindled from its peak in 2021.

From the highs of $150-300 billion daily trade volumes, we're now hovering around $50 billion.

Then there was the surge of the US treasury yield in 2022.

The appeal of stablecoins weakened as traditional financial yields outshone crypto-native yields.

Nic Carter, a partner at Castle Island Ventures, has a simple spin.

"It's really just traditional finance rates exceeding crypto-native yields"

So, what now?

Carter anticipates this downtrend to last as long as traditional finance rates remain high or until crypto yields bounce back through mechanisms like DeFi or Ethereum staking.

The titans of the stablecoin world

Although the stablecoin market is rich in variety, it's a handful of assets (USDT, USDC, DAI, TUSD, and BUSD) that reign supreme, holding a colossal 95% of the entire market capitalisation.

Among these, USDT has emerged as the true gladiator.

Even amidst instability and depegging concerns, it's surged to $83 billion market cap.

Meanwhile, USDC, a formidable adversary, has been grappling with challenges, diving to multi-year lows, in stark contrast to its parent company Circle's expansion.

Why the discrepancy?

US regulators, not being the biggest fans of the stablecoin market, have inadvertently shifted the balance.

USDC, an on-shore stablecoin, took a hit, while off-shore stablecoins like USDT rose to prominence.

Surprisingly, despite their volatility, stablecoins account for a whopping 70-80% of all settlement activities on public blockchains.

Even in a bear market, they remain a pivotal player in the crypto universe.

Uranium-backed stablecoin

A proposal has been made to back Maker's DAI stablecoin with tokenised uranium.

Maker's "Endgame Plan" is metamorphosing in surprising ways.

The addition of mainstream collateral like vanilla t-bills and accounts payable made sense.

But tokenised uranium? It's as groundbreaking as it is perplexing.

Aim of the endgame: Maximise revenue from real-world assets and convert to Ethereum, ensuring DAI's resilience against governmental actions.

Aim of Uranium tokenisation: "Democratise ownership of uranium" is the motto of the proposal, as penned by Uranium3o8. With tokenised uranium in the fold, DAI might just experience a nuclear-powered uplift.

Uranium3o8 is entirely serious about backing DAI. While they acknowledge there's much groundwork to be laid, their commitment is unwavering.

Redemption mechanism

Holding a significant number (20,000 tokens) allows users to redeem for 10 tons of real uranium.

Shipping responsibility lies with Madison Metals, not Uranium3o8.

Around the Globe

In Africa: Yellow Card believes stablecoins are the future of Africa's economy. Their statistics show a massive 1200% increase in stablecoin adoption within just a year, painting a promising picture for digital currencies in the region.

With Africa using crypto as a shield against inflation and a tool for cross-border payments, Yellow Card's addition of USDC on Solana's blockchain is a significant move.

In Canada: Canadian Securities Regulators (CSA) have softened their stance on stablecoins. The new guidelines require stablecoin issuers to ensure sufficient asset reserves with qualified custodians and maintain transparency regarding their operations.

This decision, influenced by feedback from Canada's crypto community, aims to enhance investor protection.

In Hong Kong: Retail stablecoin trading still doesn't have the green light in Hong Kong. Secretary Christian Hui underscores concerns about the volatility and potential collapse associated with stablecoins like Tether (USDT) and USD Coin (USDC).

The shadows of the JPEX exchange's recent fraud case loom large over the city's crypto outlook.

TTD Blockquote 🎙️

Sam Altman, OpenAI CEO

Bitcoin is "a super logical and important step on the tech tree.“

Sam Altman sat down with Joe Rogan on The Joe Rogan Experience podcast and shared his upbeat view on Bitcoin, labeling it a “super logical” step in our tech evolution.

Why's that?

“I think this idea that we have a global currency that is outside of the control of any government"

Altman is all thumbs-up about Bitcoin being a global currency out of the clutches of any government.

Talking tech and progress, he points out that corruption often hits the brakes on society's forward momentum.

But, thanks to Bitcoin and the tech-led world, transactions aren't old-school bags of cash anymore but are digital.

Watching where the money flows can be a game-changer in keeping corruption in check.

He's gunning for a "technologically enabled world," where Bitcoin can be the hero we need in battling corruption.

Rogan's two cents: While Joe Rogan’s a bit iffy about the vast ocean of cryptos, he’s pretty gung-ho about Bitcoin.

He sees it as the crown jewel, a potential “universal viable currency.”

It's got a cap on its quantity and people mine it DIY-style. That combo is music to Rogan’s ears.

Not so rosy CBDC views: Both Rogan and Altman aren't singing praises for Central Bank Digital Currencies (CBDCs).

Rogan’s got the heebie-jeebies thinking about CBDCs being tied to social credit scores.

He sees it as Big Brother watching and controlling people’s spending.

Altman, too, isn't in the CBDC fan club.

He sees them as tools that could turbocharge government surveillance.

He's also been facepalming at the US government's recent cold shoulder towards the crypto world.

TTD Numbers 🔢

Stars Arena, a budding social platform riding on Avalanche’s Contract Chain, gained traction swiftly, especially in the wake of Friend.tech's success.

It promised influencers, creators, and celebs a golden opportunity: monetise your fans by offering exclusive goodies and monetising interactions using Avalanche’s AVAX token.

The two hiccups

First, on October 5th, the platform fell prey to an exploit which led to the siphoning of $2,000 worth of AVAX.

Stars Arena proclaimed to be at "war" with these adversaries, confidently emphasising their robust security.

However, the promise of invulnerability was short-lived. In less than 48 hours, another disaster struck.

On October 7th, the platform's smart contract was compromised, leading to an unspecified amount of user funds being drained.

Further muddying the waters, Stars Arena faced a distributed denial of service (DDoS) attack.

Data from DeFiLlama: The incidents caused the total value of assets locked in Stars Arena to plummet from a solid $2.78 million on October 7th to a meagre $1 by the next press update.

The Public Address

To quell the mounting apprehensions, Stars Arena orchestrated a live Twitter Spaces event. They elaborated on the crisis and delineated their roadmap to resilience.

"A special white hat development team is coming in to rapidly review the security of the platform," they announced. "We will re-open the contract with all the funds in full after a full security audit. This will happen very soon."

The FTX Saga🚨

Former Alameda Research CEO Caroline Ellison is expected to testify in the trial against former crypto mogul Sam Bankman-Fried👇🏻

TTD DeFi 💸

Switzerland’s Backed Finance is making waves by expanding its tokenised short-term US Treasury offering to Coinbase’s Base blockchain.

Their new token, bIB01, is basically the blockchain twin of BlackRock's short-term US Treasuries ETF.

Oh, and it promises a juicy 5.25% annual yield.

To grab a piece of the action, you'll need to clear the KYC and AML hurdles.

US investors, you're on the sidelines for this one.

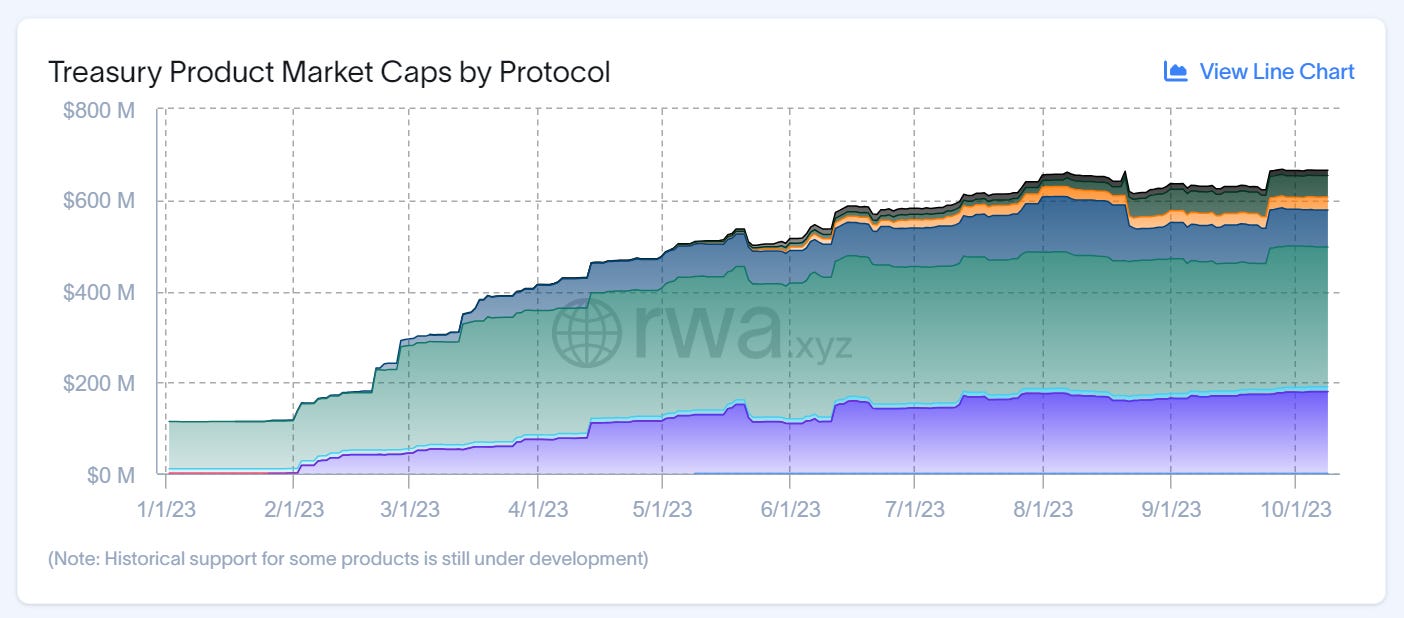

Hot topic in the crypto world: Tokenisation of real-world assets (or RWAs, if you're feeling fancy). We're talking about giving traditional assets like government bonds and private equity a digital makeover.

And boy, is it booming.

The tokenised US Treasuries market alone has bulged to $666 million this year. The big player in the game? Franklin Templeton.

💡 Why Base? Backed Finance was all praises for Base, emphasising its cost-effectiveness and its developer-friendly vibes. And if you're an Ethereum enthusiast, there's more good news. Base is pals with Ethereum, but it'll save you a ton on transaction fees.

We don’t want to be asking in 30 years, ‘Who lost crypto?’

Coinbase's chief legal officer, Paul Grewal, warns that the US is falling behind in adopting crypto regulations, which could result in the loss of 1 million developer jobs and 3 million other high-paying crypto jobs to overseas markets.

Grewal believes that if the US does not act soon, the crypto industry could suffer the same fate as the US semiconductor industry, which has moved to countries that may not always prioritise US interests.

“If these jobs are coming and we know they are, wouldn’t we want to have at least a fair share of those here in the United States? I think the answer to that is an obvious one — it’s yes.”

TTD Layoffs🚶🏻

Yuga Labs Announces Layoffs

Yuga Labs, the $4 billion force behind the famed Bored Ape Yacht Club NFTs, has disclosed an organisational reshuffle leading to layoffs.

CEO Daniel Alegre, who transitioned from Activision earlier this year, conveyed in a candid email that the company might have over-extended its internal efforts.

This revelation came after acknowledging that certain projects had overburdened the team or surpassed their core expertise.

Although the exact number of layoffs remains unspecified, the changes predominantly affect US-based employees.

Internationally, the firm's structural evaluations are ongoing.

While there were significant triumphs, including collaborations with BAPE and Gucci, some initiatives, especially in gaming, were below par.

An essential component of Yuga's future plans is 'Otherside,' their anticipated metaverse game. Alegre signaled a holistic approach to their "Otherside strategy," integrating ongoing digital content.

Additionally, teams from the NFT avatar project Meebits and the 10KTF digital apparel venture will merge into Otherside.

Ledger cuts 12%

French hardware crypto wallet provider Ledger has announced a 12% staff reduction due to the ongoing bear market.

The company, valued at $1.4 billion, has faced controversies including server breaches and criticised services.

This follows a trend in the crypto industry, with other firms like Chainalysis and Chia Network also cutting staff.

Ledger CEO Pascal Gauthier blamed the macroeconomic situation, the current bear market, and fallout from last year's collapses for the decision.

However, he expressed confidence that the company will come out stronger and highlighted sales of its crypto wallets.

“Macroeconomic headwinds are limiting our ability to generate revenue, and in response to the current market conditions and business realities, we must reduce roles across the global business.”

The 15% of Chainalysis

Blockchain forensics firm Chainalysis is laying off around 150 employees, or 15% of its staff, due to reduced commercial demand for its products in the crypto space.

The majority of the job cuts will be in the marketing and business development departments, as the company shifts its focus to more stable government contracts.

This is the second round of cuts for the company this year.

Chainalysis, which had around 900 employees before the layoffs, stated that it needs to reduce expenses and grow efficiently in light of the market conditions.

TTD Surfer 🏄

FriendTech developers have earned nearly $20 million within a few months of the platform’s launch.

Huobi Global has successfully recovered $8 million worth of stolen Ethereum after offering a bounty to the hacker.

"The Quiet Maid," a film funded by the sale of NFTs and backed by Steven Soderbergh, has secured a global sales deal.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋