Stablecoins: Can the traditional players beat Tether? 🏋️

Traditional payments and finance companies issuing stablecoins can increase legitimacy and mainstream adoption. But can a centralised entity truly champion the decentralised ideals of cryptocurrency?

Hello, y'all. The music quiz game that you want to play. Over 1.7 million plays and music fandom to flex. Who are you playing with then 👇

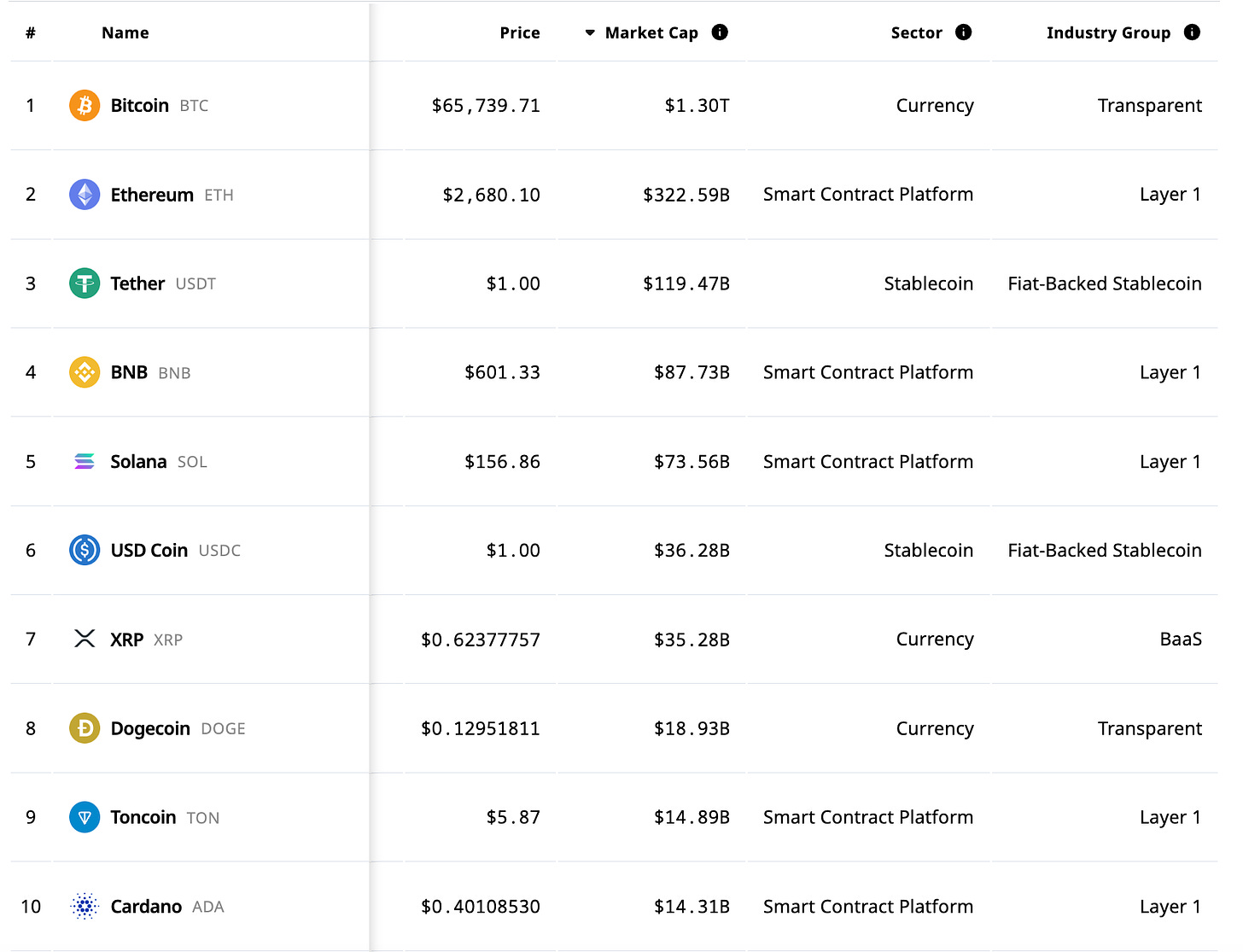

One clear winner for crypto, beyond the flagship Bitcoin and Ethereum, has been Tether.

The company issues the stablecoin USDT.

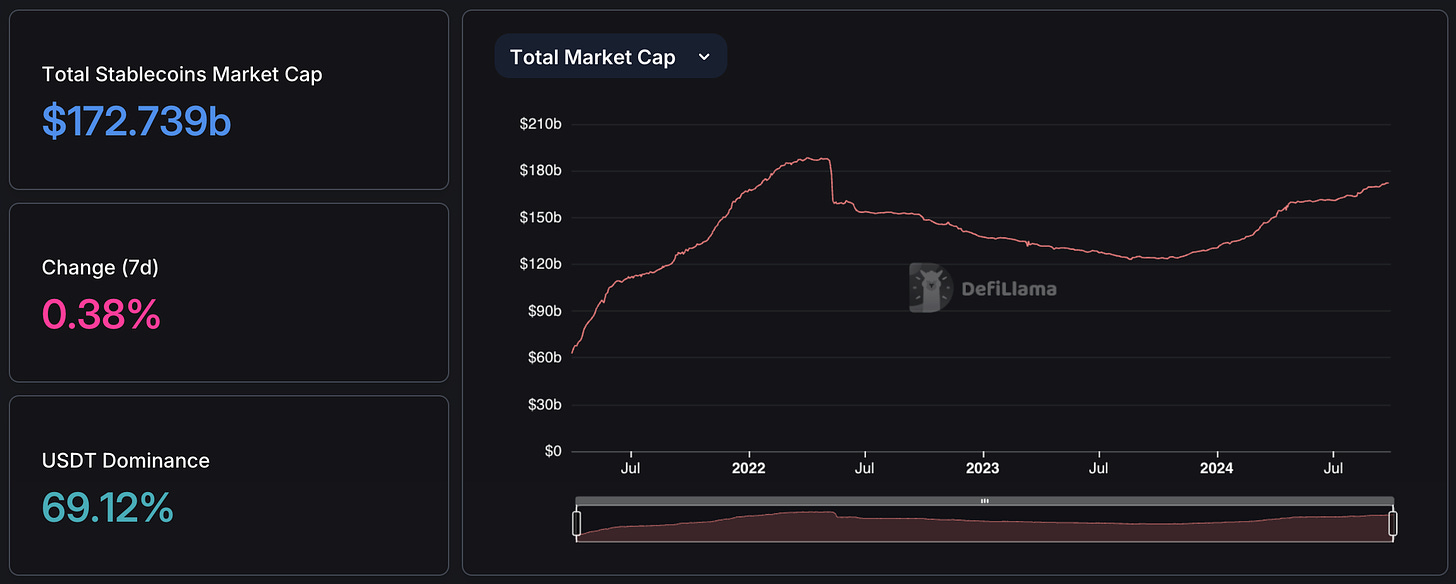

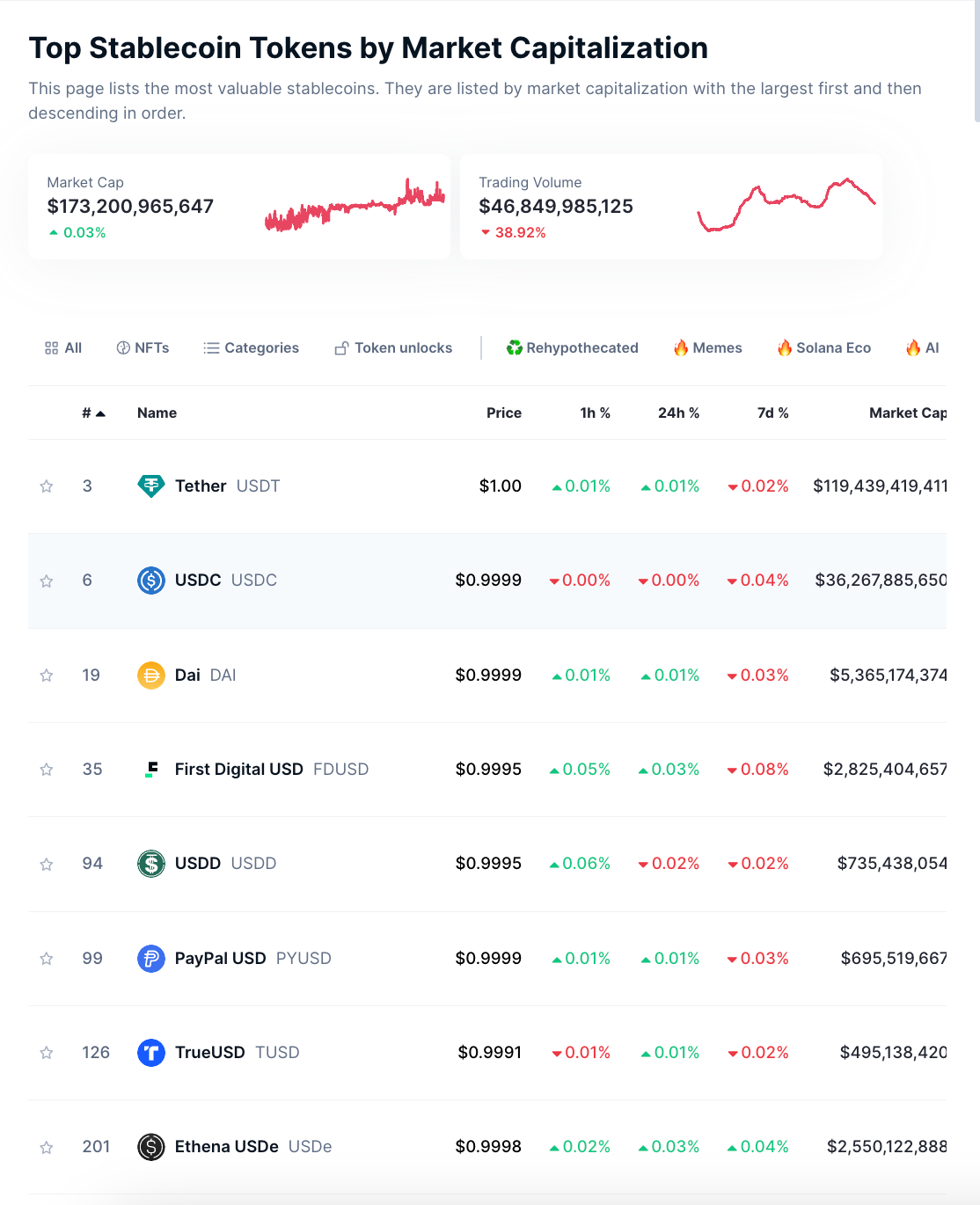

Stablecoins market cap - $173 billion

Tether value - $119 billion

Market dominance - 69%

Bitcoin pitched itself as the digital gold with store value.

Ethereum as decentralised infrastructure for the finance and the new internet.

Tether as the bridge for the traditional finance and the decentralised crypto ecosystem.

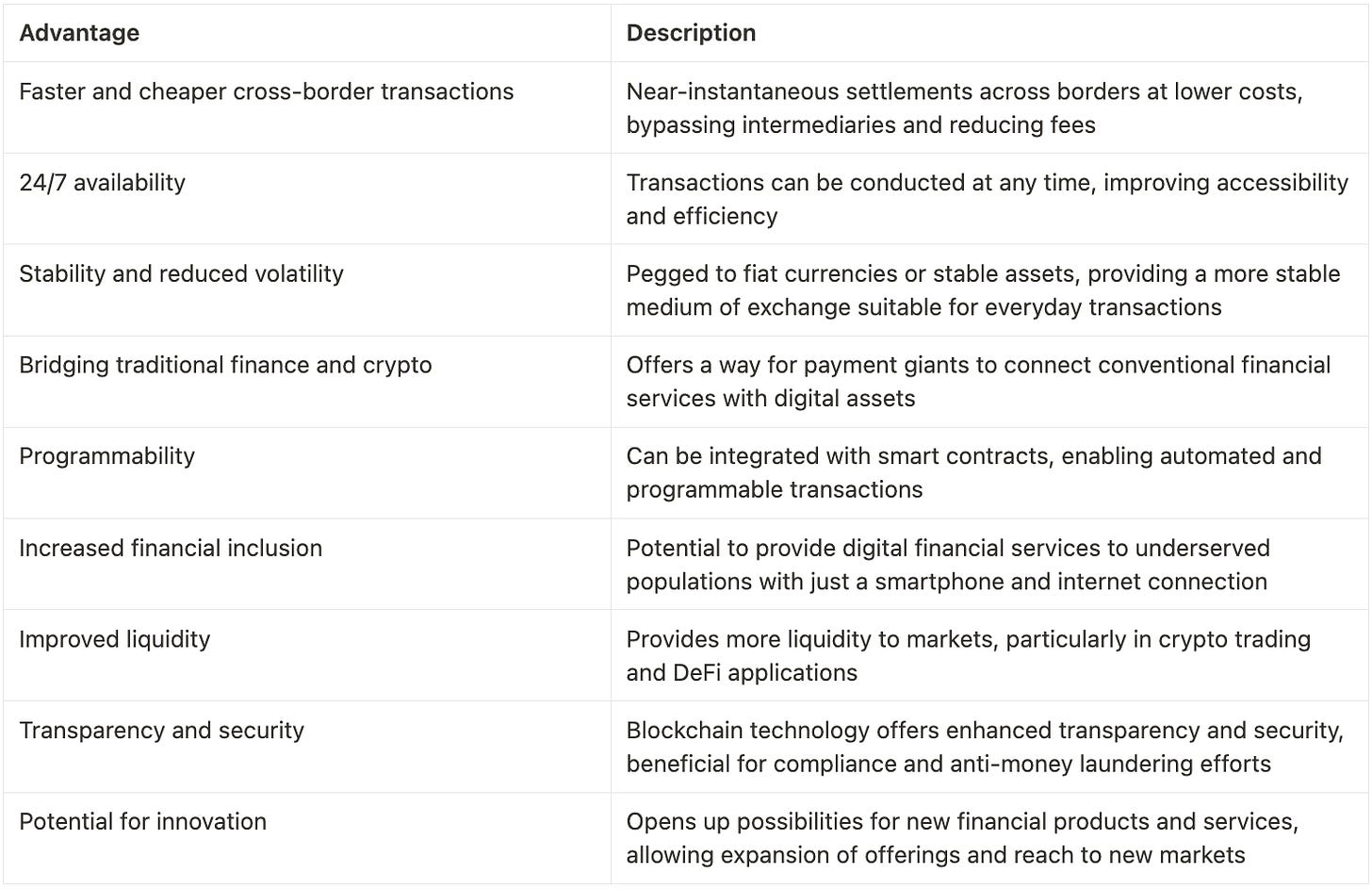

The established financial players can’t not recognise the potential of stablecoins to revolutionise cross-border payments. The single biggest reason for making the stablecoins play.

Fintech giants Robinhood, a US investing app and Revolut, a crypto-friendly neobank based in London, are reportedly considering launching their own stablecoins.

To leverage their vast user bases and regulatory compliance to challenge the dominance of crypto-native stablecoins like Tether.

These firms already have a foot in both traditional finance and cryptocurrency markets, making them well-positioned to create stablecoins that could seamlessly integrate with existing financial infrastructure.

Issuing stablecoins represents a natural progression in their fintech offerings.

Robinhood has already made inroads into the stablecoin world by listing Circle's USDC, the second-largest stablecoin with a $36.3 billion market capitalisation.

Revolut has been expanding its crypto offerings, recently launching staking services for major tokens like Ethereum.

Europe's clearer regulatory frameworks may provide an advantage for these fintech companies as they explore stablecoin issuance.

While neither Robinhood nor Revolut has officially confirmed their plans, sources indicate both are seriously considering entering the stablecoin market.

The appeal of stablecoins: Vital link between the volatile world of cryptocurrencies and the relative stability of fiat currencies. They offer a reliable medium of exchange, making them attractive for both individual users and businesses.

Regulatory expertise as an asset: One potential advantage for traditional payment companies is their familiarity with regulatory frameworks. As governments around the world work to define clearer guidelines for stablecoins, established firms may find themselves better positioned to navigate these complexities.

Innovation as a differentiator: New entrants must offer more than just stability. Robinhood and Revolut could leverage their existing platforms to create innovative stablecoin solutions that integrate seamlessly with their services.

The cross-border advantage: Traditional payment giants possess the infrastructure and global reach necessary to facilitate faster and cheaper international payments. Stablecoins for remittances and business transactions could disrupt existing models and capture significant market share.

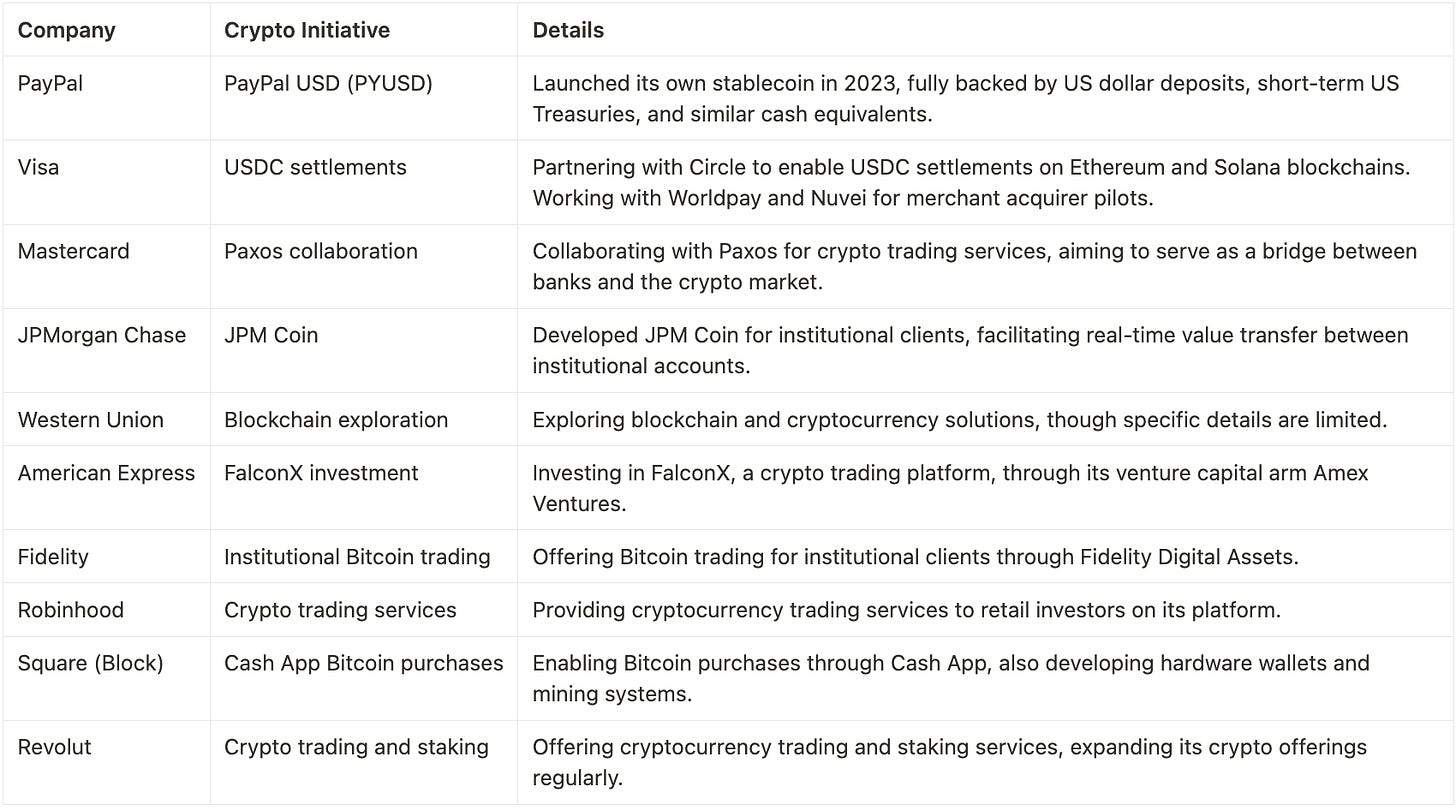

Traditional payment players making crypto plays.

The Home for All the Music Lovers

Muzify - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Can these traditional players break through Tether's stronghold, or will they struggle like so many before them?

Breaking into the stablecoin market is not easy. PayPal’s testament to the struggle.

Despite PayPal's vast user base and strong brand recognition, PYUSD's supply remains around $700 million, a fraction of Tether's dominance.

Data shows a 30% drop in PYUSD's circulating supply over the past month, after hitting a market cap of $1 billion in August 2024.

Tether's appeal lies in its promise of stability.

As a stablecoin pegged to the US dollar, it offers traders and investors stability in crypto volatility. Making USDT an essential tool for facilitating transactions and preserving value in the crypto ecosystem.

Despite its popularity, Tether has faced ongoing scrutiny regarding its reserves and business practices. The lack of a full audit and past regulatory issues have cast a shadow over the stablecoin giant.

New entrants must address these concerns to gain trust and market share.

Tether's widespread adoption across exchanges and DeFi platforms has created a powerful network effect. New stablecoins, even those backed by established financial institutions, face an uphill battle in achieving the same level of liquidity and utility.

While Tether's dominance seems unshakeable, the crypto market is young and can evolve and embrace the change.

A more diverse stablecoin market could enhance resilience and reduce systemic risks. It may also lead to fragmentation and reduced liquidity across platforms.

Token Dispatch View

Is this what crypto really wants?

Traditional payments and finance companies issuing stablecoin has the potential to bring increased legitimacy and mainstream adoption to the digital asset space.

By combining their existing financial services with the efficiency of blockchain, these firms could create stablecoins that serve as a bridge between traditional finance and the crypto ecosystem.

The success depends on their ability to navigate regulatory hurdles, build user trust, and offer compelling use cases that differentiate them from existing stablecoin options.

As the lines between traditional finance and crypto continue to blur, the entry of established payment players into the stablecoin market could mark a significant milestone in the broader adoption of digital assets.

Centralisation struggles in decentralised ethos: While PayPal's initiatives may facilitate mainstream adoption, they also raise questions about the fundamental ethos of cryptocurrencies. Many advocates argue that true decentralisation and user control are core principles of the crypto movement.

By using platforms like PayPal—which retains custody of users' assets—individuals may sacrifice some degree of control over their digital currencies.

While PayPal's services provide convenience, they also reinforce traditional financial systems that cryptocurrencies sought to disrupt.

The lack of private keys for users in PayPal’s ecosystem means that individuals cannot fully own their assets in the way that decentralised wallets allow.

Building trust in a skeptical market: Ultimately, the success of any new stablecoin hinges on trust.

Tether has weathered scrutiny over its reserves yet continues to command confidence among users.

For traditional players to succeed, they must not only deliver technological advantages but also prioritise transparency and reliability in their offerings.

This dichotomy presents a challenge: can a centralised entity truly champion the decentralised ideals of cryptocurrency?

Week in Funding 💰

Initia. $14M. Network for 0-to-1 omnichain rollups built by fusing L1 with L2 infrastructure to build scalable and sovereign systems for modular multi-chains.

Mawari Network. $10.8M. Decentralised 3D and XR content delivery platform that breaks the bottlenecks of infrastructure supply for real-time rendering.

Daylight. $6M. Crypto wallet discovery service for all the functions their wallet can perform: minting, airdrops, unlocking and voting.

AminoChain. $5M. L2 blockchain protocol to connect enterprise medical institutions, for building user-owned decentralised healthcare applications.

EarthFast. $1.4M. Infrastructure protocol for updating, deploying, and hosting your frontend to a community of voters.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

How do you yourself see the market for cryptocurrencies developing?