Tether Trumps BlackRock 😲

Tether made $6.2B in profit in 2023, more than BlackRock by $700M. Altcoin markets have shown resilience? US SEC's $2.6B budget for 2025. Robinhood's crypto push paying off. Major memecoins down 63%.

Hello, y'all. The music quiz game that’s got over million plays. Who are you playing with then 👇

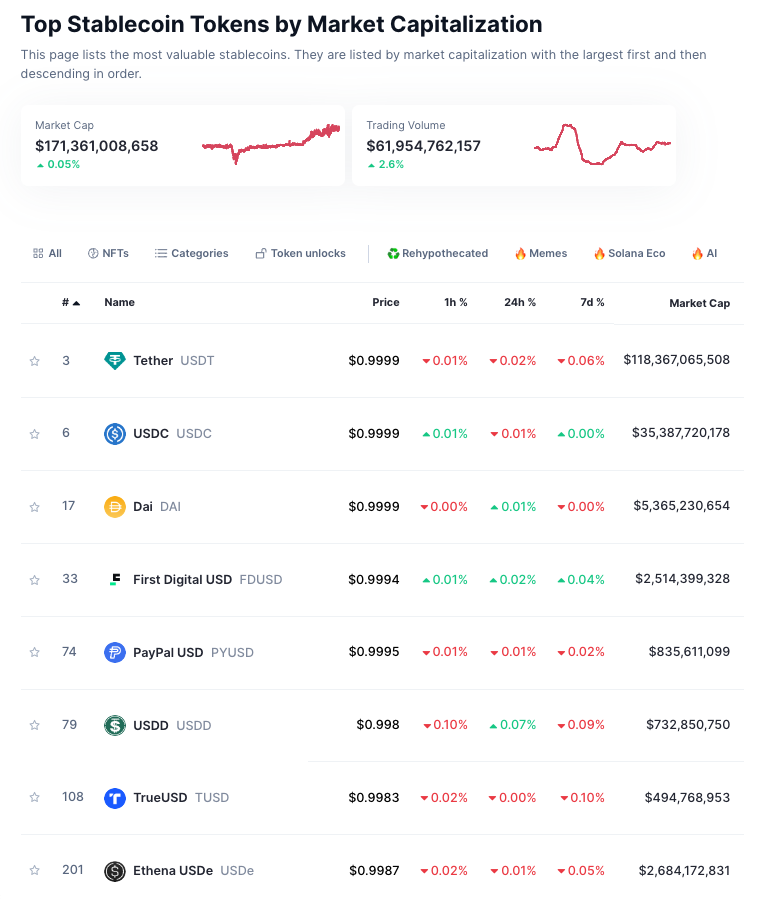

Tether, the USDT issuer, the largest stablecoin by market capitalisation.

Isn't just a big player in the crypto world - it's a crypto titan.

So big, it's making Wall Street sweat.

Tether raked in more dough than BlackRock last year.

Yes, Blackrock, the world's largest asset manager, $10 trillion in assets under management.

Let’s talk numbers

Tether reported a profit of $6.2 billion in 2023.

This profit surpasses that of BlackRock by $700 million.

What’s more interesting?

Tether operates with a workforce of around 120 employees.

BlackRock? Employs 26,000 people as of August 2024.

That proves size doesn't matter?

USDT is not so small though.

Holds a $118 billion market capitalisation.

This represents nearly 70% market share in the stablecoin sector.

Other stablecoins lag behind, with Circle's USDC at $32 billion and DAI at $5 billion.

Tether's success supports the notion that stablecoins fulfil a genuine need in the cryptocurrency market.

Stablecoin volumes are going higher.

Ethereum's on-chain stablecoin volume has reached a new high of $1.46 trillion.

What does this mean?

Deeper liquidity pools and improved market efficiency - a healthier and more robust DeFi ecosystem.

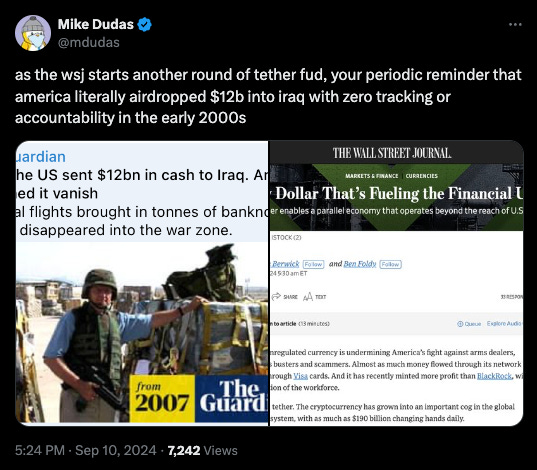

But, also a good time to attract FUD (Fear, uncertainty, and doubt).

That’s why WSJ had this headline👇🏻

Maybe everyone didn't like the idea of a decentralised, community-driven financial tool outperforming their age-old institutions.

Crypto world is not so happy👇🏻

Why the FUD?

The process of creating Tether tokens involves multiple private authorisation keys signing and broadcasting creation transactions.

New tokens are "authorised but not issued," meaning they are held in Tether's treasury until officially issued.

But, there’s no stopping Tether.

Investing in agriculture: They just invested $100 million in a big Latin American agriculture company called Adecoagro. This is their first time dipping their toes into the farming industry, after focusing on things like AI and Bitcoin mining.

Fighting financial crime: Tether, along with Tron, has launched a financial crime unit.

Aims to identify and stop illicit USDT transactions. Already frozen over $12 million in USDT linked to bad activities. Tron is the biggest network for USDT, making their collaboration effective.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

Analysts from crypto exchange Bitfinex

“Altcoin markets have shown resilience”

Does this mean investors may be moving away from relying solely on Bitcoin?

If yes, the reason could be a market uncertainty.

Bitcoin experienced a price decline, dropping to $52,827 on September 7, marking a 10.8% decrease over the week.

In contrast, the market capitalisation of cryptocurrencies outside the top ten has increased by 4.4%.

Total altcoin open interest (OI) has dropped 55% from its all-time high, indicating potential exhaustion among sellers.

Traders are observing this decline as a sign of market strengthening.

Altcoins are likely to continue outperforming Bitcoin in both downturns and recoveries?

Major Memecoins Down 63%

Remember the Memecoin Mania 💫 and Celebrity Memecoin Chaos 🙆♀️?

How’s it going now?

Memecoins are CRASHING

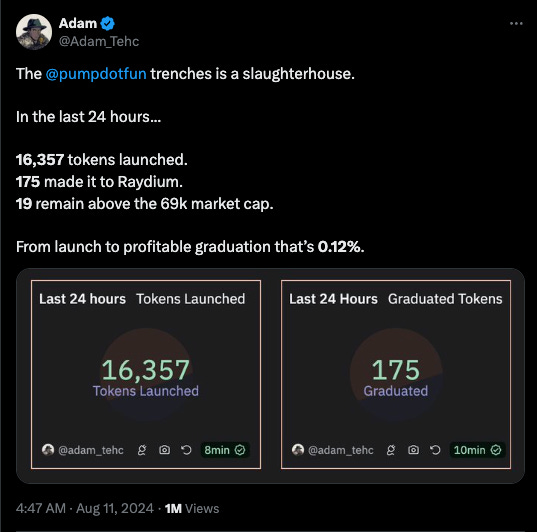

Why the sadness? New "safe-launch" tokens are stealing the spotlight.

Platforms like Pump.fun and BaseJump have simplified the launch of new tokens, attracting significant investor attention.

Resulted in a fast-paced market that favours short-term trading strategies.

New tokens are rapidly emerging, with millions launched since March 2024, leading to increased competition.

1.98 million tokens have been launched since March on Pump.fun.

Pump.fun surpassed $100 million in revenue on August 30.

Memecoin veterans are calling it a "slaughterhouse" for investors.

On August 13, the Tron-based SunPump was announced - already launched over 80,000 tokens. On Aug. 21 alone, the platform launched 7,531 tokens , generating $465,000 in fees.

Everyone's worried about where all the liquidity (aka your money) is going.

The influx of memecoins is creating liquidity concerns across the broader crypto market.

Some believe that the focus on memecoins is redirecting capital from legitimate projects, hindering innovation.

“It is possible that memecoins have already sucked the life out of this bull run, and now money is being redirected into rug pulls and pump-and-dump schemes. That’s why there is no liquidity in the altcoin market,” - Slava Demchuk, CEO of AMLBot.

In The Numbers 🔢

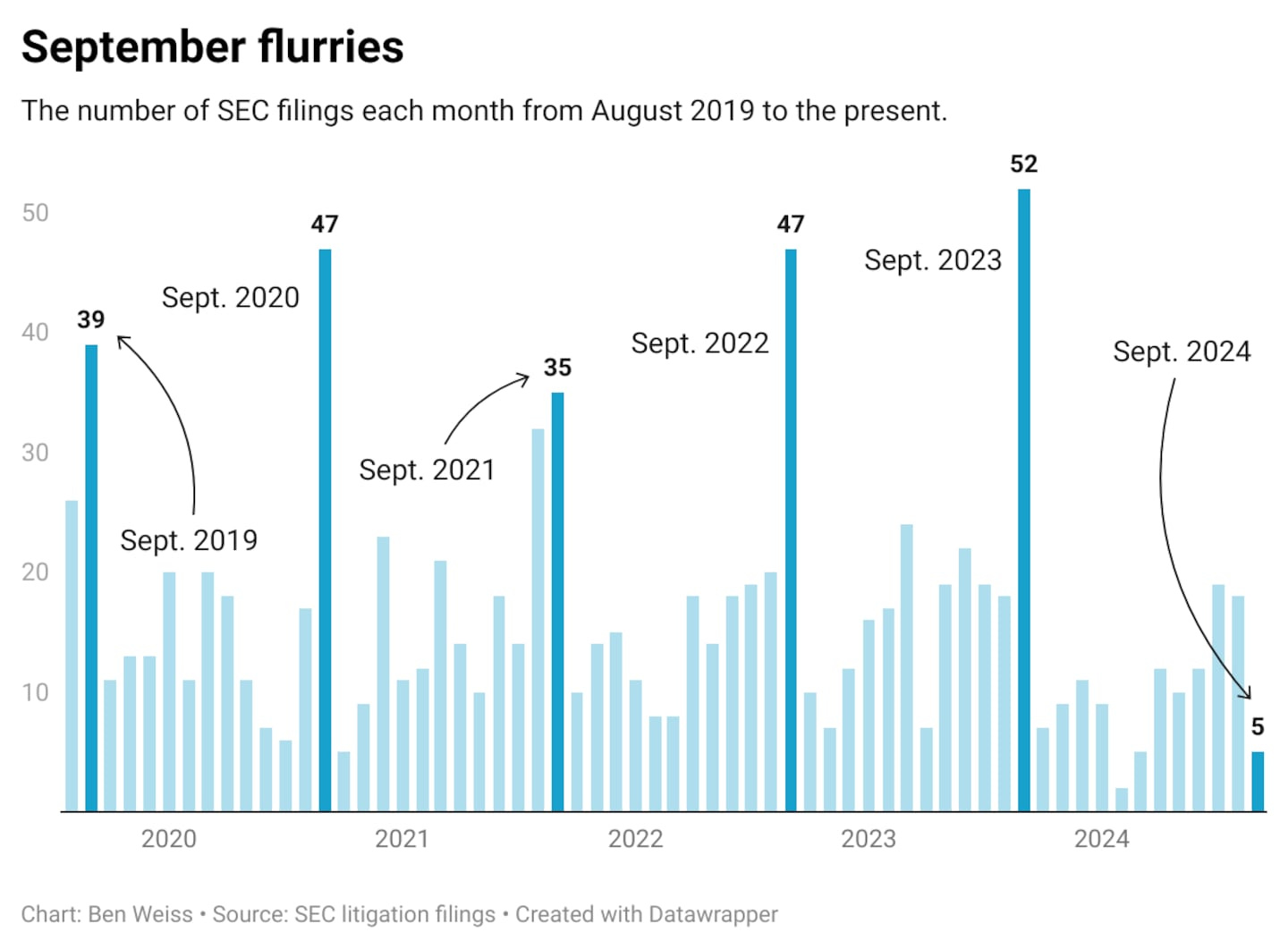

$2.6 billion

That’s how much Gary Gensler (US Securities and Exchange Commission chair) has requested for the 2025 fiscal year to strengthen enforcement capabilities and address staffing shortages.

More to fear? US SEC has already slapped crypto firms and execs with $4.7 billion in enforcement actions in 2024 - a 3,000% jump from 2023.

Typical September enforcement surge: The SEC typically sees a spike in enforcement actions every September, as the agency works to shore up its performance reports and budget requests for Congress before the end of the fiscal year on September 30.

Increasing fines and penalties

The SEC has brought around 158 crypto-related enforcement cases, with about 50 levied since late 2022.

Total SEC crypto fines have ramped up - a record $4.68 billion in 2024 alone under Gensler.

The largest fine was $4.7 billion against TerraForm Labs and founder Do Kwon.

Robinhood’s Crypto Bet Paying Off?

The popular trading app market cap is projected to rise by 35% this year.

Crypto initiatives are paying off big time💰

Millennials are loving it: About 60% of Robinhood's customers are under 43, and they're investing big in crypto.

Millennials have increased their share of US household wealth from 1% in 2010 to about 10% today, benefiting Robinhood's offerings.

Cryptocurrencies now make up a huge chunk ($81 million) of Robinhood's revenue, growing by 161% in just one year.

What’s new? The firm is acquiring Bitstamp for $200 million and has expanded its crypto trading services to the European Union.

Bernstein predicts: Analysts initiated coverage on Robinhood with an "outperform" rating, predicting the stock will surge 83% from its current $16.39 price to $30 by 2025.

Bernstein projects the total crypto market value will skyrocket from $2.6 trillion currently to $7.5 trillion by 2025.

They describe this as "a monster of a crypto cycle" that the "buy-side and sell-side alike, refuse to see."

Robinhood is not alone in its crypto ambitions; competitors like Revolut, Stripe, and PayPal are also enhancing their crypto offerings.

The Surfer 🏄

Friend.tech faces accusations of a rug pull after the team relinquished control over the project's smart contracts, setting admin parameters to Ethereum's null address. The Friend.tech team reportedly sold 19,477 ETH, around $52 million, from December 2023 to June 2024, while also earning over $60 million in fees.

Brazilian bank Nubank has suspended trading of its native crypto token, Nucoin, following a staggering 97% price drop. The token, launched on the Polygon blockchain in October 2022, saw its price plummet from an all-time high of $0.59 to $0.0158.

The European Banking Authority (EBA) anticipates the publication of stablecoin standards in the EU's Official Journal by the end of 2024. These standards will regulate how stablecoin issuers like Tether and Circle operate within the EU.

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋