The FTX 🏅 $7 Billion in 🏃 $2 Billion to go 🏊♀️

FTX has some happy news for the debtors. HSBC Hong Kong launches support for ETH and BTC ETFs. Trader opens $4M short position on the TUSD. Do Kwon’s Balkan jailhouse. NFT avatars for secret agents.

Hello, y'all. US House bans members from using all chatbots except ChatGPT Plus. Dispatchers 🫶 this👇 This one is for winners, and winners alone.

We dispatch, no matter what. Give your books a »» Muzify «« spin? This is The Token Dispatch, you can hit us on telegram 🤟

FTX Debtors' second interim report is out.

FTX CEO John Ray's mission is tough.

He's tracking down funds amidst a maelstrom of chaos where customer assets were, apparently, jumbled in with FTX operating funds.

The asset recovery situation

$7 Billion: Amount of liquid assets FTX has recovered so far

$2 Billion: Estimated additional amount needed to cover misappropriations

How much was lost?

The misappropriation mess

$8.7 Billion: Estimated total customer assets misappropriated

$6.4 Billion: Part of the total assets misappropriated in fiat and stablecoins

The ex-FTX leadership was accused of intentionally stirring this financial soup. But they didn't do it alone, oh no - they had a little help from a senior FTX Group attorney.

This money mix-up even included a cameo from false bank statements, misrepresentation, and even statements to the US Congress.

"Notwithstanding extensive work by experts in forensic accounting, asset tracing and recovery, and blockchain analytics, among other areas, it is extremely challenging to trace substantial assets of the Debtors to any particular source of funding, or to differentiate between the FTX Group's operating funds and deposits made by its customers."

Former FTX execs and Alameda Research CEO Caroline Ellison reportedly had their own guesstimates on the misappropriations, somewhere between $8.9 Billion to $10 Billion. A bit higher than FTX Debtors' estimate, but who's counting?

Here's a tour of luxury Bahamas properties bought by ex-FTX CEO Dear Sam using customer funds.

The Albany Resort Penthouse, Nassau

Infamous six-bedroom, 11,500 sq ft penthouse where SBF and other execs resided

Part of the whopping $243 Million spent on Bahamas real estate

Albany Honeycomb Units

FTX Group splashed over $18 Million on these luxe units

With stunning views, a wine cellar, and a terrace overlooking the mega yacht marina, it's luxury at its best

Old Fort Bay Lot A

Another $16 Million went to this mystery lot, likely featuring homes with expansive pools close to the water's edge

Purchased by SBF on April 7, 2022

Meanwhile, in the SEC vs crypto war

The Security and Exchange Commission's lawsuits against Binance and Coinbase have sent shockwaves through the crypto world. (nothing new)

A handful of tokens were named in SEC lawsuits against Binance and Coinbase, causing a 15% drop, or $5 Billion, in their collective market caps since June's start.

Tokens affected: Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos Hub (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and COTI (COTI).

Binance's BNB has seen its market cap deflate by 21% since the SEC lawsuit, dropping from $47 Billion to $37 Billion. Similarly, Charles Hoskinson's Cardano experienced a significant 17% plummet in market cap, now trading at $0.29 with a $10 Billion market cap.

Collateral damage: Avalanche (AVAX) dropped roughly 6% since the lawsuits were filed, and Optimism (OP) shed 17.5% of its total market cap over the same period.

Standouts in the storm: Despite the turbulence, Filecoin and Algorand are showing resilience, bouncing back close to their pre-lawsuit market caps. The Cosmos ATOM token is not far behind, with just a 5% gap to close. However, some tokens like Polygon are finding the road to recovery a bit steeper.

The silver lining: But it's not all doom and gloom. The crypto market has been on a bullish rally recently, largely thanks to the 'BlackRock Rally'. Bitcoin has shot past $31,000 for the first time in months, offering a much-needed boost to other tokens in its wake.

TTD ETF 📊

ETFs provide “simplicity and convenience” - Sei Labs co-founder Jeff Feng.

The context: HSBC Hong Kong has now launched support for Bitcoin and Ethereum Exchange Traded Funds (ETFs)! This major move expands access to digital asset derivatives in the emerging Asia crypto hub.

These ETFs, which are traded as securities, were listed on HSBC Hong Kong's "Easy Invest" mobile app on Monday. They allow traders to gain exposure to Bitcoin and Ethereum futures based on derivative contracts that trade on commodity exchanges.

The specific offerings are the CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF.

HSBC is the first lender in Hong Kong to offer customers access to digital asset ETFs.

HSBC's move opens up access to derivatives for its customers who might otherwise be forced to seek out unregulated exchanges. This presents a clear opportunity for HSBC to get ahead and cater to a "clear customer need," says Jeff Feng.

The "Simplicity and convenience" of ETFs make them a much more palatable option for retail traders as compared to other derivatives. "When you have simplicity, what you eventually will get is volume," Jeff Feng highlights. People will speculate because it's just so easy.

TTD Trader 📉

A daring trader, armed with an Ethereum wallet and a mischievous grin, decides to take on the TUSD stablecoin.

With a brilliant move, they open a whopping $4 Million short position using the marvellous Aave platform.

Why? Well, turns out the stablecoin's issuer, TrueUSD, found itself in a bit of a pickle with their pal Prime Trust. Minting and redemption of TrueUSD had to hit the pause button due to some complications with Prime Trust, the trusty banking partner.

The trader, armed with their Ethereum savvy, deposits a cool 7.5 Million USDC (another stablecoin) as collateral on Aave's V2 lending platform. With that move, they manage to borrow a mind-boggling 4 Million TUSD! But instead of sitting on it, they immediately sell those TUSD for USDC, creating a classic short position.

The recent drama with Prime Trust: The Nevada Department of Business and Industry's Financial Institutions Division thought they could spoil the fun and issued a cease-and-desist order. But the TrueUSD issuer swiftly reassured everyone that they're not fazed by the Prime Trust situation. They've got multiple USD rails for their minting and redemption operations.

Now, let's give credit where credit's due. TUSD may not be the most famous stablecoin out there, but it's no slouch either. It proudly claims the title of the fifth largest stablecoin, standing tall alongside heavyweights like Tether USD, USD Coin, DAI, and BUSD. With a market cap of over $3.1 Billion, TUSD means business.

TTD Jailhouse 👮

Imagine steering a $60 Billion blockchain empire one day and finding yourself caught up in a Balkan prison the next. Just imagine.

That's the astonishing plot twist in the life of Do Kwon, with his attempted getaway using a fake Costa Rican passport.

Money talk: Swiss prosecutors have become virtual pirates, seizing a treasure chest of approximately $26 Million in digital assets and US dollars, all belonging to Do Kwon.

Kwon's digital booty was stashed away in Sygnum, a Swiss-based digital asset bank. Sygnum proudly boasts the title of the world's first digital asset bank, with branches sprinkled across Switzerland, Singapore, and Abu Dhabi.

Who shares the loot? The Swiss didn't freeze Kwon's assets alone. Sharing the cold fate are assets belonging to TFL corporation, Han Chang-Joon (former CEO of Chai Corporation), and former TFL research lead Nicholas Platias.

The frozen assets turned out to be a 2-for-1 deal. Double the original estimates by prosecutors.

The lone ranger among bandits: Spuz Prison, where Kwon now resides, is a home away from home for various notorious gang members! However, for safety or special reasons, Kwon gets the "luxury" of solitary confinement - a quiet retreat amidst the cacophony.

The most wanted: Kwon and Han, are now the popular kids on the block, being sought after by South Korea and the US for alleged fraud.

The 'overbooked' jailhouse: Spuz Prison is teeming with 380 inmates despite a capacity for just 292. In this bustling facility, authorities have the fun task of preventing gang wars by strategically placing rival gang members at different locations.

With Kwon and Han's extradition under consideration, they are set to extend their stay at Spuz for at least six more months.

TTD NFT 🐝

On the NFT front, we've got secret agents swapping suits for NFT avatars, celebs trying their hand at digital design, and a token bearing a tax load that would make Scrooge McDuck wince.

Secret agents go not-so-secret

The San Francisco arm of the US Secret Service, also known as the Digital Asset Technology Alliance (DATA) Squad, isn't so secret anymore. Revealing more about their own NFT collection, they've swapped their usual shades and suits for some quirky, digital getups.

Each agent boasts a personalised NFT, styled to their individual tastes and set against a backdrop of their choice in Northern California. Imagine that! Agent Smith, known for his love of sushi, depicted next to the Golden Gate Bridge with a giant sushi roll.

But don't think you can acquire these prized avatars. While they've received offers, none have been accepted.

A-List art judges

On a different note, the celebrity world is also taking a dip in the NFT pool. Kendall Jenner, J Balvin, Kate Moss, Jeff Koons, and Baz Luhrmann are swapping their glamorous outfits for digital design judge robes. They are set to judge a competition of digital backgrounds to be included in an NFT collection benefiting The Foundation for AIDS Research (amfAR).

Budding creators have until July 9 to submit their work and impress these A-list judges. The top 100 backgrounds will be combined with amfAR's own foreground characters and later sold to fund AIDS research.

So, whether it's Jenner's fashion-forward thinking or Luhrmann's cinematographic eye, participants better bring their A-game! It's not every day you get to impress such an eclectic group of celebs, all while contributing to a vital cause.

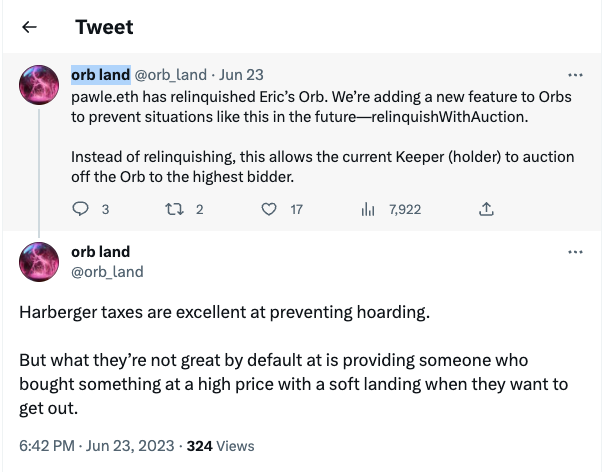

Taxing times in the land of orbs

Our last tale from the digital frontier brings us to Orb Land, where a formidable foe known as the Harberger tax lurks. Eric Wall's innovative project tokenises his time and expertise, granting the holder unique access to his personal consulting services. But beware, tax time in Orb Land can be, well, taxing.

One unfortunate holder relinquished their prized NFT after facing a daunting 300% Harberger tax. That's right, the taxman cometh and he demands a 25% monthly tribute. This brought a swift end to the holder's reign, prompting a Dutch auction to ease ownership transitions and maintain liquidity.

TTD Surfer 🏄

Online brokerage firm Robinhood will lay off roughly 150 full-time staff — 7% of its total workforce — in its third round of layoffs in just over a year.

Damus – a decentralised social media app on Nostr protocol – will be removed from Apple’s app store after failure to come into compliance with its Bitcoin tipping service.

Binance Australia head Ben Rose claimed the exchange got 12 hours’ notice before it was cut off from the local banking system in May.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋