The Ghost Of Gary Gensler 👻

Kamala Harris to nominate Gary Gensler as Treasury Secretary if elected? Democrats 2024 platform omits crypto. Bitcoin to bottom if Trump wins? Tether mints $1B USDT on Tron. New lawsuit for Binance.

Hello, y'all. The coolest dope on Web3 is on Decentralised.co ✅

Insights and information by the founders and developers covering all things Web3. Check out their episode on building business on Bitcoin 👇

The way US presidential elections are like a sitcom.

Swinging. Swaying. Never short on drama.

What’s the latest then? Rumours going around that Vice President Kamala Harris may nominate Gary Gensler, current head of the SEC, as Treasury Secretary if she wins the presidential election in November.

The Washington Reporter cites multiple senior Senate staffers as saying Gensler is a likely candidate for the Treasury position, given his reputation as a crypto skeptic.

Bipartisan concerns: Critics from both parties express skepticism about Gensler's nomination.

Republican Rep. Tom Emmer warns that Gensler's regulatory approach could harm the US economy, while some Democratic lawmakers may still support him.

Speculation on Gensler's future: There are rumours that Gensler may step down as SEC chairman before the election, allowing President Biden to appoint a new chair, possibly Caroline Crenshaw.

Impact on crypto regulation: If nominated as Treasury Secretary, Gensler's strict oversight at the SEC could lead to more stringent policies and enforcement actions against crypto firms.

Former SEC crypto enforcement leaves for private practice

David Hirsch, former head of the SEC’s Crypto Assets and Cyber Unit, has joined law firm McGuireWoods as a partner in Washington, D.C.

Hirsh will focus on securities enforcement and regulatory counselling, leveraging his extensive experience in crypto regulation amid increasing scrutiny of the industry.

The odds back in favour of Republicans

After a brief upswing in favour of, Kamala Harris leading on Polymarket, the tide has turned back in favour of Republicans. Donald Trump is back in the lead.

SkyBridge Capital founder Anthony Scaramucci believes that presidential candidate Kamala Harris could lose the 2024 US election by failing to attract pro-crypto voters.

And that that the Democrats' stance toward the crypto industry has been a "disaster" so far.

“Let’s say there are only 25 million people that own crypto in the United States. But let’s say 5% of them are single-issue voters [...] If they’re in the swing states of the United States, she will lose the election.”

Scaramucci thinks Donald Trump is not a good candidate for crypto, despite Trump's pro-crypto campaign promises.

“He’s the most transactional son of a bitch that you’ll ever meet. Today, he’s for crypto; tomorrow, he may or may not be for crypto.”

Read: Is the Kamala Harris crypto ‘reset’ coming?

Unlock Web3 Insights by the Web3 Builders

Long-form articles trusted by the best in Web3. Hundred hours of research into 20 minute articles. No propaganda. Only good writing. Right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Democrats' 2024 Platform Omits Crypto

The Democratic National Committee (DNC) unveiled its 2024 platform, which does not mention cryptocurrencies or blockchain technology, contrasting sharply with the Republican platform.

The nearly 100-page document is expected to be approved at the Democratic National Convention in Chicago and was finalised before President Joe Biden's withdrawal from the 2024 election.

Democrats' shifting attitudes: The omission comes as Democrats signal a willingness to engage with crypto industry leaders, coinciding with significant pro-crypto donations to Democratic congressional candidates.

Harris' history with crypto: Vice President Kamala Harris, likely to secure the Democratic nomination, has had a contentious relationship with the crypto industry, which may alienate crypto-focused voters.

Disappointment among some democrats: Pro-crypto congressman Wiley Nickel (D-NC) expressed disappointment over the omission, having hoped for a more favourable stance on crypto under Harris's potential administration.

Block That Quote 🎙️

A new Bernstein Research report

"We believe the Bitcoin price would bottom, only if the crypto market catches a bid on a likely Trump win, given [the] crypto market continuing to interpret only a Republican win as positive for crypto policy.”

Bernstein Research reports that the outcome of the upcoming US presidential election could significantly affect the cryptocurrency market, particularly Bitcoin (BTC).

Trump’s potential victory: Could lead to a bottom in Bitcoin prices, with the market interpreting a Republican victory as positive for crypto policy.

Current market trends: Bitcoin recently dipped below $49,000 after failing to reclaim the $60,000 mark, attributed to election uncertainty and a close race between Trump and Democratic candidate Kamala Harris.

Capital-raising activities: US-listed Bitcoin mining companies are actively raising capital, with Marathon Digital Holdings securing $300 million in convertible notes to purchase Bitcoin, and Riot Platforms announcing a $750 million equity offering.

Emerging "Mullet Strategy": A growing trend among miners involves pivoting towards AI data centres while maintaining Bitcoin mining operations, appealing to institutional investors familiar with data centre economics.

In The Numbers 🔢

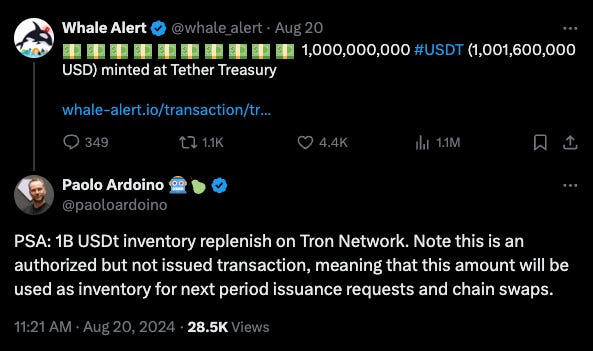

$1 billion

The amount of USDT Tether has minted on the Tron blockchain, following a similar minting on Ethereum just a week prior.

Inventory replenishment strategy: CEO Paolo Ardoino explains that this minting serves as an "inventory replenish," with tokens authorised but not yet issued to manage liquidity effectively.

Demand on Tron: As of August 19, only $36 million in USDT tokens were available on Tron, indicating strong demand for the stablecoin on that network.

Impact on crypto market: Continuous USDT minting aligns with recent market rallies, fuelling speculation that these issuances may be influencing crypto market momentum.

Record stablecoin market capitalisation: Has reached a record high of over $165 billion, suggesting increased liquidity in the crypto markets.

Launch on Aptos blockchain: Tether has also launched USDT on the Aptos blockchain, the integration allows Tether to mint USDT directly on Aptos, similar to its operations on Tron and Ethereum, reinforcing its presence in the stablecoin market.

Tether is set to launch a dirham-pegged stablecoin in collaboration with Phoenix Group and Green Acorn Investments, aiming for licensing under the UAE Central Bank's new regulations.

Binance Hit With Fresh Lawsuit

A new class action lawsuit has been filed against Binance and its founder Changpeng Zhao in the US Western District Court of Washington.

The plaintiffs, former exchange users Philip Martin, Natalie Tang, and Yatin Khanna, allege that Binance's negligent compliance practices allowed bad actors to launder stolen crypto on the platform, causing financial harm to US users

Lawsuit accuses company of enabling money laundering and violating financial regulations.

Complaint claims Binance operated as unlicensed money transmitter, ignored AML requirements.

Lawsuit alleges Zhao prioritised profits over compliance, turning Binance into money laundering hub.

Fresh lawsuit follows series of legal actions, including $4 billion DOJ settlement where Zhao admitted AML failures.

Fresh lawsuit follows series of legal actions, including $4 billion DOJ settlement where Zhao admitted AML failures. Zhao stepped down as CEO, and he was fined $50 million personally for his role in the company's violations.

Meanwhile in China: Top legal authorities have classified the use of virtual assets for transferring illicit funds as a money laundering method, facilitating the investigation and prosecution of crypto-related cases.

The judicial interpretation clarifies that while virtual asset trading can be linked to money laundering, it does not criminalise the act of holding or trading cryptocurrencies within China.

The Surfer 🏄

Malaysian authorities destroyed 985 bitcoin mining machines valued at 1.98 million ringgits ($452,500) amid a crackdown on power theft, which has reportedly cost the country RM3.4 billion ($777 million) since 2018.

Japanese firm Metaplanet has acquired 57.273 Bitcoin for ¥500 million ($3.4 million), increasing its total holdings to 360.368 BTC valued at about $21.9 million. The announcement boosted the company's stock by over 10%.

Brazil has approved a second Solana ETF, boosting its crypto investment options, while US efforts for similar ETFs face uncertainty after recent filings by VanEck and 21Shares were reportedly removed from the Cboe exchange.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋