The Memecoins Rug Pull 🚨

12 Solana presale memecoins abandoned after a month. Buterin on crypto's core mission: liberty and decentralisation. Mt. Gox’s 142,000 BTC payout. Runes fuels Bitcoin miners’ record $107M earnings.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

A dozen Solana memecoin projects that raised $26.7 million have vanished into thin air after just a month.

These "presale" projects promised memecoin glory, but instead delivered disappointment.

Many coins plummeted after launch, and some never even materialised.

A project called "I like this coin" (LIKE) raised $7.7 million, but its value dropped by 99% within hours. Their social media channels have been silent since.

Another project, MOONKE, followed a similar path, raising a lot of money and then crashing after launch.

One project raised 4,567 SOL, and failed to launch a coin.

This follows a recent memecoin craze.

Some Solana memecoins skyrocketed in value.

Is this a sign of a bubble bursting? The recent rally says otherwise.

While Bitcoin saw modest gains after its recent halving, meme coins like BONK and FLOKI were skyrocketing on April 21.

BONK rose 46%

FLOKI rose 26%

SHIB rose 24%

PEPE rose 13%

WIF rose 8%

So what's going on?

Memecoins have been the narrative this bull run.

It has broken down not just the entry barrier but opened up wider crypto participations across chains and projects.

Providing crucial liquidity, and the rising market cap is the testament 👇

More likely traders are sticking with familiar memecoin favourites.

Maybe traders are exploring new "Rune" tokens minted on Bitcoin after the halving.

Runes makes launching and trading memecoins on Bitcoin faster and cheaper.

Early projects are already seeing a boost.

Runestone airdrop: Over 100,000 users holding Bitcoin NFTs received a valuable airdrop worth an estimated $300 million.

More airdrops coming: Runestone holders can expect additional airdrops from three different memecoin projects after the Runes upgrade.

BRC-20 scramble: Existing token projects on Bitcoin are deciding their future. Some, like the massive memecoin PUPS, are switching to the new Runes standard.

Read: What Are Bitcoin Runes? 🙇♀️

FTX to Auction Remaining Locked Solana

FTX is ditching fixed prices and switching to an auction for their next batch of locked Solana tokens.

Why the change? High demand.

Buyers are eager to get their hands on these discounted tokens, even if they're locked until a later date.

Here's the conclusion: Memecoins are having a moment and stealing the spotlight after the Bitcoin halving.

Block That Quote 🎙️

Ethereum co-founder Vitalik Buterin

"Crypto is not just about trading tokens, it's part of a broader ethos of protecting freedom and privacy and keeping power in the hands of the little guy."

Buterin wants us to remember crypto's core mission: liberty and decentralisation.

Even decentralised projects like Ethereum face censorship concerns (eg - compliance with OFAC).

Mt. Gox’s 142,000 Bitcoin Payout

Mt. Gox is finally inching closer to repaying creditors. After a decade-long wait, the defunct exchange might start disbursing 142,000 Bitcoin.

The good news: Creditors could see their Bitcoin returned soon.

The potential worry: A mass sell-off of Bitcoin by creditors who waited nearly 10 years to get their hands on it. This could put downward pressure on the price.

Some believe the sell-off won't be significant, while others anticipate a price drop in October, the target repayment month.

Mt. Gox is warning of a scam: Beware of emails claiming an earlier payout and urging you to click on links. These are fake.

In the Numbers 🔢

$107 million

After halving, Bitcoin miners raked in that much, blowing past the previous record of $77 million.

How? Transaction fees! These fees accounted for 75% of the total earnings, with the remaining 25% coming from block rewards (cut in half by the halving).

And the culprit here is Runes.

$206 million

For the second week straight, investors pulled out a total of $206 million from digital asset investment products.

Bitcoin itself saw $192 million in outflows, with even short-bitcoin positions experiencing a small pullback.

Grayscale's Bitcoin Mini Trust (BTC)

A new fund charging a rock-bottom fee of 0.15%.

Much lower than Grayscale's current Bitcoin trust (GBTC) fee of 1.5%, making it the cheapest option in the market.

Existing GBTC holders will automatically receive shares in the Mini Trust (date TBA).

The Mini Trust starts with 10% of the Bitcoin held by GBTC, around $4 billion worth.

Both trusts (Mini and GBTC) will trade separately.

But, Bloomberg analyst Eric Balchunas believes these fees might be a tad optimistic. He calls them "hypothetical" and suggests they're more of a marketing ploy than a guaranteed rate.

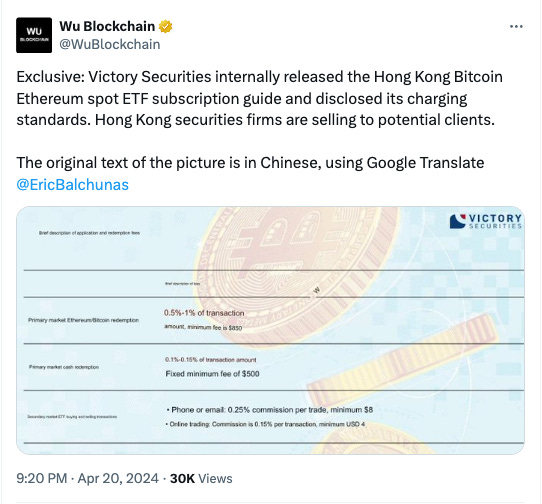

Meanwhile, Hong Kong investment firm Victory Securities has revealed its proposed fees for Bitcoin and Ethereum ETFs.

The Surfer 🏄

Jailed former FTX chief Sam Bankman-Fried agrees to help in a lawsuit targeting FTX celebrity endorsers. Tom Brady, Shaquille O’Neal, and Gisele Bundchen are accused of promoting unregistered securities for FTX.

ZKasino, a cryptocurrency project, is facing a rug pull scandal. The project raised over 10,500 ETH (worth $32 million) through its fundraising campaign.

RFK Jr. wants to put the entire US budget on a blockchain. He believes this move would allow every American to have access to the budget 24/7.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋