The Worldcoin Dilemma🌎

How's Worldcoin doing? The hype really worth it? CZ is hopeful as always. What's happening with FTX and who's leading the new lows? definitely not CYBER.

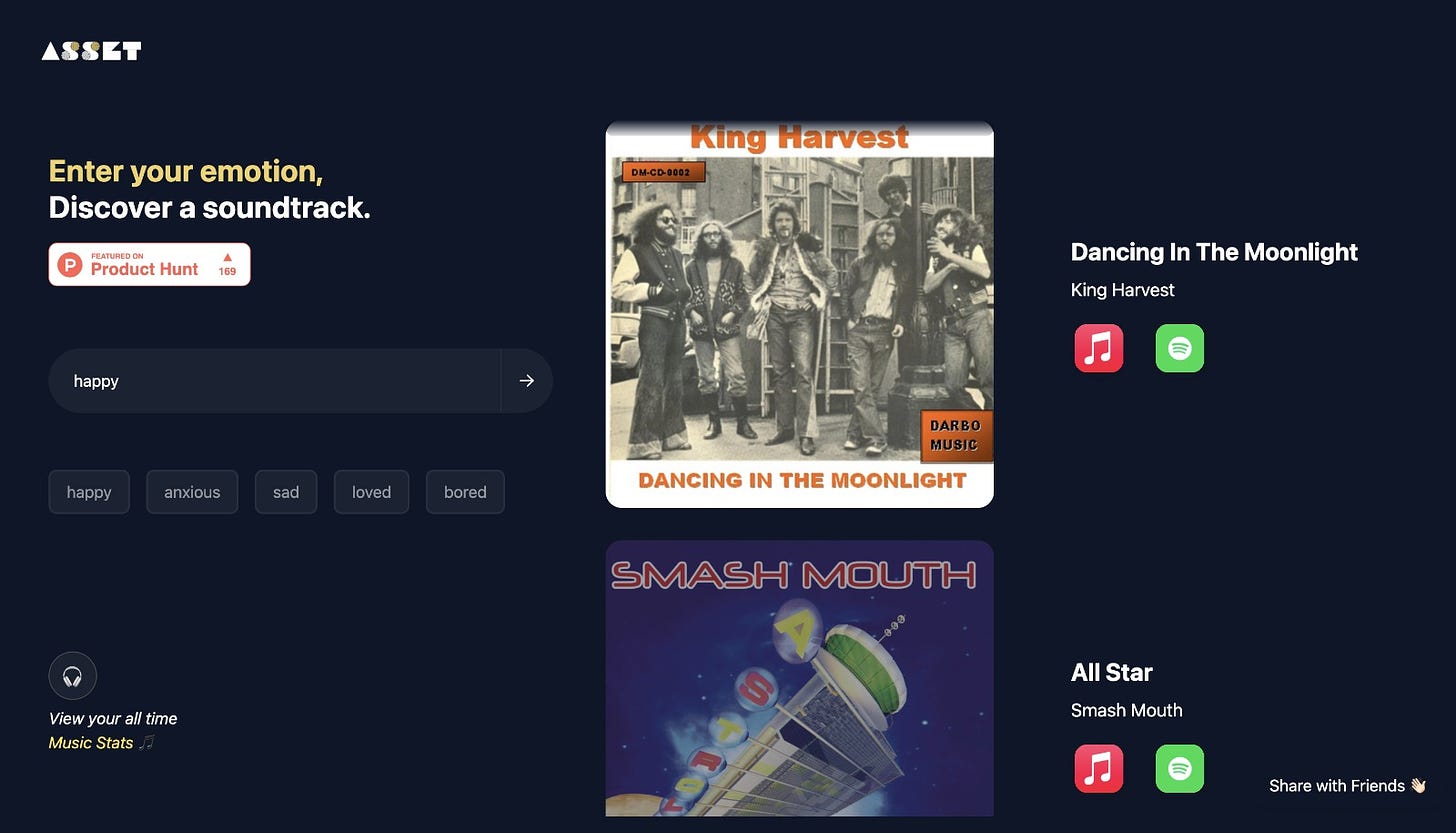

Hello, y'all. Now catch ya feeling in a song 👇

Sometimes words just can't capture how you're feeling, but maybe a song can? 🎸

We've been working on something special for moments like that.

Meet ImFeeling - a platform that understands your emotions and crafts the perfect soundtrack for them. 🎼

Whether you're riding a wave of happiness, navigating through anxiety, or just feeling a bit blue, let music be your companion. 🙌

This is The Token Dispatch, you can hit us on telegram 🤟

What’s the status of the Worldcoin hype now? More like a roller coaster ride - in its nosedive era.

Worldcoin has taken a beating, sliding below $1.20 from an all-time high of $2.50 in August. The aftermath? A whopping 90% of WLD holders are seeing red.

A quick reminder on the whole thing:

Launch: After three years in development, Worldcoin launched on July 24, 2023.

Founders & Aim: Co-founded by OpenAI CEO Sam Altman, Worldcoin's goal is to provide users with a verified digital identity, cryptocurrency token (WLD), and a crypto wallet app.

AI Era Concerns: Increasing difficulty in distinguishing between human and AI-generated online content.

Solution: A digital passport system called "proof of personhood".

Iris Scanning: Worldcoin's platform verifies identity by scanning the iris.

Unique Feature: Personal and secure ID codes are stored on a decentralised blockchain. Claims of non-duplicity.

Current Stats: 16 million registered users; operations in 20 countries.

Worldcoin's Functionality:

World ID: The core is World ID, offering "proof of personhood" through an iris-scanning device known as the Orb.

Uniqueness: Every iris is unique; IrisCode ensures one ID per person.

Coverage: Worldcoin Orbs are available in major cities worldwide.

World App: Houses the World ID; also functions as a crypto wallet.

WLD Cryptocurrency Token: Accessible post World ID creation. Supported on major crypto exchanges.

Where are the Retail Buyers? 🛍️: Despite the initial hype, Worldcoin’s adoption among regular buyers (retail adoption) has slumped. Stats from IntoTheBlock show active addresses dropped from 2,270 on July 24 to a mere 137 by the end of August - 94% drop!

Whale Watch 🐋: The big institutional players aren't giving up, though. They're doubling down, with a cluster of them grabbing an extra 5.04 million WLD tokens over the past week. At the current trading price, that's a bit north of $6 million. Their faith in the coin might offer some hope to the beleaguered Worldcoin community.

The rapid drop in both retail interest and new address creation (down by a startling 98%) paints a challenging landscape for Worldcoin's future.

Crystal Ball Gazing: 🔮

Pessimistic Outlook: Various indicators, including the telling GIOM data, suggest a potential slide below the $1 mark. And if retail interest keeps waning? We might be looking at a $0.50 price point.

Optimistic Scenario: If these financial giants can rally the market, there's a slim chance Worldcoin could climb back past $2. But a lot hinges on a group that acquired WLD at an average of $1.78, not dumping their stash.

But, the regulators are concerned.

In Kenya

Preliminary investigations have found that Worldcoin imported biometric data mining devices without regulatory approval in Kenya. The devices used to scan the iris had not received certification from the Communication Authority of Kenya. The ongoing forensic audit has revealed that Worldcoin Project was using the same identification technology as the BVR kits used during the general election.

Regulatory authorities' failure to coordinate allowed World Coin to exploit data. The current legal framework is inadequate to address these novel issues, according to the Communication Authority of Kenya Director General. Worldcoin issued tokens to users for free, but their value is unclear.

In France

French data regulator, CNIL, has conducted checks at the Paris office of Worldcoin. The regulator is investigating the company's privacy practices, particularly its collection and storage of biometric data, which it claims may violate the EU's General Data Protection Regulation (GDPR). Worldcoin requires users to provide an iris scan in exchange for a digital ID, which has raised concerns. The investigation is part of CNIL's broader effort to ensure data protection regulations are being followed by companies across Europe. Worldcoin is confident it can resolve the issues while abiding by the GDPR.

In Argentina

Argentina has joined the growing list of countries expressing concerns over the cryptocurrency project Worldcoin. But, Argentina has seen a surge in user verifications for World ID, reaching a record high of 9,500 citizens verifying their identities.

The Ethical Dilemma of Tech Innovations

Issues? Sure. Concerns over onboarding security risks and the use of biometric data have led to investigations by countries like the UK, France, and Argentina. But if history has taught us anything, it's that innovation often walks hand in hand with controversy.

The tech landscape has always been a playfield of innovations, with ethical dilemmas often lurking in the backdrop. Machine learning, facial recognition, and big data analytics have only amplified these ethical concerns.

Beyond Borders and Bureaucracy

Worldcoin's vision is clear: solve the global digital identity challenge without relying on government infrastructure. Such a system could prevent identity loss, safeguard against changes in national politics, and stand firm against corruption and fraud. And it could be game-changing for those relying on international aid.

Lessons from Libra: Doomed to Repeat?

Remember the Web3 pioneer, Libra? Like Worldcoin, it also aimed to revolutionise a space — offering a global currency system. Although it faced scrutiny and eventual disbandment, the idea persisted. Many from the Libra team continue their quests to innovate and evolve the financial ecosystem elsewhere.

So, are we letting history repeat itself with Worldcoin? Maybe embrace and refine?

TTD Blockquote🎙️

Binance CEO Changpeng Zhao.

"We are a much stronger company today than we were two years ago … [Binance] way ahead of the game in terms of regulatory compliance.”

Changpeng Zhao, commonly known as CZ, the CEO of Binance, has come out strong against the recent regulatory onslaught faced by the company. He considers this phase an opportunity to display Binance's resilience.

Here's What Went Down:

During a Twitter Spaces event, CZ voiced his concerns against what he feels is an undue amount of fear, uncertainty, and doubt (FUD) being circulated about Binance. He clarified that Binance and FTX are distinct entities and any comparison in light of FTX's legal troubles is unjust.

"We are a much stronger company today than we were two years ago", said CZ. He firmly believes that Binance is well ahead of many others when it comes to regulatory compliance.

Legal Hurdles ⚖️:

Binance has faced its fair share of legal challenges recently:

The SEC accused Binance of operating as an unlicensed securities exchange, participating in wash trading, and operating illegally in the U.S.

U.S. Commodities and Futures Trading Commission has alleged violations of U.S. trading and derivatives rules.

Other countries, including Canada, Australia, and France, have expressed regulatory concerns as well.

The Market Impact 📉:

While Binance continues to retain its title as the world's largest exchange, these legal battles have dented its standing. Post the SEC's lawsuit, Binance US saw a 78% drop in market share, with Binance's overall trading volumes dipping by 52%.

CZ predicts DeFi might soon outpace CeFi. He emphasised cryptocurrency's potential as it becomes more decentralised, noting DeFi currently represents 5-10% of CeFi volumes. This follows a reported 444% surge in decentralised exchanges' trading volume after SEC actions against Coinbase and Binance. Additionally, CZ hailed the dismissal of a lawsuit against Uniswap, emphasising developer protection.

Where’s ETF?🚨

JPMorgan analysts believe that the SEC will likely be forced to approve spot bitcoin exchange-traded funds (ETFs) following Grayscale's recent victory in its case against the SEC👇🏻

TTD New Lows📉

Ethereum NFTs' Slippery Slope

In August, the trading volume for Ethereum-based NFTs hit its lowest level in two years. Marketplaces such as OpenSea, Blur, LooksRare, and X2Y2 experienced a decline in activity. OpenSea, which was once a dominant player in the NFT marketplace, saw a 12% decrease in active users, reaching its lowest count since July 2021. The overall trading volume for Ethereum NFTs dropped to $407 million, a 32% decline from July. X2Y2 experienced the largest decline, falling 40% month-over-month. This decrease in trading volume suggests a slowdown in the NFT market.

A Tightening Purse:

Venture capital funding for crypto startups has hit a two and a half year low, falling for the fourth consecutive month. In August, less than $500 million was invested in crypto businesses, the lowest monthly volume since January 2021. This decline in funding is not limited to the crypto industry, as venture funding levels have dropped significantly across various sectors this year. However, a few later-stage rounds have managed to secure funding, with BitGo raising $100 million in August. Overall, venture funding levels in the crypto sector are projected to be below $2.5 billion in the third quarter of 2022.

DeFi's Recent Plunge 📉:

DeFi's TVL (Total Value Locked) has recently plummeted to a mere $37.7 billion, its lowest level in over two years.

When we rewind to November 2021, things looked much rosier, with a record high of $175 billion in TVL. Fast-forward to now, and we're seeing a massive slide, mirroring the price dips of many altcoins, including Ethereum (ETH).

Current DeFi stats, according to DeFiLlama, indicate this is the gloomiest the sector has been since February 9, 2021.

Back in the glory days of late 2021 and early 2022, daily transactions floated around $4 billion. The current landscape? A significant dip to an average of about $1.5 billion, indicating a sharp decrease in crypto activities.

DeFi Stars Amidst the Decline:

Lido – the Ethereum liquid staking platform, holds its head high as the largest DeFi player, boasting a TVL of $14.10 billion. Even during rough patches, Lido continues to shine, recently locking in an astonishing 8.61 million ETH.

MakerDAO, the following top performer, has a TVL of $5.07 billion, though it hasn't been immune to the decline. Other popular platforms, such as Aave, JustLend, Uniswap, and Curve Finance, have also felt the pinch.

A significant mention is Compound Finance. Once a leading name in the DeFi TVL, it has tumbled to the 11th position after its TVL shrunk by 17.87% within the last month.

TTD FTX🦹🏻♂️

Recent revelations in the FTX bankruptcy case provide insight into financial decisions and potential misuse of company funds.

Yacht Purchase:

Sam Trabucco, former Alameda CEO, reportedly spent $2.5 million of company funds to acquire a yacht.

Robinhood Shares and Cash Transfers:

Transactions outlined in the court filing show cash payments made to Sam Bankman-Fried and Gary Wang, both former FTX executives. Notably, they had purchased shares in Robinhood, which were later seized by the US Department of Justice and repurchased by Robinhood itself.

Breakdown of Transfers:

Significant transfers include $900 million to Bankman-Fried, $15.5 million in cash to Gary Wang, and $3.5 million to ex-Alameda CEO Caroline Ellison. The American Yacht Group was also paid $2.5 million for the aforementioned yacht.

Cryptocurrency Transfers:

Despite its bankruptcy status, FTX transferred $10 million worth of digital assets from the Solana network to Ethereum, which has raised concerns in the crypto community.

FTX has proposed appointing Galaxy Digital Capital Management as the investment manager for its recovered crypto holdings, with a limit of selling $100 million of tokens per week. The exchange also filed a motion to hedge its larger holdings of Bitcoin and Ether. FTX's reorganisation plan includes a potential reboot of the exchange in 2024.

TTD Hype🚀

CYBER tokens have recently been drawing significant attention. What is that all about?

CYBER's Rapid Ascend: Despite a largely stable crypto market, CYBER from CyberConnect has seen a sharp increase, with its market cap now at $113 million. The token's value has doubled in just one week.

Trading Volume Surge: The enthusiasm for CYBER is evident in its trading volumes, which have increased tenfold from $30 million to $225 million within 24 hours.

What Powers CYBER? CyberConnect offers a platform for developers to work on applications related to digital identity, content, and blockchain relationships. Notable features include CyberGraph, a mechanism to record user interactions, and CyberID, a unique user identifier within their ecosystem.

High Fees, High Risks? Traders are currently paying substantial fees, sometimes up to 2000% annualised, to buy these tokens on margin. Such high fees often come with equally high risks.

The Rise and Fall of Similar Platforms: It's essential to note previous platforms like Friend.tech, which experienced rapid growth only to see a 95% revenue drop in a few weeks. Such precedents call for careful analysis of CYBER's potential trajectory.

Funding Rates Spike: The difference between CYBER's spot and futures contract prices has led to skyrocketing funding rates, reaching 2,190% on platforms like Bybit and Bitget, and 1,500% on Binance.

TTD Surfer 🏄

Yes Bank in India has integrated UPI compatibility on the RBI's Digital Currency app, allowing users to execute transactions by scanning any UPI QR code.

The US added 187,000 jobs in August, surpassing expectations of 170,000, but the unemployment rate rose to 3.8% from 3.5% in July.

The SEC has charged a man from Hawaii for running a fake crypto pump-and-dump scheme.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋