Time For AVAX ⏰

What's powering the layer 1 blockchain Avalanche's (AVAX) price rally? Banks suffer as Musk’s Twitter buyout hits major hurdles. Justin Sun’s USDD loses BTC backing. Rethinking crypto's anonymity.

Hello, y'all. A music quiz that’s got over million plays. Have you challenged your friends at it yet? Do it then 👇

A year of pain, followed by a quick recovery.

A short-lived surge, or is it the start of a bigger bullish trend?

We are talking about Avalanche (AVAX).

What’s happening? AVAX hit a nine-month low of $17.29 in August but has since rallied 45% to $26.26.

10% up in 24 hours, 30% up in 7 days.

Outpaced even the market leaders, Bitcoin and Ethereum.

Why is this happening? A few key developments have contributed to AVAX's recent price surge.

1/The California DMV’s Push

The state has digitised 42 million car titles on the Avalanche network, thanks to a partnership with Oxhead Alpha.

This means users can now track, manage, and even transfer vehicle titles right from their phones.

No long waits at the DMV. With this new system, transferring a car title can be done in minutes instead of weeks.

Read: California's Blockchain Push 💡

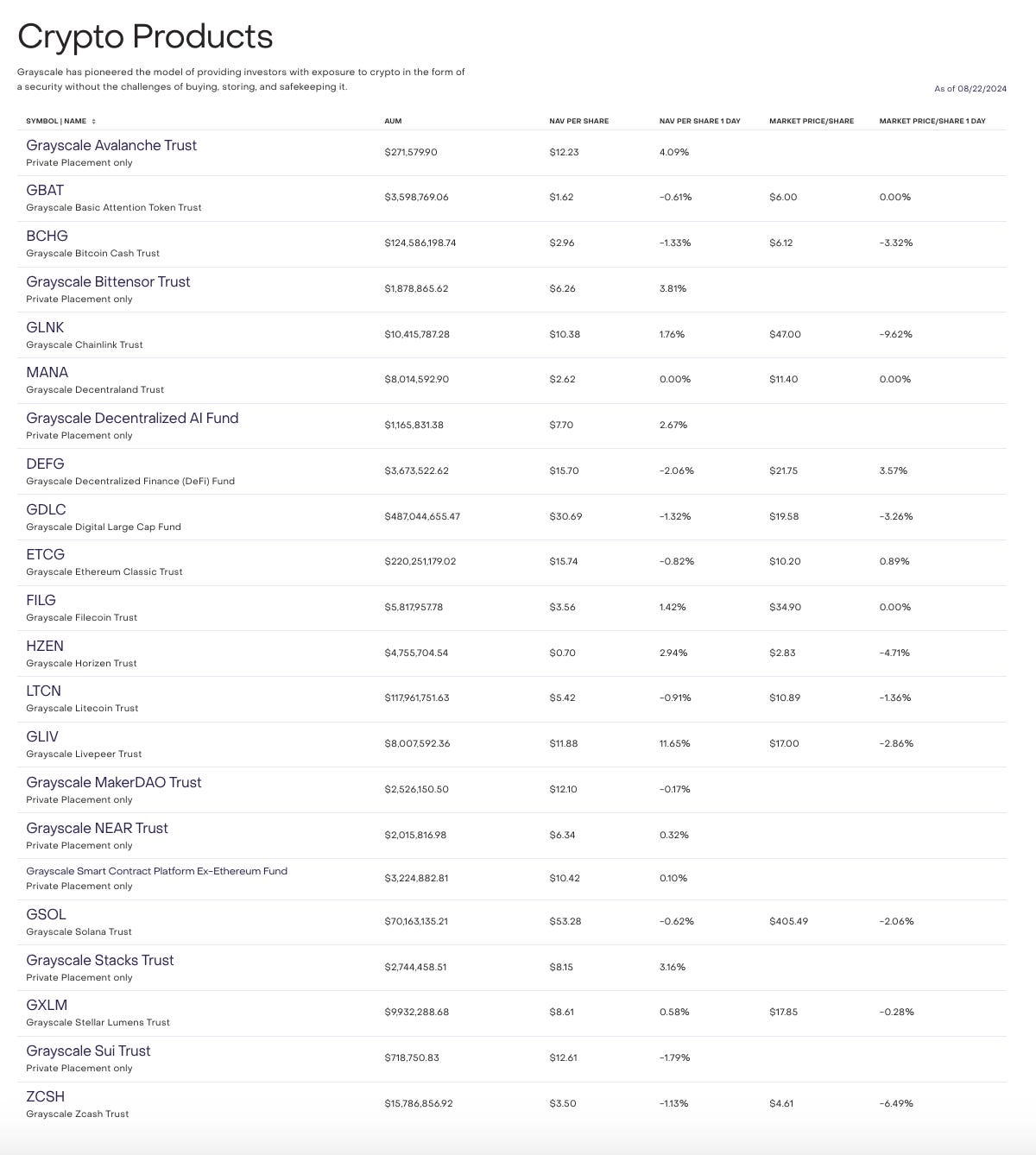

2/Grayscale’s AVAX Trust

Grayscale Investments, a leading asset manager in the crypto world, launched a new investment fund focused on Avalanche's native token, AVAX.

The trust is now open for daily subscriptions. It operates similarly to Grayscale’s existing single-asset investment products, focusing exclusively on AVAX.

This latest AVAX trust adds to Grayscale's impressive collection of crypto investment products.

The firm already manages a suite of over 20 products, including the well-known Bitcoin and Ethereum ETFs.

3/Franklin Templeton's Money Market Fund

The Asset manager is expanding its on-chain money market fund, FOBXX, onto the Avalanche blockchain.

This marks the fourth network launch for the fund, which was initially launched on Stellar and Polygon.

What's the big deal?

Tokenised Money Market Fund: FOBXX is a unique asset, represented by the BENJI token. It's a way for investors to access a traditional money market fund through a blockchain.

Institutional appeal: This fund is geared towards both institutional and retail investors, offering a convenient way to invest in low-risk U.S. government securities.

Avalanche expansion: This move expands access to FOBXX, making it available to a wider audience of investors on the Avalanche network.

Growing trend: Tokenised government securities are gaining traction, with over $1.8 billion under management according to Dune Analytics.

4/Token Unlock Schedule

Investors are excited about a significant reduction in token unlocks after 2024.

This could mean less selling pressure and a more favourable environment for price appreciation.

Why? Typically, token unlocks increase the circulating supply, which, if not met with proportional demand, can lead to price drops due to increased sell pressure.

5/Avalanche memecoin initiatives

Launched $1 million "Memecoin Rush" liquidity mining program and the Culture Catalyst program to support and promote meme coins on its network.

These efforts aim to enhance liquidity, empower creators, and recognise meme coins as significant cultural assets within the blockchain community.

We all know what memecoins have done for Solana.

Read: Solana ❤️

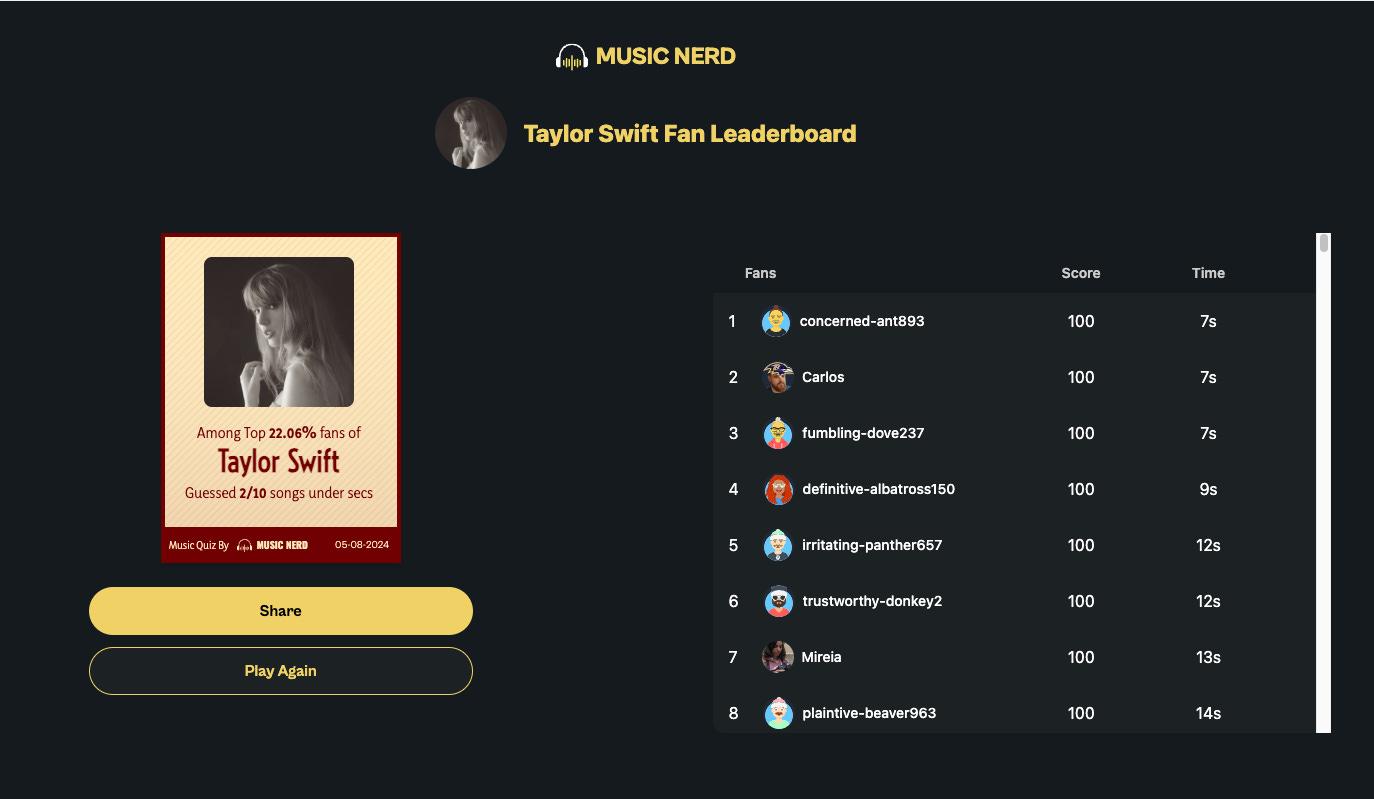

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to the fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

The Wall Street Journal on Elon Musk’s Twitter deal.

“Worst merger-finance deal for banks since the 2008-09 financial crisis.”

Tesla founder Elon Musk wanted to buy Twitter.

He borrowed $13 Billion - a big headache for banks.

We are talking about the banks that helped finance the deal.

Billions of dollars in loans are stuck on their balance sheets, creating a significant burden.

Banks feel the pinch

Big banks like Morgan Stanley and Bank of America are saddled with approximately $13 billion in loans related to the Twitter acquisition.

These banks typically sell such loans to other investors, but X's private status makes this difficult.

As X struggles with revenue, the value of these loans has taken a nosedive.

The "hung" loans prevent banks from reinvesting the money, limiting their ability to generate profits.

Some banks, like Barclays, have even resorted to cutting employee salaries to manage the financial strain.

Crypto and AI Titans who backed Musk

A recent court order has revealed a list of X's (formerly Twitter) shareholders, shedding light on the crypto and AI heavyweights who backed Elon Musk's $44 billion acquisition.

Binance Capital Management, a prominent player in the crypto space, was among the investors.

Fidelity, a financial giant, also made an appearance on the shareholder list. Its digital assets arm has been actively involved in the crypto space.

Several venture capital firms known for their crypto and AI investments, including Andreessen Horowitz (a16z), ARK Venture, and 8VC, joined the ranks of X's shareholders.

These firms have a strong track record in backing innovative projects in the AI and crypto. Include Coinbase, Anchorage Digital, Robinhood, Anthropic, PathAI, and Cognition.

Elon Musk's acquisition of X has been one of the most significant tech deals in recent history.

In The Numbers 🔢

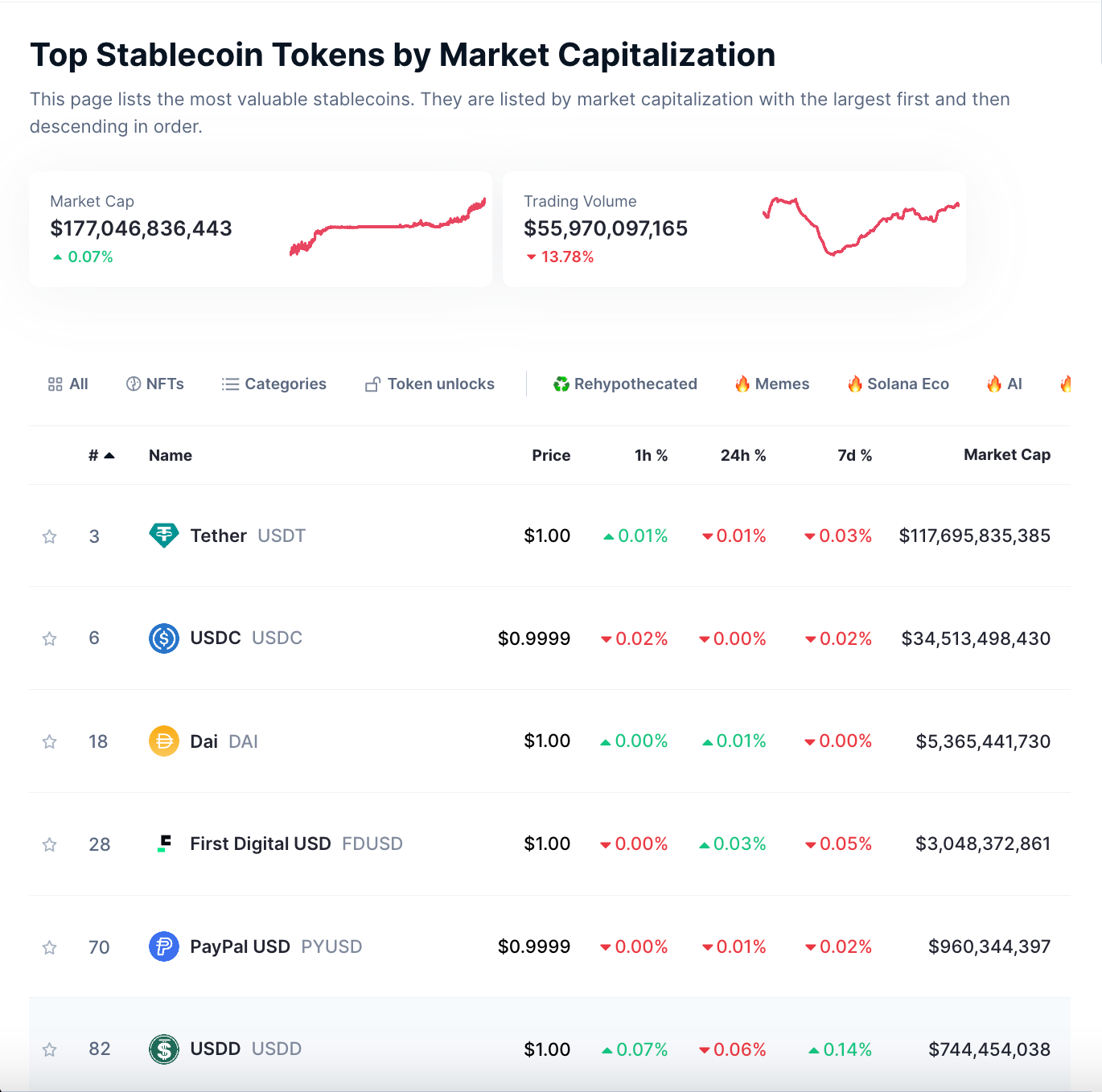

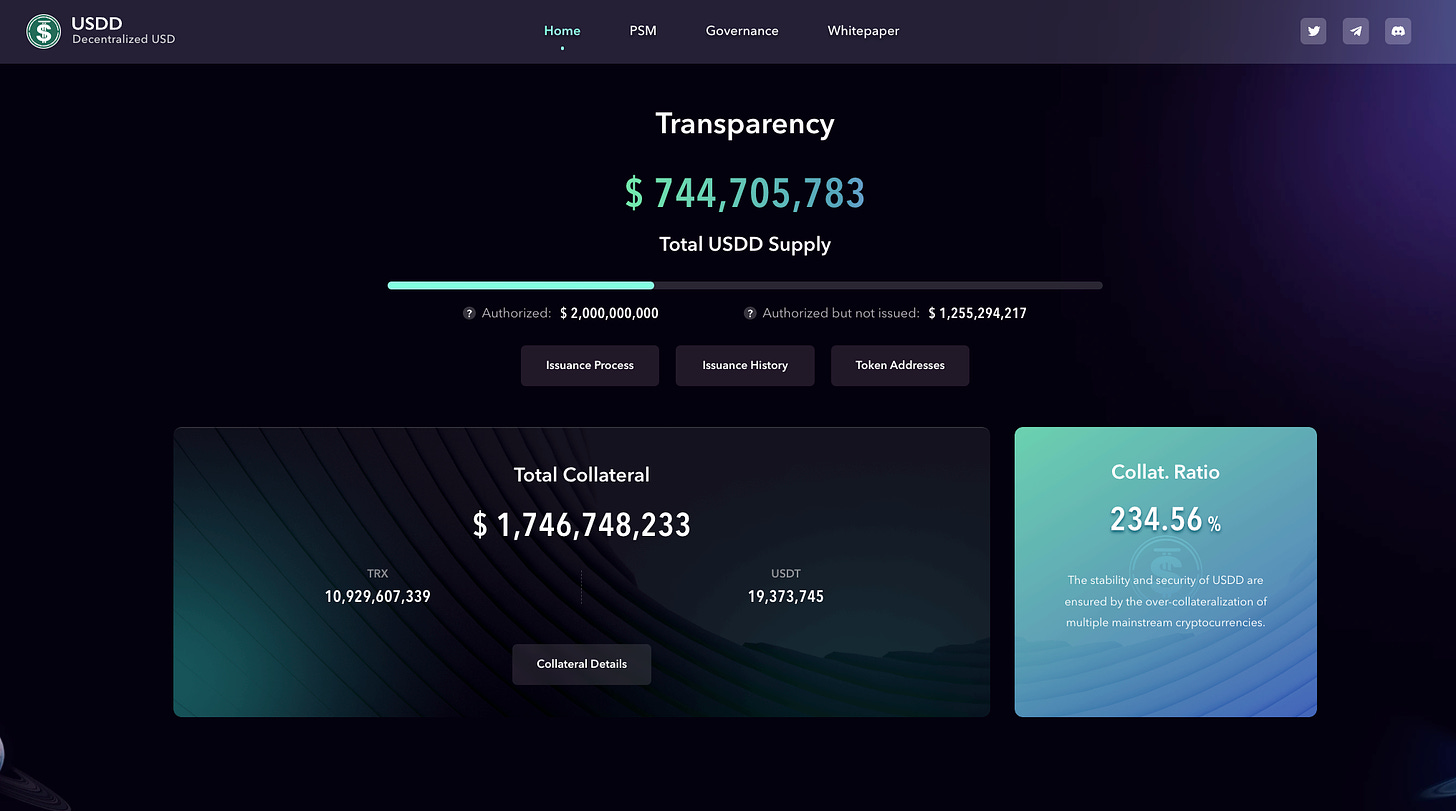

12,000 BTC

The amount Tron DAO Reserve has removed approximately $732 million in Bitcoin backing USDD stablecoin.

Done without a vote from the Tron DAO Reserve.

Why does it matter? It raises concerns over decentralisation.

What happened? On August 19th, a blockchain explorer identified a significant outflow of Bitcoin from an address previously linked to USDD reserves.

This move raised questions about who authorised the withdrawal and why there was no community vote despite USDD being a DAO-governed project.

Negative ratings: Stablecoin rating agency Bluechip gave USDD its lowest rating, criticising its stability mechanisms and ownership issues.

USDD the sixth largest stablecoin is not backed by Bitcoin anymore.

Justin Sun's defense: “This is part of the basics of DeFi 101.”

Launched in 2022, USDD is an algorithmic stablecoin pegged to the US dollar and is managed by the Tron DAO Reserve.

Current backing: USDD, with a supply of over $749 million, is now largely backed by TRX, the Tron blockchain's native token.

Rocky history: USDD was initially under collateralised and switched to an over collateralised model following the collapse of Terra's TerraUSD stablecoin in 2022.

Minimum collateralisation commitment: The Tron DAO had previously committed to maintaining a minimum collateralisation ratio of 130%.

Rethinking Crypto’s Anonymity

Once celebrated as a protector of privacy and financial sovereignty, rooted in the cypherpunk ethos.

Ethereum’s Vitalik Buterin argues that this view is outdated.

Advocates for a multidimensional identity framework.

Suggests that anonymity is outdated and insufficient for addressing modern governance challenges.

Argues anonymity fails to address issues like collusion and governance attacks, which can undermine trust and accountability.

Read: Plurality philosophy in an incredibly oversized nutshell

Proposal have faced pushback from technologist Vinay Gupta, who calls the approach "a genuinely terrible idea."

Argues that the focus should be on adapting governance philosophies rather than changing identity frameworks.

Gupta supports a return to the cypherpunk ideal, where individuals can engage in digital spaces without revealing their identities.

Magic Eden Adopts ME Token

A utility token that will fuel the NFT marketplace ecosystem and offer exciting new possibilities for users.

Cross-chain trading: ME tokens will enable seamless trading across different blockchains, giving users the freedom to explore NFTs on various networks like Solana, Bitcoin, Polygon, and Ethereum.

Third-tarty integration: Magic Eden envisions ME tokens being used in other decentralised apps and protocols, expanding its reach and utility beyond the platform itself.

Community-owned and governed: ME will be a community-driven token, empowering users to have a say in its development and direction.

Magic Eden platform has done more than $6 billion in trading volume to date across various networks representing 60% of all NFT revenue, says ME Foundation Director Matt Szenics.

Accounts for 80% of all Bitcoin Ordinals and Runes trading volume.

The Surfer 🏄

Austin Michael Taylor, co-founder of CluCoin, pleaded guilty to wire fraud after misappropriating $1.14 million of investor funds. Funds raised through CluCoin's ICO were intended for project development but were instead gambled away by Taylor.

Australia's Federal Court ruled against Kraken's local operator, Bit Trade Pty Ltd, for violating the Corporations Act. The court found that Bit Trade issued a "margin extension" product to retail clients without a required target market determination.

Hong Kong's SFC is scrutinising crypto exchanges that are "deemed to be licensed" for compliance issues amid stricter regulations. Inspections revealed deficiencies in managing cybercrime risks and over-reliance on a few executives for client asset custody.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋