Vitalik's Paper 🗞️

Buterin wants Privacy Pools and Roman wants to plead not guilty. Base makes summer hotter with NFTs. ARK's knocking on regulation's door and Google has a new ad policy. Mashinsky feels the freeze?

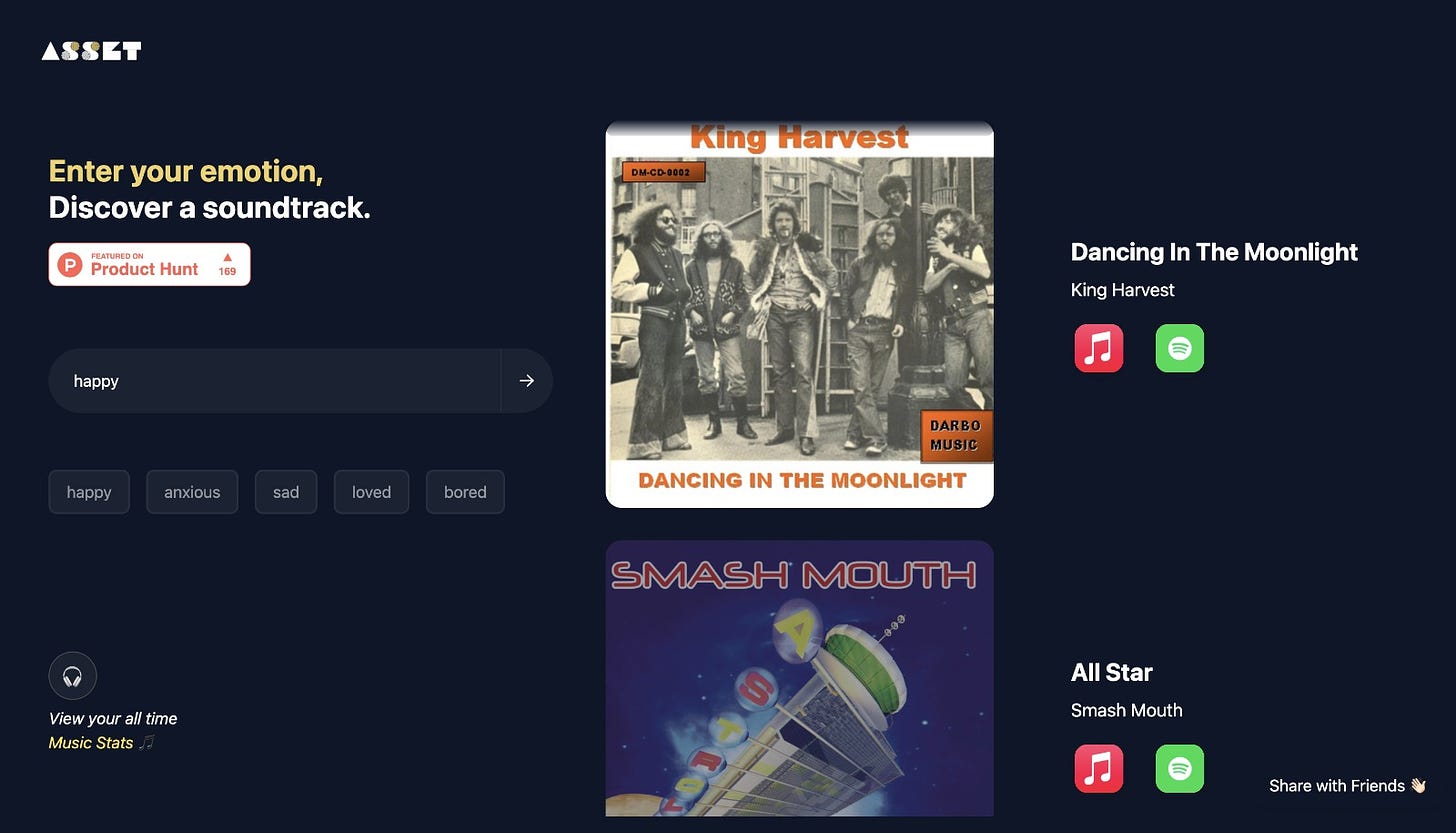

Hello, y'all. When words fail you, a song can come to your rescue 🎼

ImFeeling - does just that. A platform that understands your emotions and crafts the perfect soundtrack for them 👇

Whether you're riding a wave of happiness, navigating through anxiety, or just feeling a bit blue, let music be your companion. 🙌

This is The Token Dispatch, you can hit us on telegram 🤟

Ethereum co-founder, Vitalik Buterin, has stepped into the limelight once again, this time with a research paper.

The paper is called "Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium" and he's not alone.

Together with a core developer, a researcher, and two academics, Buterin is working on a privacy protocol that could possibly dethrone the embattled Tornado Cash.

The objective? Bridging the gap between utmost financial privacy and strict regulatory oversight.

The Team 🤝

Vitalik Buterin: Ethereum's co-founder.

Ameen Soleimani: Core developer.

Jacob Illum: Researcher from Chainalysis.

Matthias Nadler & Fabian Schar: Academicians.

The ensemble has christened the new protocol "Privacy Pools."

What are Privacy Pools? 🏊

Privacy Pools is touted as a "smart contract-based privacy-enhancing protocol." At its core, it looks to leverage zero-knowledge proofs. With this tech, it verifies the legality of user funds, ensuring they aren't tied to any illicit activities. Yet, it does this without baring the user's full transactional history.

"All users with 'good' assets have strong incentives and the ability to prove their membership in a 'good’-only association set," the paper says. "Bad actors, on the other hand, will not be able to provide that proof."

The Art of Balancing: The protocol strives for a "separating equilibrium." In layman's terms, it aims to segregate funds tied to criminal endeavours from legitimate ones, balancing the scales of privacy with the hefty weight of regulation.

Functionality: Users can publish a zero-knowledge proof to confirm the legitimacy of their funds without revealing their transactional web. This indicates that financial privacy and the stringent rules of regulations can, indeed, harmoniously co-exist.

Why Was This Necessary? Tornado Cash, another privacy tool, although effective, became a victim of its own success. It allegedly became a haven for illicit actors, including the North Korea-affiliated hacker group, Lazarus. The legal quagmire it found itself in culminated in being blacklisted by the U.S. Treasury Department's Office of Foreign Assets Control in August 2022.

This move received criticism from various quarters, including some who felt it was an overreach of the department's authority. A lawsuit challenging this action, financially supported by crypto exchange Coinbase, was unfortunately unsuccessful for the plaintiffs.

Pleading not guilty

Roman Storm, the co-founder of Tornado Cash has chosen to plead not guilty.

Roman Storm was taken into custody by US authorities in August over allegations connected to Tornado Cash's purported role in facilitating money laundering activities.

Roman Storm and an alleged associate, Roman Semenov, face multiple charges:

Conspiracy to commit money laundering.

Conspiracy to violate U.S. sanctions.

Conspiracy to operate an unlicensed money-transmitting business.

The charges revolve around the alleged aid provided by Tornado Cash to North Korea's Lazarus Group. This assistance purportedly enabled the group to sidestep U.S. sanctions, indirectly funding North Korea's nuclear ambitions.

Apparently, Storm has pleaded not guilty before a judge in the U.S. District Court for the Southern District of New York.

Ethereum's Mobile Node Vision

At the Korea Blockchain Week, Ethereum's co-founder, Vitalik Buterin, hinted at the intriguing possibility of mobile devices running full Ethereum nodes. These remarks shed light on the future direction of Ethereum, focusing on decentralisation and scalability.

Buterin is optimistic about future upgrades that would allow running fully verified Ethereum nodes on mobile devices. A full node, in essence, verifies all the transactions and smart contracts on Ethereum.

The Current Scenario

Presently, to run a full node, one requires hardware that includes an SSD larger than 2TB and 16 GB RAM.

Due to these hefty specifications, the majority of nodes are centralised, operating mainly on servers like Amazon Web Services.

Decentralisation & Scalability Issues

The Ethereum mainnet grapples with centralisation and scalability challenges.

Buterin identifies six pivotal problems related to the Ethereum network's centralisation.

Solution - Stateless Clients

700To reduce the hardware prerequisites for running full nodes, Ethereum's roadmap introduces the concept of "stateless clients" and "Verkle Trees".

With stateless clients, the data required to run a node will be nearly null.

"Statelessness" would mean the entire Ethereum blockchain state wouldn't need storage by all nodes. Only a limited space for validating transactions would be required.

While this sounds promising, Buterin also added that introducing statelessness isn't without challenges. It might span over 10 to 20 years to address all the technicalities.

Distribution of Staked ETH

Buterin addressed the centralisation surrounding staked ETH.

He encouraged the incorporation of "non-dominant forms of staked ETH" in the stablecoin lending platform.

According to Buterin, scalability is the primary concern. Solutions like rollups, particularly those founded on zero-knowledge proofs, are making headway in addressing the scalability issue.

TTD Number 🔢

700k

The Base network has been the focal point of the NFT community, witnessing skyrocketing NFT minting in August. Dubbed "Onchain Summer," this campaign saw tremendous participation and showcased the appetite for NFTs among users.

During the "Onchain Summer" promotion, over 700,000 NFTs were minted. This activity was distributed among more than 268,000 unique wallets.

About Base

Coinbase introduced Base, its layer 2 solution for Ethereum, on August 9.

To foster its growth and attract users, the Base network initiated a month-long event, collaborating with over 50 entities comprising companies, artists, and creators. This event saw exclusive NFT digital art drops on the Base platform, with different art sets releasing on unique dates.

The promotional event's initial fortnight saw crypto worth over $242 million being bridged to Base.

Additionally, each day, more than 130,000 unique wallets interacted with Base.

Top Collections

Among the varied collections available, the Coca-Cola set (available from August 13-16) experienced the highest traction, with over 80,000 mints.

Other prominent collections included Web3 gaming platform Iskra (71,000 mints), social media platform Friends With Benefits (71,000 mints), layer-2 network Zora (70,000 mints), and music rights marketplace Anotherblock (55,000 mints).

Throughout this event, the amount of cryptocurrency locked in Base contracts exhibited a consistent uptick. By September 3, it peaked at an impressive figure exceeding $402 million ($393.58 million now), as per data from DefiLlama.

Where’s ETF?🚨

ARK Invest and 21Shares have filed for regulatory approval to launch the first Ether ETF in the US. 👇🏻

TTD NFTs 🐝

Google's Nifty NFT Game Ad Update 🌐

Starting September 15, Google's sprucing up its ad game by letting blockchain video games with NFTs advertise away.

Allowances

Ads promoting games that feature in-game items such as cosmetics, weapons, or other NFT items are greenlit under this policy change.

Restrictions

Games that enable players to stake or wager their NFTs for a chance to win tangible value, including other NFTs, cannot advertise on Google.

"Social casino games" that reward players with NFTs are banned from advertising.

Games offering "real money gambling" cannot purchase ads.

Additionally, games that allow users to stake or lock their cryptocurrencies or NFTs to earn additional cryptocurrencies over time are not allowed to advertise.

Justin Bieber's "Company" Royalties for Sale 🎸

Producer Andreas "Axident" Schuller is selling NFTs that grant owners a percentage of future streaming royalties for Justin Bieber's hit song "Company."

💸 The Deal: With AnotherBlock, he's selling a 1% total share of the streaming rights. All wrapped up in 2,000 Ethereum NFTs. Starting price? 0.017 ETH ($28) each. Sale kicks off on September 7. Card or crypto, they're taking both.

AnotherBlock isn't new to this. They've already sold rights to jams by Rihanna, MIMS, and David Guetta and Martin Garrix.

Reddit's Ready for NFL with NFTs 🏈

Just in time for the NFL season, Reddit's rolled out NFT-backed avatars of all teams. The digital assets, priced at $25 each, represent the 32 teams in the league and are limited to 500 per team. The avatars can be used by fans to represent their teams in comment sections on the platform.

The New England Patriots, Kansas City Chiefs, and Philadelphia Eagles are among the most popular teams in terms of NFT sales. Reddit entered the NFT space last year and has since released several collections, with 22 million avatars minted so far.

TTD Ruling👩🏻⚖️

Former Celsius CEO Alex Mashinsky's in hot water! Judge Jed Rakoff's put a chill on Mashinsky's assets, including bank accounts and a Texas property.

Why? Alleged fraud charges against Celsius investors.

Mashinsky was nabbed in July on multiple counts, including securities fraud. Though he claims he's innocent, things are heating up.

On August 16, Rakoff quietly told financial bigwigs (like Goldman Sachs) to halt the sale of assets under Mashinsky's name. The reason? Stopping the ex-CEO from draining those funds dry. Now, that hush-hush move's been revealed to the public.

This asset freeze is a big blow to Mashinsky. With legal bills piling up, being locked out of his savings and property couldn't have come at a worse time. Especially after coughing up $40 million for bond post his arrest in July.

The Allegations: Prosecutors are throwing shade at Mashinsky for portraying Celsius as a safe crypto bank. But, they claim, it was more like a risky investment with Mashinsky allegedly fudging the truth about its fiscal health.

The network had to slam the brakes on withdrawals, swaps, and transfers in June 2022, thanks to some market madness. And a month later? They filed for bankruptcy protection.

The plot thickens with allegations that Mashinsky fibbed about sales of CEL, the company's native token. Mashinsky and Celsius executive Roni Cohen-Pavon could face some serious jail time if found guilty.

Mashinsky's lawyers are coming out swinging, calling the claims "baseless". But with big regulators like the SEC, CFTC, and FTC on his tail, it's going to be a tough battle.

What Now? With his assets frozen, Mashinsky's got to defend himself without dipping into his savings or selling off real estate. And if he's found guilty? That freeze ensures the government can snatch up fines and get restitution.

TTD Rug Pull 🚫

Xirtam, an Arbitrum-based project, pulled the rug right from under its investors, swindling a cool $3.2 million from them. But here's the twist: instead of getting crafty, they directly dumped the stolen loot onto Binance.

Binance to the Rescue: The crypto exchange giant didn't let this slide. Binance was swift to freeze the assets once they sniffed out the scam, ensuring the bad actors didn't skip town with their ill-gotten gains.

How Will Users Get Refunded?: Binance has set up an automated smart contract for affected users. They just have to connect their wallets to Etherscan, pass a verification check, and claim their funds through the provided contract address. However, there's a catch: users should've submitted their claims by Aug. 2 to get their cash back.

Xirtam's Slick Moves: Before the big scandal, Xirtam successfully lured investors through a series of funding rounds, racking up nearly 1,909 Ether. These included initial coin offerings and sales via liquidity bootstrapping pools. But drama ensued when an airdrop offering got axed after some undisclosed seed sales by Xirtam came to light.

Rug Pull Revealed: After getting their hands on the cash, Xirtam's owners went full rogue, emptying out assets from the project's smart contract. But instead of being sly about it, they waltzed into Binance with all the stolen cash in hand, making it easy for the exchange to lock down the funds.

TTD Surfer 🏄

Bitcoin miner Riot Platforms received over $31 million in power credits in August, reducing its production costs.

IndyCar legend Michael Andretti's special purpose acquisition company (SPAC), Andretti Acquisition Corp, is merging with AI startup Zapata AI.

Non-profit blockchain infrastructure company, Anoma Foundation, has launched the mainnet for its layer-1 blockchain protocol, Namada.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋