What's Ethena USDe? 🗣️

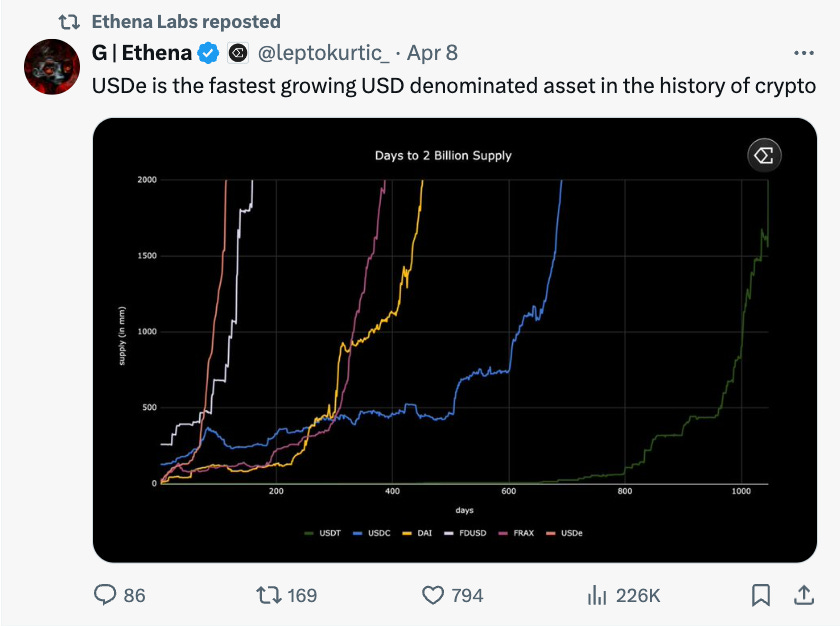

Decentralised Finance (DeFi) protocol Ethena Lab's synthetic dollar, USDe, is designed to be a censorship-resistant, scalable, and stable crypto-native solution for money. We take a deeper look.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Ethena Labs is growing into a key player in the Decentralised Finance (DeFi) space.

Why? Introduces a new approach to finance with its synthetic dollar protocol, USDe. It aims to revolutionise how we interact with stablecoins and savings instruments within the crypto ecosystem.

It has had a rockstar curve since the launch. Let's go deep dive into that.

What is Ethena Labs?

A DeFi protocol built on the Ethereum blockchain.

Primary focus is twofold.

Introducing USDe: Ethena Labs created USDe, a synthetic dollar pegged to the value of the US dollar. Unlike traditional stablecoins backed by fiat reserves, USDe leverages algorithmic mechanisms to maintain its price peg.

Building a DeFi Bond System: Ethena envisions a future with a robust DeFi bond system, offering users alternative ways to earn passive income within the decentralised financial landscape.

Ethena's mission is to provide the crypto space with.

Stable and Censorship-Resistant Base Money Asset: USDe strives to offer a reliable store of value, independent of traditional financial institutions.

Globally Accessible Savings Instrument: Ethena aims to create an accessible and permissionless savings solution within the DeFi ecosystem.

What is the ENA Token?

The ENA token serves as the governance token for the Ethena protocol.

Breakdown of its functionalities.

Governance: ENA token holders have the right to participate in crucial protocol decisions through voting. This empowers the community to shape the future of Ethena Labs.

Securing the Network: ENA holders can contribute to the security of the USDe peg through various mechanisms that are still under development.

Ethena's USDe stablecoin uses a different strategy than most, and their airdrops reward activities that help it grow.

In the first round, users collected "shards" by holding USDe, using it in DeFi protocols, and providing liquidity.

These shards were then converted to ENA tokens, which themselves have seen a nice price bump.

ENA Tokenomics

Total Supply: 15 billion

Initial Circulating Supply: 1.425 billion

Ethena recently distributed 450 million ENA tokens through an airdrop to USDe participants.

The remaining tokens will likely be distributed through various channels, including liquidity pools, team allocations, and future airdrops.

Ethena Labs airdropped a whopping $450 million worth of ENA tokens to lucky participants, with the biggest winner walking away with a cool $1.96 million.

Ethena's airdrop went live on April 2nd, distributing the tokens swiftly within hours.

Exchange Listings and Price Fluctuations: Following the airdrop, major exchanges like Binance and Bybit listed ENA for trading, leading to an initial price drop of over 15%. Despite the dip, ENA currently holds a market cap of 1.77 billion.

Now, Ethena has integrated with Binance, Bybit, OKX, and Bitget exchange wallets, allowing users to earn their juicy USDe yields directly from those platforms.

Round Two is Here: Didn't get in on the first airdrop? No worries.

Ethena's kicking off a second round with a new reward system called "sats" that focuses on integrating Bitcoin. Users can earn sats by holding USDe, staking it in pools, and more.

The party goes until September or when USDe supply hits $5 billion.

Read more here.

Comparisons with the Terra-Luna ecosystem

Ethena Labs' USDe stablecoin offers a 27.6% annual percentage yield (APY), which raised worries in the crypto community about its economic viability, especially after the collapse of the Terra-Luna ecosystem.

Unlike Anchor Protocol's artificially inflated yield, Ethena Labs' USDe yield is generated through staking returns and shorting Ether perpetual futures contracts, providing a more sustainable yield mechanism.

Ethena Labs is now using Bitcoin alongside existing assets to back USDe. By incorporating Bitcoin's futures market, Ethena hopes to boost yields for USDe holders. The addition of Bitcoin is claimed to make USDe a "safer" product.

Critics have highlighted the risks associated with maintaining such high yields, especially in bear markets, which could lead to adjustments in USDe's yield in the future.

Ethena Labs' approach involves complex financial strategies, such as basis trades and tokenising trading, to generate yield, but it also carries risks related to collateral depegging and market fluctuations.

Despite its impressive growth and attracting significant deposits, Ethena's high yields and design have sparked concerns and comparisons with past unstable ecosystems like Terra-Luna

TTD Week That Was 📆

Saturday: Crypto Succumbs to the World Order 🔴

Friday: Hong Kong's Crypto Happy 😊

Thursday: SEC Corners Uniswap 🫷

Wednesday: Crypto Hangover 🍺

Tuesday: Ethereum Back On Track? 🔀

TTD Week in Funding 💰

Uplink. $10 million. Decentralised physical infrastructure is a better distributed and user-operated infrastructure.

Veremark. $3 million. Blockchain-based “career passport” service that allows job seekers to manage their verified credentials.

Gull Network. $1.6 million. Layer 3 solution by Manta Network. DeFi with code-less pools, customisable tokens, and sniper-proof liquidity.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋