Why Are We crashing? 🚨

Geopolitical tension, economic concerns & sell-offs - bring the largest 3-day wipeout in a year. What happened to Jump Crypto? $1.19B lost to crypto hacks in 2024. Investors prefer ETH ETF over Ether?

Hello, y'all. The music might have gone quite in the markets, but you can still play 👇

What goes up. Comes down.

Law of gravity.

Why should crypto be different?

What it does when it happens in crypto, financial markets - MAYHEM.

It’s like seeing the money burn.

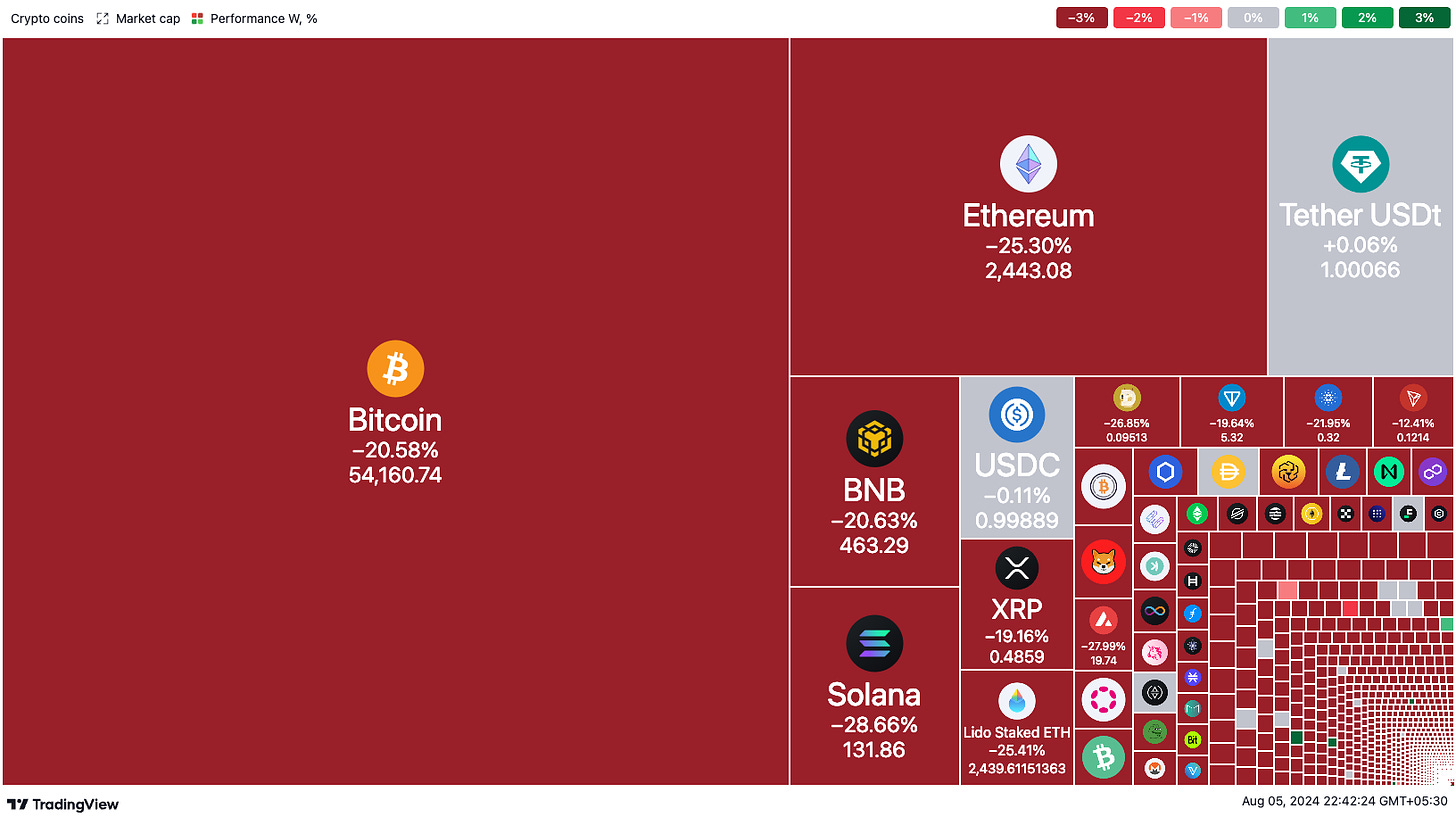

Crypto witnessed its most brutal three-day sell-off of 2024.

Wiped out over $500 billion from its total value.

Volatility that will send you down a tunnel of hopeless traders.

Bitcoin and Ether, dropped 10% and 18% respectively in a single day.

Over the past week, they're down a whopping 20% and 25%.

BTC touching close to $58,000 and ETH plummeting to a low of US$2,100.

The Crypto Fear & Greed Index is in "fear" territory.

But hang on, do you believe in what you see to make your future decisions?

Why are we crashing?

There are reasons, and then there are reasons. We will look at them anyway.

1/ Geopolitical and economic concerns

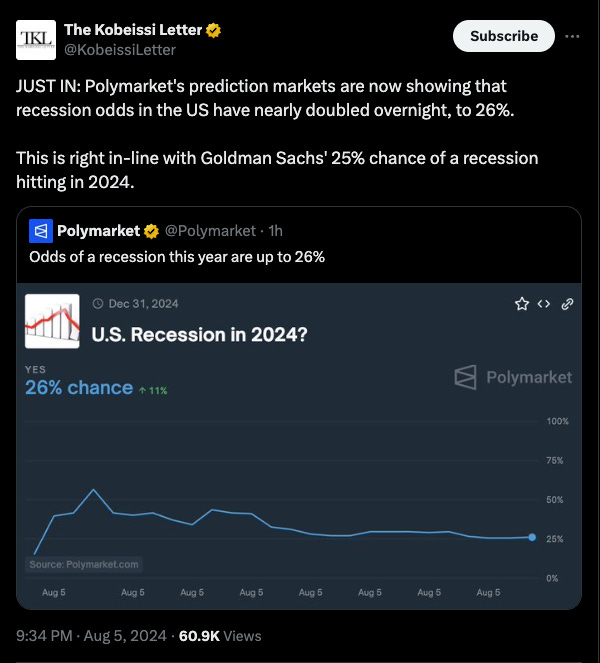

Rising geopolitical tensions and fears of a recession in the US have got the crypto market by the neck.

Increased selling pressure across the markets, why should crypto be spared.

Read: Why the stock market is freaking out again

Weak US jobs data and recession fears

The US unemployment rate rose to 4.3% in July, the highest level in nearly 3 years.

Why does that matter? Fears of recession.

That thing is real. It affects everyday people.

It’s not just unemployment, there are other indicators too - US manufacturing sector downturn.

The bets are on.

2/ Tech stocks take a beating

The tech stocks have been the darling this season.

The big tech stocks have led the magnificent rally in 2024.

Q2 2024 hasn’t been too good. We are down the correction route.

3/ Another culprit? Japan is triggering the crypto market sell-off

The unexpected interest rate hike by the Bank of Japan.

A significant departure from its longstanding ultra-low interest rate policy.

Yen Surge: The policy change has led to a rapid appreciation of the yen, gaining nearly 10% against the USD in a short span.

Carry Trade Crunch: The yen carry trade, a popular investment strategy, has been severely impacted by the yen's strengthening.

The Japanese stock market, Nikkei 225, has suffered a major decline. This spread to the US. Nasdaq slid more than 5% in last week's final two sessions.

Adding fuel to the fire, the Federal Reserve's less-than-enthusiastic stance on potential rate cuts in September

The US 10-year Treasury yield dropped from 4.25% to 3.75% in just a week.

Read: How Japan is triggering the crypto market selloff — and why Bitcoin’s price can benefit

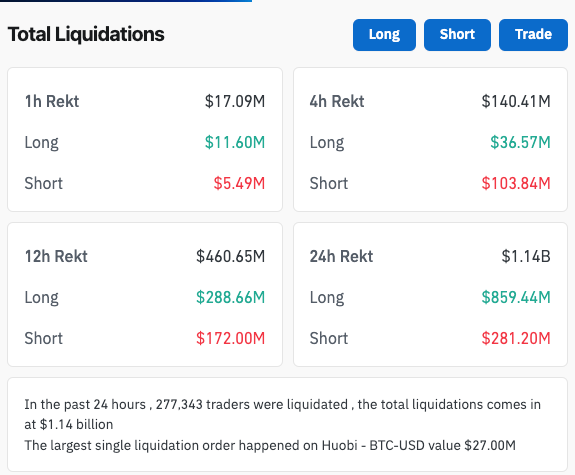

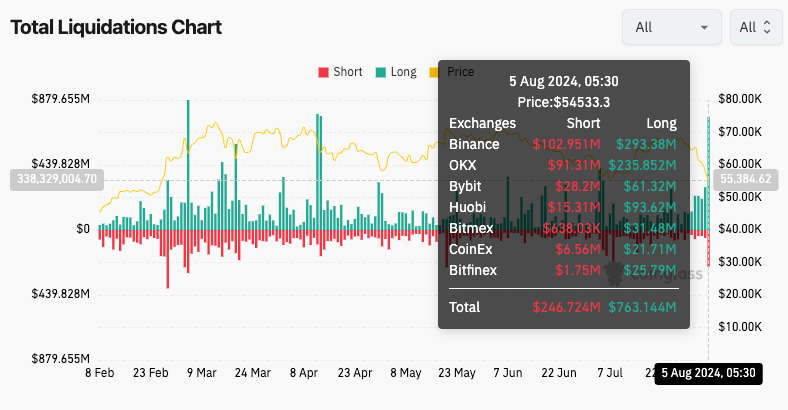

4/Leveraged Positions: $1+ billion in liquidations

Many traders use leverage to amplify their potential returns, but it can also magnify losses.

When prices drop sharply, these leveraged positions are liquidated, exacerbating the downward pressure.

Most of the traders with leveraged long positions got Rekt.

5/ Under Pressure from potential surplus supplies and government Sales

The crypto market is also grappling government Bitcoin sales and the clean up of surplus supply from tokens returned to creditors in bankruptcy cases.

Crypto endured the German government sell-off and the on-going Japanese exchange Mt. Gox creditors payback.

Now murmurs of US government moving it’s Bitcoin for potential sale.

All of this built a wall for crypto to climb.

Grayscale's Ethereum Trust (ETHE) has seen slowdown in outflows after a massive initial surge. $2 billion in outflows since its launch. The trust witnessed a massive $1.5 billion outflow in its first week.

Other Ethereum ETFs have attracted over $1.5 billion in just two weeks, eclipsing ETHE's performance.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

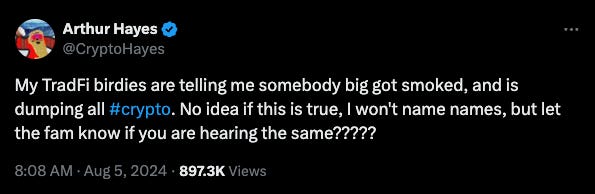

Block That Quote 🎙️

Arthur Hayes, the former CEO and co-founder of BitMEX.

“Somebody big smoked”

Bitcoin plummeted over $20,000 in a week.

Hayes speculated that a major player in the financial sector might be behind the recent sell-off.

One name that frequently surfaced in the blame game was of Justin Sun, the founder of Tron and HTX’s advisor.

Rumours circulated that Sun and his team had been liquidated.

Sun came out - Not me. Not us. We are not the ones.

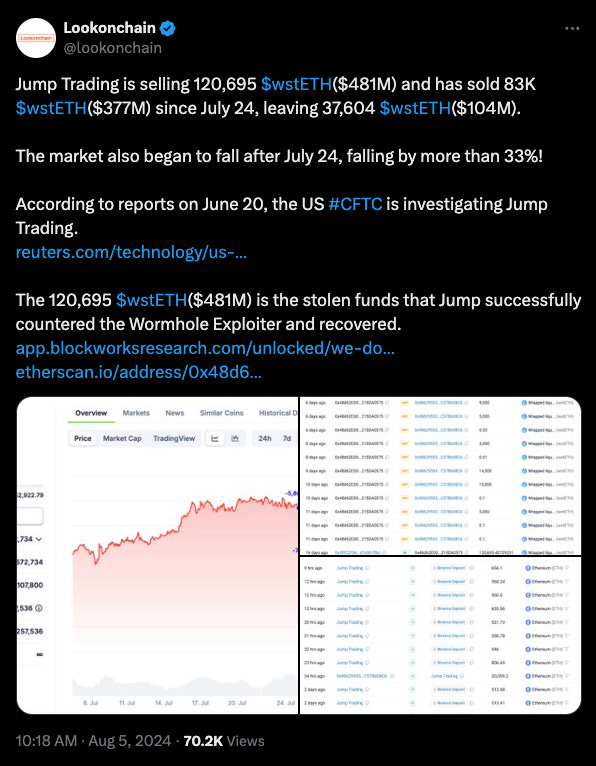

What Happened to Jump Crypto?

That’s the biggest question today. We call it a weekend coincidence.

Jump Crypto, the crypto arm of Jump Trading, is out liquidating.

Speculation of a potential sell-off = market anxiety.

Over 120,000 ETH tokens, valued at roughly $315 million, were unstaked and transferred to deposit addresses on prominent exchanges like Binance, Coinbase, and OKX.

Blockchain analytics firm Arkham Intelligence revealed the unstaking process and subsequent transfers to exchange wallets.

Crypto sleuths like EmberCN estimate the total unstaked amount could be closer to $410 million, with a portion already hitting exchanges.

However, Jump Crypto still holds over $125 million in staked ETH.

Read: A look at Jump Crypto and its shady past

In The Numbers 🔢

$1.19 billion

That’s how much crypto industry lost to hacks and scams in 2024, according to Immunefi.

July's losses

Overall: $269.4 million stolen, bringing the year-to-date total past the billion-dollar mark.

Year-over-Year: 16.3% increase compared to the same period in 2023.

Month-over-Month: July's losses were down 15.9% compared to July 2023.

A single event – the $235 million hack on Indian exchange WazirX – accounted for the lion's share of July's losses.

This attack, suspected to be the work of North Korean hackers, has been particularly damaging due to WazirX's controversial "socialized loss" recovery plan.

Read: How India's WazirX Got Hacked 🏴☠️

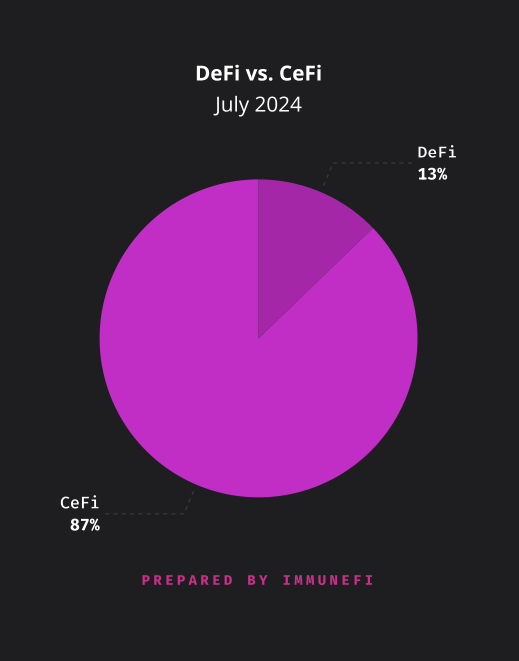

Centralised Exchanges still a target

Hacks dominated July's losses, with CeFi exchanges (like WazirX) suffering the most.

Over the entire year so far, CeFi hacks account for over half of all stolen funds.

Ethereum and BNB Chain continue to be the most targeted by attackers, representing over 70% of total on-chain losses.

Decline in New Ethereum Wallet Addresses

Yearly low: New Ethereum wallet addresses are at their lowest in 2024, following the launch of spot ether ETFs in the US.

Data trends: The seven-day moving average is the lowest since December 2023 but remains higher than much of last year.

Impact of spot Ether ETFs: Investors may prefer spot ETFs for ether exposure instead of creating new wallets.

Decrease in network activity: Active addresses and transactions, both metrics have declined, reaching six-month lows, indicating reduced network activity.

The Surfer 🏄

A virtual meeting is set for Monday between crypto executives and White House officials, organised by Democratic Representative Ro Khanna. The discussion aims to shape policies regarding digital assets and blockchain technology, advocating for a more progressive stance from the Democratic Party.

The French regulator AMF is now accepting applications for crypto-asset service providers, starting from July 1. This move comes ahead of the EU's Markets in Crypto Assets (MiCA) rules, which will take effect on December 30.

Xapo Bank has successfully passported its banking license into the UK, becoming the first UK bank to offer interest-bearing bitcoin and fiat accounts. Customers can earn 1% interest on bitcoin without needing to stake, lend, or lock up their assets, although details on the interest source remain unclear.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

The detailed explanation of Japan's interest rate hike and its ripple effects on global markets was particularly enlightening. It's fascinating to see how interconnected the financial systems are and how one country's policy can impact the global crypto market.

The discussion on leveraged positions and their impact on market volatility is crucial for understanding the inherent risks in crypto trading. It's a stark reminder of how quickly things can spiral when the market turns.