Will AI and Crypto score big in 2024? 👩🎨

Why AI and Web3 works. VanEck to donate 5% of BTC ETF profits to Bitcoin core developers. $1.2M of BTC sent to Genesis wallet. North Korean hackers steal $600M in 2023. CertiK account hacked.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

The year 2024 could be a pivotal year for both artificial intelligence (AI) and cryptocurrencies.

Analysts are exploring the potential for a new sub-sector of cryptocurrencies to emerge that combines AI and web3 technologies.

Driven by innovations in both AI and web3, and could lead to new use cases and applications for both technologies.

AI and Web3: A Match Made in Heaven?

Both technologies are based on distributed computing, which means that they are not reliant on any single central authority.

They can share data and resources without the need for a middleman.

AI can be used to improve the security and privacy of web3 applications.

For example, AI agents can be used to detect and prevent fraud, or to protect user data from being hacked.

Emerging Use Cases for AI and Crypto

AI-powered investment platforms: These platforms could use AI to analyse data and make investment recommendations.

Decentralised marketplaces: These marketplaces would allow users to buy and sell goods and services without the need for a central authority.

AI-generated content: AI could be used to create new forms of content, such as art, music, and games.

Investor Interest is High

Investors are already starting to take notice of the potential of AI and crypto.

AI-related crypto tokens have already outperformed the market in 2023, with some tokens gaining over 500% in value.

TTD Pledge 👊

VanEck, an asset manager with a pending Bitcoin ETF application, plans to donate a portion of the profits to Bitcoin core developers.

The pledge comes ahead of a potential SEC approval, with a Jan. 10 deadline looming for other applications.

VanEck has already made a $10,000 donation to developers, regardless of the SEC's decision.

VanEck is among several asset managers awaiting the SEC's decision, including BlackRock, Fidelity, and Grayscale.

5% of Profits for Developers, Highlighting Long-Term Commitment

VanEck's pledge commits 5% of its Bitcoin ETF profits to Bitcoin core developers through Brink, a nonprofit organisation.

The commitment extends for at least 10 years, showcasing VanEck's long-term dedication to Bitcoin.

This move follows a similar pledge by VanEck in September 2023, allocating 10% of profits from its Ether (ETH) futures ETF to Ethereum developers.

VanEck's Pledge Amidst Broader ETF Anticipation

VanEck's pledge to Bitcoin core developers highlights its commitment to the cryptocurrency, regardless of the SEC's decision.

The move comes amidst widespread anticipation for a spot Bitcoin ETF approval, which could be a major milestone for the industry.

FUN FACT: VanEck spot Bitcoin ETF ticker will be $HODL.

TTD Numbers 🔢

$1.2 million

The amount transferred to Genesis Wallet by an anonymous person.

The Genesis wallet is the first wallet ever created on the Bitcoin network.

It was created by the pseudonymous entity known as Satoshi Nakamoto, who also likely mined a high number of other blocks in the network's early days.

On Friday, someone sent $1.2 million of bitcoin to the Genesis wallet.

The funds are unlikely to ever be retrieved, as the private keys associated with the wallet are believed to be lost.

What does this mean?

The transaction has sparked speculation about the identity of Satoshi Nakamoto.

Some believe that it could be a sign that Nakamoto is still active in the Bitcoin community. Others believe that it is more likely that the transaction was made by someone who has hacked into the Genesis wallet.

The transaction is also significant because it highlights the security risks associated with storing bitcoin in wallets that are not connected to the internet.

The Genesis wallet is one of these "cold wallets," and it is considered to be one of the most secure places to store Bitcoin.

Where’s ETF? 🚨

Spot Bitcoin ETF fees vary, with Fidelity's 0.39% the lowest and Ark/21Shares/Valkyrie's 0.80% the highest. Lower fees could make an ETF more popular👇🏻

TTD Hack 🥷

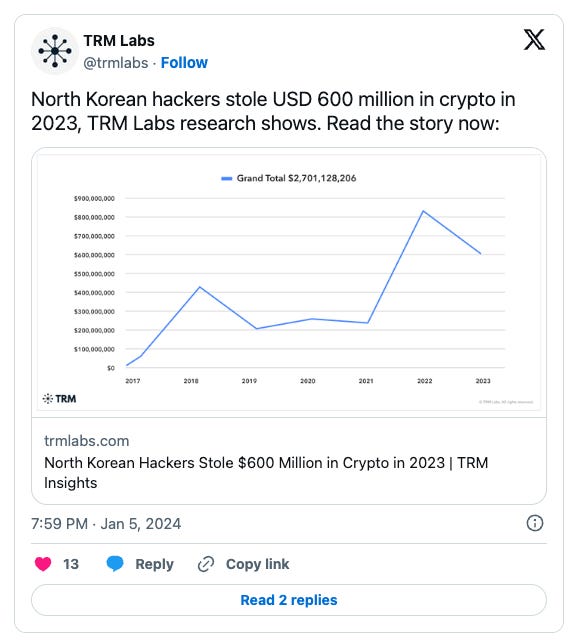

TRM Labs reported North Korean hackers potentially stole up to $700 million in crypto in 2023, with $600 million confirmed according to its research.

While North Korea's crypto heists have decreased in 2023, the long-term trend remains concerning.

North Korea-linked hackers have stolen nearly $3 billion in cryptocurrencies over the past six years.

2023 saw a decrease in stolen funds compared to 2022, but the threat remains significant.

North Korea uses stolen crypto to fund its nuclear and missile programs, as well as to evade sanctions.

Hackers often target bridges and DeFi protocols, exploiting vulnerabilities in these emerging technologies.

TTD Phishing 👩💻

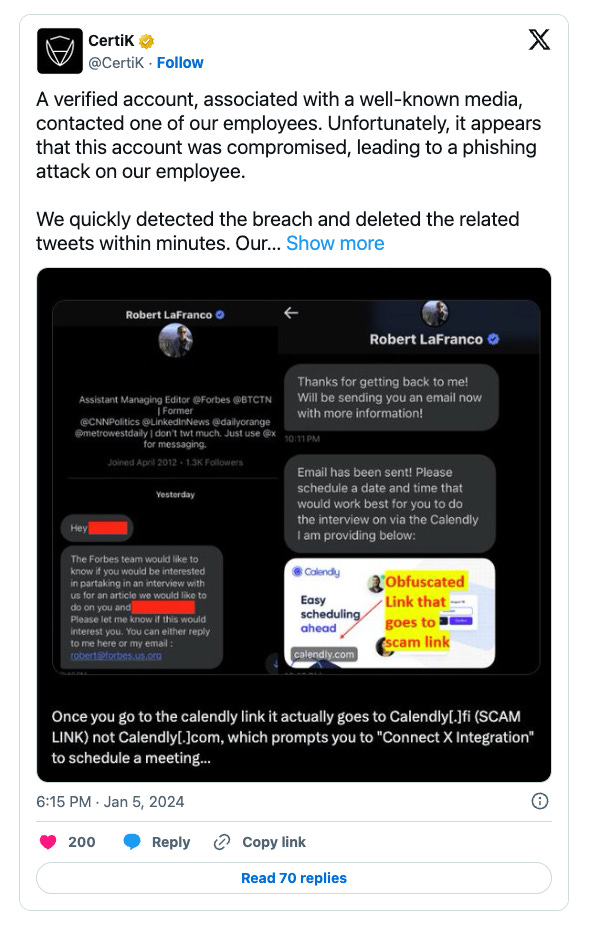

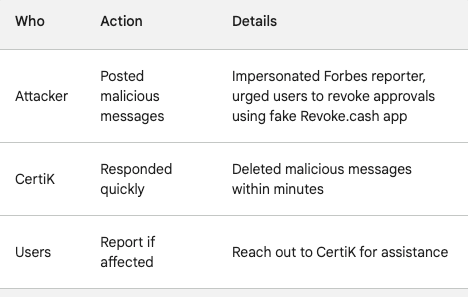

A blockchain security platform, CertiK, fell victim to a phishing attack on its X account. The attacker, impersonating a Forbes reporter, posted malicious messages urging readers to revoke approvals using a fake Revoke.cash app.

Revoke.cash Phishing App Used: The malicious messages posted by the attacker encouraged readers to revoke approvals using a fake Revoke.cash app. This app was likely designed to steal users' cryptocurrency or private keys.

CertiK Responds Quickly, Deletes Messages: CertiK quickly detected the phishing attack and deleted the malicious messages within minutes. This swift response helped to mitigate the potential damage caused by the attack.

Similar Attack Occurred on Dec 21st: This phishing attack was not an isolated incident. According to the article, a similar attack occurred on CertiK's X account on December 21st.

CertiK Encourages Affected Users to Reach Out: CertiK is encouraging anyone who may have been affected by the phishing attack to reach out to them.

TTD Surfer 🏄

Dave, a banking app, is buying back a $100 million stake it purchased from bankrupt crypto exchange FTX.

Coinbase plans to acquire a company with a MiFID II license to offer crypto derivatives in the EU.

Digital Currency Group (DCG) has settled $700 million of debt with bankrupt crypto lender Genesis.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋