Approval In. What Now? 🤷♂️

SEC’s abrupt approval of Ethereum ETF has raised a lot of questions. Does Ethereum have a simple elevator pitch? Ether futures open interest reaches all-time high. Next ETH upgrade by Q1 2025.

Hello, y'all. right here, right now … all we’ve got is questions.

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

The US Securities and Exchange Commission (SEC) surprised many by approving critical rule changes to allow for exchange-traded funds (ETFs) holding Ethereum's native token, ETH.

It’s been celebrated as a victory for crypto, but it may be a long road ahead and questions that the whole ecosystem must weigh in.

Read: Ethereum ETFs Day 🎉

Political Motivation? The US government’s stance on crypto appears to be softening, with recent pro-crypto votes in Congress and President Biden's decision not to veto the FIT21 bill.

These events may have influenced SEC Chairman Gary Gensler's decision to approve ETH ETFs, avoiding a potential political hazard.

Read: Crypto Wins. FIT21 IS A GO 🔝🤝🏻

Impact on Ethereum: The approval of spot ETH funds is expected to increase institutional interest in Ethereum.

It provides a familiar on-ramp for investors and a stamp of approval for the asset. It may also drive more users to the Ethereum network, particularly if they choose to stake their ETH to earn yields.

Technical Considerations: The ETH ETFs could impact Ethereum's economics by potentially increasing buying pressure and supporting the burn mechanism.

Though concerns about the impact on the staking economy remain, as more ETH may be pulled out of circulation.

Implications for Other Chains: The ETH ETF approval solidifies Ethereum's dominant position in the market. It may also open the door for alternative chains like Cardano, Solana, and Ripple to gain traction in the world of high finance.

While ETH and BTC have the advantage of being embraced by financial incumbents, other crypto assets may face regulatory hurdles, as the SEC has indicated that assets like SOL and ADA fit the definition of a security according to the Howey Test.

Read: Three Questions About the SEC’s Abrupt ETH ETF Approval

Ethereum ETFs, Security Risks

Ganesh Swami, CEO and co-founder of blockchain data analytics company Covalent.

“Removing staking language from ETH ETF applications was a move to appease the SEC. But this short-term solution could cause a long-term problem. If multiple ETFs use the same custodians, this type of centralisation would cause concentration to increase, exposing the network to operational risks such as malicious collusion.”

Andrew O’Neill, analytical lead on digital assets at S&P Global.

“Staking ETH ETFs are not a new concept, they exist in other countries, but clearly the US market brings a much larger scale. The risk in that case is that if ETFs are concentrating their stake with a small number of custodians, this could create validator concentration risks in the consensus mechanism.”

Mona El Isa, CEO and co-founder of institutional DeFi company Avantgarde Finance.

“You can measure concentration risk by the number of nodes a single entity would need to control the chain. The lower that number, the higher the central point of failure. If any party amassed that much control, they could potentially alter the state of the blockchain itself. That poses serious risks to security.”

Read: Ethereum ETFs Could Lead to 'Serious' Security Risks, Say Experts

When does Ethereum ETFs begin trading?

According to JPMorgan analysts, trading of the recently approved spot Ethereum ETFs is expected to begin well before November 2024, likely in the coming weeks or by July/August.

The analysts view the ETF approval and crypto more broadly as increasingly political issues ahead of the 2024 US presidential election.

Former US SEC Chairman Jay Clayton said approval of trading in spot Ethereum ETFs would be inevitable, having received approval to list, but approval of the products themselves is still pending.

Clayton said in an interview with CNBC.

"There’s the listing approval, which is what happened yesterday, and then there’s the approval of the product itself, which is still pending … I think it means it’s inevitable. We went through this same process with the bitcoin product, where almost all or all of the questions were decided. The question that was decided yesterday, to speak technically, is that the market is efficacious enough for this product to be listed on the exchange. That is what was decided, but there are other questions out there."

Block That Quote 🎙️

Bloomberg ETF analyst Eric Balchunas

“Does a simple one-liner like that exist for Ether? If so, what is it?

Crypto analysts reckon that Ethereum hasn't quite found its simple elevator pitch yet, whereas Bitcoin is often marketed as "digital gold."

Glassnode lead analyst James Check aka “CheckMatey"

Some have a simple one-liner pitch to set Ethereum apart. Adam Cochran, partner at venture capital firm Cinneamhain Ventures.

On Bankless podcast episode, Bitwise chief investment officer Matt Hougan agreed that it might be confusing explaining the difference between Bitcoin and Ethereum.

He argues that the easiest way to explain the difference is to use the analogy of there are different software companies out there, that use softwares in different ways.

"SalesForce use software in one way, Microsoft use it in another way."

All That ETF? 🔔

Bloomberg ETF analyst James Seyffart reckons that the demand for spot Ethereum ETFs could reach 20% to 25% of demand for spot Bitcoin ETFs.

This prediction is based on the Ethereum market being approximately 30% the size of Bitcoin. Limitations of the Ethereum ETF include the inability to stake and the inability to take advantage of on-chain utility.

Standard Chartered analyst Geoffrey Kendrick is of the view that cryptocurrency ETFs such as SOL and XRP may be approved in 2025, and the approval of the ETH ETF means that ETH and similar cryptocurrencies will not be classified as securities.

Trading in the ETH ETF is expected to begin next month, potentially bringing in $15 billion to $45 billion in inflows in the first 12 months.

In the Numbers 🔢

$15 billion

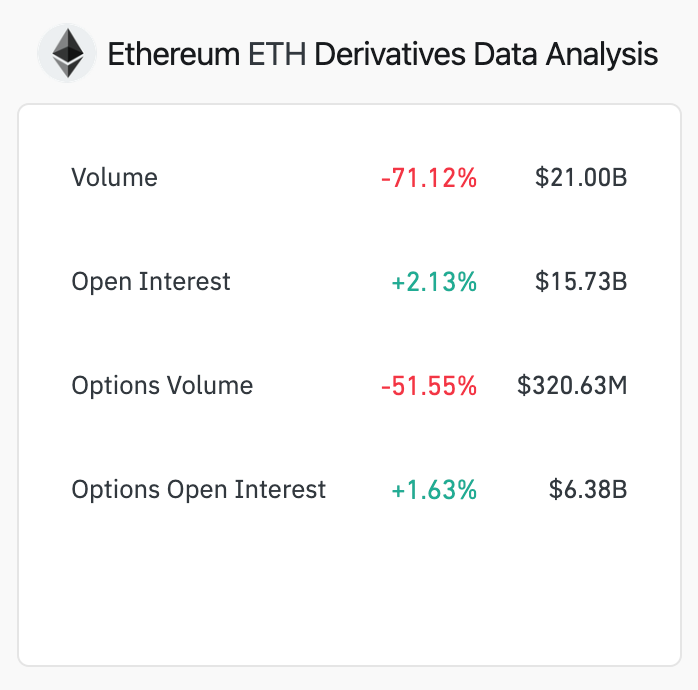

Ethereum (ETH) futures open interest has reached an all-time high of over $15 billion across major derivatives exchanges, indicating strong investor demand and bullish sentiment around the second-largest cryptocurrency.

The spike in open interest coincides with a significant price increase, with Ether rising 18-20% to trade above $3,600 in the past week.

While the surge in open interest reflects strong institutional demand, it does not necessarily indicate excessive bullishness.

The options market shows a neutral sentiment, with the 25% delta skew indicating balanced pricing between call and put options.

Next Ethereum Upgrade by Q1 2025

Ethereum core developers are targeting to launch Pectra, the next upgrade for Ethereum, by the end of the first quarter of 2025.

The inclusion of EVM Object Format (EOF), which is a set of about 11 EIPs that introduce an opt-in container for EVM code.

EVM Object Format (EOF): Enhances code with optional container system (11 EIPs).

PeerDAS: Improves data distribution and network performance.

EIP-7702: Replaces EIP-3074, allowing accounts to act as smart contract wallets for better security and user experience.

Two-Part Upgrade: Prague (Execution Layer) and Electra (Consensus Layer) for overall efficiency.

While the final features of Pectra are still under discussion, some proposals, like Verkle tree integration, might be postponed to a future hard fork named Osaka.

The Surfer 🏄

Ethereum Foundation Executive Director Aya Miyaguchi said the organisation is developing a formal policy to address potential conflicts of interest after two of its researchers disclosed receiving significant EigenLayer token incentives.

A UK court debunked Craig Wright's claim to be Satoshi Nakamoto, allowing the Bitcoin whitepaper to return to Bitcoin.org. The site's maintainer, Hennadii Stepanov, confirmed the whitepaper's return after a 2021 copyright suit by Wright forced its removal.

Uniswap is holding an on-chain vote on May 31st to establish a system for automatic fee collection and distribution, moving forward despite a recent SEC warning. This vote is a first step, and additional votes will be needed to activate fees in Uniswap V3 pools.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋