Ballad Of Ethereum ETF 💃🕺

Rumours in. Odds up. Ethereum ETF approval incoming? Why regulators fear an ETH ETF? Vitalik Buterin on threats to Ether decentralisation. Bitcoin ETFs clock $1B inflow last week. Whales make moves.

Hello, y'all. You can't always get what you want.

But if you try sometime you'll find | You get what you need … 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Ethereum (ETH) is on a tear.

The price jumped over 20% on May 21.

Stands at $3,800.

The reason? Rumours that says SEC approval of Ethereum ETFs are almost near.

Three good reasons👇🏻

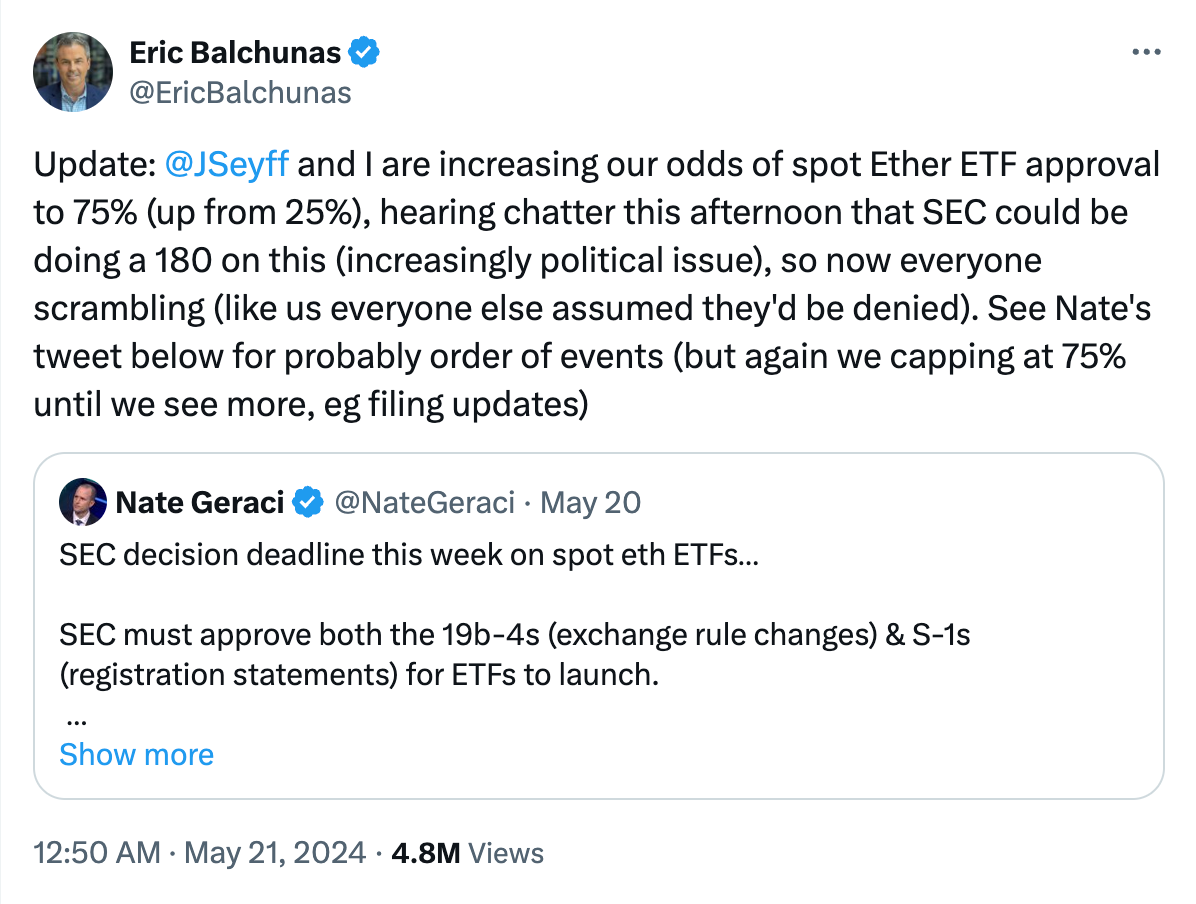

#1 The Bloomberg guys increased their approval odds from 25% to 75%.

But not guaranteed yet: While the SEC might approve exchange rule changes (19b-4s) for ETFs, registering individual funds (S-1s) could still be delayed.

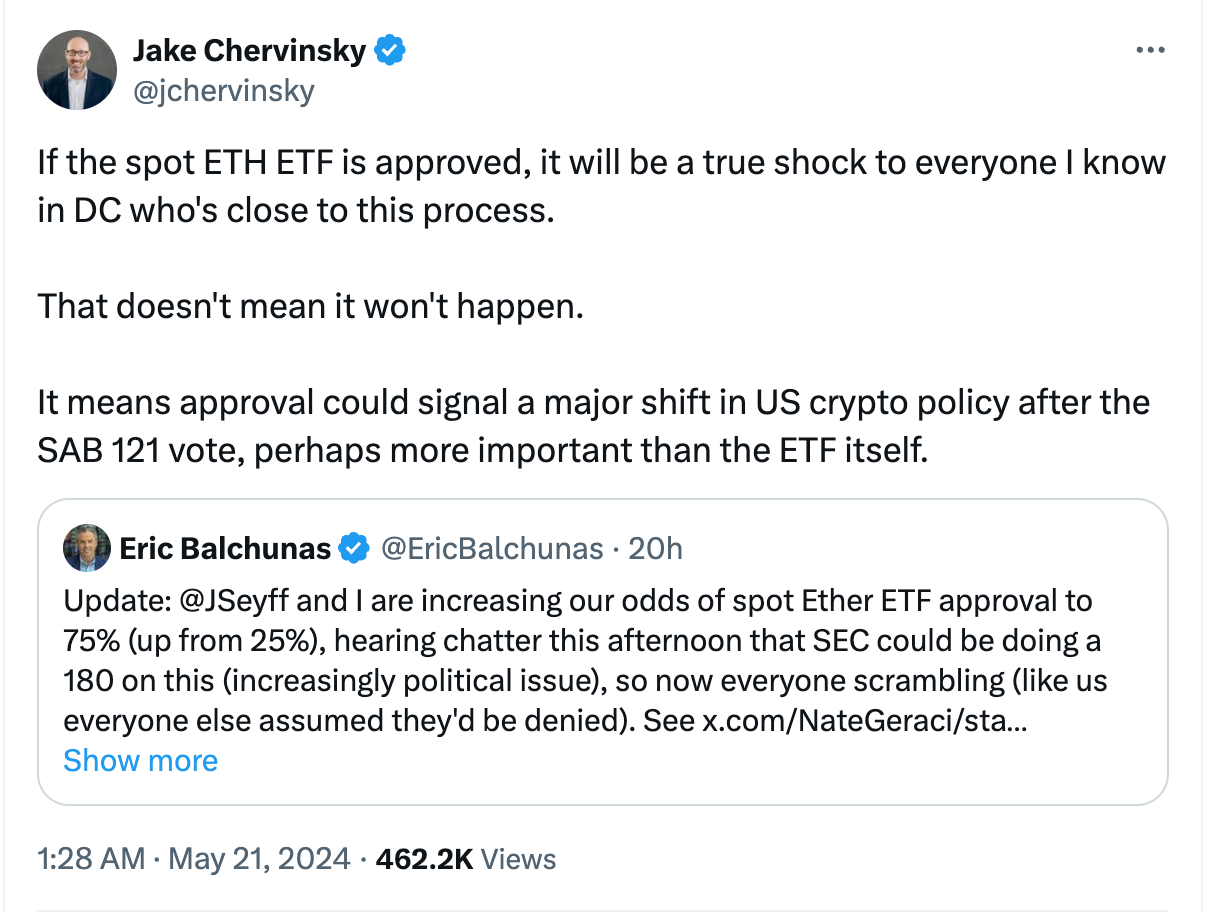

#2 SEC changing stance on crypto due to political pressure?

Recent actions, including the potential reversal of a controversial crypto custody rule (SAB 121), suggest a more crypto-friendly stance.

A dozen Democrats voted alongside 48 Republicans in favour of the resolution.

#3 SEC requests updated filings.

The SEC is requesting amended 19b-4 filings from firms looking to list spot Ether ETFs. These filings outline proposed rule changes and are crucial for approval.

Good thing, why? When the SEC approved spot Bitcoin ETFs earlier in 2024, they also reviewed and approved these same 19b-4 filings.

All of this comes just days before a key decision by the SEC on a spot Ether ETF application from VanEck on May 23.

If rejected, go the BTC way?

VanEck, Ark Invest, Grayscale, and BlackRock are all waiting on the SEC's decision on their Ether ETF proposals.

The SEC approved Bitcoin ETFs due to a court ruling. A similar outcome might be needed for Ether ETFs.

A lawsuit by Consensys against the SEC might play a role in the Ether ETF decision.

Fate in 5 commissioners' hands

The future of Spot Ether ETFs hinges on a 5-person vote at the SEC, with Chair Gary Gensler potentially holding the deciding vote, just like with Bitcoin ETFs.

Hester Peirce (Crypto Mom): Bullish on crypto, her vote is a mystery.

Caroline Crenshaw: Strong critic of crypto, likely to reject.

Mark Uyeda: Crypto-friendly, may repeat his "independent reasons" for approval.

Jaime Lizárraga: Against Bitcoin ETFs, likely against Ether too.

Gary Gensler (Key Figure): Not a fan of crypto at all. Voted yes on Bitcoin ETFs, could be the deciding vote again.

Flashback to Bitcoin ETFs

In January, 5 commissioners voted on Bitcoin ETFs.

"Crypto Mom" Hester Peirce and Mark Uyeda were the only ones in favor.

The rest - Caroline Crenshaw and Jaime Lizárraga - dissented, while Gensler's approval likely sealed the deal (3-2 vote).

Security vs Commodity

The SEC's stance on whether Ethereum is a security (like a stock) or a commodity (like gold) is unclear. This ambiguity could delay approval.

Meanwhile, Prometheum, a controversial firm, launched Ethereum custody services, classifying ETH as a security under the SEC.

Read: Fate Of Ethereum ETFs 💊

Block That Quote 🎙️

Kinga Bosse, chief operating officer at crypto infrastructure firm MPCH.

“Once you do Ethereum, where do you stop?”

Bosse reflects on the concerns about approving an Ethereum ETF after recently approving a Bitcoin ETF.

Why regulators are hesitant? They want to see the impact of the Bitcoin ETF before approving another cryptocurrency ETF. Approving Ethereum could open the door for ETFs for other cryptocurrencies, which regulators might not be comfortable with.

“Going forward, the question is really, ‘Okay, what did we just do?’ It’s going to get harder and harder for regulators to push back if they have concerns.”

Reasons for uncertainty: There's uncertainty about how Ethereum is controlled and who makes decisions about upgrades. The fact that one person, Vitalik Buterin, has significant influence is a concern for some regulators.

“Vitalik Buterin has a lot of say about what happens on Ethereum... not necessarily a comforting notion.”

Stakes are high: Hong Kong, Canada, or Singapore — can experiment with new products with little to fear about global ramifications. But not the US. Not when decision made are responsible for the leading world economy. Experimentation is not a luxury that US regulators and policymakers have.

“When the SEC makes the decision, it makes a decision for the entire world market. There’s not a lot of room for error.”

Buterin on Ethereum's Decentralisation Threats

Ethereum co-founder Vitalik Buterin recently addressed some hot-button issues regarding Ethereum's decentralisation in a blog post.

“We should have deep respect for the properties that make Ethereum unique, and continue to work to maintain and improve on those properties as Ethereum scales.”

The Issues

MEV (Miner Extractable Value): Miners can manipulate transactions for personal gain, hurting fairness for smaller users.

Staking Complexities: High hardware requirements and technical knowledge make solo staking difficult, pushing users towards centralized staking services.

Node Hardware Requirements: Running a full Ethereum node requires significant storage space, limiting who can participate in securing the network.

Buterin's Solutions

MEV Mitigation

Minimise MEV: Protocols like CowSwap promote fair trading. Encrypted mempools hide transaction details until confirmed, giving everyone a fair shot.

Quarantine MEV: Separate block proposers from builders (PBS) to prevent manipulation. Inclusion lists could also help.

Simpler Staking

Reduce hardware and storage needs for nodes using Verkle trees and EIP-4444. This could allow even browser extensions to run nodes.

Consider lowering the minimum 32 ETH requirement for staking.

In the Numbers 🔢

$1 billion

US Spot Bitcoin ETF inflows rebound.

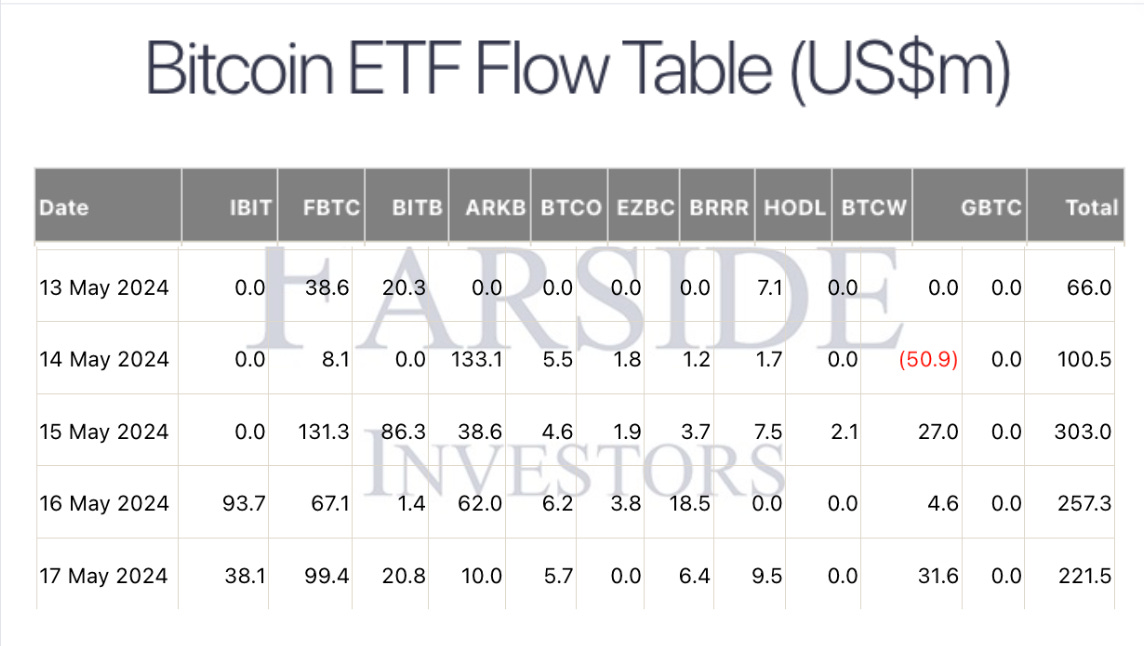

Big rebound: US spot bitcoin ETFs saw $948.3 million in net inflows last week.

Total inflows: This brings the total net inflows since launch in January to over $12.5 billion.

Recovery complete: This reverses four weeks of consecutive outflows totalling $1.05 billion.

Fidelity leads the pack: Fidelity's FBTC dominated inflows with $344.5 million, followed by Ark Invest's ARKB at $243.7 million and BlackRock's IBIT at $131.8 million.

BlackRock surges: BlackRock's IBIT hit a record market share by trading volume (55.2%) and is closing in (276,759 BTC) on Grayscale's GBTC (288,954 BTC) in terms of assets under management.

Whales Move Ethereum

With all the spot Ethereum ETFs drama going around, a crypto whale just sold $46 million in Ethereum (ETH) to Kraken.

Who: A crypto whale with a history of smart moves (wallet address: 0x7f1).

What: Sold 15,000 ETH (around $46 million) to Kraken.

When: May 20, 2024.

Why it matters: This is the first time this whale has moved such a big chunk to Kraken, and it coincides with rising Ethereum prices and the looming SEC decision.

Large investors are accumulating ETH.

Accumulating over $1.26 billion worth of ETH in the past week.

The addresses holding between 100,000 and 1 million ETH have added a little over 390,000 ETH, a supply worth $1.26 billion, bumping the whales’ holdings to 19.94 million ETH.

Read: This is How Whales Could Propel Ethereum (ETH) Price to $3,500.

A significant amount of ETH was bought between $3,000-$3,163.

The Surfer 🏄

Grayscale Investments has named Peter Mintzberg as its new CEO, effective August 15, 2024. He will succeed Michael Sonnenshein and also join the Board of Directors. Edward McGee, CFO, will serve as interim leader until Mintzberg assumes the role.

A Taiwanese national, Rui-Siang Lin, was arrested in New York for running Incognito Market, a darknet bazaar that allegedly facilitated over $100 million in illegal narcotics sales. Lin faces life in prison. Incognito Market shut down in March after reportedly scamming users and extorting vendors.

Justin Drake, a researcher at the Ethereum Foundation, disclosed his new advisory role at Eigen Foundation, along with a significant incentive in Eigen tokens. This disclosure followed a discussion on transparency involving Ethereum co-founder Vitalik Buterin and crypto trader Jordan Fish.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋