Binance Bites the Bullet 🙊

CZ's $200 million farewell, and Binance's exit from the US market. Sam Altman reclaims the CEO throne at OpenAI. Celsius shifts gears from lending to mining. And, Bitcoin's NFT surge.

Hello, y'all. Music fans can now discover new and unique sounds from up-and-coming artists. Check out 👉 Asset - Your Music Stats.

We feel what?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

A blockbuster settlement.

A colossal fine.

And the ousting of a crypto titan.

A $4 billion trouble 💸

The US Department of Justice (DOJ) dropped a bombshell with a jaw-dropping $4.3 billion fine on Binance, the world’s largest crypto exchange.

The charges? Violating money transmission laws and US sanctions.

CZ's Exit Stage Left

Changpeng “CZ” Zhao, the man behind Binance’s meteoric rise, had to bid farewell. Forced to resign, CZ leaves a void as not just a figurehead but the heart and soul of Binance.

The price? $200 million in penalties.

But, CZ will still maintain ownership of the exchange but the settlement restricts him from holding executive roles within the company.

Things to note

Binance accused of prioritising profits over legal compliance, allowing illicit funds to flow through undetected.

Binance will exit the US market and pay $4.3 billion

CEO Zhao emphasized growth over compliance, jokingly stating "better to ask for forgiveness than permission."

Over $898 million in illegal trades between US users and sanctioned countries went unaddressed by Binance.

Plea deal includes forfeiture of $2.5 billion and a $1.8 billion criminal fine.

Zhao's guilty plea focuses on the lack of anti-money laundering controls and violations of the Bank Secrecy Act.

Settlement addresses CFTC charges. SEC lawsuit over alleged investor-protection violations excluded.

Richard Teng, will be CZ successor, becomes new CEO.

Quick succession plan aims to maintain order.

US to review bail order with an effective date set for Nov 27.

Outflows? Of course.

Data from DefiLlama says Binance’s 24-hour outflows topped $1 billion as of 3:30 pm. Hong Kong time on Wednesday.

Total outflows over 7 days = $703.1 million.

The $175 Million Gamble: CZ is shelling out a staggering $175 million as a release bond, a move that allows him to await his Feb 23, 2024 sentencing in a potentially distant location.

Dubai on the Horizon: CZ's choice of residence during this legal limbo could be Dubai, where he has been based for several years. The absence of an extradition agreement between the US and the United Arab Emirates adds a layer of complexity to this potential move.

Stringent rules demand CZ's return to the US two weeks pre-sentencing or face hefty fine and a maximum of 10 years in jail.

CZ sweetens the deal with an extra $15 million in a trust account, with guarantors adding $250,000 and $100,000.

This amount will be forfeited if he fails to comply with the bond conditions.

Cash Exodus

Predictions of a mass customer exodus after the settlement didn't pan out as Binance weathered the storm.

With a "proof of reserves" report flaunting $65 billion in crypto assets, Binance seems to be standing tall.

Withdrawals did spike, but the ship appears steady.

The US is expected to review the bail order, with the effective date set for Nov 27 at 5 pm Washington time. If a judge grants a review before this date, CZ must stay in the U.S. until a decision is made.

CZ was known for his quirky tweets and unshakeable positivity. Whether facing FUD or celebrating victories, he’d often sum it up with a single number: “4”.

His departure leaves big shoes to fill.

What people say?

Some say this is bullish, while some definitely don't think so.

“This is an opportunity to buy BTC if it falls due to this news and the mistrust it generates among the masses,” Jaime Merino, a prominent retail trader says.

"Binance disappearing overnight remains a potential systemic risk to the crypto market," Sui Chung, CEO of CF Benchmarks. told Reuters.

“Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed — now it’s paying one of the largest corporate penalties in US history,” Attorney General Merrick Garland said.

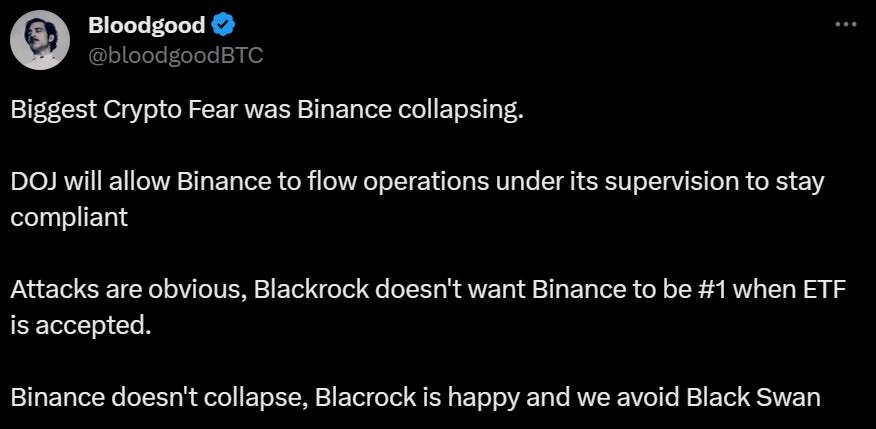

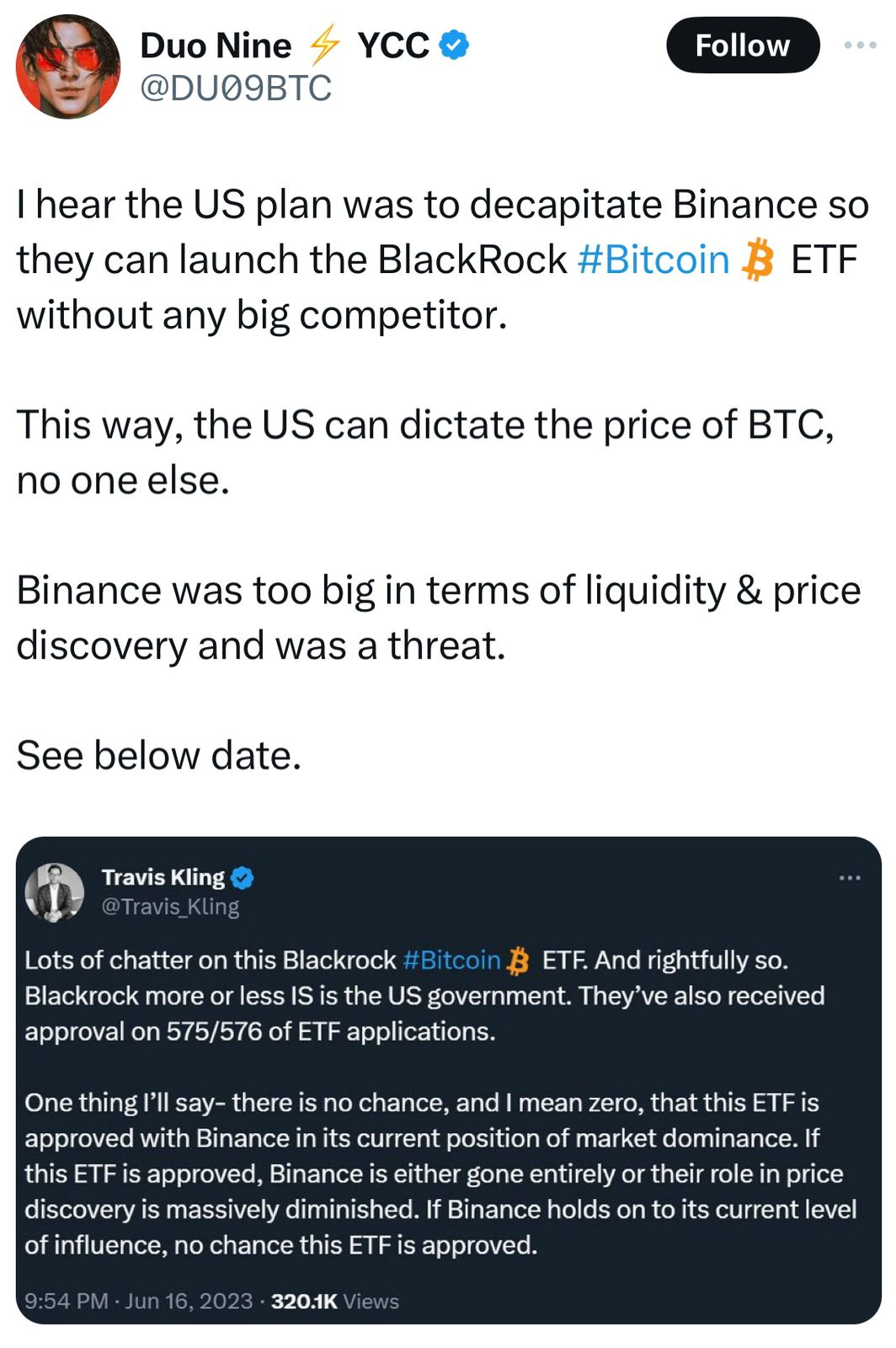

And there's always speculations like this👇🏻

TTD Blockquote🎙️

Coinbase CEO Brian Armstrong.

“We now have an opportunity to start a new chapter for this industry.”

With the Big Binance fallout, is it all doom and gloom?

According to Brian Armstrong, not quite.

In fact, he's seeing it as a chance to hit the reset button and start a new chapter for the entire crypto industry.

Armstrong's post reflected on Coinbase's journey, emphasizing that the "hard way" was the right way. As Binance faces legal hurdles, Armstrong believes it's an opportunity for greater regulatory certainty in the crypto realm.

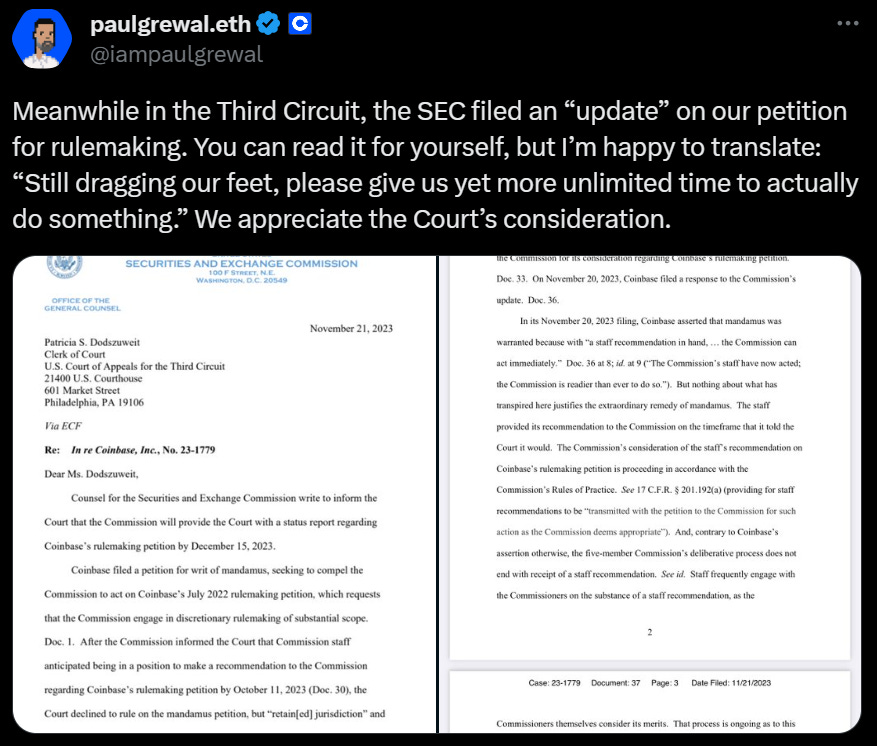

Meanwhile Coinbase's Chief Legal Officer, Paul Grewal, highlights perceived flaws in the U.S. approach to crypto regulation.

Also👇🏻

Despite Coinbase's compliance efforts, it hasn't escaped regulatory scrutiny.

The ongoing tussle with the SEC involves allegations of operating as an unregistered broker and exchange, leading to a lawsuit.

TTD Celsius 🔐

Celsius, the once crypto lending heavyweight, is changing lanes.

Facing scrutiny from the SEC, the company is tweaking its roadmap.

From Lending to Mining: Celsius is giving birth to a new corporate entity, aptly named Mining NewCo. This fresh face will set its sights on Bitcoin mining as its core business, abandoning the earlier plan that included staking.

Mining NewCo is poised to become publicly traded in the United States, with ownership bestowed upon Celsius customers.

Celsius plans to file modifications to the restructuring plan in the coming weeks. Anticipated creditor distributions are set to commence in January 2024.

Due to regulatory intricacies flagged by the SEC, Celsius is hitting pause on transferring certain assets to Fahrenheit Holdings.

Instead, these assets will be retained by Celsius's estates, becoming part of the Plan Administrator and/or Litigation Administrator's toolkit to benefit creditors.

Where’s ETF? 🚨

Grayscale Investments, the world's largest digital asset manager, met with officials from the US SEC to discuss its bid to convert the GBTC into a spot Bitcoin ETF👇🏻

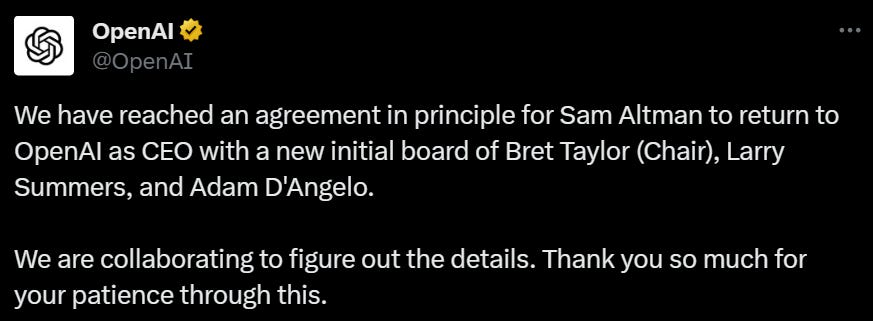

TTD Open AI 👁️

Sam Altman is reclaiming his throne as the CEO of OpenAI, just days after Microsoft snagged him for a new AI research team.

Read this: Para Winners Only 🍻

It seems like OpenAI realised they needed Altman more than they thought.

OpenAI announced their reunion with Altman, confirming that they are working on the nitty-gritty details.

Altman, on the other hand, expressed his love for OpenAI with a heart emoji.

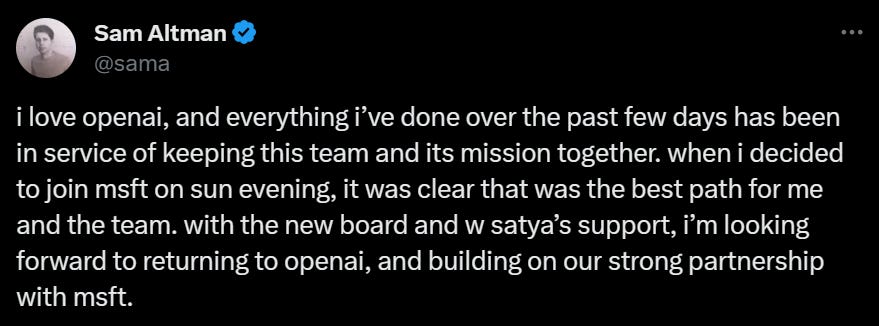

In his words, he's excited to return to OpenAI and continue the mission alongside Microsoft.

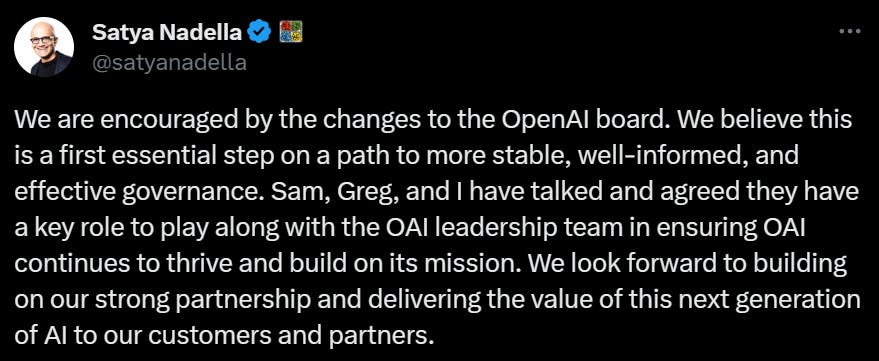

Satya Nadella, the head honcho at Microsoft, played the supportive friend, saying that Altman and OpenAI's decision is crucial for the company's continued success.

Cue the group hug.

OpenAI faced a mini-revolt from its own employees, with over 500 signing a letter expressing discontent over Altman's firing.

It turns out you don't mess with the boss, especially when he's well-liked.

TTD NFTs 🐝

Blur NFT Trader Wins $8.4M

Blur NFT's Season 2 airdrop showered a staggering $8.4 million worth of BLUR tokens upon trader Hanwe.

The trader's significant activity in NFT bids, listings, and lending earned them 22.85 million BLUR tokens.

Blur, surpassing OpenSea in NFT trading volume, announced Season 3 with a twist—introducing the Blast Ethereum layer-2 network.

Powered by Blast, Season 3 promises airdrops, with the community receiving "REDACTED" when the season concludes in May 2024.

Additionally, Blur alters its reward structure, offering depositors 50% of the season's rewards.

Meanwhile, Jeffrey Huang, AKA Machi Big Brother, vented his frustrations on Twitter, selling Bored Ape Yacht Club NFTs like hotcakes.

Bitcoin Takes the Crown

Bitcoin is flexing its NFT muscles and giving Ethereum a run for its digital money.

Recently, Bitcoin's transaction fees outshone Ethereum's for the first time in three years.

Why, you ask? Well, it's all thanks to the surging popularity of BRC-20 token inscriptions on the Bitcoin blockchain.

Bitcoin's blockchain is leaving Ethereum in the dust over the last 30 days.

Bitcoin NFT sales are riding high at a whopping $312 million, outpacing Ethereum's $304 million, according to the crypto scorecard by Cryptoslam.

BRC-20 NFTs are taking centre stage with a jaw-dropping $83 million in sales.

The buyers' frenzy for BRC-20 NFTs witnessed a staggering 398% surge in the past month.

TTD Surfer 🏄

Mt. Gox, the defunct bitcoin exchange that collapsed in 2014, plans to start repaying creditors in cash "shortly" this year.

CoinGecko has acquired NFT startup Zash to expand its data offerings.

Altcoins are leading the market retrace ahead of the release of the Federal Reserve's minutes from its November meeting.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋