Carry Trade Crash? 💥

What has Japan got to do with the global market crash? US BTC, ETH ETFs hit $6B volume amid market rout. Markets rebound after brutal few days. Things to keep an eye on. Is Bitcoin still Trump play?

Hello, y'all. This Sunday help yourself with all them insights from Decentralised.co.

Long-form articles trusted by the best in Web3. Hundred hours of research into 20 minute articles. No propaganda. Only good writing. Right in your inbox 👇

A small tweak in Japan

Triggered a global meltdown.

Billions wiped out in the weekend.

Who thought that would happen? Well some of us did.

What exactly happened?

Read: Why Are We crashing? 🚨

It all started with the Bank of Japan (BoJ) finally raising interest rates after a 17-year slumber.

This tiny change ignited a chain reaction that shook the crypto world to its core.

Why? Carry trade.

The idea is to borrow a low-interest-rate currency (like the yen) and invest it in a higher-yielding asset (like Bitcoin).

The strategy relies on the borrowed currency staying weak.

But recently, Yen did the unexpected.

it strengthened by 10% against the dollar.

To top it off

This caught carry traders off guard.

Scrambling to unwind their positions, which means?

Selling risky assets like Bitcoin (causing the price to plummet).

Buying yen (pushing its value even higher).

This frantic activity creates a domino effect.

As more traders close their positions, it creates a fire sale for Bitcoin and other risky assets.

To put it simply: With interest rates rising in Japan, the yen suddenly became a hot commodity. Its value soared, making it more expensive for traders who had borrowed yen cheaply to fund their crypto adventures.

Leverage Addiction

Crypto traders are big with leverage. Traders generally are big with leverage.

This means borrowing money to amplify their potential profits (and losses).

Traders were heavy on leverage, with open interest reaching nearly $40 billion.

2023, crypto boom. With leveraged trades doubling profits (or losses), and nearly free yen loans, the party was on.

To fund these leveraged bets, traders flocked to Japan.

The yen carry trade, popular across markets, exploded.

By 2024, these loans hit $2 trillion, a 50% surge in two years.

When the yen started getting pricier, these traders were trapped.

To avoid massive losses, traders were forced to sell their crypto holdings in droves.

Liquidation. Massive liquidation.

Across the board. In all markets. Crypto was not spared.

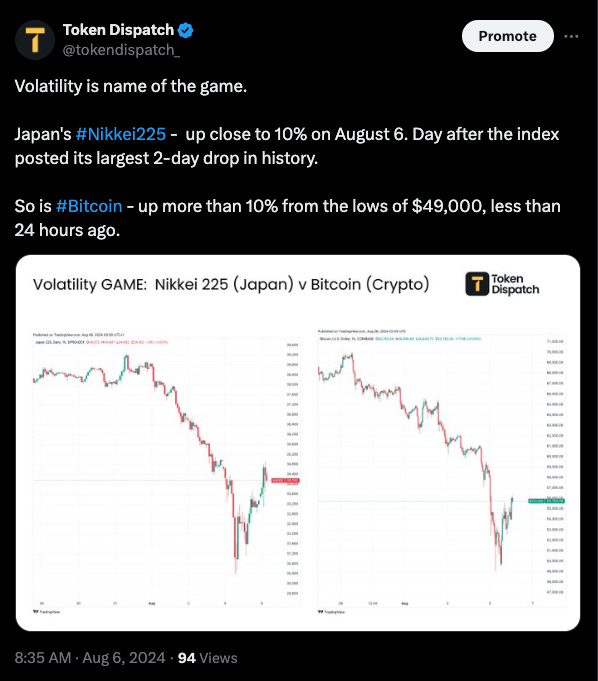

What’s the state now?

Stocks: Yesterday ended like. Today, likely to be in green.

Nasdaq (IXIC): -3.4%

S&P 500 (INX): -3%

Dow Jones (DJI): -2.6%

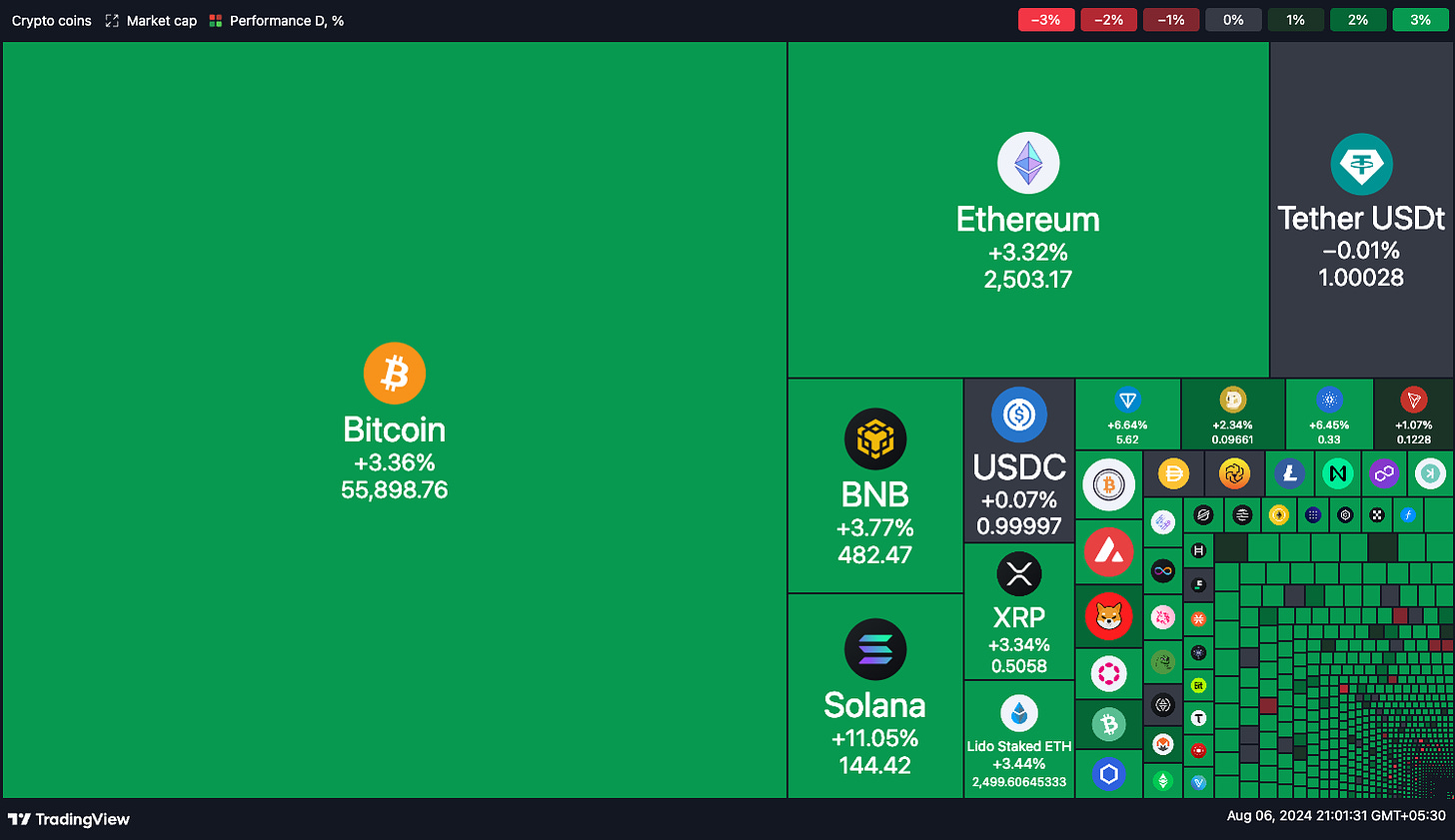

Crypto? We have rebounded 10%.

It’s all green now. Damage? Already done.

Unlock Web3 Insights with Decentralised.co

Three articles each week for people who like to stay updated on Web3 without being glued to Twitter. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

If you like stories with depth, insight & numbers on how the internet is evolving.

Written by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth

Five things to keep an eye on

1/ Economist calls for panic button

Top economist Jeremy Siegel urges the Federal Reserve to implement an emergency interest rate cut to prevent US economic turmoil.

He suggests the Fed funds rate should be lowered to between 3.5% and 4%, a reduction of 1.5% from the current 5.25% to 5.5% range.

Calls for an immediate 75 basis point cut, with another 75 basis points expected at the September meeting.

2/ Polymarket flooded with bets on Fed rate cut

Polymarket has seen a surge in bets totalling nearly $1.44 million, wagering on a Federal Reserve interest rate cut by September 2024.

3/Goldman Sachs cuts rate forecast after jobs report shock

Goldman Sachs has slashed its interest rate cut predictions following last week's weaker-than-expected US jobs report.

The investment bank now expects the Federal Reserve to lower rates by a total of 0.75 percentage points by the end of the year, down from its previous forecast.

4/US Government moves 300 ETH

300 ETH, valued at approximately $699,000, was transferred from a wallet linked to the US government on August 5.

The funds came from the “Noman Seleem Seized Funds” wallet, which now has a balance of $0 after the transfer. The transfer occurred amid disappointing price action for Ethereum following the anticipated launch of ETFs in the US.

5/A cautious report

A 10x Research report indicates Bitcoin could fall below $50,000 due to US economic uncertainty.

Founder Markus Thielen advises against opening leveraged long positions due to market volatility.

“The market structure, including fiat-to-crypto on-ramps, has been weak for months [...] it’s unlikely that significant players will invest amid high volatility and unpredictable prices. Many still need to exit positions and deleverage their portfolios.”

In The Numbers 🔢

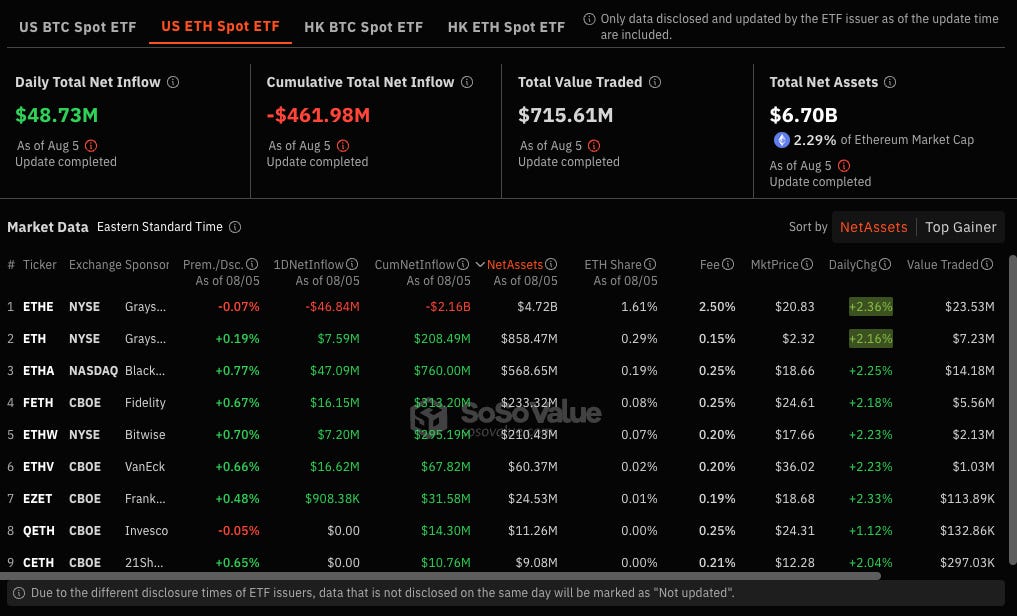

$6 billion

The trading volume marked by crypto-related ETFs on August 5.

With Bitcoin plunging below $50,000, trading volume for these ETFs skyrocketed.

Bitcoin ETF: BlackRock's iShares Bitcoin Trust accounted for more than half of the $5.24 billion Bitcoin ETF trading volume.

Ethereum ETF: Grayscale's Ethereum Trust and BlackRock's iShares Ethereum Trust led the $715.3 million Ethereum ETF trading volume.

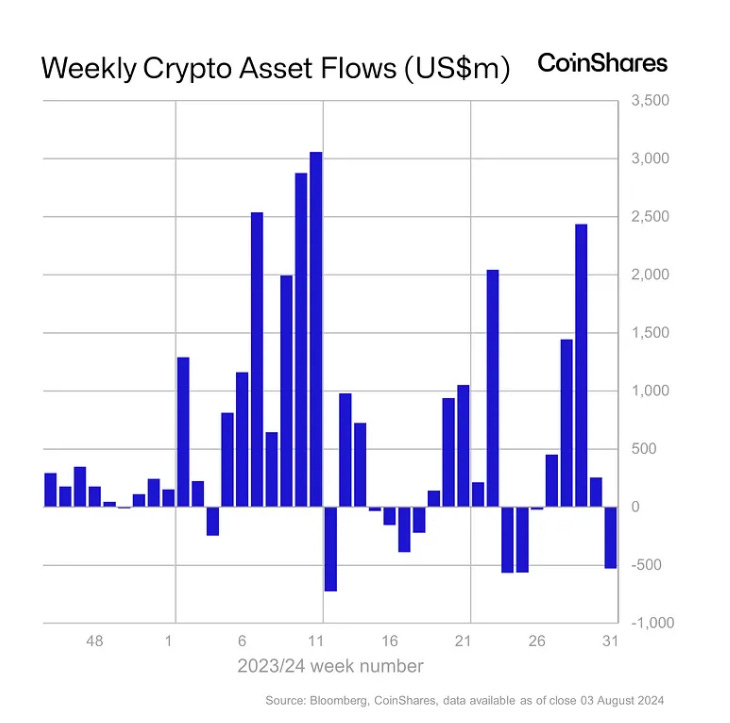

$528 million

Net outflow for crypto investment products, last week - CoinShares.

Ending a month-long streak of inflows.

Bitcoin-based products accounted for the majority of outflows at $400 million.

Ethereum saw outflows totalling $146 million.

US-based funds saw the most net outflows - $531 million.

“We believe is a reaction to fears of a recession in the US, geopolitical concerns and consequent broader market liquidations across most asset classes.”

Block That Quote 🎙️

Presidential candidate, Donald Trump

“Crypto is a very modern currency”

Trump discussed crypto again during a livestream interview with Adin Ross on the platform Kick.

About the sell-off?

"It's something they shouldn't be doing because they should be trying to build it."

Last week, a wallet labelled as belonging to the US government transferred $2 billion worth of bitcoin to an unidentified wallet.

And now the 300 ETH (as mentioned above).

Trump also likened crypto to AI

"It’s like AI — 'do you love it or do you not like it?' — if we don’t do it, China is going to do it, or other people are going to do it, and we can’t be left behind, and crypto is right in that sphere."

Bitcoin remains a “Trump trade” - Bernstein analysts.

It’s not bitcoin’s fault this time. The analysts agree on this.

Regarding the cryptocurrency's drop below $50,000 on Monday

“We don’t see any incremental negatives for crypto here ... If rate cuts and monetary liquidity is the usual template response to U.S. recession fears, we expect ‘hard assets’ such as bitcoin (digital gold) to reprice up.”

Bitcoin remains a "Trump trade" due to the market favouring Trump's pro-crypto stance.

“It’s not surprising that as the Polymarket odds between Trump and Harris narrowed, bitcoin and crypto have traded weak ... We expect bitcoin and crypto markets to be range bound until the U.S. elections, trading off catalysts such as the presidential debate and the final election outcome.”

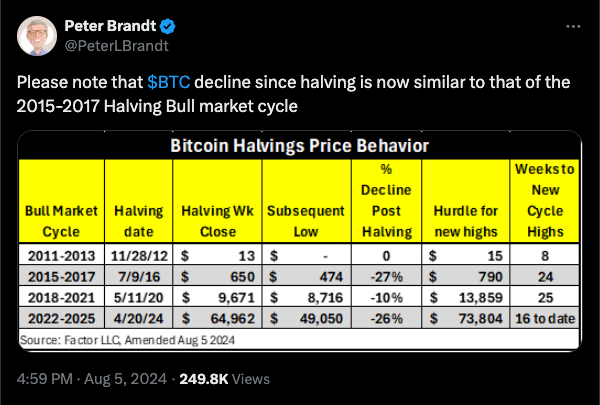

BTC decline similar to the start of 2016 bull run?

Veteran trader Peter Brandt is seeing deja vu in Bitcoin's recent price action.

The cryptocurrency's decline since the April 2024 halving is eerily similar to the market movements leading up to the 2016 bull run.

A tale of two halvings: Both in 2016 and 2024, Bitcoin experienced a significant drop following the halving event. While the 2016 decline was around 27%, the recent one sits at approximately 26%.

While this might seem like bad news, history could be repeating itself. After the 2016 dip, Bitcoin skyrocketed to a new all-time high. Could a similar fate await the cryptocurrency this time around? Maybe.

But, some experts believe that Bitcoin is in for a rough ride for the next couple of months.

The Surfer 🏄

Caitlyn Jenner is launching the MEDAL token on Ethereum layer-2 Base, inspired by her 1976 Olympic gold medal. The project will allow investors to own a fractionalized digital piece of the medal through the ERC-20 token, MEDAL, with a total supply of 100 million.

Over 2,000 Australian crypto wallets were compromised in a widespread phishing scheme, leading to unauthorised token transfers. The scams have resulted in approximately $162 million in losses globally, with over 260,000 individuals affected in the first half of the year.

Xapo Bank has officially entered the UK market, becoming the first licensed bank to offer interest-bearing Bitcoin and fiat accounts.Customers can earn 1% interest on Bitcoin accounts without the need for staking, lending, or locking up assets.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋